Introduction: Navigating the Global Market for ptfe o’ring

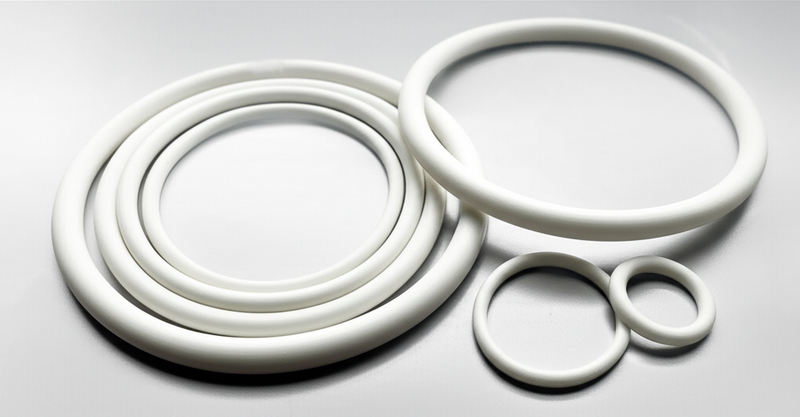

Polytetrafluoroethylene (PTFE) O-rings have become essential assets in modern industrial operations, particularly where demanding process conditions and strict compliance requirements are the norm. For international B2B buyers operating in diverse markets—whether in Colombia’s petrochemical plants, Saudi Arabia’s energy sector, or Europe’s advanced manufacturing hubs—the choice of PTFE O-rings can make a decisive difference in system reliability, productivity, and overall operational safety. These components are not only valued for their outstanding chemical resistance, low friction, and thermal endurance, but also for their ability to meet the rigorous standards set by global regulators across food, pharmaceutical, and heavy industry segments.

Securing the right PTFE O-ring is more than a technical purchase; it is a strategic investment that impacts maintenance cycles, downtime risks, and total cost of ownership. However, navigating the global market for these specialized seals can be challenging. Buyers must contend with a wide array of material variants (including solid PTFE and PTFE-encapsulated cores like Viton® and silicone), regional supply chain nuances, and supplier quality inconsistencies. Additionally, fluctuating costs, evolving industry standards, and the need for technical documentation and traceability further complicate procurement efforts—making it vital for buyers to be well-informed.

This guide delivers a structured, actionable resource designed for purchasing managers, engineers, and procurement professionals worldwide. It covers the full spectrum of PTFE O-ring types and material options, key technical and performance considerations, best practices in manufacturing and quality control, optimized approaches to supplier selection, cost management insights, and current market dynamics. Frequently asked questions address practical concerns unique to African, Middle Eastern, South American, and European contexts. By providing deep technical know-how aligned with global sourcing realities, this handbook empowers decision-makers to reduce risk, maximize value, and ensure a secure, compliant supply of high-performance PTFE O-rings.

Understanding ptfe o’ring Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| FEP Encapsulated O-Ring | FEP PTFE jacket over elastomer core; broad chemical resistance | Chemical processing, pumps, industrial valves | Cost-effective, good compatibility; temp limit ~205°C |

| PFA Encapsulated O-Ring | PFA PTFE jacket, higher temp stability, stiffer than FEP | Pharmaceutical, food, high-temp chemical systems | Withstands up to 260°C, premium durability; higher cost |

| Silicone Core Encapsulated | PTFE jacket over flexible silicone core; excellent flexibility | Dynamic seals, food and medical equipment | High resilience in dynamic use; less suitable for harsh chemicals |

| Viton Core Encapsulated | PTFE jacket with robust Viton (FKM) core; superior chemical/heat resistance | Oil & gas, petrochemicals, solvent handling | Excellent media resistance; stiffer, costlier than silicone core |

| Solid PTFE O-Ring | Fully-molded PTFE, no elastomer; inert and pure | Semiconductor, ultra-pure systems, static seals | Ultra-chemical/purity, non-contaminating; low flexibility |

FEP Encapsulated O-Ring

FEP encapsulated O-rings feature a seamless FEP (fluorinated ethylene propylene) PTFE jacket surrounding a resilient elastomer core, typically silicone or Viton. This design offers a versatile and cost-effective solution for sealing needs in chemical processing, pumps, and general industrial valves. FEP jackets provide a wide spectrum of chemical compatibility but are limited to operating temperatures up to 205°C. For buyers balancing performance and budget, FEP variants offer a reliable choice for standard applications, though care must be taken to avoid installations exceeding their thermal threshold.

PFA Encapsulated O-Ring

Utilizing a PFA (perfluoroalkoxy) PTFE jacket delivers enhanced high-temperature and chemical resistance compared to FEP. PFA encapsulated O-rings are preferred in pharmaceutical, food, and high-purity process industries, particularly where sterilization cycles or aggressive chemicals are present. Capable of withstanding up to 260°C, they offer increased durability and lifespan, crucial for minimizing downtime in critical processes. However, the higher cost and slightly decreased flexibility require B2B buyers to assess lifecycle savings versus upfront investment.

Silicone Core Encapsulated O-Ring

With a PTFE outer layer and a silicone rubber core, this type is engineered for flexibility and dynamic sealing performance. Frequently utilized in food production, medical equipment, and other sanitary applications, these O-rings excel where movement, vibration, or repeated assembly/disassembly is frequent. Their soft core allows for excellent compression set recovery and low-temperature resilience, but provides less protection in environments with highly aggressive chemicals or extreme heat. Buyers in regulated industries appreciate their FDA and medical-grade compliance.

