Introduction: Navigating the Global Market for thermoplastic elastomers

Thermoplastic elastomers (TPEs) have become a cornerstone material for industries ranging from automotive and medical devices to consumer goods and electrical components. Their unique blend of elastomeric flexibility and thermoplastic processability makes them indispensable for manufacturers seeking both performance and efficiency. As global supply chains become increasingly interconnected, B2B buyers in diverse regions like Nigeria, Italy, Brazil, and the UAE are facing new complexities—and opportunities—in the quest to source optimal TPE solutions.

Selecting the right TPE is far from a commodity decision. With a broad spectrum of types—including styrenic block copolymers, thermoplastic vulcanizates, and specialty blends—buyers must navigate a landscape marked by rapid innovation, fluctuating input costs, and varying regulatory requirements. The ability to distinguish between materials, evaluate suppliers’ technical capabilities, and assess cost-effectiveness is now a direct driver of competitive advantage.

This guide serves as a practical, in-depth resource designed to equip international B2B buyers with critical insights at each stage of the sourcing journey. Key areas covered include:

- Fundamental types and properties of TPEs

- Material selection criteria for application-specific needs

- Manufacturing processes and quality control considerations

- Supplier engagement strategies and global sourcing channels

- Cost structures and market dynamics across major regions

- Frequently asked questions and sourcing best practices

By leveraging the guide’s actionable frameworks, checklists, and market intelligence, decision-makers can confidently align their TPE procurement with technical requirements, local market realities, and long-term business objectives. Whether optimizing costs, enhancing product performance, or ensuring regulatory compliance, this guide is tailored to support B2B buyers across Africa, South America, the Middle East, and Europe in making informed, future-ready decisions.

Understanding thermoplastic elastomers Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Styrenic Block Copolymers (SBC/TPE-S) | ABA block copolymer structure, wide hardness/customization range | Footwear, adhesives, soft-touch grips, toys | Excellent versatility and cost-effective, but limited oil/heat resistance |

| Thermoplastic Polyolefins (TPO) | Blend of polypropylene and elastomers, good chemical/weather resistance | Automotive interiors/exteriors, building products | Cost-efficient, recyclable, moderate flexibility, but lower elasticity than some TPEs |

| Thermoplastic Vulcanizates (TPV) | Dynamic vulcanization for rubber-like properties, high elasticity | Seals, gaskets, hoses, under-the-hood automotive | Combines rubber-like durability with thermoplastic processing, but higher material cost |

| Thermoplastic Polyurethanes (TPU) | Exceptional abrasion resistance, transparency options | Industrial belts, cables, medical devices | Superior mechanical strength and flexibility, can be more expensive and process-sensitive |

| Thermoplastic Copolyester Elastomers (COPE/TPE-E) | High-temperature performance, chemical resistance with polyester backbone | Conveyor belts, automotive parts, electronics | Excellent heat/oil resistance, premium pricing and processing expertise needed |

Styrenic Block Copolymers (SBC/TPE-S)

These TPEs, including SBS, SIS, and SEBS, offer broad customizability in hardness and flexibility, enabling tailored solutions for diverse markets from consumer goods to packaging. B2B buyers benefit from their easy processability (injection molding, extrusion) and lower cost, making them ideal for high-volume or price-sensitive projects in Africa, South America, and emerging markets. However, awareness of their relatively modest resistance to oils and high temperatures is essential for applications demanding rigorous durability.

Thermoplastic Polyolefins (TPO)

TPOs combine polypropylene with elastomers, yielding materials that resist chemicals, UV, and environmental stress. Their moderate flexibility, excellent weatherability, and cost-effectiveness make them highly attractive for automotive and construction sectors, especially in Europe and the Middle East where regulatory and sustainability trends are prominent. Buyers should note that while TPOs are recyclable and lightweight, their elasticity may not match that of other TPE variants, possibly limiting use in applications requiring high stretch or recovery.

Thermoplastic Vulcanizates (TPV)

TPVs like Santoprene are created via dynamic vulcanization, imparting permanent elastic, rubber-like performance alongside the ease of thermoplastic processing. This makes them particularly suitable for demanding sealing and automotive applications where both durability and efficient production are needed. TPVs command a higher price but frequently deliver better lifecycle value through reduced replacements and consistent quality. Key purchasing factors include supply chain reliability and technical support for molding optimization.

Thermoplastic Polyurethanes (TPU)

TPUs stand out for their mechanical strength, abrasion resistance, and, in certain formulations, transparency. They serve critical roles in industrial, medical, and electronics sectors, responding well to dynamic stress, low temperature, and repeated flexing. For B2B buyers seeking long-lasting, high-performance materials—particularly for export markets or high-end products—TPUs can justify higher upfront costs, though attention should be paid to precise processing conditions to realize their full benefits.

Thermoplastic Copolyester Elastomers (COPE/TPE-E)

COPEs (also called TPE-E) leverage a polyester backbone for robust performance at elevated temperatures and resistance to oils and chemicals, crucial for conveyor systems, automotive, and specialized electronics manufacturing. Their reliability in harsh environments is prized in European and Middle Eastern industrial sectors, where equipment downtime is costly. B2B buyers must balance their advantages against higher purchase prices and the technical expertise required for optimal processing, often collaborating closely with material suppliers to ensure specification alignment.

Related Video: What are Transformer Models and how do they work?

