Introduction: Navigating the Global Market for rubber protective edging

Rubber protective edging has become a critical component across global manufacturing, construction, energy, and logistics industries. Whether safeguarding machinery in Germany, protecting construction materials in the UAE, or ensuring product longevity in South Africa and Brazil, the right edging solution directly impacts operational safety, product durability, and regulatory compliance. With increasing pressures on quality, cost efficiency, and supply chain resilience, B2B buyers are expected to source edging solutions that not only protect assets but also meet local standards and evolving customer requirements.

The international market for rubber protective edging is rich and diverse, offering a wide array of product types, materials, and manufacturing processes. However, navigating this landscape—from identifying reliable suppliers to ensuring robust quality control—poses significant challenges. For buyers in Africa, the Middle East, South America, and Europe, the stakes are even higher due to regional compliance standards, import tariffs, customs procedures, and the need for consistent technical support.

This comprehensive guide empowers buyers with actionable insights to make informed, strategic sourcing decisions. Key topics include:

- Types of Rubber Protective Edging: An overview of profiles, applications, and product variants.

- Materials & Specifications: Understanding key material options for different environments.

- Manufacturing & Quality Assurance: What to demand in terms of process, certifications, and compliance.

- Supplier Evaluation: Tactics to identify, vet, and build relationships with global suppliers.

- Cost Considerations & Market Trends: Pricing models, total cost analysis, and future market directions.

- Frequently Asked Questions: Addressing real-world concerns from international buyers.

By equipping your procurement team with industry best practices and regionally relevant knowledge, this guide will streamline your sourcing process, minimize risk, and support sustainable, cost-effective decisions in the dynamic market for rubber protective edging.

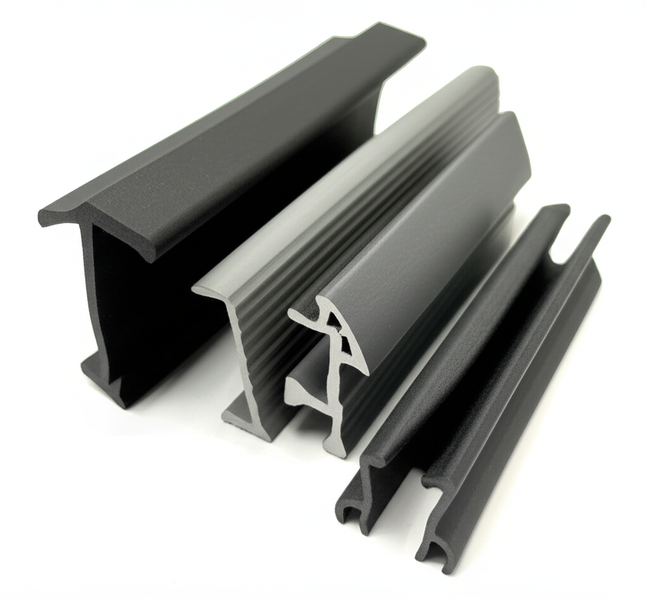

Understanding rubber protective edging Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard Rubber Edge Trim | U-shaped flexible profile, often with internal metal core | Furniture, automotive doors, machinery panels | Easy installation, good general protection; may lack weatherproofing |

| Rubber Edge with Bulb Seal | Adds a compressible bulb (round or D-shaped) for enhanced sealing | HVAC, marine, industrial enclosures | Superior sealing; higher cost due to added material |

| Adhesive-Backed Rubber Edging | Flat or L-shaped profile with integrated adhesive strip | Glass, mirrors, display cases | Quick application; adhesion may suffer in humid/dirty environments |

| Heavy-Duty Industrial Edging | Thicker rubber, reinforced for impact and abrasion resistance | Construction machinery, loading docks | Durable for harsh use; can be hard to cut and install |

| Decorative Rubber Edging | Textured or colored, designed for visibility and aesthetics | Retail displays, signage, architectural | Improves visual appeal; may have limited mechanical strength |

Standard Rubber Edge Trim

Standard rubber edge trim is the most versatile variety, featuring a U-shaped or channel profile. It’s typically reinforced with a steel or aluminum insert to grip edges securely. This type is ideal for protecting sharp or unfinished edges on vehicle doors, sheet metal, and furniture, reducing the risk of injury or material damage. For B2B buyers, prioritizing dimension compatibility (edge thickness), material formulation (EPDM vs. PVC rubber), and ease of bulk handling is critical, especially in diverse climates like those in Africa or the Middle East.

Rubber Edge with Bulb Seal

Rubber edging with a bulb seal integrates a compressible bulb—round, oval, or D-shaped—adjacent to the primary edge trim. Designed to provide superior sealing against dust, moisture, and air infiltration, it’s widely used in demanding environments like marine hatches, HVAC systems, and industrial enclosures. For international procurement, ensure the rubber compound resists UV and chemicals, and confirm certification standards (e.g., automotive or marine) for target markets. Although costlier, this type often justifies its investment through reduced maintenance and extended service life.

Adhesive-Backed Rubber Edging

Adhesive-backed rubber edging features a pressure-sensitive adhesive strip on a flat or L-shaped rubber profile, allowing for tool-free application. This makes it highly desirable for glass manufacturing, display construction, and quick refurbishment projects where mechanical fasteners are impractical. B2B buyers should consider substrate compatibility and regional climate factors (humidity/temperature) that could impact adhesion. Buyers in Europe or humid equatorial regions should request adhesion testing or climate-specific backing materials from suppliers.