Viton Core Encapsulated O-Ring

These O-rings combine a PTFE encapsulation with a Viton (FKM) fluoroelastomer core, targeting harsh chemical and high-temperature environments such as oil & gas, petrochemical, and solvent-handling operations. Viton cores provide superior chemical/solvent resistance and stability under thermal stress, making them ideal for aggressive process conditions. Relative rigidity compared to silicone may limit use in highly dynamic applications, but buyers seeking long-term reliability in demanding fluid or gas handling systems will find strong value in this variant.

Solid PTFE O-Ring

Manufactured entirely from solid PTFE, these O-rings are chemically inert and non-contaminating, making them indispensable in semiconductor manufacturing, ultra-pure water systems, and laboratory equipment. While they offer unmatched purity and resistance to virtually all media, their lack of an elastomer core results in low compressibility and flexibility. This limits their use to static sealing applications. B2B purchasers must weigh the need for purity or non-contamination against installation challenges and potential sealing reliability under dynamic conditions.

Related Video: Denoising Diffusion Probabilistic Models | DDPM Explained

Key Industrial Applications of ptfe o’ring

| Industry/Sector | Specific Application of ptfe o’ring | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Chemical Processing | Sealing in pumps, reactors, and valves | Chemical inertness, minimizes downtime, non-contaminating | Resistance to aggressive chemicals, local regulatory compliance |

| Oil & Gas | Pipeline flange and control valve sealing | Withstands high pressure, temperature, harsh media | Temperature/pressure ratings, certification (e.g., API, ISO) |

| Food & Beverage | Sanitary equipment (fillers, mixers, CIP systems) | Prevents contamination, FDA/EC compliance, easy cleaning | Food-grade certification, traceability, hygienic design |

| Pharmaceuticals/Biotechnology | Seals in sterile processing and fluid transfer | Maintains purity, resists sterilization chemicals | Cleanroom manufacturing, documentation, low extractables |

| Water Treatment & Utilities | Chemical dosing pumps, UV system seals | Long service life, resists corrosion, low maintenance | Compliance with potable water standards, UV/ozone resistance |

Chemical Processing

In chemical plants—especially in regions handling acids, solvents, or aggressive reagents—PTFE O-rings are essential for sealing in pumps, reactors, and valve assemblies. Their unmatched chemical inertness prevents leakage and equipment damage, even during temperature fluctuations or exposure to harsh cleaning cycles. For international buyers, it’s vital to ensure O-rings meet both the chemical compatibility profile of local processes and relevant safety standards to maintain uptime and reduce costly shutdowns or environmental risks.

Oil & Gas

For oil and gas producers in regions like the Middle East, Africa, and Latin America, PTFE O-rings are deployed extensively in flanges, control valves, and high-pressure connectors. These critical seals must endure variable pressures, sour gas conditions, and hydrocarbon exposure without degrading. Key requirements include verifying material certification (API, ISO), ensuring the O-rings can handle specified temperature and pressure ranges, and selecting suppliers capable of rapid, consistent delivery for both planned maintenance and urgent repairs.

Food & Beverage

PTFE O-rings are widely specified for sanitary equipment, including fillers, mixers, and clean-in-place (CIP) systems, due to their inert, non-stick surfaces and compliance with global food contact regulations (such as FDA and EU standards). By minimizing risk of contamination and facilitating easy cleaning, these O-rings help businesses protect brand integrity and meet export standards. International buyers, especially in Europe and South America, should prioritize traceability, food-grade certifications, and compatibility with both aggressive cleaning agents and temperature cycling.

Pharmaceuticals/Biotechnology

In pharmaceutical and high-purity production, PTFE O-rings safeguard sterile environments—sealing reactors, transfer lines, and processing vessels against both contamination and chemical attack. Their non-porous and low-extractable characteristics are vital for regulatory compliance and product purity. B2B buyers should seek suppliers offering cleanroom manufacturing, full traceability, and detailed documentation to satisfy GMP and regional regulatory requirements, especially for production destined for global markets.

Water Treatment & Utilities

Municipal water plants and utility providers increasingly specify PTFE O-rings for seals in chemical dosing pumps, filtration systems, and UV disinfection equipment. These O-rings’ resistance to corrosive water treatment chemicals (such as chlorine and ozone) ensures prolonged service intervals and reduced maintenance costs. Buyers should assess compliance with potable water standards and confirm UV/ozone resistance, ensuring long-term performance even under irregular operating conditions common in emerging markets.

Strategic Material Selection Guide for ptfe o’ring

Understanding Core Material Options for PTFE O-rings

Selecting the right material configuration for PTFE O-rings is fundamental to ensuring operational efficiency, process safety, and long-term value. Here, we explore the most common PTFE-based O-ring materials and encapsulations, highlighting actionable factors relevant to international B2B buyers across Africa, South America, the Middle East, and Europe.

1. Solid PTFE (Virgin or Filled)

Solid PTFE O-rings are manufactured entirely from PTFE (polytetrafluoroethylene), either in its pure (virgin) form or with various fillers (such as glass, carbon, or bronze). Key properties include outstanding chemical inertness, a wide temperature operating range (typically -200°C to +260°C), and non-contaminating characteristics. As a non-elastomeric material, PTFE O-rings are hard, non-resilient, and maintain their integrity even in highly aggressive chemical environments.

Pros:

– Excellent resistance to almost all chemicals, solvents, and gases

– Stable across vast temperature variations

– Non-contaminating, making them ideal for high-purity processes (e.g., pharmaceuticals, electronics)

Cons:

– Poor elastic recovery; ineffective in dynamic or low-pressure sealing

– Brittle compared to elastomeric O-rings

– Challenging to install in tight seal glands

Application impact: Best matched to static sealing, harsh chemical processing, or where purity is paramount. For B2B buyers, especially in regulated sectors (e.g., European pharma; Middle Eastern petrochemical), verifying virgin PTFE grades meet standards such as ASTM D4895 or DIN EN ISO 12086 is crucial.

