Introduction: Navigating the Global Market for valves seals

Valves seals stand as the critical safeguard between operational efficiency and unplanned downtime in modern industrial systems. Whether in the oil fields of the Middle East, processing plants of South America, power stations across Africa, or advanced manufacturing in Europe, the integrity of valves and their seals directly determines productivity, regulatory compliance, and asset lifespan. For B2B buyers navigating a rapidly evolving global market, the selection and sourcing of the right valve seals is no longer just a technical detail—it’s a strategic imperative that influences safety, sustainability, and competitive edge.

Today’s global landscape for valve seals is defined by increasingly complex requirements. Buyers must evaluate a vast spectrum of seal types and materials to address diverse media, temperature extremes, pressures, and environmental factors unique to their region or sector. The risks of improper selection—ranging from costly leaks and equipment failure to regulatory violations and reputational harm—are simply too high to ignore.

This comprehensive guide is engineered to demystify the complexity and drive confident, informed decision-making for international procurement teams. It delivers:

- A clear breakdown of essential valve seal types, their core functions, and optimal application scenarios.

- Guidance on selecting high-performance materials that match specific operating environments, including resistance to chemicals, heat, or abrasion.

- Insights into manufacturing processes, quality control protocols, and international certifications to help buyers assess supplier reliability and product compliance.

- Best practices for qualifying global and regional suppliers, structuring effective partnerships, and navigating the nuances of cross-border sourcing.

- Practical advice on cost structures, logistics, and market trends to support sustainable procurement strategies.

- Straightforward answers to common challenges and expert recommendations, tailored to the needs of buyers from Brazil to Saudi Arabia and beyond.

By leveraging the actionable insights in this guide, B2B buyers gain the tools needed to minimize risks, maximize value, and future-proof their operations—ensuring every valves seal procured becomes a pillar of system performance and business growth.

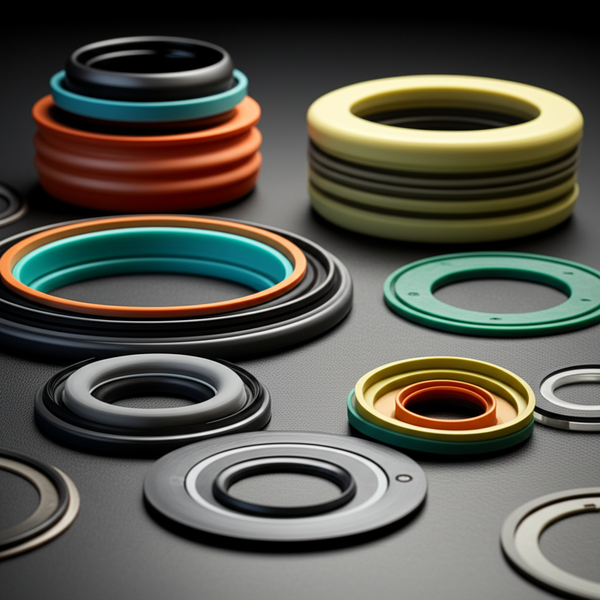

Understanding valves seals Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| O-Ring Seals | Circular elastomer ring, fits in a gland around or inside valve parts | Water treatment, energy, process industries | Cost-effective, widely available; may fail in high-temperature/chemical exposure |

| Lip Seals (U-Cup, V-Ring) | Flexible sealing edge with dynamic or static fit | Oil & gas, chemical, mining, rotating equipment | Excellent dynamic sealing; installation can be delicate, material compatibility critical |

| Gasket Seals | Flat or shaped component, often compressed between flanges | Pipelines, utilities, power generation | Handles wide pressures/sizes; may require periodic tightening/replacement |

| Metal Seals | Precision-machined metal ring, used in extreme environments | Petrochemical, high-pressure steam, nuclear | Exceptional durability for high stress; higher cost, stringent surface finish requirements |

| Diaphragm Seals | Flexible membrane (elastomer/metal) isolating process fluid | Pharma, food processing, instrumentation | Prevents contamination, precise control; limited to relatively low pressures |

O-Ring Seals

O-Ring seals are a staple in valve sealing, valued for their simplicity and adaptability across a broad range of applications. Formed from elastomers (commonly NBR, EPDM, FKM), they provide a primary static or dynamic seal by being compressed in a groove between valve elements. For international buyers, especially with distributed or aging infrastructure, the universal sizing and global availability of O-Rings facilitate maintenance and replacement. Buyers should consider chemical compatibility and temperature ratings, particularly for regions with harsh environmental conditions or aggressive media. Ensuring supplier certification and access to non-standard sizes is crucial for diverse equipment fleets.

Lip Seals (U-Cup, V-Ring)

Lip seals offer dynamic sealing through a flexible lip that maintains contact with moving surfaces, excelling in valves where shafts or stems must rotate or reciprocate. Typical materials include PTFE, FKM, or polyurethane, delivering robust sealing in environments subject to frequent operation and high cycle counts. For B2B buyers, particularly in oil & gas and mining, these seals reduce leakage risk and extend operational lifespans. Attention should be paid to installation practices, as improper fitting can quickly compromise performance. Prioritize suppliers offering proven material traceability and compliance with ISO or ASTM standards.

Gasket Seals

Gasket seals are compressible elements—commonly made from graphite, PTFE, fiber, or metal-reinforced composites—used between flanged valve connections. Their broad applicability ranges from municipal water networks to high-pressure industrial pipelines. B2B buyers benefit from the ability to match gasket material and thickness to specific pressure and chemical conditions, which is instrumental in cost-effective system integrity. For international operations, sourcing pre-cut kits or securing local fabrication capability ensures reduced downtime. Regular inspection and scheduled replacements are necessary to prevent leaks and unplanned outages.