Key Industrial Applications of thermoplastic elastomers

| Industry/Sector | Specific Application of thermoplastic elastomers | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive | Seals, gaskets, soft-touch interior parts | Weight reduction, ease of processing, durability | OEM specifications, UV and chemical resistance, color stability |

| Medical Devices | Flexible tubing, syringe plunger tips, grips | Biocompatibility, sterilizability, clarity | ISO 10993/USP Class VI compliance, traceability, batch consistency |

| Consumer Electronics | Cable insulation, connectors, device overmolding | Electrical insulation, design flexibility | RoHS compliance, flame retardancy, precision in molding |

| Footwear & Apparel | Shoe soles, grips, component overmolding | Comfort, shock absorption, design versatility | Abrasion resistance, color options, supply chain reliability |

| Industrial & Construction | Expansion joints, tool grips, vibration dampers | Enhanced durability, weather resistance | Temperature range, chemical compatibility, compliance with local standards |

Automotive

Thermoplastic elastomers are extensively used in automotive manufacturing for seals, gaskets, and soft-touch interior elements. Their ability to combine flexibility with processability allows automakers to reduce assembly times and weight, which improves fuel efficiency and meets regulatory demands. For international buyers—such as those sourcing for factories in Nigeria or Italy—it’s essential to evaluate TPE grades for resistance to UV exposure, fluctuating temperatures, and chemicals like fuels and oils. Compliance with OEM and industry standards is critical to ensure product longevity and customer satisfaction.

Medical Devices

In the medical sector, TPEs serve as materials for flexible tubing, syringe plunger tips, and ergonomic grips for devices. Their biocompatibility and ability to be sterilized (via gamma irradiation, autoclave, or ethylene oxide) make them ideal for use in direct patient contact applications. Buyers need to carefully verify certifications such as ISO 10993 or USP Class VI to ensure regulatory acceptance in Europe, the Middle East, and beyond. Contract manufacturers in South America or Africa should ensure supply partners maintain strict batch consistency and traceability for global market compliance.

Consumer Electronics

Electronic manufacturers rely on TPEs for overmolding connectors, insulating cables, and creating durable yet soft-touch surfaces on devices. TPEs enable innovative designs and provide excellent electrical insulation, crucial for safety and performance. International buyers must ensure materials meet RoHS directives and required flame retardant standards, particularly when exporting to Europe. Attention to precise molding properties and color-matching is essential for maintaining brand consistency across global product lines.

Footwear & Apparel

Footwear companies use TPEs for soles, inserts, and ergonomic parts, taking advantage of their shock-absorbent and customizable qualities. They offer greater design flexibility compared to traditional rubber and can be colored to suit market trends, which is vital in fashion-sensitive regions like Europe and the Middle East. Buyers should prioritize abrasion and slip resistance, color fastness, and work with suppliers who demonstrate reliable delivery schedules given seasonally-driven fashion cycles, especially in fast-growing markets in Africa and South America.

Industrial & Construction

Thermoplastic elastomers are chosen for industrial applications like expansion joints, pipe seals, and anti-vibration mounts due to their resilience, weather resistance, and ability to dampen noise and vibration. In regions such as Nigeria or the Middle East, where temperature swings and chemical exposure are common, buyers must verify the material’s operating temperature range and resistance to oils, solvents, and other harsh substances. Adherence to local building codes and international standards should be checked before committing to large-scale procurement.

Related Video: Thermoplastic elastomers (TPE) tourniquet or excerise band extrusion line

Strategic Material Selection Guide for thermoplastic elastomers

Thermoplastic elastomers (TPEs) offer a diverse material portfolio for B2B buyers seeking to balance performance, manufacturability, and cost in a range of market segments—automotive, healthcare, consumer goods, and construction, among others. Understanding the distinctions among the principal TPE families is essential for effective material selection, especially given the region-specific compliance, logistics, and application factors relevant for buyers in Africa, South America, the Middle East, and Europe. Below is a focused analysis of the most frequently specified TPE material types.

Styrenic Block Copolymers (SBC/TPE-S)

Key Properties:

Styrenic block copolymers, such as SBS and SEBS, provide excellent flexibility, resilience, and processability. They perform across a broad hardness range, show good clarity, and exhibit moderate resistance to water and chemicals (but are less resistant to hydrocarbons and oils).

Pros & Cons:

Advantages include rapid, energy-efficient processing and ease of coloring, making them ideal for consumer products (e.g., grips, seals) and packaging. However, their UV and weather resistance is usually limited unless modified, and their upper continuous use temperatures (~70–90°C) are lower than those of some TPEs. Their resistance to abrasion is moderate.

Impact on Application:

SBCs are most suitable where tactile comfort, flexibility, and appearance are prioritized over high chemical or temperature resistance. Oil, fuel, and outdoor exposure are less ideal.

B2B Considerations:

SBCs are widely accepted and available, lowering supply chain risk. They generally conform to standards like ASTM D3677 or ISO 18064. European buyers may require REACH or RoHS compliance, while African and Middle Eastern importers should confirm UV stabilization for outdoor uses. They are among the most cost-effective TPEs, helpful for markets sensitive to price volatility.

Thermoplastic Vulcanizates (TPV)

Key Properties:

TPVs, typically blends of EPDM rubber dynamically crosslinked in a polypropylene matrix, exhibit high elastic recovery, excellent chemical resistance, and can withstand continuous use temperatures up to 120°C.

Pros & Cons:

These materials combine the process efficiency of thermoplastics with the durable resilience of vulcanized rubbers, including superior flex fatigue and good long-term sealing performance. Downsides are higher cost compared to basic SBCs and more complex processing. Some TPVs may be stiffer at low temperatures.