2. FEP-Encapsulated PTFE O-rings (Elastomer Core + FEP Jacket)

This design combines the chemical resistance of an FEP (fluorinated ethylene propylene) outer jacket with the elasticity of an internal silicone or Viton® core. FEP offers broad media compatibility—water, acids, bases, and steam—up to around 205°C.

Pros:

– Good flexibility and compression recovery from elastomer core

– Cost-effective relative to PFA versions

– Excellent chemical and corrosion resistance for most industrial applications

Cons:

– Temperature limited (FEP softens above 205°C)

– Not suitable for highly dynamic or abrasive motions

– Potential for jacket deformation under high pressures

Application impact: Ideal for pumps, valves, and pipeline connections in chemical processing, agro-industrial, and food sectors. For international buyers, FEP encapsulated rings often meet FDA, EU, and national food-contact standards (important for South America and Europe), but always confirm compliance with local requirements (e.g., EC 1935/2004, FDA 21 CFR).

3. PFA-Encapsulated PTFE O-rings (Elastomer Core + PFA Jacket)

PFA (perfluoroalkoxy) jackets improve upon FEP with higher temperature resistance (up to 260°C) and superior toughness. The internal core is typically silicone (for flexibility) or Viton® (for enhanced chemical resistance).

Pros:

– Handles more severe chemical and higher temperature applications

– Greater jacket durability versus FEP, especially under pressure cycling

– Low risk of jacket cracking or creep

Cons:

– Higher cost than FEP-encapsulated options

– Stiffer, potentially impacting seal in low-pressure or highly dynamic applications

– Marginally increased lead times for specialty grades

Application impact: Primarily used in high-purity, ultra-clean, or high-temperature environments—pharmaceutical batching, petrochemical transfer, or electronic component manufacturing—where downtime is costly and contamination control is critical. Ensure PFA-encapsulated O-rings adhere to application-specific standards (e.g., ASTM D3307, FDA, or 3-A Sanitary in food and biotech). Particularly relevant for Middle Eastern and European facilities seeking extended service life in extreme conditions.

4. Encapsulated PTFE O-rings (Silicone vs. Viton® Core)

The encapsulated O-ring’s elastomer core plays a defining role:

- Silicone Core: Offers great low-temperature flexibility and is suitable for food, beverage, or pharmaceutical industries needing repeated assembly or movement.

- Viton® (FKM) Core: Preferred in aggressive chemical or hydrocarbon-rich environments (oil & gas, refineries in Saudi Arabia, Nigeria, Brazil), thanks to high resistance to swelling, heat, and solvent attack.

Pros:

– Versatile, can tailor core choice to process environment

– Both options provide improved sealing over solid PTFE in dynamic or cycled assemblies

– Available in FDA and EU-compliant grades

Cons:

– Viton® core is less flexible than silicone, which can limit dynamic performance

– Slightly higher cost versus standard elastomer-only seals

– Not ideal where only static, ultra-pure environments are present

Application impact: For buyers, choosing the correct core is vital. For instance, Arab and African oil installations should prioritize Viton® core encapsulation, whereas European food processors might benefit from silicone-cored FDA-certified options. Always confirm both jacket and core comply with market-specific certifications and requisite test reports (e.g., ASTM D2000 for FKM, FDA 177.2600 for food contact).

Summary Table: PTFE O-Ring Material Selection for B2B Buyers

| Material | Typical Use Case for ptfe o’ring | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Solid PTFE | Static seals in aggressive chemicals, high-purity | Maximum chemical and temp resistance | Poor elasticity; hard to install; not suitable for dynamic sealing | Medium |

| FEP-Encapsulated (Silicone/Viton® core) | Industrial valves, pumps, food processing | Good flexibility and chemical resistance | Temp. limit (~205°C); possible jacket deformation at high pressure | Low to Medium |

| PFA-Encapsulated (Silicone/Viton® core) | Pharma, chemical reactors, high-temp food processes | Excellent temperature & chemical durability | Higher cost; less flexible; longer lead times for special grades | High |

| Encapsulated (Silicone core) | Dynamic seals, medical/food equipment, low temp | Enhanced flexibility, FDA/medical suitability | Not for aggressive chemicals; lower max temp compared to Viton® core | Medium |

In-depth Look: Manufacturing Processes and Quality Assurance for ptfe o’ring

To make informed procurement decisions for PTFE O-rings, B2B buyers from regions such as Africa, South America, the Middle East, and Europe must grasp both the underlying manufacturing processes and the rigorous quality assurance measures that separate premium products from substandard alternatives. PTFE O-rings—critical in numerous demanding applications—are only as reliable as their material integrity and the controls in place during their production. Below, we break down the key manufacturing stages, quality checkpoints, relevant international standards, and practical steps buyers can follow to ensure product quality and compliance.

Typical Manufacturing Processes for PTFE O-Rings

1. Material Preparation

- PTFE Resin Selection: The foundation of high-quality O-rings is virgin or filled PTFE (Polytetrafluoroethylene) resin. Some O-rings use pure PTFE for maximum chemical resistance, while others incorporate fillers (e.g., glass, graphite) to enhance properties like wear resistance.

- Elastomer Core Selection: For encapsulated O-rings, the choice between silicone or Viton® (FKM) cores depends on application-specific chemical and temperature requirements.

- Quality Verification: Resins and elastomers undergo incoming quality checks to verify purity, filler content, and batch consistency using methods like DSC (Differential Scanning Calorimetry) or FTIR (Fourier-Transform Infrared Spectroscopy).

2. PTFE Jacket and Core Forming

- Molding or Extrusion: The PTFE jacket can be formed by compression molding (for solid O-rings), or extrusion into tubing for encapsulated types. Precision is vital, as dimensional tolerances are tight.