Heavy-Duty Industrial Edging

Heavy-duty industrial rubber edging is engineered with thicker, often reinforced, rubber designed to withstand extreme mechanical stress and environmental exposure. Applications include the perimeters of loading docks, construction equipment, and warehouse machinery. Intended for high-traffic or impact-prone areas, this type offers enhanced longevity but can increase installation time due to rigidity. Buyers should assess installation capabilities (special tools or skilled labor required) and confirm that the product meets relevant safety and durability certifications for their industry.

Decorative Rubber Edging

Decorative rubber edging serves primarily aesthetic functions, featuring textured surfaces, colored finishes, or special profiles to enhance product visibility and design. Commonly adopted for retail fixtures, signage, and architectural elements, this edging helps brands or projects differentiate visually while still offering basic protection. B2B decision-makers should weigh the balance between decorative effect and the component’s protective capability, and consider customization options to match branding or compliance with local fire-retardancy or safety codes.

Related Video: Lecture 1 Two compartment models

Key Industrial Applications of rubber protective edging

| Industry/Sector | Specific Application of rubber protective edging | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive & Transport | Door seals and edge protection in vehicles and equipment | Enhanced safety, noise reduction, improved longevity | UV/weather resistance, compliance with safety standards |

| Manufacturing | Machinery and equipment edge protection | Operator safety, equipment preservation | Abrasion resistance, fitment precision, chemical compatibility |

| Construction | Edge sealing in panels, glass, and metal fittings | Watertight/dustproof environments, reduced damage | Flame retardance, durability, conformity to building codes |

| Energy & Utilities | Cable routing and protection in power and data sectors | Minimized cable wear, improved reliability | Electrical insulation properties, temperature tolerance |

| Marine & Shipbuilding | Hatch, deck, and compartment edge sealing | Corrosion prevention, watertight integrity | Saltwater resistance, anti-slip properties, international maritime certifications |

Automotive & Transport

In the automotive and transport sectors, rubber protective edging is widely utilized for door seams, trunk lids, and window frames, as well as for heavy-duty vehicles and rail applications. It shields passengers and cargo from sharp edges, prevents moisture ingress, and reduces noise and vibration—vital for both comfort and operational safety. For international buyers, especially in environments such as the Middle East and Africa where intense sunlight and temperature extremes are common, sourcing edging that is UV and weather resistant, and meets local safety regulations, is essential for long-term performance.

Manufacturing

Protective edging is indispensable in safeguarding machinery and factory equipment. It is typically installed along panels, hatches, and moving parts to protect operators from accidental cuts and abrasions, and to prevent wear on expensive equipment. This application is particularly prominent in high-throughput manufacturing plants in South America and Europe, where worker safety and regulatory compliance drive purchasing decisions. Buyers should prioritize materials that resist abrasion, fit precisely to complex geometries, and offer resistance to oils and cleaning chemicals commonly found in industrial settings.

Construction

Rubber edging is critical in the construction industry where it is applied to glass panels, sheet metal, and prefabricated structural elements. Its primary function is to create tight, weatherproof seals that guard against water and dust penetration, while also protecting fragile finishes from damage during installation and use. In emerging markets, such as Africa and the UAE, where construction standards are rapidly evolving, selecting edging products with certified flame retardance and compliance with local and international building codes ensures both safety and acceptance in commercial projects.

Energy & Utilities

In energy generation, transmission, and communications infrastructure, rubber edging is used to line cabinets, cable trays, and field enclosures. It plays a vital role in protecting cables from mechanical wear, preventing ingress of dust and moisture, and enhancing system reliability. For international buyers in regions with wide temperature fluctuations or significant dust—like North Africa or parts of the Middle East—specifying products with excellent insulation and temperature resistance is crucial for minimizing maintenance costs and downtime.

Marine & Shipbuilding

Marine environments impose demanding requirements—salt spray, constant movement, and the need for watertight integrity. Here, rubber protective edging is essential for sealing hatches, walkways, and equipment compartments, preventing both water ingress and corrosion-related damage. European shipyards and South American port operators often look for edging with saltwater resistance, anti-slip surfaces, and certifications such as IMO approval. When sourcing, buyers should ensure that products meet stringent international marine and safety standards to guarantee vessel integrity and crew welfare.

Related Video: How to Thread Overlock Edging Machine. Siruba 4Threads Industrial Sewing Machines.

Strategic Material Selection Guide for rubber protective edging

Common Materials for Rubber Protective Edging: Properties and Selection Insights

International B2B buyers must assess material options for rubber protective edging to ensure optimal fit for operating environments, compliance needs, and end-use performance expectations. The four most common material choices are EPDM (Ethylene Propylene Diene Monomer), Neoprene (Polychloroprene), Natural Rubber, and PVC (Polyvinyl Chloride). Each material presents a unique balance of properties, cost, durability, and standards implications, all of which can significantly impact selection decisions for projects in Africa, South America, the Middle East, and Europe.

EPDM (Ethylene Propylene Diene Monomer)

Key Properties:

EPDM is widely valued for its excellent resistance to UV rays, ozone, and a broad temperature range (typically -40°C to +120°C). It is non-conductive, boasts superior weathering properties, and resists aging, water exposure, and many mild chemicals.

Pros & Cons:

EPDM offers outstanding durability for outdoor and automotive applications, has long service life, and maintains flexibility across temperature extremes. However, it is not resistant to hydrocarbon oils or petroleum-based fluids, which limits its use in contact with fuels or greases. Manufacturing complexity is moderate, and availability is high, keeping relative costs in the medium range.

Impact on Application:

Best suited for exterior edging on vehicles, construction, or any application with significant sunlight or humidity exposure. Resists cracking and hardening over time, minimizing the need for premature replacements.