Metal Seals

Metal seals serve in the highest-pressure and temperature environments where elastomeric solutions would degrade. Crafted from stainless steel, Inconel, or other alloys, these rings or corrugated forms provide unmatched durability in power generation, petrochemical, and nuclear sectors. Their precision manufacture ensures ultra-tight sealing in critical processes but requires exacting surface finishes and often custom engineering. Buyers should weigh the higher upfront cost against the long-term risk reduction in severe applications. Close collaboration with suppliers for design and application assessment can mitigate installation challenges.

Diaphragm Seals

Diaphragm seals employ a thin, flexible membrane to separate process fluids from sensitive valve components or measurement instruments, providing both sealing and isolation. Materials vary from PTFE to specialty elastomers, and even metals for hygienic or corrosive applications. These seals are indispensable in pharmaceuticals and food processing, where product purity is a key concern, and in instrumentation isolators where traditional seals may be compromised. B2B purchasers should emphasize validation to regulatory standards (FDA, EU) and verify cleanability for process compliance. The pressure range is generally limited, so careful assessment of operating conditions is essential when specifying diaphragms.

Related Video: Mechanical seals types and installation part 1

Key Industrial Applications of valves seals

| Industry/Sector | Specific Application of valves seals | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Oil & Gas | Pipeline isolation and flow control | Prevents leaks, ensures system integrity under high pressure | Resistance to hydrocarbons, API/ISO certification, extreme temperature tolerance |

| Water & Wastewater | Treatment plant filtration and pumping systems | Maintains contaminant-free flow, reduces losses, enables compliance | Chemical compatibility, longevity in abrasive environments, ease of maintenance |

| Chemicals & Petrochemicals | Handling aggressive fluids in process pipelines | Prevents hazardous leaks, minimizes downtime, protects workforce | Compatibility with corrosive chemicals, traceability, anti-extrusion properties |

| Power Generation | Boiler and steam circuit sealing | Ensures efficiency, contains high-temperature media, reduces emissions | High-temperature/pressure resistance, standard compliance, reliability |

| Mining & Heavy Industry | Slurry and abrasive media handling | Minimizes unplanned downtime from seal failure, protects expensive equipment | Abrasion resistance, robust construction, reparability and local support |

Oil & Gas: Pipeline Isolation and Flow Control

In oil and gas operations, valve seals play a pivotal role in ensuring safe, leak-free performance in pipelines, refineries, and offshore/onshore installations. These seals are exposed to aggressive hydrocarbons and extreme conditions, making durability and chemical resistance essential. The risk of leaks can lead to regulatory penalties and environmental hazards—a significant concern for producers in regions like Saudi Arabia and Brazil. International buyers must select seals certified to stringent API and ISO standards, and ensure compatibility with both crude and refined products, especially when managing multi-grade fuels or sour gas.

Water & Wastewater: Treatment Plant Filtration and Pumping Systems

Valves seals are integral to filtration, pumping, and fluid transport within municipal and industrial water treatment plants. Their main function is to prevent fluid losses and cross-contamination, maintaining hygienic standards and process efficiency. In Africa and the Middle East, where water scarcity heightens operational risks, selecting the right seal ensures longevity and minimal downtime. Buyers should prioritize seals with high resistance to chemicals (like chlorine and ozone) and abrasive particulates, and favor options that allow quick inspection and replacement to reduce service interruptions.

Chemicals & Petrochemicals: Handling Aggressive Fluids in Process Pipelines

Chemical and petrochemical facilities depend on valve seals to contain highly corrosive and hazardous media within reactors, pipelines, and storage systems. A compromised seal can result in toxic leaks, production delays, and costly safety incidents. Facilities in Europe and South America often operate under stringent environmental and safety regulations, requiring traceability and material certifications for all components. Buyers must validate seal compatibility with specific chemicals, temperature cycles, and pressure spikes, and seek suppliers who can guarantee batch consistency and advanced anti-extrusion properties.

Power Generation: Boiler and Steam Circuit Sealing

In both conventional and renewable power plants, valve seals ensure the reliable containment of high-pressure steam and hot water within boilers and distribution circuits. Any seal failure here can result in lost efficiency, emissions violations, and severe equipment damage. Regions with growing power demands—such as northern Africa or Eastern Europe—benefit from seals engineered for sustained high temperatures and rapid cycling. Sourcing priorities include verified resistance to thermal shock, compliance with international power industry standards, and proven performance in continuous operation scenarios.

Mining & Heavy Industry: Slurry and Abrasive Media Handling

Mines, mineral processors, and heavy industry operations rely on robust valve sealing solutions to withstand slurries, abrasive particles, and harsh processing chemicals. Frequent seal replacements disrupt production and inflate maintenance costs, making durability a strategic priority—particularly in remote South American or African sites. Buyers must focus on seals made from advanced wear-resistant materials and those with designs that facilitate quick repairs. Local availability of spares and technical support is also crucial to minimize operational downtime and maintain fleet-wide reliability.

Related Video: Types of Valves | All in One Guide to Industrial Valve Types

Strategic Material Selection Guide for valves seals

Material Options for Valve Seals: Analysis for International Buyers

Selecting the optimal material for valve seals is a critical decision with long-term impacts on system integrity, downtime, and compliance—especially for industrial operators and procurement teams managing assets in varied and demanding global environments. Below is a practical analysis of four widely used materials for valve seals, focusing on their operational characteristics, advantages and limitations, cost factors, and advice tailored to procurement realities across Africa, South America, the Middle East, and Europe.

1. Nitrile Rubber (NBR)

Key Properties:

Nitrile Rubber (NBR) is an elastomer renowned for its resistance to petroleum-based oils and fuels, making it a standard choice in general industrial, water, and moderate temperature applications. It typically functions well within -30°C to +100°C, with good mechanical strength and abrasion resistance.

Pros & Cons:

Pros: NBR is cost-effective, widely available, and easy to process, supporting high-volume production and rapid lead times.