- Core Fabrication: Elastomer cores are typically extruded or molded separately, ensuring they meet durometer (hardness) specifications.

- Encapsulation Process: The core is inserted into the PTFE jacket, followed by joining processes such as butt-welding or thermally fusing the jacket to produce a seamless, closed O-ring.

3. Finishing and Post-Processing

- Sizing and Flash Removal: O-rings are precisely cut (if produced as hollow tubes) and subjected to finishing to remove flash and ensure surface smoothness—key for sealing and hygienic applications.

- Annealing: Some manufacturers anneal PTFE O-rings to relieve internal stresses. This improves dimension stability and enhances performance in temperature cycling.

- Marking and Traceability: For traceability, reputable suppliers mark batches and often assign unique codes, aiding accountability and defect tracking.

4. Customization and Special Treatments

- Special Grades: Depending on end-use (e.g., cleanroom, food contact, oil & gas), O-rings may require special compounding, additional washing, or coatings.

- Packaging: Cleanroom or pharmaceutical applications demand high-purity packaging and documented contaminant controls.

Key Quality Control (QC) Checkpoints and Standards

International and Industry-Specific Certifications

- ISO 9001: This globally recognized standard ensures suppliers have robust Quality Management Systems (QMS), traceability, and documentation practices.

- CE Marking, API, and FDA: For Europe, CE marking may apply in equipment assemblies. The API (American Petroleum Institute) standards are particularly relevant for oil & gas buyers—especially in the Middle East. FDA and 3-A Sanitary standards are vital in the food and pharmaceutical sectors (notably in Europe and Latin America).

- Regional Nuances: Middle Eastern markets may also require SASO (Saudi Arabia), and certain South American buyers might seek INVIMA (Colombia) for pharma or ANVISA (Brazil) for medical compliance.

Stages of QC Oversight

- Incoming Quality Control (IQC):

– Raw Materials Verification: Confirm supplier Certificates of Analysis (COA) for all PTFE and elastomer materials. Validate through random compositional testing. - In-Process Quality Control (IPQC):

– Dimensional Checks: Use optical measuring systems or micrometers to validate ID, OD, and cross-sectional tolerances after molding or extrusion.

– Visual Inspection: Detect surface flaws (bubbles, voids), misjoining, or non-uniform encapsulation, which can compromise seal integrity.

– Bond Integrity Tests: For encapsulated O-rings, test jacket seams using pressure, mechanical pull, or immersion tests for leaks.

– Hardness and Elasticity Testing: Ensure core meets specified durometer and recoverability parameters. - Final Quality Control (FQC):

– Batch Sampling: Final products are sampled per AQL (Acceptable Quality Level) to check for overall conformity.

– Functional Testing: Depending on contract, O-rings may undergo pressure cycling, elongation and compression trials, or immersion in aggressive chemicals to simulate end-use environments.

– Cleanliness Assessment: Especially for food/pharma grades, check for particulates, extractables, or bioburden.

Common Testing Methods

- Dimensional and Visual Inspections: Profilometers and magnified visual systems check for defects and maintain strictly defined tolerances.

- Material Analysis: Spectroscopic tests (e.g., FTIR, XRF) confirm material identity and filler content.

- Physical Performance Testing:

- Compression Set: Measures how well the O-ring recovers after deformation.

- Tensile and Elongation: Assesses mechanical strength of the PTFE jacket and core.

- Leakage/Pressure Retention: Simulates operating conditions relevant to target industries.

Ensuring Supplier Quality: Practical Steps for International B2B Buyers

Verifying Supplier Quality Control

- Request Full Documentation: Always require certificates (e.g., ISO 9001, FDA compliance), detailed inspection reports, and batch traceability records. For commodity and mission-critical O-rings, check records for at least the last three years.

- Supplier Audits: Where feasible, conduct site visits or independent factory audits. This is especially prudent for buyers placing large or recurrent orders. Audits should review QMS, raw material controls, and process consistency.

- Third-Party Inspection: Employ reputable agencies (SGS, Intertek, Bureau Veritas) for pre-shipment inspections, especially for first-time orders or high-value procurement. Specify test protocols prior to sampling.

- Product Samples and Pilot Batches: Before volume commitments, request real samples and, if possible, conduct in-house or third-party lab validation against technical datasheets and your industry-specific requirements.

Navigating Regional Certification and Compliance

- Europe: Insist on documentation supporting REACH, RoHS, and CE (if applicable). Confirm FDA or EC 1935/2004 food-contact approval for food/pharma use.

- Middle East: Seek evidence of compliance with local regulations (e.g., SASO in KSA), and API certification for oil & gas needs.

- Africa & South America: Familiarize with national standards or certifications (e.g., INVIMA for pharmaceuticals in Colombia). Establish clear acceptance criteria to avoid disputes at customs or with regulatory bodies.

- Language and Documentation: Request documentation in dual language or with certified translations for regions where English may not be the standard technical language.

Key Considerations for Due Diligence

- Regular Supplier Performance Reviews: Monitor on-time delivery, defect rates, and responsiveness to corrective actions as ongoing KPIs.

- Samples Retention: Keep counter-samples from delivered batches for later comparison if quality disputes arise.

- Sustainability and Ethics: Increasingly, buyers in Europe, and emerging markets in Africa or Latin America, value sustainability documentation (e.g., conflict mineral statements, energy-efficient processes).

Action Points for B2B Buyers

- Establish Technical Specifications Upfront: Provide detailed specs—including material, core type, tolerances, compliance needs—to avoid ambiguity.

- Build Supplier Relationships: Reliable communication channels enhance problem-solving and fast resolution of nonconformities.