International Considerations:

EPDM materials often comply with ASTM D2000 standards and are widely accepted in European markets (DIN standards). Weathering resistance is particularly beneficial for buyers in harsh climates, like those in Africa and the Middle East.

Neoprene (Polychloroprene)

Key Properties:

Neoprene provides balanced resistance to moderate chemicals, ozone, and weathering. It can operate in temperatures roughly from -30°C to +100°C. It also demonstrates some resistance to oils and greases, unlike EPDM.

Pros & Cons:

The main advantages are broad chemical compatibility, moderate aging properties, and versatility. However, Neoprene is more costly than basic rubber or PVC, and prolonged exposure to strong acids or solvents can degrade it. It is somewhat less UV resistant than EPDM.

Impact on Application:

Commonly used in industrial machinery, marine environments, and HVAC systems where moderate chemical exposure is likely. Its oil resistance makes it suitable for certain automotive or industrial installations.

International Considerations:

Neoprene often conforms to ASTM and ISO standards for industrial elastomers. It is popular in Europe and South America for marine and transportation applications. Buyers should verify local standards and import regulations, particularly in regions with strict environmental or product safety requirements.

Natural Rubber

Key Properties:

Natural rubber is notable for its high elasticity, tensile strength, and low-temperature flexibility. It performs best between -20°C and +70°C and provides good abrasion resistance but poor weather and ozone resistance.

Pros & Cons:

Its main strengths are cost-effectiveness and ease of manufacture. Natural rubber is not ideal for outdoor or high-heat applications due to rapid degradation from UV, ozone, and oils. Its mechanical durability makes it suitable for high-impact indoor environments.

Impact on Application:

Well-suited for interior edge protection, vibration damping, and scenarios where mechanical shock absorption is paramount but exposure to sun or chemicals is limited.

International Considerations:

Complies with general rubber standards (such as ASTM D297). Frequently used in South America and African markets for basic industrial and commercial applications. For buyers in the Middle East and high-UV regions, alternatives with better aging properties are often recommended.

PVC (Polyvinyl Chloride – Flexible Grades)

Key Properties:

Flexible PVC, often used as an economical rubber substitute, offers good resistance to abrasion, chemicals, and some weathering. Its temperature range is narrower (-10°C to +60°C) and it may harden or crack at lower temperatures or after prolonged UV exposure.

Pros & Cons:

Advantages include low cost, coloring versatility, and ease of processing (including extrusion). Key limitations are lack of long-term flexibility in harsh outdoor environments and potential environmental or health concerns associated with certain plasticizers. Its fire performance and compliance may require careful scrutiny.

Impact on Application:

Best for cost-sensitive projects, light industrial edging, or where sunlight and extreme heat are not major concerns.

International Considerations:

Flexible PVC edge trims should be compliant with RoHS and REACH regulations in the EU, and standards such as DIN 16941 may be applicable. In countries like Germany, strict environmental regulations apply. Buyers in regions with prolonged high temperatures (Middle East, Africa) may find PVC less suitable due to risk of embrittlement over time.

Summary Table

| Material | Typical Use Case for rubber protective edging | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| EPDM | Vehicle doors, outdoor panels, HVAC enclosures | Superior weather/UV resistance | Poor resistance to oils / hydrocarbons | Medium |

| Neoprene | Marine, industrial machinery, HVAC, automotive | Balanced chemical & oil resistance | Less UV resistant, higher cost than natural rubber | Medium-High |

| Natural Rubber | Indoor equipment, vibration isolation, general purpose | Excellent elasticity & low cost | Poor weather/ozone resistance; limited outdoor use | Low |

| Flexible PVC | Cost-sensitive indoor/outdoor trim, basic machine guards | Inexpensive, easy to process | Can degrade under UV/heat; environmental concerns | Low |

In-depth Look: Manufacturing Processes and Quality Assurance for rubber protective edging

Rubber protective edging is engineered to provide robust protection and aesthetic finishing for exposed edges across diverse industries—from automotive and machinery to construction and furniture manufacturing. For international B2B buyers, especially those sourcing from regions such as Africa, South America, the Middle East (including the UAE), and Europe (notably Germany), understanding how these products are manufactured and quality standards are upheld is crucial for risk mitigation and optimizing procurement decisions.

Core Manufacturing Stages for Rubber Protective Edging

The manufacturing of rubber protective edging is a multi-stage process involving precise engineering and continual quality monitoring. While specific methods may vary by product design and end-use, the core process follows these stages:

1. Raw Material Selection and Preparation

- Material Choices: The most common materials include EPDM (ethylene propylene diene monomer) for exterior weather resistance, natural rubber for flexibility, and TPE (thermoplastic elastomer) for hybrid performance.

- Preparation: Raw materials are inspected for purity and consistency. They are compounded with additives (plasticizers, stabilizers, colorants) in specific formulations to ensure desired mechanical and environmental characteristics.

2. Mixing and Compounding

- Precise Blending: Ingredients are mixed in internal mixers or two-roll mills. This stage ensures uniform distribution of reinforcing agents and chemical additives.

- Batch Verification: Samples from each batch are tested for viscosity, cure rate, and other physical properties before proceeding to the next step.

3. Forming: Extrusion or Molding

- Extrusion: The compounded rubber is fed into an extruder and forced through a die that gives the protective edging its profile (e.g., U-channels, bulb seals).

- Molding (for complex shapes): Some custom products are manufactured using compression, transfer, or injection molding for intricate shapes or integrated metal cores.

- In-line Curing: During or after forming, the extrudate passes through a vulcanization process—typically in a salt bath, hot air, or microwave oven—to set the final properties.

4. Assembly and Reinforcement

- Metal Core Integration: Many edging profiles include steel or aluminum wire reinforcements, automatically inserted during extrusion or assembled post-extrusion for enhanced grip.