Cons: Limited resistance to ozone, sunlight, and some aggressive chemicals (such as esters and ketones). Performance declines at higher temperatures.

Impact on Application:

Ideal for water, hydraulic oils, and air, but unsuitable where harsh chemicals or prolonged high temperatures are present.

International B2B Considerations:

Common to find NBR seals meeting ASTM D2000, DIN 3771, or equivalent standards—important for cross-border projects. In equatorial regions or desert climates, UV and ozone exposure merit careful assessment. In Brazil and Saudi Arabia, local supply chains often support NBR inventory, but buyers should confirm material traceability for compliance and warranty claims.

2. Fluorocarbon Rubber (FKM/Viton®)

Key Properties:

Fluorocarbon rubber—commercially known as FKM or Viton®—is prized for its outstanding resistance to high temperatures (up to 200°C), aggressive chemicals, fuels, and vacuum environments.

Pros & Cons:

Pros: Superior chemical and thermal stability, excellent compression set, and longevity under harsh operating conditions.

Cons: Higher material and manufacturing costs; can be less flexible at low temperatures, and not suitable for some amines or ketones.

Impact on Application:

Essential for petrochemical, oil & gas, and process industries where seals are exposed to aggressive media, solvents, or frequent thermal cycling.

International B2B Considerations:

Globally recognized standards include ASTM D1418 (FKM) and common references such as DIN ISO 1629. For buyers in regions with stringent environmental controls (e.g., EU), using FKM ensures seal longevity and compliance. In parts of the Middle East and Africa with high ambient temperatures, FKM delivers reliability, but budget allocations must account for the higher cost.

3. Polytetrafluoroethylene (PTFE/Teflon®)

Key Properties:

PTFE (often known by the brand Teflon®) is a fluoropolymer noted for its extreme chemical resistance, broad temperature range (from -190°C to +260°C), and exceptionally low friction coefficient.

Pros & Cons:

Pros: Non-reactive to virtually all chemicals, suitable for food, pharmaceutical, and corrosive service; operates in a wider temperature range than most elastomers.

Cons: Less elastomeric (not flexible), requires precise machining or special lip designs for sealing; typically higher cost.

Impact on Application:

Preferred in applications where aggressive chemicals, high purity, or sanitary requirements are essential (e.g., chemical processing, water treatment in regions with stringent regulations, or pharmaceutical production in the EU).

International B2B Considerations:

Compliance with global regulations such as FDA (for food contact), EC1935/2004 (Europe), and often ASTM D4894. In South American mining and African chemical plants, PTFE’s durability offsets higher upfront costs with reduced maintenance. Availability of qualified machining partners and assured certification is essential for reliable procurement.

4. Ethylene Propylene Diene Monomer (EPDM)

Key Properties:

EPDM elastomer stands out for excellent resistance to water, steam, and a wide variety of acids and alkaline substances. It performs well from -40°C to +140°C and offers strong resilience to aging from sunlight, ozone, and weathering.

Pros & Cons:

Pros: Affordable, resilient to environmental degradation, and maintains sealing properties in potable water and HVAC service.

Cons: Poor compatibility with oils, fuels, and most hydrocarbons; some grades may swell or degrade in oil-rich environments.

Impact on Application:

Common in potable water systems, steam valves, and HVAC, especially for projects requiring compliance with health and safety drinking water standards.

International B2B Considerations:

EPDM is often specified under EN 681-1 (Europe) or NSF/ANSI/CAN 61 (for drinking water). For clients in African or Middle Eastern climates, its weathering resistance is advantageous in outdoor or infrastructure projects. However, buyers must prevent cross-use in oil service to avoid premature failure.

Comparative Summary Table for Valve Seal Materials

| Material | Typical Use Case for valves seals | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Nitrile Rubber (NBR) | Water, hydraulic, air, general industry valves | Cost-effective, good oil resistance | Not suitable for high temperature or aggressive chemicals | Low |

| Fluorocarbon Rubber (FKM/Viton®) | Oil & gas, chemical processing, high-temp valves | Excellent chemical & heat resistance | Higher cost, limited low-temp flexibility | High |

| PTFE (Teflon®) | Aggressive chemicals, food/pharma, high purity valves | Exceptional chemical resistance, broad temp range | Less flexible, requires precision install; cost | High |

| EPDM | Potable water, steam, HVAC, weather-exposed valves | Excellent water, steam, and weather resistance | Poor with oils/fuels, not for hydrocarbon service | Low-Med |

In-depth Look: Manufacturing Processes and Quality Assurance for valves seals

Valve seals serve as critical components in the reliable operation of industrial valve assemblies, preventing fluid or gas leaks and maintaining system integrity under diverse and often challenging conditions. For B2B buyers sourcing these components internationally—especially across Africa, South America, the Middle East, and Europe—understanding the intricacies of their manufacturing and quality assurance is essential for managing supplier risk, meeting regulatory requirements, and maximizing operational performance.

Core Manufacturing Stages for Valve Seals

The production of high-performance valve seals involves several well-defined stages. Each phase directly impacts the durability, chemical compatibility, and lifecycle of the final product.

1. Raw Material Selection and Preparation

– Material Choice: The first step is the careful selection and verification of materials, typically elastomers (like NBR, FKM/FPM, EPDM), reinforced PTFE, or specialty alloys depending on the application’s chemical and temperature demands.

– Material Testing: Suppliers often conduct initial material certification and testing (for purity, tensile strength, and compatibility) to ensure conformity with global and regional regulatory expectations.

– Preprocessing: Raw elastomers may undergo internal mixing and compound formulation—customized for resistance to heat, abrasion, and chemical exposure prevalent in regions such as the Middle East (high-temperature oil & gas) or sub-Saharan Africa (abrasive mining conditions).

2. Forming and Molding

– Compression/Injection Molding: Elastomeric valve seals are typically shaped using compression or injection molding techniques, ensuring precision for critical sealing lips and interfaces.