Impact on Application:

TPVs are favored in demanding automotive, industrial, and infrastructure applications—such as seals, hoses, and gaskets—where temperature, chemical exposure, or dynamic fatigue are design factors.

B2B Considerations:

TPVs are compatible with major global standards (e.g., ASTM D5046, ISO 18064). In Europe and the Middle East, low VOC and halogen-free requirements are increasingly important, especially in transport and construction. Their chemical and temperature resistance make them attractive for South American and African climates with extreme environmental conditions.

Thermoplastic Polyurethanes (TPU)

Key Properties:

TPUs offer high transparency, excellent abrasion resistance, and notable resistance to oils and fuels. They perform at continuous service temperatures up to 120°C and provide high tensile strength and tear resistance.

Pros & Cons:

Major advantages are outstanding mechanical properties and process versatility—TPUs can be injection molded, extruded, and calendared. Cost is generally higher than SBCs or TPVs. Some grades can be hydrolysis-sensitive or UV-sensitive, and must be specified based on final use.

Impact on Application:

TPUs are well-suited for automotive parts, hoses, technical films, and cables—products requiring durability, flexibility, and resistance to harsh fluids or physical abuse.

B2B Considerations:

Many TPUs meet standards like DIN 53504 and ASTM D412. In Europe and the Middle East, comply with REACH, RoHS, and sometimes FDA for food-grade uses. South American and African buyers should assess local infrastructure for process support and verify lead times, as specialty TPU grades may be less readily available than basic TPEs.

Thermoplastic Olefins (TPO)

Key Properties:

TPOs, usually PP-based blends with EPDM or similar rubbers, offer good impact resistance, low density, and resistance to UV and weather. Their service temperature typically ranges up to 100°C.

Pros & Cons:

TPOs are cost-effective and show good dimensional stability, especially for large automotive and construction parts. They have lower elasticity and flexibility than SBCs or TPVs and may require surface modification for adhesion or painting.

Impact on Application:

Frequent in automotive bumpers, exterior trim, roof membranes, and building materials requiring bulk and durability at moderate temperatures.

B2B Considerations:

Compliant with ISO and ASTM specifications (e.g., ASTM D3892). Africa and the Middle East benefit from TPO’s UV/weather resistance for outdoor installations. In Europe, sustainable content and recyclability can be a procurement requirement—TPOs often perform strongly in these areas.

Summary Table: Thermoplastic Elastomer Material Selection

| Material | Typical Use Case for thermoplastic elastomers | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Styrenic Block Copolymers (SBC) | Grips, flexible packaging, soft-touch consumer products | Cost-effective; easy to process/formulate | Limited temperature & UV resistance | Low |

| Thermoplastic Vulcanizates (TPV) | Seals, gaskets, automotive and industrial profiles | High chemical & temperature resistance | Higher cost; more complex processing | Medium |

| Thermoplastic Polyurethanes (TPU) | Durable hoses, cables, automotive, and technical films | Superior abrasion & oil resistance | Cost; potential UV/hydrolysis sensitivity | Medium to High |

| Thermoplastic Olefins (TPO) | Automotive bumpers, construction parts, exterior applications | Good weatherability & impact resistance | Lower flexibility; may need surface treatment | Low to Medium |

In-depth Look: Manufacturing Processes and Quality Assurance for thermoplastic elastomers

Thermoplastic elastomers (TPEs) offer a unique blend of processability and elastomeric properties, making them increasingly popular across industries as diverse as automotive, medical, electronics, and consumer goods. For international B2B buyers, understanding the intricate manufacturing workflows and robust quality assurance (QA) protocols behind TPE production is crucial for risk mitigation, compliance, and ensuring reliable supply chains.

Overview of Manufacturing Process: Stages and Techniques

The manufacturing process for TPEs typically unfolds through several well-defined stages. Each step requires strict control to deliver materials with the intended physical, chemical, and mechanical properties.

1. Material Preparation

Raw Material Selection:

Each TPE family (e.g., styrenic block copolymers, thermoplastic vulcanizates, polyolefin blends) demands precise selection of base resins, additives, and modifiers. Common raw materials include:

- Base polymers (polystyrene, polypropylene, polyethylene)

- Elastic phase components (rubbers like polybutadiene, polyisoprene)

- Plasticizers, stabilizers, fillers, pigments, and flame retardants for customized performance

Material Handling & Compounding:

Consistent blending is achieved via high-shear mixing or twin-screw extrusion. Factors such as component viscosity, blend ratios, and thermal stability are meticulously managed to produce uniform premixes.

2. Forming and Shaping

Melt Processing:

TPEs are processed at elevated temperatures using conventional thermoplastic forming techniques, which include:

- Injection Molding: Dominant method for high-volume items and components requiring complex geometries.

- Extrusion: Used for profiles, tubing, films, and wire coatings. Control over temperature, screw speed, and die design is essential.

- Blow Molding: Applied for bottles or hollow parts.

- Calendering or Compression Molding: Used less frequently depending on specific product needs.

Each technique must maintain optimal thermal and mechanical conditions to prevent material degradation and ensure surface and dimensional quality.

3. Assembly and Integration

TPEs often undergo secondary operations, especially in multi-material or over-molded assemblies (e.g., soft-touch grips over a rigid substrate). Compatibility with other polymers (such as polypropylene) enables efficient in-line assembly processes, minimizing cycle times and production costs.

4. Post-processing and Finishing

Cooling & Stabilization:

Formed products are cooled and stabilized to achieve final elastomeric properties. Post-cooling annealing might be applied for enhanced performance in critical applications.