- Adhesive Application: Where required, pressure-sensitive adhesives or pre-applied seals are added to enable easier installation for the end user.

5. Cutting, Finishing & Packaging

- Precision Cutting: Edging is cut to required lengths using automated guillotines or rotary cutters.

- Surface Inspection: Visual and tactile inspection for surface flaws, edge uniformity, and accurate cross-sectional profile.

- Packaging: Products are bagged, coiled, or boxed per buyer specifications, with labeling for traceability.

Quality Assurance Protocols and International Standards

Consistent product quality is mission-critical, especially for applications where safety, durability, and regulatory compliance are essential. Leading suppliers institute rigorous quality control measures, often tailored to both international norms and region-specific buyer requirements.

Key International Standards

- ISO 9001: The foundational standard for quality management systems, ensuring robust controls at every step—from incoming material inspection to finished product auditing.

- Industry Certifications:

- CE Mark (EU): Mandatory for products used in certain sectors within Europe, certifying conformity to health, safety, and environmental protection standards.

- RoHS/REACH Compliance: Europe-focused regulations restricting hazardous substances, relevant if rubber edging contacts sensitive settings (e.g., food, medical, electronics).

- UL, ASTM, or API: For buyers in specialized sectors (e.g., oil & gas, electrical), additional standards may mandate flame resistance, chemical inertness, or other properties.

Quality Control Checkpoints

- Incoming Quality Control (IQC): Inspection of raw materials upon arrival (checking for contamination, batch consistency, documentation).

- In-Process Quality Control (IPQC): In-line checks during mixing and forming to monitor dimensional accuracy, surface finish, and in some cases, in-situ physical testing (e.g., hardness, elasticity).

- Final Quality Control (FQC): Comprehensive testing of finished batches for conformity with technical datasheets, often including destructive and non-destructive testing.

Common Testing Methods

- Dimension and Tolerance Checks: Calipers, profile projectors, and laser scanners ensure profiles meet precise specifications and are consistent batch-to-batch.

- Physical & Mechanical Testing: Shore hardness testing (durometer), tensile strength, elongation at break, and compression set to confirm performance parameters.

- Environmental Resistance: Accelerated aging (UV, ozone, salt spray) simulates harsh service conditions, particularly relevant for buyers in Africa, the Middle East, or coastal regions.

- Adhesion and Bonding Validation: Particularly for edged trims with metal cores or adhesives, tests for peel strength and core bond integrity are performed.

Strategies for Verifying Supplier Quality as an International B2B Buyer

For buyers sourcing from outside their own borders, greater due diligence is required to safeguard against non-conformities, supply delays, and hidden costs. Buyers from Africa, South America, the Middle East, and Europe should prioritize the following:

1. Supplier Audits

- Remote Audits: Request virtual facility tours, video demonstrations of QC procedures, and live data sharing where on-site visits are impractical.

- On-Site Audits: For strategic partnerships or large-volume sourcing, conduct or commission in-person audits focusing on manufacturing capability, document traceability, and real-time process monitoring.

2. Quality Documentation Review

- QC Certificates: Insist on batch-specific certificates of analysis (COAs), ISO 9001:2015 compliance documents, and certifications relevant to your market (CE, RoHS, etc.).

- Test Reports: Request recent lab testing documentation, ideally from both the supplier’s in-house QC and, where applicable, independent third-party testing agencies.

3. Third-Party Inspection Services

- Pre-Shipment Inspections: Engage internationally-recognized inspection firms (e.g., SGS, Bureau Veritas, TÜV) to perform random sampling, on-site product verification, and supervision of container sealing.

- Continuous Monitoring: For ongoing orders, consider Lot Acceptance Testing or ongoing supervision contracts to ensure ongoing compliance.

4. Sample and Pilot Orders

- Initial Qualification: Place small pilot orders and test the edging under real-world conditions before scaling up to production volumes.

- Feedback Loop: Provide performance feedback to the supplier for continual improvement and customizations as required by local use cases (e.g., heat resistance for Middle East climates, ozone resistance for South America or Africa, strict environmental compliance for EU markets).

5. Regulatory Nuances and Best Practices

- Align with Import Regulations: Be aware that standards such as CE and REACH are legally required for EU imports, while other markets may have local registration or documentation requirements.

- Traceability Protocols: Ensure all batches are clearly labeled with date codes, batch numbers, and production run identifiers for swift issue resolution or recall management.

- Transparent Communication: Establish clear, contractually binding agreements on product specs, QC procedures, delivery schedules, and after-sales responsibility.

Regional Considerations: What International Buyers Should Watch For

- Africa & South America: Pay special attention to UV and ozone resistance for products exposed to intense sunlight and atmospheric conditions; request testing certificates for these properties.

- Middle East (UAE): Prioritize heat aging and flexibility at elevated temperatures; require suppliers to provide accelerated aging test results.

- Europe (Germany): Insist on full regulatory compliance (CE, REACH, RoHS) and demand comprehensive documentation and regular QC reporting.

By carefully understanding the typical manufacturing workflow, insisting on robust quality assurance, and implementing vigilant supplier verification practices, international B2B buyers can secure reliable, compliant, and long-lasting rubber protective edging—reducing risk, preventing costly recalls, and safeguarding their brand reputation in a competitive global marketplace.

Related Video: Lean Manufacturing – Lean Factory Tour – FastCap

Comprehensive Cost and Pricing Analysis for rubber protective edging Sourcing

Rubber protective edging is a critical product for safeguarding machinery, panels, and sharp edges across a range of industries—including automotive, construction, furniture, and manufacturing. For international B2B buyers, especially those in Africa, South America, the Middle East, and Europe, understanding the full cost structure and the nuanced pricing drivers is vital for successful and cost-effective sourcing.