– Machining: For PTFE or metal-reinforced seals, CNC machining and lathe operations provide the necessary dimensional tolerances, critical for high-pressure or hygienic European process markets.

– Advanced Techniques: Some seals, particularly for pharmaceutical or food-grade valves in Europe or the Middle East, demand secondary processes such as cryogenic deflashing or laser trimming for smooth edges and tight tolerances.

3. Post-Molding Finishing and Assembly

– Deflashing and Inspection: Post-molding, seals undergo mechanical or manual deflashing to remove excess material, enhancing surface finish for a leak-proof fit.

– Assembly: For composite seals (e.g., cassette or multi-lip designs), manual or semi-automated assembly brings together elastomeric and metallic components, sometimes integrating dust excluders or wear sleeves for harsh environments (common in South American mining or North African industries).

– Surface Treatments: Optional treatments—such as PTFE coatings or vulcanization—may be applied to improve chemical resistance, make cleaning easier (crucial for regulated European sectors), or reduce friction for high-cycling valve applications.

4. Final Inspection and Packaging

– Visual and Dimensional Checks: Each batch undergoes detailed checks for defects, surface irregularities, and dimensional conformance, ensuring compatibility with international standard housings.

– Batch Coding and Traceability: Best-in-class suppliers implement batch coding and full traceability, aiding compliance verification and after-market support.

Quality Assurance Frameworks and QC Protocols

The reliability of valve seals hinges not only on manufacturing rigor but also on robust quality assurance (QA) systems. International buyers face varying standards, so a nuanced understanding of certification and QC is necessary.

Key International and Industry-Specific Standards

– ISO 9001: Globally, ISO 9001 certification is the baseline for quality management. It verifies that a supplier operates under documented, repeatable processes for production and continual improvement.

– ISO/TS 16949 (Automotive): Especially relevant if seals are used in automotive or mobile machinery exported to Europe or the Americas.

– API (American Petroleum Institute) Certifications: Commonly required for oil & gas valves and seals, particularly in Middle Eastern energy projects or African petrochemical facilities.

– CE Marking: Obligatory for products sold within the European Economic Area, including pressure-testing and traceability for certain valve seals.

– Materials Compliance (FDA, WRAS): For food, potable water, and pharmaceutical applications (Europe, Middle East), seals must also conform to strict hygiene and material leaching standards.

Quality Control (QC) Checkpoints

A world-class valve seal supplier will implement multi-stage QC processes:

- Incoming Quality Control (IQC): Raw materials and compounds are tested for physical, chemical, and mechanical conformity before production.

- In-Process Quality Control (IPQC): Real-time monitoring during molding, machining, and assembly—often involving automated vision systems or random sampling for dimensions and defect detection.

- Final Quality Control (FQC): A comprehensive battery of tests on finished seals, including:

- Dimensional Inspection (using micrometers, calipers, optical comparators)

- Hardness Testing (Shore A/D for elastomers)

- Tensile/Elongation and Compression Set Tests

- Leakage Tests (air or liquid pressure exposure)

- Aging/Environmental Resistance (especially for sub-Saharan or Middle Eastern climates)

- Material Compatibility (chemical soaking, fluid immersion)

- Batch Retention Samples: Retained for later investigation if failures occur.

Practical Steps for B2B Buyers to Validate Supplier Quality

Ensuring consistent quality requires more than reviewing certificates. International buyers should pursue a proactive approach:

1. Supplier Audits and Onsite Visits

– Pre-contractual Audits: Conduct formal audits—onsite or via third-party agents—to examine production lines, material stores, and QC protocols.

– Process Walkthroughs: Request detailed process workflows and sample inspection checklists to gauge rigor.

– Regional Considerations: In regions with less established regulatory environments (parts of Africa or South America), prefer suppliers with documented audit histories and verifiable references.

2. Quality Documentation and Lot Traceability

– QC Reports: Insist on detailed, batch-specific reports including test data, material certificates, and process logs.

– Traceability Systems: Partners should offer full traceability from raw material to dispatch, critical for markets with strong liability laws (e.g., EU, GCC).

3. Independent and Third-Party Inspections

– Before Shipment: Hire international inspection agencies (SGS, Bureau Veritas, TÜV) to perform pre-shipment checks—dimensional, visual, and functional tests.

– During Production: For high-risk or high-value orders (e.g., seals for oil refineries in Saudi Arabia or hydropower in Brazil), consider in-process inspections at key milestones, with witness testing for crucial performance parameters.

4. Product Sampling and Pilot Batches

– Initial Approvals: Request pilot batch samples for third-party laboratory testing, especially for applications in regulated sectors or different environmental conditions (extreme heat, high dust).

– Field Trials: For critical applications, install sample batches in operational settings and monitor for early-life failures or compatibility issues.

Regional and Application-Specific Considerations

For buyers across Africa, South America, the Middle East, and Europe, QC and certification requirements can differ markedly, impacting procurement strategy and compliance obligations.

- Regulatory Scrutiny (Europe): EU buyers should prioritize partners who can reliably produce EN, CE, and hygiene-compliant seals, with full documentation for audits.

- Challenging Environments (Africa & Middle East): Specify additional aging, abrasion, and thermal testing to simulate local conditions and guarantee lifecycle performance.

- Emerging Markets (South America): Emphasize education of local technical teams to interpret QC reports and implement field-based acceptance testing, reducing risk of early failures due to installation error or environmental mismatch.

- Document Management: In all regions, place special importance on document archiving, digital delivery of certificates, and rapid incident response protocols—essential during warranty or failure investigations.

Actionable Takeaways for B2B Buyers

- Align Specifications: Always communicate your application conditions—pressure, temperature, fluid properties—with the supplier and demand material and design validation accordingly.

- Prioritize Proven Suppliers: Favor those with established quality certifications (ISO, API, CE) and strong international references.