Trimming & Surface Treatment:

Deflashing, trimming, and—when required—surface texturing or plasma treatments are performed to improve appearance or adhesion properties for further assembly or coating.

Quality Assurance: Standards, Testing, and Verification

A robust quality assurance framework is non-negotiable for B2B buyers sourcing TPEs internationally. This encompasses adherence to recognized standards, multi-step inspection protocols, and transparency in testing.

Key International Standards and Certifications

- ISO 9001:

The global benchmark for quality management systems, certifying that manufacturing processes are standardized, monitored, and continuously improved. - ISO 14001:

Environmental management, increasingly tied to procurement by European and Middle Eastern buyers. - CE Marking (Europe):

Mandatory for products used in regulated EU sectors (toys, medical devices). - API (American Petroleum Institute):

Required for components in energy/petrochemical applications, especially in Middle East and African markets. - REACH & RoHS (EU):

Chemical safety and hazardous substance directives.

Suppliers serving global markets should maintain up-to-date certificates and be able to demonstrate compliance on request.

Quality Control Checkpoints

Quality control typically includes multiple checkpoints, each targeting different risks in the manufacturing chain:

- Incoming Quality Control (IQC):

Verification of all incoming raw materials (base resins, additives) for conformity (e.g., melt flow index, moisture content, purity). - In-Process Quality Control (IPQC):

Real-time monitoring of key parameters during compounding and molding (temperature, viscosity, density, mixing uniformity). Sampling and testing are conducted on the shop floor. - Final Quality Control (FQC):

Finished goods inspection covering: - Dimensional accuracy (using optical or laser measurement)

- Mechanical properties (tensile strength, elongation at break, hardness/Shore A-D)

- Surface finish and absence of defects (voids, inclusions)

- Application-specific tests (e.g., electrical insulation for cables, biocompatibility for medical devices)

Common Testing Methods

For TPEs, the following methods are typically used:

- Tensile and Tear Strength: ISO 37, ASTM D412

- Hardness: ISO 868, ASTM D2240 (Shore A/D scales)

- Compression Set: ISO 815, ASTM D395 (for resilience and recovery)

- Thermal Analysis: Differential Scanning Calorimetry (DSC) for melting and glass transition points

- Aging and Weatherability: Accelerated heat/UV/kettle tests (ISO 4892)

- Chemical Resistance: Exposure to solvents, oils, acids per customer specification

Upon request, reputable suppliers should furnish full test reports correlating batch numbers to specific test results.

Supplier QC Verification for International B2B Buyers

Due Diligence Tactics:

- Requesting Audit & Certification Documentation:

Always ask for recent ISO/CE/API certificates, test reports, and audit summaries. Third-party verification (via SGS, Intertek, TÜV, etc.) is particularly valuable when sourcing from new regions or suppliers. - Conducting or Commissioning Onsite or Virtual Audits:

African, South American, and Middle Eastern buyers—often facing logistical or regulatory differences—should prioritize suppliers with transparent audit histories and proven openness to inspection. - Sample and Batch Traceability:

Insist on clear labeling and tracking of production batches, including material certificates and traceable batch numbers, to mitigate risks associated with supply chain disruptions or recalls. - Regular Performance Review and Requalification:

Periodically (e.g., annually), require suppliers to submit updated test samples, retest reports, and if feasible, share continuous improvement records.

Regional Nuances:

- Africa:

Infrastructure variabilities make local QC less predictable; sourcing from ISO-certified exporters and leveraging third-party inspection services reduces risk. - South America:

Customs and legal standards can fluctuate; prioritize suppliers familiar with Mercosur regulations and able to provide both local and international certifications. - Middle East:

Oil & gas sector applications demand compliance with both international (API, ISO) and national specs—ensure dual compliance. - Europe:

Regulatory stringency is high; CE marking, REACH, and RoHS compliance are often non-negotiable, and complete material disclosure (including trace elements) may be mandatory.

Best Practices for B2B Buyers

- Develop a Clear Technical/QA Specification:

Define end-use application criteria, required standards, and testing protocols in your RFQ and supply contracts. - Establish Ongoing Communication Channels:

Maintain regular dialogue with supplier technical and QC teams to stay informed of any process changes, recalls, or certification updates. - Utilize Third-party Inspection:

Especially valuable for first shipments or critical applications. Independent laboratories can verify sample conformity before bulk shipment. - Insist on Data Transparency:

Require full, detailed batch test reports and retain the right to spot-audit production or sampling processes.

By rigorously scrutinizing manufacturing and quality assurance frameworks, international B2B buyers equip themselves to select reliable TPE suppliers, minimize risk, and safeguard product performance and regulatory compliance across diverse export destinations.

Related Video: Glenroy’s Flexible Packaging Manufacturing Process

Comprehensive Cost and Pricing Analysis for thermoplastic elastomers Sourcing

Key Cost Components in TPE Sourcing

Understanding the comprehensive cost structure is critical for international buyers when sourcing thermoplastic elastomers (TPEs). The total cost can be broken down into several core components:

- Raw Materials: This forms the bulk of the TPE cost. Prices fluctuate based on the type (e.g., styrenic block copolymers, thermoplastic polyurethanes, polyolefin blends), feedstock costs (like styrene, ethylene, butadiene), and any specialty resins or additives for performance enhancement.

- Manufacturing and Labor: Labor costs vary significantly across regions. Countries with lower labor costs may offer better pricing, but it is crucial to balance this against quality consistency. Manufacturing overheads encompass energy, equipment amortization, and plant maintenance.