Key Cost Components

The total landed cost for rubber protective edging comprises several interrelated elements:

- Raw Materials: The primary material is typically EPDM rubber, though PVC and thermoplastic rubber are used for specific needs. Raw material quality directly impacts durability, flexibility, and cost.

- Labor: Labor costs vary significantly depending on the country of manufacture and the level of automation in production facilities. Markets with higher labor costs (such as the EU) will generally command higher unit prices.

- Manufacturing Overhead: This includes utilities, factory maintenance, machinery depreciation, and the operational costs required to maintain efficient production lines.

- Tooling: For customized profiles or unique edging requirements, new tooling may be necessary, with upfront charges or amortized costs across the order volume.

- Quality Control (QC): Rigorous QC protocols—especially when international certifications (e.g., REACH, RoHS) are required—add to the overall cost, but ensure consistency and reduce long-term risk.

- Logistics: International shipping fees (via air, sea, or road), packaging, port handling, and insurance can represent up to 15-25% of the total cost, particularly for buyers in Africa or South America faced with complex shipping routes.

- Profit Margin: Supplier profit margins typically range from 8% to 20%, influenced by order size, repeat contracts, and market competition.

Pricing Influencers and International Considerations

Several factors can shift the price point or overall buying strategy:

- Order Volume & Minimum Order Quantity (MOQ): Larger orders allow for better economies of scale, both in raw material purchasing and in manufacturing efficiency. MOQs may be higher for custom profiles or specialty compounds.

- Specifications & Customization: Unique cross-sections, color matching, specific durometer (hardness), and co-extrusions (e.g., with metal grippers) increase complexity and unit cost. Standard profiles are generally more affordable.

- Material & Quality Requirements: If the end-use demands are for flame retardant, UV-resistant, or food-grade rubber, special compounds raise costs. Buyers in the Middle East and Africa should carefully specify required standards to avoid overpaying for unnecessary features.

- Certifications: European buyers (e.g., Germany) often require CE, REACH, or RoHS certifications—adding compliance costs that will impact final pricing.

- Supplier Location and Capacity: Proximity to port facilities, export experience, and ability to deliver consistent volumes all affect supplier pricing structures. Many price quotes may be offered “ex-works” (EXW) or “free on board” (FOB); analyze Incoterm differences carefully.

- Incoterms & Payment Terms: Logistics responsibilities (CIF, DDP vs. FOB, EXW) and payment arrangements (LC, TT, OA) can drive up or reduce overall landed costs.

Actionable Tips for International B2B Buyers

To maximize value and avoid hidden costs, consider the following strategies:

- Negotiate for Total Cost of Ownership (TCO): Look beyond unit price. Evaluate product lifespan, installation costs, and the supplier’s ability to handle after-sales support or replacement issues locally.

- Request Detailed Quotations: Insist on transparent, itemized pricing—breaking down raw material, labor, tooling, QC, logistics, and any certification fees. This makes it easier to benchmark offers and negotiate fairly.

- Leverage Volume for Discounts: Consolidate demand across projects or business units to negotiate better prices and share shipping costs, particularly valuable for buyers in Africa and South America seeking to offset higher logistics expenses.

- Assess Logistic Hubs and Regional Distribution: Buyers in the UAE or Europe may benefit from working with suppliers who already have warehousing or partnerships in free zones or major ports, reducing lead times and customs hassles.

- Confirm Supplier Experience with Target Markets: Validate that your supplier understands market-specific regulations, shipping routes, and documentation—minimizing risks of customs delays or non-compliance charges.

- Monitor Currency and Tariff Trends: Fluctuations in exchange rates or the introduction of sectoral tariffs can sharply impact landed costs—especially for buyers in countries with volatile currencies.

Disclaimer: All price considerations are indicative and can vary significantly by supplier, market conditions, and specification changes. Buyers are strongly advised to obtain multiple quotations, factor in local duties/taxes, and review the latest regulatory requirements before finalizing procurement decisions.

By integrating these insights into your sourcing strategy, you can navigate complex pricing landscapes, make well-informed buying decisions, and achieve consistent value and reliability for your rubber protective edging requirements.

Spotlight on Potential rubber protective edging Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘rubber protective edging’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Edge Protection Rubber Profiles (therubbercompany.com)

The Rubber Company stands out as a specialized manufacturer and supplier of rubber protective edging, with an extensive portfolio of edge protection rubber profiles designed for diverse industrial applications. Their range supports a wide variety of sheet, panel, and edge thicknesses, produced from multiple rubber compounds to meet specific environmental and operational requirements. For B2B buyers, especially those operating in demanding sectors across Africa, the Middle East, South America, and Europe, The Rubber Company offers tailored solutions to local standards, ensuring excellent fit and protection for equipment and infrastructure.

Key Strengths

- Custom Engineering: Ability to deliver bespoke profiles adapted to unique application challenges.

- Material Versatility: Profiles manufactured in various rubber compounds for durability and resistance to chemicals, weather, and abrasion.

- Global Reach: Experience serving international industries suggests familiarity with complex export, regulatory, and logistical requirements.

- Broad Application Scope: Suitable for automotive, manufacturing, marine, construction, and transport sectors.

While specific certification details are not published, the company’s focus on high-performance materials and customized solutions positions it as a reliable partner for international procurement projects requiring specialized rubber edging.