- Stay Updated on Standards: Regulatory and technical standards evolve; subscribe to industry bulletins or partner with local consultants to maintain compliance.

- Document Everything: Maintain comprehensive procurement and QC documentation, which supports compliance in audits, regulatory reviews, and dispute resolution.

Understanding and enforcing rigorous manufacturing and quality assurance protocols is essential. By engaging with suppliers transparently and methodically, B2B buyers across Africa, South America, the Middle East, and Europe can ensure a consistent supply of PTFE O-rings that meet both global and local standards—maximizing operational safety, reducing downtime, and safeguarding end-user trust.

Related Video: Amazing factories | Manufacturing method and top 4 processes | Mass production process

Comprehensive Cost and Pricing Analysis for ptfe o’ring Sourcing

Understanding Cost Structure and Key Pricing Variables in PTFE O-Ring Procurement

PTFE O-rings represent a significant investment for international buyers seeking chemical resistance and operational reliability. To source competitively and avoid hidden expenses, it’s essential to dissect the cost makeup and the influences behind pricing. Below is a transparent overview tailored to assist B2B buyers from Africa, South America, the Middle East, and Europe in making informed procurement decisions.

Core Cost Components

- Raw Materials

– PTFE Jacket Material: Pure PTFE, FEP, or PFA jackets are the most expensive elements, with market-driven price fluctuations based on resin quality and global supply.

– Core Elastomers: Core materials, such as silicone or Viton® (FKM), impact not just technical performance, but also price—Viton® often incurs a premium for its superior chemical and heat resistance. - Manufacturing Labor

– Labor costs vary by manufacturing location, automation level, and part complexity—regions with established PTFE expertise and scale tend to offer more competitive labor rates. - Manufacturing Overhead

– Includes energy, maintenance, facility, and compliance costs. Suppliers in regions facing high utility or regulatory costs may pass these on to buyers. - Tooling and Setup

– Custom dimensions or specialized cross-sections require bespoke tooling, often adding a one-time upfront charge for new projects or large modifications. - Quality Control and Certifications

– Strict QC procedures, traceability, and certifications (FDA, EU 1935/2004, ISO 9001, etc.) add costs but are crucial for regulated or export-sensitive industries. - Logistics and Packaging

– Export packing, compliance with destination market standards, and international freight (air, sea, DDP, EXW) must be factored—especially given recent disruptions and varying regional customs requirements. - Supplier Margin

– Reputable suppliers typically apply tiered margins based on order value, customization required, and post-sale service commitments.

Major Price Influencers

- Order Volume & Minimum Order Quantity (MOQ): Bulk orders benefit from economies of scale. Smaller runs, especially custom sizes, may carry higher unit costs and surcharges.

- Specification & Customization: Non-standard sizes, profiles, or advanced materials (such as PFA or custom blends) increase manufacturing complexity and price.

- Material Grade & Certifications: Certifications for food contact, pharmaceutical use, or specific industry standards add premiums. Check the necessity of such compliance for your application to avoid over-specification.

- Supplier Location & Quality: Sourcing from established PTFE-producing hubs (Europe, China, US) impacts price and lead time. Local regulations, labor costs, and technical capability drive regional price differences.

- Incoterms: The choice of shipping terms (e.g., FOB, CIF, DDP) affects landed cost calculations, insurance, and import duties—which are particularly significant for Africa, South America, and Middle Eastern importers.

Strategic Tips for Cost-Effective Sourcing

- Aggregate Demand for Volume Discounts: Consolidate internal needs across departments or business units to reach better pricing tiers and justify lower MOQs.

- Ask for Tiered Pricing Structures: Seek quotes for multiple volume brackets. Suppliers may offer significant unit price drops once certain thresholds are passed.

- Balance Specification with Cost: Avoid overengineering—specify material grades and certifications that directly match operational or regulatory needs.

- Clarify Total Cost of Ownership (TCO): Consider lifespan, maintenance, and risk of unplanned downtime—cheaper O-rings may incur higher replacement or lost productivity costs if failures occur.

- Negotiate on Incoterms and Logistics: Factor the total landed cost, not just unit price. Inquire about consolidated shipments, regional warehousing, or logistics partnerships to reduce import/ex-works risks.

- Request Sample Batches or PPAP: Before large-scale orders, test samples or small PPAP runs validate fit and quality, minimizing costly quality issues once in production.

- Build Supplier Relationships: Reliable partners may offer favorable payment terms, rush order support, and advanced notice of price increases.

Regional Considerations

- Africa: Prioritize suppliers with established export logistics and local agency support to navigate customs and import taxes.

- South America: Factor long customs clearance times and inland freight overages; seek suppliers experienced in documentation for LATAM-specific regulations.

- Middle East: Request halal or local conformity certificates if needed for industrial or food/pharma markets; consider suppliers with GCC import experience.

- Europe: Ensure products comply with EU REACH or food contact requirements; European suppliers may offer faster fulfillment but at a premium.

Disclaimer: The pricing of PTFE O-rings is highly variable and subject to changes in raw material prices, currency fluctuations, and global trade conditions. Quoted prices serve as a reference and should be confirmed through individual supplier RFQs for actual procurement.

By methodically analyzing these cost drivers and leveraging best practices in negotiation and total cost management, B2B buyers can secure reliable PTFE O-ring supply at optimal value—adapting strategies to their specific regional and industry requirements.

Spotlight on Potential ptfe o’ring Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘ptfe o’ring’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Chemicalresearchinsight (chemicalresearchinsight.com)

Chemicalresearchinsight is recognized within the global PTFE resin industry as a specialist driving innovation for high-performance applications, including PTFE O-rings essential to demanding industrial sectors. With expertise rooted in advanced polymer science, the company addresses stringent requirements in electronics, chemical processing, and medical devices. They are noted for enabling solutions that deliver outstanding chemical resistance and thermal stability—key advantages for buyers operating in aggressive environments found across Africa, South America, the Middle East, and Europe.