- Leverage Third-Party QC: Particularly valuable in markets where in-house resources or expertise to assess technical documentation are limited.

- Maintain Communication: Engage in sustained dialogue with suppliers about evolving performance requirements and regional compliance changes to future-proof your procurement.

By integrating these manufacturing and quality assurance protocols into your sourcing process, you significantly reduce risk while maximizing the operational value and reliability of your valve seals in any international market.

Related Video: Inspection and Quality control in Manufacturing

Comprehensive Cost and Pricing Analysis for valves seals Sourcing

Key Cost Components in Valve Seal Sourcing

Securing valve seals for industrial applications involves an array of cost elements, each affecting your final procurement price and long-term value. Material costs are primary—premium elastomers (such as FKM, EPDM, or PTFE) and specialty metals for springs or casings generally command higher prices due to their chemical and temperature resistance properties. For demanding sectors (oil & gas, mining, pharmaceuticals), material choice is non-negotiable, driving up costs but ensuring operational reliability and compliance.

Labor and manufacturing overhead represent further significant outlays. Skilled labor is required for precision molding, finishing, and assembly—especially for custom or high-spec seals. Automation can lower these costs, but not all suppliers have invested in such systems, particularly in regions where manual processes prevail.

Tooling and setup charges are often overlooked by buyers. Initial mold fabrication for custom sizes or geometries can be a substantial upfront investment, though these charges typically amortize over large or repeat orders. The cost per unit thus falls with rising volume.

Quality control and certification costs are a must for international buyers aiming to meet industry standards (ISO, TS, API, etc.) or specific in-country regulatory requirements (such as the EU’s REACH or Saudi SABER registrations). Qualified suppliers invest in advanced inspection, testing, and documentation—which boosts cost but adds vital assurance and market access.

Logistics, packaging, and duties round out the core cost structure. Freight costs—impacted by shipping distance, mode (air vs. sea), packaging standards, and local tariffs—can dramatically alter the landed cost, especially for buyers in remote or regulated markets. Larger, heavier shipments or those to regions with limited direct logistics routes (e.g., landlocked African nations) may incur premiums.

Supplier margin must also be considered. Suppliers will factor in business sustainability, product complexity, payment terms, and market dynamics when setting markups.

Major Price Influencing Factors

B2B buyers need to recognize several pricing levers when sourcing valve seals on the global stage:

- Order Volume & MOQ: Higher quantities generally reduce the unit price, not only through economies of scale but also by spreading setup and QC costs. However, some suppliers, particularly in Asia or the EU, impose minimum order quantities (MOQs) that can be prohibitive for smaller buyers.

- Specifications & Customization: Special profiles, non-standard dimensions, or unique compound formulations significantly add to cost. Customized packaging, branding, or special finish requirements will be reflected in quotes.

- Material Grade: Moving from standard NBR to FKM or PTFE can double or triple material costs. Buyers must align features strictly with application needs to avoid unnecessary overspecification.

- Quality & Certifications: Demanding ISO/TS/API certifications, extensive test reports, or third-party validation invariably adds to supplier overhead—and thus to sale price.

- Supplier Location & Factors: Local currency fluctuations, labor rates, energy costs, and environmental compliance all influence ex-works pricing. Established suppliers with proven export experience and global references may also charge a premium for added reliability.

- Incoterms: Choosing between EXW, FOB, CIF, or DDP dramatically alters your cost responsibility. For example, EXW requires the buyer to manage all logistics from the factory door—better rates for large importers, but higher risk. DDP shifts all responsibility to the seller, often at a higher quoted price.

Actionable Buyer Tips for Cost Efficiency and Negotiation

- Total Cost of Ownership (TCO) Matters: Rather than focusing solely on unit price, evaluate complete lifecycle costs—durability, maintenance intervals, failure risk, lead time, and local support. Higher initial spend on quality often offsets expensive downtime.

- Negotiate Bundled Deals: Grouping multiple seal types or including associated valves in one order can increase leverage for volume discounts and better payment terms.

- Clarify Certification Scope: Only pay for compliance relevant to your market. For example, EAC certification is crucial in Kazakhstan but unnecessary in Brazil.

- Benchmark Multiple Suppliers: Source from several qualified suppliers across different regions. Comparing offers helps negotiate better deals and reduces dependency risk, vital in politically or logistically volatile countries.

- Factor Logistics Early: For international buyers (e.g., in Africa or the Middle East), work closely with freight forwarders to optimize shipment consolidation and select Incoterms that balance risk, cost, and convenience.

- Customize Only When Necessary: Tailor specifications strictly to operational realities—resisting the temptation to over-engineer will avoid unnecessary custom tooling or rare materials.

Indicative Pricing Disclaimer:

Valve seal prices can fluctuate widely, affected by global commodity trends, regional labor rates, and logistics disruptions. All reference prices are indicative only. Buyers should request up-to-date quotations and clarify all inclusions with suppliers before committing to an order.

By understanding the full cost breakdown and proactively managing the of factors above, international buyers from Africa, South America, the Middle East, and Europe can unlock strategic advantages—balancing cost with reliability, compliance, and scalability in competitive global markets.

Spotlight on Potential valves seals Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘valves seals’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Parjetseals (www.parjetseals.com)

Parjetseals stands out as a globally recognized manufacturer specializing in advanced sealing solutions for a range of industrial applications, including valves seals. The company is highlighted among top industry leaders for its commitment to reliability and innovative engineering, serving sectors such as oil & gas, manufacturing, and heavy industry. Parjetseals is reputed for utilizing high-performance materials and applying rigorous quality control throughout its production processes. While detailed public certifications or technical specifications are not widely disclosed, their global presence and recognition suggest strong compliance with industry standards and the ability to support large-scale, international procurement needs. B2B buyers, especially in emerging and established markets across Africa, South America, the Middle East, and Europe, will find Parjetseals’ reputation for durable, efficient sealing solutions particularly attractive when sourcing for demanding environments or critical applications.