Your Ultimate Guide to Sourcing Edge Rubber (www.rubber-tools.com)

Company Overview

Your Ultimate Guide to Sourcing Edge Rubber stands out as a dedicated resource and supplier in the global rubber protective edging market, catering to industries ranging from manufacturing and construction to automotive and infrastructure. The company is recognized for its focus on high-performance edge rubber solutions, supplying products that deliver critical protection, sealing, and insulation in harsh and demanding environments. Their portfolio appears to span a wide array of rubber formulations—including EPDM, silicone, and recycled compounds—enabling tailored solutions for diverse application needs.

Capabilities and Strengths

- Customization & Material Expertise: The manufacturer emphasizes flexibility in offering edge rubber products engineered for specific project demands, including custom shapes and grades for weather resistance, chemical exposure, or dynamic loads.

- Global Market Reach: With a keen understanding of international compliance and the operational challenges unique to regions such as Africa, South America, the Middle East, and Europe, they are well-positioned to support cross-border B2B sourcing and logistics.

- Commitment to Quality: Though specific certifications are not publicly listed, the firm’s alignment with strict durability and regulatory standards suggests manufacturing practices in line with ISO or similar international benchmarks.

- Industry Insight: Their proactive adoption of technological advances in rubber processing and their familiarity with evolving material trends further enhance reliability for buyers seeking both cost-effectiveness and enhanced service life.

Strategic Value for B2B Buyers

International buyers benefit from the company’s ability to guide the sourcing journey, helping navigate the complex landscape of global edge rubber markets. This expertise minimizes procurement risk, shortens lead times, and ensures critical supply chain resilience for both large-scale projects and ongoing operational needs.

Rubber edge protector, Rubber corner protector (www.directindustry.com)

As a prominent presence on the DirectIndustry B2B marketplace, this manufacturer/supplier specializes in a comprehensive range of rubber edge and corner protectors tailored for industrial protective edging. By aggregating offerings from leading brands such as Ganter, RS, and WORLD IMPRESSIONS, they provide access to multiple configurations suitable for equipment, machinery, heavy vehicles, and sensitive installations. Their platform is designed for professional buyers, supporting quick quotation comparisons, multilingual support, and multiple currency options—key for buyers across Europe, Africa, the Middle East, and South America. While detailed manufacturing certifications or proprietary technologies are not publicly disclosed, the emphasis on partnering only with vetted suppliers suggests a commitment to quality. Buyers benefit from a streamlined sourcing process, worldwide reach, and diverse selection—from standard protective edging to customized solutions.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| Edge Protection Rubber Profiles | Versatile, customizable rubber edge protection profiles | therubbercompany.com |

| Your Ultimate Guide to Sourcing Edge Rubber | Global edge rubber, custom solutions, B2B expertise | www.rubber-tools.com |

| Rubber edge protector, Rubber corner protector | Curated, multi-brand industrial rubber edging supplier | www.directindustry.com |

Essential Technical Properties and Trade Terminology for rubber protective edging

Core Technical Properties for Informed Rubber Protective Edging Sourcing

When evaluating rubber protective edging for industrial, commercial, or manufacturing applications, understanding specific technical properties and how they impact performance and compliance is crucial for buyers across Africa, South America, the Middle East, and Europe. Here are the key properties you should prioritize during specification, quotation, and negotiation processes:

1. Material Grade and Type

Rubber protective edging can be manufactured from various elastomers, including EPDM (ethylene propylene diene monomer), NBR (nitrile butadiene rubber), and PVC blends. Each material offers distinct benefits: EPDM provides superior resistance to UV, weather, and temperature extremes—ideal for outdoor or automotive use. NBR excels in oil and chemical resistance, often suited for industrial machinery, while PVC blends enhance flexibility and cost efficiency. Ensuring the correct material grade directly impacts longevity and regulatory compliance in your end market.

2. Shore Hardness

Shore hardness, measured on the Shore A scale for most rubbers, indicates how firm or flexible the edging is. Harder profiles protect against heavy impact but may be less adaptable to complex curves, while softer grades offer better flexibility and compression for irregular surfaces or tight radii applications. Clearly specifying acceptable Shore hardness ensures your edging balances protection with ease of installation.

3. Operating Temperature Range

This metric defines the conditions under which edging retains physical integrity. For example, standard EPDM edging remains stable from -40°C to +120°C, making it suitable for harsh climates, such as in parts of Africa and the Middle East. Buyers should consider the highest and lowest expected working temperatures to prevent material degradation or failure in service.

4. Tolerance and Fit

Tolerance refers to the allowable deviation from specified dimensions (width, thickness, leg length). Tight tolerances are crucial when the edging must slot seamlessly into grooves or around panels, as in automotive and aerospace industries. Discuss required tolerances with suppliers to ensure interchangeability and reduce assembly issues, particularly when ordering for distributed operations or when dealing with multiple production lots.

5. UV and Chemical Resistance

Particularly critical for applications exposed to sun, saline, or industrial chemicals, these properties affect lifespan and performance. Buyers in regions such as the Gulf states or coastal South America must specify UV- and chemical-resistant formulations to avoid premature aging, discolouration, or brittleness.

6. Certification and Compliance

Key standards may include REACH compliance (for the EU), RoHS, or ISO 9001 manufacturing processes. Confirming certifications is vital for market access and to avoid regulatory delays or import issues in Europe, the UAE, and other regulated markets.