Key strengths for B2B buyers include a focus on tailored formulations, consistent product quality, and close alignment with evolving international standards. While detailed public information on certifications or in-house manufacturing capabilities is limited, Chemicalresearchinsight is frequently cited as a trusted supplier among top PTFE resin providers powering global supply chains. For procurement teams seeking reliable partners for critical sealing applications, their market presence and innovation-driven approach stand out.

Lip Seals, PTFE Seals, Forseal, Industrial Sealing Products (www.fst.com)

Freudenberg Sealing Technologies, through its Forseal product line, delivers advanced PTFE sealing solutions engineered for demanding industrial applications. The company’s Forseal designs, including internally and externally sealing options such as FOI and FOA, leverage PTFE compounds with metallic tension springs to ensure superior chemical resistance and reliable performance under high pressure and dynamic movements. These sealing products are produced using rigorous quality control and are supported by a comprehensive digital catalog and technical resources, enhancing buyer confidence in product selection and traceability.

Freudenberg’s global presence and established reputation make it a strategic partner for organizations across Africa, South America, the Middle East, and Europe seeking high-purity and durable PTFE O-rings. Notable strengths include custom-engineered sealing solutions for aggressive media and adherence to stringent industry standards, making the Forseal line a preferred choice for OEMs requiring safety, longevity, and regulatory compliance in critical process environments.

Packaging Materials and Solutions (www.dupont.com)

DuPont’s Packaging Materials and Solutions division is a globally recognized innovator in advanced materials technologies, supplying a broad range of industries—including those requiring demanding sealing applications like PTFE O-rings. Leveraging decades of polymer science expertise, DuPont collaborates closely with equipment manufacturers, converters, and brand owners to deliver tailored, application-specific solutions. While detailed public information on dedicated PTFE O-ring manufacturing is limited, DuPont’s established portfolio of technical resins, sealants, and barrier coatings suggest strong capabilities in engineered sealing products for challenging chemical, thermal, and sanitary environments. The company is known for rigorous quality standards and extensive international reach, making them a reliable partner for B2B buyers in Africa, South America, the Middle East, and Europe. Their focus on anti-counterfeit features and compliance solutions can be particularly valuable for regulated and export-driven sectors.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| Chemicalresearchinsight | Polymer science-driven PTFE O-ring solutions | chemicalresearchinsight.com |

| Lip Seals, PTFE Seals, Forseal, Industrial Sealing Products | High-performance PTFE seals with global support | www.fst.com |

| Packaging Materials and Solutions | Advanced polymer expertise, global industrial presence | www.dupont.com |

Essential Technical Properties and Trade Terminology for ptfe o’ring

Critical Technical Specifications for PTFE O-rings

1. Material Grade (PTFE purity and core type)

The outer material—typically virgin PTFE, FEP, or PFA—determines the O-ring’s resistance to chemicals, temperature range, and overall inertness. Additionally, the inner core is usually silicone or Viton (FKM); each has distinct performance characteristics. For B2B buyers, identifying both jacket and core materials is crucial: it impacts compatibility with process fluids, regulatory compliance (FDA, EU), and lifespan in aggressive or clean environments. Always request full material composition and compliance certificates, especially for regulated applications (food, pharma, oil & gas).

2. Temperature Resistance

PTFE O-rings are selected based on their ability to withstand operating temperatures. Standard FEP encapsulations function up to +205°C, while PFA encapsulated O-rings tolerate up to +260°C. The temperature rating is vital for procurement managers sourcing for equipment in climates with extreme heat, or for industries such as chemical processing and petroleum where thermal cycling is frequent. Exceeding temperature limits leads to jacket deformation or loss of sealing integrity.

3. Chemical Resistance

One of the core benefits of PTFE O-rings is their near-universal chemical resistance, enduring exposure to acids, bases, solvents, fuels, and more. However, B2B buyers must match the ring’s grade with the precise chemicals in their process. Not all elastomer cores are equally resistant—for example, silicone cores are less suited for aggressive solvents than Viton. Ensuring chemical compatibility reduces maintenance frequency and mitigates risk of equipment failure or contamination.

4. Dimensional Tolerance and Standards

PTFE O-rings are manufactured in standardized cross-section diameters (CS) and inner diameters (ID), with strict dimensional tolerances typically aligning to ISO 3601, AS568 (imperial), or DIN specifications. For international buyers, referencing these standards ensures fit with global machinery, facilitates cross-supplier benchmarking, and avoids miscommunication in orders. Always clarify tolerances in your purchase agreement to guarantee proper sealing and avoid costly rework.

5. Compression Set and Elastic Recovery

Compression set refers to how well the O-ring returns to its original shape after long-term compression. PTFE jackets provide chemical and thermal protection but are non-elastic, so the core’s resilience becomes critical—Viton generally offers superior elastic recovery compared to silicone in aggressive environments. A low compression set means longer service life, essential for industries seeking reduced maintenance intervals.

6. Regulatory and Quality Certifications

Depending on your sector, O-rings may need to comply with ISO 9001, FDA, EC1935/2004, or other international standards for quality, hygiene, or traceability. For export markets and heavily regulated industries, requesting these certifications at the outset can accelerate customs clearance and site qualification processes, safeguarding your compliance posture.

Common B2B Trade Terms for PTFE O-Ring Procurement

OEM (Original Equipment Manufacturer):

Indicates that the O-ring is supplied by, or suitable for, the manufacturer of the original machinery. When sourcing, clarifying OEM compatibility ensures the part will fit and function as intended, which is critical for warranty and performance assurance.