- Tooling and Molds: Custom applications often require tailored tooling, which is a significant one-time investment—especially for new product development or customized geometries.

- Quality Control (QC) and Certifications: Rigorous QC processes, required certifications (such as ISO, RoHS, REACH), and compliance testing add to the per-kg cost but are essential for international markets.

- Logistics and Packaging: Transportation expenses are influenced by distance, shipping mode (sea, air, road), packaging needs (bulk vs. pallets), and local import duties or tariffs. Buyers from Africa, South America, and the Middle East must be particularly mindful of the embedded costs of ocean freight, customs clearance, and last-mile delivery.

- Supplier Margins: Established suppliers typically build in profit margins reflecting industry norms, value-added services, and market competitiveness.

Major Factors Influencing TPE Pricing

B2B TPE pricing is subject to both direct and indirect influencers—understanding these is crucial for strategic sourcing.

- Order Volume and Minimum Order Quantities (MOQs): Larger volumes typically result in tiered discounts due to economies of scale. However, smaller runs or unique color/custom blends often attract higher per-unit prices.

- Material Grades and Specifications: Enhanced properties (UV-resistance, medical grade, flame retardance, specific hardness) command premium prices due to costly ingredients and more stringent QC.

- Level of Customization: The more an order deviates from standard off-the-shelf grades—such as requiring custom formulation, color masterbatch, or compound modification—the higher the prototyping, compounding, and development costs.

- Supplier Location and Capability: Suppliers in regions with integrated petrochemical industries (e.g., Europe, parts of Asia) may offer more stable pricing. Suppliers with established certifications and export experience add value but may charge more for reliability and compliance.

- Incoterms and Delivery Terms: Whether pricing is quoted as EXW (Ex Works), FOB (Free on Board), CIF (Cost, Insurance, Freight), or DDP (Delivered Duty Paid) significantly affects the total landed cost and should be clarified early in negotiation.

- Market Dynamics and Raw Material Price Fluctuations: Global shifts in feedstock pricing, supply-demand imbalances, and currency volatility can cause frequent price updates. Forward contracts or hedging mechanisms may be considered for large or ongoing purchases.

Tactical Buyer Insights for International Sourcing

For B2B buyers from Africa, South America, the Middle East, and Europe, strategic attention to the following can result in more competitive and predictable TPE procurement outcomes:

- Total Cost of Ownership (TCO): Move beyond ex-factory price; evaluate logistics, tariffs, local taxes, delivery reliability, and post-delivery service for a comprehensive cost picture.

- Negotiate for Value, Not Just Price: Engage in discussions about bundled services (such as technical support, expedited delivery, or onsite QC verification) to extract additional value.

- Leverage Market Multiples: Source quotes from multiple geographies to benchmark pricing. Consider not just cheapest offers, but supplier credibility, lead times, and regional risk factors (such as port congestion or regulatory delays).

- Optimize MOQs and Batch Flexibility: For regions with variable demand (e.g., Nigeria or Chile), negotiate for flexible MOQs or explore local warehousing options with your supplier to manage working capital and avoid stockouts.

- Clarify Incoterms and Duties: Ensure full clarity on precisely which costs are borne by the supplier and which by the buyer to avoid hidden charges upon import. For buyers in markets with complex customs (e.g., Nigeria or Middle Eastern countries), DDP or DAP terms may offer more cost predictability.

- Quality and Regulatory Alignment: Insist on certificates of conformance and independent QC reports as part of your contract, especially for applications subject to international standards (medical, automotive, food contact).

- Monitor Raw Material Indices: Regularly track feedstock price movements and negotiate indexed pricing where appropriate to share risk and avoid unexpected inflationary pressures.

Disclaimer: All prices and cost components mentioned are indicative and subject to significant variation based on region, market conditions, and supplier terms. Thorough due diligence and detailed negotiations are essential for accurate landed cost determination.

By comprehensively analyzing these cost drivers and actively managing supplier relationships, international buyers can optimize sourcing strategies for thermoplastic elastomers to meet both performance and budget requirements.

Spotlight on Potential thermoplastic elastomers Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘thermoplastic elastomers’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

10 thermoplastic elastomer manufacturers (www.verifiedmarketresearch.com)

With its main office in Beijing and operating under the “YANAC” brand, this company has been manufacturing thermoplastic elastomers since 2000. It offers a diverse portfolio of TPEs tailored for key industries such as automotive, construction, and consumer goods, with formulations designed for performance and durability. The firm’s continued presence among leading producers suggests a commitment to scalable manufacturing and competitive quality, making it a reliable partner for sourcing bulk TPE requirements. Though detailed public data on certifications or specific manufacturing technologies is limited, its market positioning and broad product applicability indicate experience serving international B2B buyers, including those in emerging markets across Africa, South America, the Middle East, and Europe. Prospective partners should inquire directly for detailed compliance, customization capabilities, and logistics arrangements.

35 Thermoplastic Elastomer Manufacturers in 2025 (us.metoree.com)

As a leading aggregation platform, the “35 Thermoplastic Elastomer Manufacturers in 2025” listing on Metoree (https://us.metoree.com/categories/3349/) offers B2B buyers a curated directory of top-rated thermoplastic elastomer (TPE) manufacturers worldwide. The platform emphasizes diversity in product offerings, ranging from standard TPE compounds to customized solutions for automotive, industrial, medical, and consumer goods sectors. While individual manufacturing capabilities or certifications (such as ISO or industry-specific standards) vary by company, the platform allows buyers to efficiently compare suppliers on the basis of technical expertise, global reach, and market reputation.