Common Industry and Trade Terms in Rubber Edging Procurement

Mastering standard industry terminology ensures smooth communication with manufacturers and distributors worldwide. Below are terms you’ll frequently encounter when sourcing rubber protective edging:

-

OEM (Original Equipment Manufacturer):

A company that produces components—such as rubber edging—which are then branded or assembled by another company. Clarifying whether your supplier is an OEM affects both quality expectations and after-sales support. -

MOQ (Minimum Order Quantity):

The lowest quantity a manufacturer is willing to supply per order. MOQs affect pricing tiers, production scheduling, and logistics. European buyers sourcing for multi-site distribution, or African SMEs with limited storage, should negotiate MOQs that align with both operational needs and cash flow considerations. -

RFQ (Request for Quotation):

A formal invitation for suppliers to submit pricing and lead times based on a buyer’s technical specifications. Submitting a detailed RFQ—including material grades, dimensions, and compliance needs—prevents misunderstandings and accelerates supplier vetting across international markets. -

Incoterms (International Commercial Terms):

Standardized trade terms published by the International Chamber of Commerce, defining responsibilities for shipping, insurance, and tariffs. Selecting appropriate Incoterms (e.g., FOB, CIF, DDP) is vital for cost clarity and risk allocation, especially in cross-continental transactions. -

Lead Time:

The time from order confirmation to delivery. Global lead times vary due to production schedules, customs, and shipping logistics. Accurately establishing lead times is critical for inventory planning, especially for Middle Eastern projects or African manufacturers with longer supply chains. -

Tolerance:

In trade context, refers to allowable measurement variance for product dimensions or weight. Explicitly stating tolerances prevents supply disputes and ensures consistent quality across different production batches or sources.

Understanding these technical properties and mastering trade terminology empowers international buyers to minimize risks, negotiate more effectively, and ensure the right rubber protective edging solutions for diverse projects and regional regulatory environments.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the rubber protective edging Sector

Global Market Landscape and Emerging B2B Sourcing Trends

The rubber protective edging sector is experiencing rapid transformation, driven by diverse global end-use industries such as automotive, construction, manufacturing, and electronics. Growing emphasis on equipment durability, improved safety, and compliance with workplace standards propels the demand for advanced edge protection in both developed and emerging markets. For international B2B buyers—particularly in Africa, South America, the Middle East, and Europe—market access and supplier agility are increasingly vital factors.

Key drivers include:

– Rising industrialization and infrastructure projects in Africa and the Middle East boost the need for robust edge protection, notably for machinery, structural glass, and transport systems.

– Automotive and electronics manufacturing hubs in Germany and Southern Europe amplify demand for precision rubber edging, emphasizing consistency and advanced material properties.

– Export-led manufacturing in South America fuels requirements for cost-effective, customizable, and resilient edging solutions to support competitiveness in overseas markets.

Technological advancements are redefining both products and procurement models. Automated extrusion processes enable manufacturers to offer diverse profiles, colors, and properties tailored to specific regulatory or client needs. Increasing digitalization in procurement—such as the use of online B2B marketplaces, real-time inventory tracking, and advanced analytics—empowers buyers to secure just-in-time delivery and optimize total sourcing costs. Price volatility in raw materials and logistics disruptions underline the importance of multi-source strategies and localized supplier networks.

Emerging trends to monitor:

– Shift toward value-added customization: Clients increasingly demand edging with integrated features such as UV resistance, fire retardancy, or antimicrobial coatings, catering to specialized applications.

– Growth of regional distribution centers: To reduce lead times and ensure supply security, suppliers are establishing logistics bases closer to major demand centers, notably in the UAE, West Africa, and Eastern Europe.

– Collaborative supply chain models: Joint development initiatives between buyers and suppliers are steeply rising, allowing for co-designed solutions and enhanced long-term partnership value.

International B2B buyers should leverage these trends by adopting sourcing strategies that balance cost, reliability, flexibility, and product performance, with a keen eye on evolving regulatory and customer requirements across their regions.

Integrating Sustainability and Ethical Sourcing in B2B Procurement

The rubber protective edging industry faces increasing pressure to minimize environmental impact and demonstrate clear ethical sourcing practices throughout the supply chain. As global markets gravitate toward sustainable development, buyers are prioritizing suppliers who integrate eco-friendly practices, use responsibly sourced materials, and adhere to international labor and environmental standards.

Environmental and ethical considerations include:

– Material selection: Preference is shifting towards natural rubber, recycled rubber, or synthetic polymers derived from renewable feedstocks. This reduces reliance on virgin petroleum-based materials and conserves resources.

– Manufacturing efficiency: Suppliers are investing in energy-efficient processing and waste reduction. Closed-loop recycling within factories and innovative scrap repurposing are becoming differentiators for conscious buyers.

– Certifications and standards: International buyers increasingly require evidence of compliance with standards such as ISO 14001 (environmental management), REACH, RoHS, or third-party certifications like FSC (for natural rubber from certified plantations).

Sustainable procurement is also about traceability and transparency. Buyers from regions with stringent regulations, such as Germany or the EU, must be able to audit suppliers for ethical labor practices and environmental responsibility. African and Middle Eastern buyers are strategically evaluating partners as end-user clients demand greener building and manufacturing solutions. Leading suppliers now provide full documentation on carbon footprint, recycled material content, and post-consumer recyclability.

By embedding sustainability and ethical protocols into their procurement criteria, B2B buyers not only reduce compliance and reputational risks but also align their offerings with global market expectations—opening access to high-value clients and institutional projects with robust sustainability mandates.

Evolution of Rubber Protective Edging: From Utility to Advanced Engineering

Initially, rubber protective edging was a basic industrial accessory, intended primarily to shield sharp or vulnerable surfaces in post-manufacturing assembly. Over the decades, its role has evolved alongside advances in material science and regulatory demands. Early products offered limited weather or chemical resistance and had few options in form or fit.

Today’s rubber edging has become an engineered solution, crucial not only for protection but also for user safety, system durability, and even aesthetics. The shift from single-application to multipurpose edge protection, with properties like thermal insulation and noise dampening, reflects the increasing integration of edge trim into product design and compliance frameworks. This evolution enables B2B buyers worldwide to leverage rubber protective edging for diverse, value-added applications, supporting modern manufacturing and construction requirements.