10 Mechanical Seal Manufacturers in the World (cowseal.com)

AESSEAL is a globally recognized manufacturer specializing in mechanical seals, seal support systems, and bearing protection devices for industrial valve applications. Established in 1979, the company has built a reputation for engineering robust sealing solutions that enhance equipment reliability and reduce operational downtime—critical factors for B2B buyers focused on lifecycle cost. With a presence in 104 countries and extensive manufacturing and service capabilities, AESSEAL has proven experience meeting the technical and logistical demands of international markets, including Africa, South America, the Middle East, and Europe.

Key strengths include broad customization options, rapid on-site support, and a strong commitment to quality, evidenced by a comprehensive suite of certifications such as ISO 9001, ISO 14001, ISO/IEC 27001, and API-compliant manufacturing in certain product lines. The company’s innovations in cartridge seals and patented bearing protection technology set them apart in challenging environments—such as aggressive chemicals or abrasive mining operations. AESSEAL’s recognized ability to deliver compliant, durable sealing solutions with global support infrastructure makes them a preferred partner for procurers seeking to optimize reliability and compliance across geographically diverse assets.

10 Mechanical Seal Manufacturers & Brands in World (www.machinemfg.com)

China-based Dandong Group Co., Ltd., featured among the world’s leading mechanical seal manufacturers, has been operational since 1988 as a high-tech private enterprise. The company’s portfolio encompasses advanced mechanical seals, magnetic drive pumps, couplings, and welded metal bellows, catering to demanding valve and industrial sealing needs. Noted for continuous R&D investment, Dandong Group supports a variety of valve sealing requirements across power generation, chemicals, water processing, and heavy industry, with robust capabilities in custom and precision-cast solutions.

Dandong Group’s manufacturing operations utilize modern precision engineering, and they adhere to recognized Chinese and international quality standards, helping assure performance and reliability for mission-critical applications. The company demonstrates proven export experience and is an established option for B2B buyers from Africa, the Middle East, South America, and Europe, especially those needing comprehensive technical support and scalable production for diverse industrial sealing projects.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| Parjetseals | Globally recognized, innovative sealing solutions for industry | www.parjetseals.com |

| 10 Mechanical Seal Manufacturers in the World | Global, certified, customizable industrial valve seals | cowseal.com |

| 10 Mechanical Seal Manufacturers & Brands in World | Full-range valve seals, global B2B export capabilities | www.machinemfg.com |

Essential Technical Properties and Trade Terminology for valves seals

Key Technical Properties for Valve Seals

For international B2B buyers, understanding the critical technical properties of valve seals is essential to ensure operational reliability, compliance, and cost efficiency. Here are the main technical specifications to prioritize when evaluating valve seals for industrial applications:

-

Material Grade and Compatibility

The choice of seal material (such as NBR, FKM, PTFE, EPDM, or metal alloys) dictates resistance to chemicals, temperature, and pressure. Material selection should align with application demands—for example, PTFE is optimal for aggressive chemicals, while FKM suits high-temperature conditions. Always verify that material certifications match your industry and regional regulations (e.g., EU REACH, FDA for food applications). -

Temperature and Pressure Ratings

Valve seals must reliably withstand both routine and peak operating temperatures and pressures. These ratings, expressed in °C/°F (temperature) and bar/psi (pressure), are crucial for preventing leaks or failures during service variations. Clarifying these thresholds with suppliers ensures suitability for local climates (e.g., extreme Middle Eastern heat or cold European winters) and process requirements. -

Tolerance and Dimensional Accuracy

Tolerances refer to the permitted deviation in seal and valve dimensions, affecting fit, leakage risk, and service life. International buyers must pay attention to ISO/DIN tolerance standards, especially when integrating seals into automated or high-precision systems. Confirming tolerances upfront helps prevent costly compatibility issues and reduces downtime. -

Seal Type and Design Features

Valve seals come in various forms—O-rings, lip seals, cassette seals, V-rings—each tailored to specific movement types (static vs. dynamic), media, and contamination risks. Selecting the right design impacts maintenance intervals and operational uptime, especially in challenging environments like mining (Africa, South America) or offshore energy. -

Certification and Compliance

Many industries require third-party tested seals that adhere to standards such as ISO, API, or EN, proving performance under defined conditions. Certifications demonstrate supplier credibility and grant smoother access to regulated markets (such as the EU or Saudi Arabia). Always request compliance documentation to support procurement audits. -

Service Life and Maintenance Interval

Seals’ expected lifespan, influenced by material, design, and operating environment, directly impacts total cost of ownership. Products specifying longer service intervals reduce maintenance costs and unplanned downtime—a critical metric for buyers accountable for fleet or facility performance.

Fundamental Industry and Trade Terms for Valve Seals Procurement

The following trade terms are widely used in the valve seals sector. Familiarity with these concepts empowers buyers to manage negotiations, logistics, and quality agreements with confidence:

-

OEM (Original Equipment Manufacturer)

Refers to companies that produce seals to original design specifications, often for integration into branded valves or machinery. Buying from OEMs assures original quality and fit but may come at a premium price compared to aftermarket alternatives. -

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell. MOQs impact procurement planning, especially for international buyers managing inventory costs. Negotiating reasonable MOQs is vital when sourcing custom or specialty seals for varied systems. -

RFQ (Request for Quotation)

A formal document sent to suppliers to obtain detailed price and delivery information for specific valve seal products. Structured RFQs enable accurate pricing comparison and clarify technical, logistical, and compliance requirements. -

Incoterms (International Commercial Terms)

Standardized trade terms (such as FOB, CIF, DAP) that clearly define buyer and seller responsibilities for shipping, insurance, customs clearance, and risk transfer points. Understanding Incoterms is key for managing international logistics and avoiding hidden costs or disputes. -

Lead Time

The period between placing an order and receiving the valve seals. Lead times affect project scheduling and inventory management. Buyers in Africa or South America, where shipping routes may be longer, should always confirm lead times during the procurement process. -

Traceability

The ability to track the manufacturing history, raw material origin, and quality testing data for each seal. Full traceability minimizes the risk of counterfeit or substandard parts entering the supply chain and is increasingly demanded by compliant industries worldwide.