For international buyers in Africa, South America, the Middle East, and Europe, this resource streamlines supplier identification and due diligence. The directory provides valuable overviews, ranked lists, and direct access to company profiles, enabling efficient pre-qualification and facilitating inquiries relevant to large-scale procurement, contract manufacturing, or long-term sourcing. Publicly available details on each manufacturer may be limited; buyers are advised to connect directly with shortlisted companies to confirm specific capabilities, certifications, and export readiness.

Thermoplastic Elastomer (TPE) Companies (www.mordorintelligence.com)

Thermoplastic Elastomer (TPE) Companies are recognized among the leading manufacturers and suppliers in the global TPE market, with strong visibility based on recent market share analyses. They focus on producing a wide spectrum of thermoplastic elastomers, catering to diverse applications such as automotive parts, medical devices, building materials, and consumer goods. Key strengths include access to the latest polymer technologies and adaptability to customer-specific requirements, making them attractive for buyers seeking tailored material properties and reliable supply. While detailed certifications and deep company history are not widely publicized, their inclusion in expert market reports suggests robust operational standards and significant international market activity, especially in regions like Africa, South America, the Middle East, and Europe. International B2B buyers benefit from their broad offering, commitment to product quality, and ability to supply at scale across varied industries.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| 10 thermoplastic elastomer manufacturers | Beijing-based TPE producer, YANAC brand, global scope. | www.verifiedmarketresearch.com |

| 35 Thermoplastic Elastomer Manufacturers in 2025 | Global directory for sourcing top TPE manufacturers. | us.metoree.com |

| Thermoplastic Elastomer (TPE) Companies | Leading TPE supplier, broad global coverage. | www.mordorintelligence.com |

Essential Technical Properties and Trade Terminology for thermoplastic elastomers

Key Technical Properties for Informed Sourcing

When evaluating thermoplastic elastomers (TPEs) for procurement, understanding the principal technical properties is vital to ensure functional performance, regulatory compliance, and long-term value in the supply chain. Here are the most relevant technical specifications for B2B buyers:

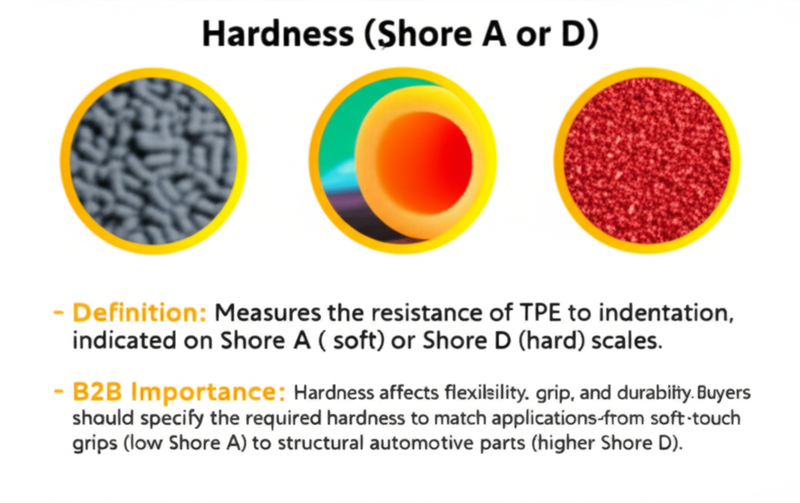

1. Hardness (Shore A or D)

– Definition: Measures the resistance of TPE to indentation, indicated on Shore A (soft) or Shore D (hard) scales.

– B2B Importance: Hardness affects flexibility, grip, and durability. Buyers should specify the required hardness to match applications—from soft-touch grips (low Shore A) to structural automotive parts (higher Shore D).

2. Tensile Strength

– Definition: The maximum stress a TPE sample can withstand while being stretched before it breaks, usually expressed in megapascals (MPa).

– B2B Importance: High tensile strength is crucial for applications needing mechanical durability, such as seals, gaskets, or footwear soles. It’s a key indicator of performance longevity.

3. Elongation at Break

– Definition: The percentage increase in length a TPE exhibits before rupture.

– B2B Importance: This specifies flexibility and resilience. High elongation materials are preferable where products face repeated stretching, like automotive bellows or flexible tubing.

4. Melt Flow Index (MFI)

– Definition: Indicates the flow characteristics of TPE during processing, measured as the amount of material that flows through an orifice at a specified temperature and load in 10 minutes (g/10min).

– B2B Importance: Essential for molding or extrusion efficiency. Selecting the right MFI optimizes production speed and ensures uniform part quality.

5. Chemical and Heat Resistance

– Definition: The material’s ability to withstand exposed chemicals, oils, and elevated temperatures without degrading.

– B2B Importance: For sectors like automotive, healthcare, or industrial equipment, ensuring TPEs meet resistance standards prevents premature part failure and costly recalls.

6. Regulatory Compliance

– Definition: Adherence to relevant international standards (e.g., REACH, RoHS, FDA).

– B2B Importance: Mandatory for buyers exporting or using TPEs in regulated industries. Always request certifications from the supplier to confirm compliance.

Essential B2B Trade Terms: Understanding the Industry Language

Grasping common trade jargon and technical terminology streamlines communication, negotiation, and documentation in the global TPE market. Here are essential terms every B2B buyer should know:

OEM (Original Equipment Manufacturer)

A business that produces finished goods or components used in another company’s end products. In TPE sourcing, buyers may be OEMs themselves or supply OEMs, often demanding specific technical or quality standards.