Related Video: THINK GLOBAL CONFERENCE 2021 – The basics of international trade compliance

Frequently Asked Questions (FAQs) for B2B Buyers of rubber protective edging

-

How should we evaluate and vet international suppliers of rubber protective edging?

Begin by assessing potential suppliers’ business licenses, company registration details, and export history—especially in your destination region. Request references from previous clients and examine independent third-party reviews where possible. Factories should provide audited reports and relevant production certifications. If feasible, arrange a video or in-person audit of production facilities to inspect capabilities and quality control measures. Engaging a third-party inspection agency is recommended, especially for first-time orders. -

Can suppliers provide customized rubber edging according to our specifications and industry standards?

Most manufacturers offer customization options, including specific profiles, durometers (hardness), UV/weather resistance, and color. Submit detailed technical drawings, samples, or CAD files to avoid misinterpretation. Clearly communicate the required regulatory standards (e.g., REACH, RoHS, fire resistance) needed for your market. For ongoing projects, request pre-production samples (PPAP) and confirm that tooling costs, lead times, and minimum order quantities for custom orders are transparently stated before committing. -

What are typical minimum order quantities (MOQ), lead times, and payment terms for international orders?

MOQs for rubber edging can range from 500–5,000 meters, depending on the manufacturer and customization level. Standard lead times are 3–6 weeks for standard products and 6–10 weeks for custom orders, with additional time for initial tooling or sample approval. Payment terms often include a 30% upfront deposit with the balance due against shipping documents (T/T), though L/C is accepted for larger shipments. Always confirm these terms in writing to prevent disputes. -

Which quality assurance processes and certifications should buyers request from suppliers?

Look for suppliers who operate under ISO 9001 quality management systems and can provide certificates of conformity for exported goods. Check if their products adhere to relevant international or local standards—such as REACH or RoHS for the EU, or fire-retardant certifications for construction in the Middle East. Ask about incoming raw material inspection, in-process checks, and final batch testing (e.g., tensile strength, aging), and request test reports with each batch shipped. -

How can we efficiently manage international shipping, customs clearance, and logistics for rubber protective edging?

Clarify logistics arrangements at the quotation stage: decide on Incoterms (FOB, CIF, DDP) and check if the supplier is experienced in handling exports to your country/region. Ensure all shipments are well-packaged and include necessary documentation (commercial invoice, packing list, certificate of origin, and product test certificates). Partner with a reliable freight forwarder or customs broker—especially for countries in Africa or South America, where import procedures can be complex. Insure all shipments to manage risks during transit. -

What are common causes of disputes between buyers and suppliers, and how can these be minimized?

Typical disputes stem from product non-conformance, delays, or inadequate documentation. Specify product requirements, tolerances, and acceptable quality levels in the contract or purchase order. Include clauses regarding penalties for late deliveries or failure to meet specifications. Deploy third-party pre-shipment inspections and require photographic evidence prior to dispatch. Maintain clear, documented communication throughout the buying process and agree on a dispute resolution mechanism—such as arbitration in a neutral jurisdiction—within your contract. -

Are there regional compliance or environmental considerations (such as REACH, RoHS, or others) we need to be aware of?

Yes. The EU market requires strict adherence to REACH and RoHS for chemical composition and safety, while the Middle East may require fire resistance and weatherproof ratings. Africa and South America may have varying requirements, but it’s still advisable to source edging that meets widely recognized international standards for safety and environmental impact. Suppliers should provide compliance documentation, especially for custom or innovative product types. Always verify if your country imposes restrictions on particular rubber additives or components. -

How should we approach long-term supplier relationships and ongoing supply risk management?

Build supplier relationships with regular communication and periodic audits. Negotiate framework agreements, including price adjustment mechanisms and agreed service levels. Diversify sourcing—consider secondary or backup suppliers from different regions to mitigate risk from geopolitical, currency, or logistics disruptions. Consider digital supply management tools for real-time order tracking and performance monitoring. Foster collaboration on product innovation, but maintain detailed records and contracts to secure your company’s interests.

Strategic Sourcing Conclusion and Outlook for rubber protective edging

International B2B buyers face a complex landscape when sourcing rubber protective edging, with operational efficiency, compliance demands, and cost competitiveness at the forefront. Buyers across Africa, South America, the Middle East, and Europe must balance product quality with supply chain resilience—especially given volatile tariffs, regional regulations, and diverse application requirements spanning industries from automotive to construction to energy.

Key takeaways for effective strategic sourcing include:

- Supplier Diversification: Engaging with multiple suppliers reduces dependency risks and enables leverage when negotiating pricing or meeting fluctuating demand.

- Due Diligence: Prioritize partners with robust documentation, proven compliance with international standards, and demonstrated logistical reliability, particularly for cross-border shipments.

- Total Cost of Ownership: Look beyond upfront pricing. Evaluate lifecycle costs, maintenance, durability, and support to maximize value and minimize hidden expenses.

Strategic sourcing of rubber protective edging delivers more than just cost savings—it embeds long-term competitiveness, operational safety, and regulatory adherence into your business. As global supply networks evolve, the most successful procurement teams will be those who embrace digital tools for supplier evaluation, foster transparent partnerships, and remain agile in their response to regulatory and market shifts.

Now is the time for proactive, informed action. Prioritize continuous market research, strengthen supplier collaborations, and build adaptable sourcing strategies to ensure durable, compliant, and cost-effective solutions—positioning your business for sustained growth in a competitive international marketplace.