MOQ (Minimum Order Quantity):

This term denotes the smallest quantity a supplier is willing to sell. B2B buyers must negotiate MOQs based on project size, storage capacity, and cash flow. Lower MOQs benefit pilot projects, while higher MOQs can unlock better unit pricing for large-volume buyers.

RFQ (Request for Quotation):

A formal process where buyers invite suppliers to provide pricing and terms for a specified PTFE O-ring order. Issuing a clear and detailed RFQ accelerates supplier response, improves quote accuracy, and strengthens negotiation leverage—especially when sourcing from multiple countries.

Incoterms (International Commercial Terms):

A globally recognized set of terms (like FOB, CIF, DAP) that clarify which party is responsible for shipping, insurance, import duties, and risk transfer. Selecting the right Incoterm in your PTFE O-ring deal prevents costly misunderstandings and supports more predictable delivery schedules.

Lead Time:

Refers to the duration between placing an order and receiving the goods. For international buyers, especially those operating JIT (just-in-time) systems or with remote sites in Africa or South America, knowing the accurate lead time enables better project planning and inventory management.

Certificate of Conformity (CoC):

A document certifying that the PTFE O-ring meets specified standards and contract requirements. Always request a CoC for specialized or regulated applications as proof of quality and compliance, which can help resolve disputes and facilitate customs procedures.

By prioritizing these technical attributes and mastering essential trade language, global B2B buyers can minimize procurement risk, ensure the suitability of PTFE O-rings for their operations, and build lasting supplier partnerships across diverse industries and geographies.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the ptfe o’ring Sector

Market Overview and Key Trends

PTFE O-rings have seen increasing global adoption driven by stringent quality demands, regulatory changes, and advancements in industrial technologies. As industries across Africa, South America, the Middle East, and Europe modernize, they prioritize reliability, chemical compatibility, and compliance with international standards—areas where PTFE O-rings excel. This demand surge is most apparent in sectors such as pharmaceuticals, food processing, chemical production, oil and gas, and water treatment. These industries require seals that withstand aggressive media, elevated temperatures, and frequent sterilization cycles, all without risk of product contamination or seal failure.

A significant sourcing trend is the shift towards customized O-ring specifications, tailored to unique operating environments. International buyers are leveraging digital supplier platforms and data-driven procurement to access broader offerings, including variant core materials (Viton, silicone) and encapsulation options (FEP, PFA). The global supply chain is also evolving, with more suppliers establishing regional distribution hubs or local partnerships to counteract shipping disruptions, minimize lead times, and ensure technical support in key markets such as Saudi Arabia and Colombia. Price transparency and total cost of ownership are under greater scrutiny, pushing buyers to factor in not just unit price but longevity, certification, and customer service.

Emerging technologies are further influencing sourcing practices. Predictive maintenance and digital twins fuel demand for O-rings with traceable manufacturing data, enabling buyers to connect procurement decisions directly to operational reliability and lifecycle performance. In parallel, buyers are increasingly requesting documentation for FDA, USP Class VI, and food-grade or cleanroom compliance, indicating a trend towards higher accountability and risk management in critical process industries.

Sustainability and Ethical Sourcing in B2B

Environmental consciousness is rising across B2B procurement strategies, including within the PTFE O-ring supply chain. International buyers face pressure from stakeholders and regulators to source components with lower environmental impact, driving interest in both process efficiency and material sustainability. The PTFE manufacturing process itself is energy-intensive, and sourcing virgin PTFE inevitably carries a higher carbon footprint. Forward-thinking suppliers are responding by investing in energy-efficient production, waste reduction programs, and, where technically feasible, offering reprocessed or partially recycled PTFE materials.

Ethical sourcing is not limited to environmental concerns. Buyers are increasingly auditing suppliers for labor practices, material traceability, and corporate social responsibility, particularly when sourcing from regions with variable regulatory enforcement. Certifications such as ISO 14001 (Environmental Management), ISO 9001 (Quality), and documentation supporting RoHS and REACH compliance are becoming standard requirements in the tender process. In some regions, especially within Europe and parts of the Middle East, buyers are requesting evidence of conflict-free minerals, transparent supply chains, and even third-party sustainability audits.

Additionally, the demand for “green” or food-grade certified PTFE O-rings continues to rise in sectors such as food and beverage, pharmaceuticals, and potable water systems. These certifications—FDA, EU 1935/2004, NSF/ANSI standards—ensure materials are safe for contact-sensitive applications and support brand positioning for downstream B2B clients promoting product safety and corporate responsibility.

Evolution and Historical Context

The use of PTFE in sealing solutions dates back to the mid-20th century, when Teflon revolutionized chemical-resistant applications. Originally adopted as solid O-rings where no elastomer could perform, PTFE proved its worth with unmatched chemical inertness and extremely low friction, but its rigidity limited dynamic sealing capabilities. Over time, encapsulated O-ring designs emerged, marrying PTFE jackets with resilient rubber cores—a breakthrough that dramatically expanded use in dynamic and sanitary environments. Today’s wide portfolio of PTFE O-rings and encapsulated versions reflects decades of iterative improvement spurred by diversifying industrial demands, international regulations, and advancements in polymer science. For B2B buyers globally, understanding this evolution informs smarter sourcing, as it helps identify which PTFE O-ring variants best meet modern performance demands and regulatory benchmarks across varied markets.

Frequently Asked Questions (FAQs) for B2B Buyers of ptfe o’ring

-

How can I effectively vet international suppliers of PTFE O-rings for quality and reliability?