Understanding these technical properties and trade terms will help B2B buyers across regions secure the right valve seals, optimize lifecycle value, and manage supplier relationships effectively in a complex global marketplace.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the valves seals Sector

Global Market Landscape and Sourcing Trends for Valve Seals

The global valve seals sector stands as a crucial enabler of uptime, safety, and regulatory compliance across industries such as oil and gas, water management, manufacturing, mining, and energy. Rapid industrialization in Africa and South America, coupled with infrastructure modernization in the Middle East and Europe, is driving strong demand for advanced sealing solutions. Buyers in these regions are navigating a market shaped by several overlapping forces: stricter environmental standards, a growing focus on operational reliability, and increasing complexity in regional regulatory frameworks.

Key global trends are redefining the sourcing landscape:

-

Shift Toward High-Performance Materials: Rising process temperatures, aggressive chemicals, and abrasive environments are spurring adoption of advanced elastomers like FKM (Viton) and PTFE (Teflon), favored for their durability and broad chemical compatibility. This is particularly relevant for buyers in the Middle East and South America who operate in harsh climates.

-

Digitalization and Smart Sourcing: The integration of digital procurement platforms and supplier portals is accelerating transparency and efficiency for international buyers. Features like real-time supplier ratings, compliance dashboards, and automated quality audits are providing buyers in Africa and Europe with better risk management and negotiation leverage.

-

Custom and Niche Solutions: Increasingly, buyers are demanding customized valve seals tailored to exacting operational requirements—such as resistance to sand intrusion in mining (Africa, Brazil) or to ultra-pure applications in pharmaceuticals (Europe). Flexible manufacturers capable of short lead times and small-batch prototyping are gaining a competitive edge.

-

Focus on Total Cost of Ownership (TCO): Rather than sourcing solely on unit price, leading B2B procurement teams are factoring in lifecycle costs, including seal longevity, maintenance cycles, and failure risk. This approach is essential in cost-sensitive sectors across Latin America and Africa, where equipment downtime can mean substantial loss.

Regional considerations add further complexity. For example, buyers in Saudi Arabia routinely require compliance with both local (SABIC, Aramco) and international standards (API, ISO), while buyers in Brazil must contend with local content regulations and high logistical costs. Sourcing strategies are therefore increasingly collaborative, with buyers engaging in long-term partnerships and transparent communications to secure supply chain resilience.

Prioritizing Sustainability and Ethical Procurement

Environmental responsibility and ethical sourcing are now critical factors driving procurement decisions in the valve seals sector. Seals, by their very function, help prevent leaks and minimize hazardous discharges—an intrinsic contribution to environmental protection. However, forward-thinking B2B buyers are pushing further, scrutinizing the entire sourcing lifecycle for environmental and social impact.

Key sustainability initiatives include:

-

Selection of Eco-friendly Materials: Manufacturers are developing valves and seals using low-emission elastomers, recycled content, and materials certified as non-toxic or compliant with REACH and RoHS directives. PTFE seals with food-grade or pharmaceutical-grade approvals are gaining traction in European and Middle Eastern markets driven by stricter consumer safety requirements.

-

Supply Chain Transparency: Traceability of raw materials and ethical labor practices are increasingly non-negotiable, especially for buyers supplying multinationals or regulated industries. Detailed documentation—such as supplier codes of conduct, conflict mineral declarations, and third-party audit results—enables buyers to mitigate reputational and compliance risks.

-

Green Certifications: Procurement teams are prioritizing suppliers with ISO 14001 (environmental management), ISO 45001 (health and safety), and industry-specific eco-labels, particularly in Europe and the Middle East where public and investor scrutiny is high. For mining and energy projects in Africa and South America, alignment with international ESG frameworks is becoming a market-entry prerequisite.

Sustainability is not only about environmental protection but is also linked to business resilience and cost savings. Durable, high-quality seals reduce the frequency of maintenance-related emissions and waste, helping buyers in emerging markets meet both operational and regulatory targets. Demonstrating sustainable sourcing can also open up access to new projects, particularly those financed by global development banks or governed by strict procurement codes.

A Brief Evolution of Valve Seals in Industrial Markets

Valve seals have evolved from rudimentary leather and rubber gaskets—prone to wear and chemical attack—to today’s sophisticated, engineered thermoplastics and composite elastomers. Major industrialization waves (such as post-war expansion in Europe and more recent energy booms in the Middle East and South America) have driven demand for seals that withstand higher pressures, temperatures, and contamination risks.

Advancements in polymer chemistry and precision manufacturing have enabled the creation of application-specific seals that extend service life, minimize leakage, and meet ever-tighter regulatory benchmarks. This evolution has transformed the buyer’s role: from transactional purchasing to a strategic, risk-managed partnership focused on reliability, compliance, and sustainability. For B2B buyers worldwide, understanding this history underscores the importance of choosing suppliers who invest in R&D, quality assurance, and continuous improvement.

Action Points for International Buyers:

– Align requirements with both local and international standards.

– Evaluate supplier sustainability and ethical compliance as core selection criteria.

– Leverage digital sourcing tools to benchmark suppliers and enhance transparency.

– Consider lifecycle cost and regional aftersales support when assessing value.

Related Video: The Inside Story of the Ship That Broke Global Trade

Frequently Asked Questions (FAQs) for B2B Buyers of valves seals

-

How can I effectively vet international suppliers of valve seals to minimize quality and compliance risks?