MOQ (Minimum Order Quantity)

The smallest number of units a supplier is willing to sell per order. TPE suppliers may set MOQs based on grade, color, or packaging. Understanding MOQ ensures accurate budgeting and inventory planning, especially for importers or distributors in emerging markets.

RFQ (Request for Quotation)

A formal document or inquiry requesting a supplier’s pricing, technical specifications, and terms for TPE materials. Providing complete details in an RFQ accelerates sourcing and helps receive comparable, competitive offers.

Incoterms (International Commercial Terms)

A set of globally recognized rules (e.g., FOB, CIF, DAP) defining the responsibilities of buyers and sellers for delivery, insurance, and customs clearance. Choosing suitable Incoterms mitigates risk and clarifies cost responsibility in cross-border transactions.

Material Grade

Indicates the composition and performance profile of a TPE, such as general purpose, medical, flame-retardant, or food-grade. Articulating required grades avoids mismatches and ensures materials meet end-use requirements and certifications.

Tolerance

Specifies acceptable variation limits for product dimensions or properties, often listed in technical datasheets. Discussing tolerances is essential to assure part interchangeability and minimize quality disputes, especially in international projects with tight specifications.

As global TPE markets expand—across Africa, the Middle East, South America, and Europe—command of these technical properties and trade terms empowers buyers to make informed, confident sourcing decisions. Robust pre-qualification, clear specification, and fluent use of industry language reduce risk, optimize cost, and ensure reliable supply.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the thermoplastic elastomers Sector

Global Market Overview and Emerging Sourcing Trends

The thermoplastic elastomers (TPE) sector is experiencing robust growth, fueled by expanding demand across key industries such as automotive, consumer goods, medical devices, and construction. This growth is especially pronounced in regions with rapid industrialization, including parts of Africa, South America, and emerging Middle Eastern markets. Europe continues to lead in high-value, innovative TPE applications, while local manufacturers and traders in countries like Nigeria and Brazil are increasingly integrating TPEs in infrastructure and manufacturing projects due to their versatility, recyclability, and processing efficiency.

Global drivers shaping the TPE market include tightening sustainability regulations, the need for lightweight and durable materials, and rising demand for products with superior performance across temperature ranges and chemical exposures. International B2B buyers are responding by sourcing specialty grades of TPEs—such as styrenic block copolymers (SBCs), thermoplastic polyurethanes (TPUs), and polyolefin-based elastomers—for specific industry needs. These materials are prized for their ability to replace conventional rubbers and PVC, offering improved processing capabilities and cleaner end-of-life disposal.

Technology-driven trends are influencing sourcing strategies; digital procurement platforms and advanced material qualification tools streamline supplier discovery, enabling buyers to evaluate quality, compliance, and sustainability credentials more efficiently. In regions where local TPE production capacity lags, such as Africa and parts of South America, strategic partnerships with global suppliers—particularly from Asia and Europe—are on the rise. B2B buyers in these markets should prioritize long-term supplier reliability, access to technical support, and product customization capabilities to meet region-specific requirements.

Price dynamics remain volatile due to fluctuating raw material costs and ongoing supply chain disruptions, particularly for butadiene, styrene, and olefins. B2B buyers should implement multi-source procurement models, develop robust forecasting practices, and monitor regulatory shifts affecting import/export regimes—particularly in regions with evolving environmental and industrial policies.

Emphasizing Sustainability and Ethical Sourcing in TPE Procurement

Sustainability considerations are now central to TPE sourcing strategies. Beyond compliance, international buyers are under increasing pressure from regulators, customers, and end consumers to demonstrate tangible progress in environmental stewardship and ethical supply chain practices. Key sustainability challenges for TPEs include the use of non-renewable feedstocks, energy-intensive production processes, and end-of-life management for products and scrap.

Leading TPE producers are innovating in several areas—formulating bio-based TPEs, incorporating recycled content, and designing polymers for enhanced recyclability without compromising performance. For B2B buyers, evaluating suppliers based on environmental certifications—such as ISO 14001 (Environmental Management), Global Recycled Standard (GRS), and specific product ecolabels—can provide credible assurance of sustainability commitments. Furthermore, scrutinizing supply chain transparency and supporting suppliers with traceable, responsibly sourced raw materials is becoming an essential due diligence step.

Europe is ahead on circularity and regulatory compliance, making it a prime sourcing destination for ‘green’ TPE grades. Middle Eastern and African markets are exploring imported sustainable TPE solutions, often in partnership with European or Asian suppliers who can offer both expertise and certified products. In South America, national regulations and multinational OEM requirements are raising the bar for local suppliers to adopt sustainable production models.

Action points for buyers include integrating sustainability requirements into RFQs and long-term contracts, requesting third-party environmental and social audits from suppliers, and staying abreast of evolving legislation governing plastics and product safety. A strategic focus on ‘design for recyclability’ and closed-loop collaborations not only mitigates compliance risks but also opens new business opportunities in value-added TPE applications.

Evolution of the Sector: A Brief Perspective

Thermoplastic elastomers emerged commercially in the 1960s, bridging the performance gap between conventional thermoset rubbers and process-friendly thermoplastics. Their unique structure—comprising hard and soft segments in a physical blend—enabled a step change in manufacturing flexibility and cost efficiency. Over subsequent decades, the refinement of block copolymer synthesis and innovations such as dynamic vulcanization broadened the performance profile and application scope of TPEs.

For B2B buyers, understanding this evolutionary pathway is instructive. The TPE sector has matured from its origins as a substitute for rubber/PVC in commodity applications to a vital enabler of advanced, high-performance products. This historical context explains both the current diversity of TPE grades and ongoing innovation—positioning TPEs as a strategic material category for forward-looking B2B supply chains worldwide.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of thermoplastic elastomers

-

How can I effectively vet international suppliers of thermoplastic elastomers (TPEs)?