Begin by requesting comprehensive documentation, such as ISO 9001 certifications, third-party testing reports, and customer references, ideally from similar industries or regions. Schedule a virtual or onsite audit when feasible to assess manufacturing processes, quality control, and compliance with application-specific standards (e.g., FDA, EU, or ATEX). Evaluate the supplier’s export experience, responsiveness, and after-sales support track record. Platforms such as Alibaba, Made-in-China, and global industry expos also provide credibility indicators, but direct due diligence is essential for mitigating risks tied to inconsistent product quality or delayed shipments. -

Are PTFE O-rings customizable for unique applications, and how should I specify requirements?

Yes, PTFE O-rings can be tailored for dimensions, core materials (like FEP, PFA, Viton, or silicone), hardness, and even compliance with region-specific regulations. Provide detailed engineering drawings or application parameters such as temperature, chemical exposure, required certifications, and dynamic/static sealing needs. Engage with the supplier’s technical team early in the sourcing process to align on feasibility, tooling needs, and minimum run quantities for custom products. Clear specifications minimize misunderstanding and help ensure product fit, especially in industries like pharmaceuticals or food where compliance is non-negotiable. -

What are typical minimum order quantities (MOQ), lead times, and payment terms for international PTFE O-ring orders?

MOQs vary by supplier and customizability—standard sizes may be available for small batch orders (100–500 units), but specialized encapsulated O-rings often require higher minimums (1,000–5,000+ units). Lead times range from 2–6 weeks for standard parts, or 6–12 weeks for custom items, factoring in production and export logistics. Payment terms commonly include a deposit (30–50%) with balance before shipment, or after delivery for trusted buyers. New buyers may benefit from securing more flexible terms via trade credit insurance or using platforms with built-in buyer protection. -

Which quality assurance (QA) measures and certifications should I request for industrial PTFE O-rings?

Insist on advanced QA protocols such as 100% visual inspection, dimensional verification, and batch traceability. For critical sectors, request compliance certificates like FDA (for food, pharmaceutical), EU 1935/2004, or ATEX (explosive atmospheres). Material certificates (COC/COA), third-party laboratory testing for physical and chemical properties, and REACH/RoHS declarations assure product safety and legal compliance. QC documentation with every batch is especially important to support future audits and claims. -

How can I manage logistics and ensure smooth shipment of PTFE O-rings to my country?

Partner with suppliers experienced in global export, ideally those familiar with your region’s import regulations and preferred incoterms (e.g., CIF for Africa, DAP for Middle East). Discuss packaging requirements to prevent contamination or deformation during transit, particularly for climate-sensitive items. Clarify documentation needs—commercial invoices, packing lists, certificates of origin, and regulatory certificates—to avoid customs delays. Leveraging a freight forwarder can streamline complex shipments and consolidate orders, saving on logistics costs and minimizing transit risks. -

What steps can I take if there are quality disputes or order discrepancies with overseas PTFE O-ring suppliers?

Clearly outline dispute resolution protocols in your contract, including acceptable tolerances and defect thresholds. Document all order details and keep photographic/video evidence of issues upon receipt. Initiate resolution first through the supplier’s customer service or dedicated export manager; reputable suppliers often prioritize settlements to maintain their international reputation. If resolution stalls, intermediaries like local chambers of commerce or trade platforms’ dispute mediation (e.g., Alibaba Trade Assurance) can assist. For higher-stakes cases, local legal counsel or arbitration in a mutually agreed locale may be necessary. -

Are there specific regulatory differences for PTFE O-ring imports across Africa, South America, the Middle East, and Europe?

Regulations vary significantly. In the EU, compliance with REACH, RoHS, and relevant food or pharma standards is mandatory. Middle Eastern countries might require Gulf conformity markings or halal-related certifications for certain sectors. Africa and South America may have their own customs codes, material safety declarations, and proof of origin requirements for tariff exemptions. Always confirm that documentation matches both general customs requirements and sector-specific standards in destinations like Saudi Arabia, Colombia, or the EU. -

What cost factors should I consider to ensure competitive PTFE O-ring pricing and total landed cost?

Beyond unit price, incorporate mold/tooling charges for custom items, shipping (air/sea, packaging, insurance), import duties, and local tariffs. Exchange rate fluctuations can impact final cost; fixed price contracts or hedging are advisable for large orders. Also assess supplier value-adds—such as technical support, faster lead times, or after-sales service—that may reduce operational risks or downtime, offsetting higher initial costs. Request detailed quotations that break down all fees for precise cost evaluation and negotiation leverage.

Strategic Sourcing Conclusion and Outlook for ptfe o’ring

International B2B buyers navigating the global PTFE O-ring market face an array of complexities—from material choices and certifications to supplier reliability and shifting cost structures. Key takeaways for procurement include the importance of understanding your precise application requirements, such as chemical compatibility, temperature tolerances, and regulatory standards. Prioritizing supplier transparency and robust quality assurance processes is equally critical, especially in regions where procurement cycles and logistics can introduce additional risk.

Strategic sourcing delivers far-reaching benefits by lowering total cost of ownership, ensuring supply chain resilience, and supporting safer, more efficient operations. Leading buyers now go beyond price checks, evaluating manufacturers on their adherence to international standards, ability to provide technical support, and track record in serving industries such as pharmaceuticals, petrochemicals, and food processing. Additionally, considering regional market dynamics—such as local demand, import regulations, and logistics infrastructure—can greatly improve lead times and cost predictability.

Looking ahead, growth in industrial investment across Africa, South America, the Middle East, and Europe will only boost the strategic value of optimal PTFE O-ring sourcing. Proactive buyers who build strong supplier partnerships, stay informed about material innovations, and embrace best procurement practices will position themselves to capitalize on both current opportunities and emerging market trends. Now is the time to reassess your sourcing strategies and engage with trusted suppliers to secure a resilient, future-ready supply of high-performance PTFE O-rings.