To thoroughly vet valve seal suppliers, begin by assessing their business credentials, customer references, and track record supplying similar clients in your region or industry. Request evidence of ISO 9001 or equivalent quality certifications and inquire about their manufacturing processes, raw material sourcing, and in-house testing capabilities. Conduct virtual factory audits if site visits aren’t feasible, and confirm compliance with relevant standards (API, ISO, DIN) for your target market. Evaluate responsiveness, technical support, and after-sales service—ideally by requesting sample seals for accelerated performance and compatibility testing before a larger commitment. -

Are valve seals customizable for specific applications and regional requirements?

Most reputable manufacturers offer customization options, enabling buyers to specify materials (such as FKM, EPDM, or PTFE) according to operating temperature, chemical exposure, and local environmental factors. You can request adjustments in seal geometry, lip configuration, hardness, color coding, and even branding. When sourcing for industries with unique demands—like mining in South America or desalination plants in the Middle East—customization is essential to maximize seal life and minimize unplanned downtime. Share detailed technical drawings, service condition data, and performance goals early in the negotiation for an accurate, optimized recommendation. -

What are typical minimum order quantities (MOQs) and lead times for international shipments of valve seals?

MOQs vary widely by manufacturer, with many factories in Asia and Europe offering flexible batch sizes (from 100 to several thousand units) for standard products, and higher MOQs (often 500–1,000+) for custom or niche items. Lead times generally range from 2–6 weeks for common seals, but can extend to 8–12 weeks for tailored designs or when specialty materials are required. Factor in shipping duration—air freight takes days, but sea freight may require a month or more, particularly for Africa or South America. Clarify these specifics before confirming your order, and request clear production and delivery schedules. -

What international payment terms and methods are safest when sourcing valve seals?

Secure international transactions typically use irrevocable Letters of Credit (L/C), bank wire transfers (T/T), or international payment platforms offering escrow services. L/Cs provide both buyer and seller with protection, but can be complex for smaller orders. Advance payments (partial or in full) are standard, especially for customized or first-time purchases; however, negotiate for a balance payment upon bill of lading or successful inspection. Always verify the supplier’s banking details via a phone call to prevent fraud, and consider trade credit insurance for large or repeated transactions in newer markets. -

Which quality assurance practices and certifications should B2B buyers prioritize for valve seals?

Prioritize suppliers adhering to internationally recognized standards, such as ISO 9001 for quality management and ISO 14001 for environmental controls. For critical applications, seek seals with certification to API, ASTM, DIN, or equivalent specifications relevant to your industry. Insist on batch-level inspection records, traceable test reports (covering hardness, tensile strength, and aging), and transparent raw material documentation. Implement sample-based incoming quality control at your destination, and negotiate the right to third-party inspections prior to shipment for high-volume or high-risk orders. -

How can buyers ensure valve seals meet local compliance and industry requirements in Africa, South America, or the Middle East?

Supply local regulatory documentation and any industry compliance guidelines upfront, as requirements can differ significantly across regions—such as potable water certification for utilities, or local content rules in oil & gas. Ask suppliers to demonstrate experience shipping to your country and provide certificates of conformity, performance data, and relevant approvals (WRAS for water, FDA for food, etc.). When possible, partner with suppliers who maintain stock or service centers in your geography; this streamlines both technical support and regulatory compliance audits or follow-up. -

What logistics best practices reduce delays, costs, and damage when importing valve seals internationally?

Consolidate shipments with other goods when feasible, and select INCO terms (such as CIF or DAP) aligned with your import capabilities and risk tolerance. Confirm packaging standards are robust enough for long-haul air or sea transport, ideally using moisture-barrier bags and export-compliant crates. Work with freight forwarders experienced in your target port(s) and customs brokers familiar with local import regulations to pre-empt clearance issues. Plan for customs documentation (commercial invoice, packing list, certificate of origin) and factor in time for local inspection and last-mile delivery, particularly in Africa or more complex markets. -

What recourse do buyers have if valve seals fail or shipments are non-compliant with the order?

A strong purchase contract should define warranty terms, product specifications, and dispute resolution mechanisms. Insist on a clear replacement or refund policy for defective or non-conforming seals, with timelines for response and rectification. Keep records of all communications, inspection results, and photographic evidence. Most reputable suppliers will cooperate to avoid reputational damage, especially in international B2B contexts. For persistent disputes, rely on international arbitration clauses, trade association support, or credit insurers, and escalate through your local chamber of commerce if necessary.

Strategic Sourcing Conclusion and Outlook for valves seals

Valves seals stand at the intersection of operational reliability and efficient fluid management in modern industry. For international B2B buyers—from the mining hubs of Africa to energy giants in the Middle East, and from dynamic Latin American manufacturers to advanced European process plants—the stakes for choosing the right valves seals have never been higher. As sectors diversify and regulatory expectations rise, procurement decisions must be grounded in a thorough understanding of seal types, material compatibilities, local operating realities, and supplier credibility.

Key B2B takeaways for successful sourcing include:

- Prioritize compatibility: Ensure seals are specified for your region’s environmental conditions (e.g., high temperatures in Saudi Arabia, abrasive dust in mining regions, aggressive chemicals in refineries).

- Demand robust certifications: Work with suppliers offering traceable quality documentation, standardized testing, and adherence to industry benchmarks like ISO or TS protocols.

- Evaluate lifecycle value: Beyond initial cost, consider ease of maintenance, local technical support, and the impact of seal longevity on total cost of ownership.

- Leverage supplier relationships: Opt for vendors with transparent communication, flexible customization, and proven experience in your sector and geography.

Looking ahead, technological advancements in materials and sealing design are poised to deliver even more durable, efficient, and sustainable valve seal solutions. By adopting a strategic, knowledge-driven approach to sourcing, B2B buyers across all regions can not only mitigate operational risks but also position their organizations for long-term competitiveness. Act now—review your current specifications, engage with trusted suppliers, and make informed investments that will secure both performance and profit in the evolving landscape of global industry.