Conduct a thorough due diligence process, starting with an evaluation of suppliers’ certifications (such as ISO 9001, REACH, and ROHS) and compliance with your industry’s standards. Request technical data sheets, samples, and recent third-party lab test reports to assess material performance. Investigate financial stability, client references—preferably from your target region—and supplier track record with global logistics. Utilize B2B platforms with verified supplier rankings and, if feasible, consider an on-site factory audit—either directly or via a trusted agent—to confirm production capabilities and quality controls. -

Can thermoplastic elastomers be customized to meet specific regional requirements or application needs?

Yes, TPEs offer significant formulation flexibility. Many manufacturers can tailor properties such as hardness, elasticity, color, UV or chemical resistance, and compliance with specific local regulations (such as European REACH or Nigeria’s SONCAP). When requesting customization, clearly communicate your application requirements, intended use scenarios, and any critical certifications. Collaborate directly with the supplier’s technical team to finalize specifications and always request pre-production samples for validation before confirming large orders. -

What are typical minimum order quantities (MOQ), lead times, and payment terms when sourcing TPEs internationally?

MOQs vary by supplier, but for international B2B buyers, typical MOQs range from 500 kg to several metric tons, depending on the grade and degree of customization. Standard lead times are usually 3–6 weeks for non-customized products and can extend to 8–12 weeks for specialty grades or bespoke formulations. Payment terms often include a 30–50% advance with the balance upon shipping or delivery; letters of credit (LC) and escrow are common for significant transactions. Always confirm terms in writing before order placement. -

Which quality assurance (QA) processes and certifications should I expect from reputable TPE suppliers?

Reputable suppliers should have robust QA processes, including batch traceability, in-house and third-party testing for mechanical and chemical properties, and conformity to international standards like ISO 9001. For critical applications, seek suppliers that can provide certificates of analysis (COA), safety data sheets (SDS), and third-party compliance reports for standards such as REACH, ROHS, or specific automotive or medical requirements. Ensuring the supplier maintains rigorous testing and documentation will mitigate quality and regulatory risks. -

What logistics and shipping challenges might I encounter when importing TPEs into regions such as Africa or the Middle East, and how can I address them?

Common challenges include limited shipping routes, port congestion, regulatory documentation complexity, and temperature sensitivity in transit. To mitigate risk, partner with suppliers experienced in your region and clarify Incoterms (such as FOB or CIF) in contracts. Invest in reliable freight forwarders for customs clearance and, if needed, request moisture-proof or temperature-controlled packaging. Proactively track shipping and maintain open communication with logistics partners to anticipate delays or regulatory issues. -

How should B2B buyers manage disputes or quality concerns with suppliers from other continents?

Clearly define the dispute resolution process in your contract, specifying inspection acceptance criteria, timelines, and recourse options. Use third-party inspection services at the factory and on arrival to independently verify quality. For significant contracts, international arbitration clauses (e.g., ICC) provide structured recourse if initial negotiations fail. Timely, documented communication—ideally via your company’s legal and procurement teams—supports fair and efficient resolution and maintains supplier accountability. -

Are there import regulations or certifications specific to my region that I must be aware of when sourcing TPEs?

Many countries and regions enforce strict import and product standards. The EU requires REACH and ROHS compliance; Nigeria mandates SONCAP certification; Brazil may require INMETRO approvals; Gulf countries have SASO or GSO requirements. Work closely with both the supplier and a local import agent to ensure all documentation and certifications are in order prior to shipment, to avoid costly delays or product rejection at customs. Regularly check updates to regulations relevant to polymers and elastomers. -

What are best practices for maintaining supply chain continuity and cost control when importing TPEs internationally?

Establish relationships with multiple vetted suppliers to avoid over-reliance on a single source. Monitor currency exchange fluctuations and consider hedging strategies for large contracts. Secure clear forecasts and regular communication with suppliers for inventory planning—especially in volatile markets—and negotiate flexible contracts to accommodate shifts in demand. Additionally, leverage consolidated shipping or regional distribution hubs to optimize freight costs and reduce lead time variability.

Strategic Sourcing Conclusion and Outlook for thermoplastic elastomers

International B2B buyers evaluating thermoplastic elastomers (TPEs) are well-positioned to capture significant value by aligning material selection with application-specific requirements. TPEs offer a unique blend of flexibility, process efficiency, and sustainability advantages, distinguishing them from traditional rubbers and other synthetics. By leveraging flexible supply structures and diverse global producers, buyers in Africa, South America, the Middle East, and Europe can access a robust portfolio of TPE grades tailored to automotive, medical, packaging, and consumer goods sectors.

Strategic sourcing initiatives should center on:

– Assessing total lifecycle cost including processing, durability, and potential for recyclability.

– Collaborating with suppliers to optimize formulations and ensure regulatory compliance across regions.

– Diversifying supply chains to mitigate risk and enhance consistency in material availability.

– Monitoring innovations in TPE blends, additives, and processing technologies for future-proof solutions.

Continued growth in TPE markets—driven by sustainability mandates and evolving industrial needs—underscores the importance of agile procurement strategies. International buyers are encouraged to proactively engage with trusted partners, explore material innovations, and incorporate flexibility in their sourcing models. By doing so, organizations will strengthen their competitive positioning and ensure resilient, future-ready TPE supply chains in a dynamic global marketplace.