Introduction: Navigating the Global Market for rubber edge protector

Rubber edge protectors may seem simple, yet they play a pivotal role across global industries—shielding sensitive edges, ensuring worker safety, providing vibration dampening, and extending the lifespan of assets in sectors as diverse as automotive, construction, transportation, manufacturing, and energy. In today’s interconnected supply chain, international B2B buyers—whether in Brazil’s booming automotive sector, South Africa’s mining infrastructure, or Europe’s precision engineering hubs—recognize that choosing the right rubber edge protector is no longer just a technicality. It is a strategic sourcing decision that affects everything from regulatory compliance to operational costs and end-user satisfaction.

Today’s marketplace for rubber edge protectors is both vast and complex. Evolving material technologies, stricter performance standards, and growing emphasis on sustainability have expanded the variety of available products and suppliers worldwide. Understanding distinctions in material composition—such as EPDM, silicone, neoprene, or recycled compounds—the intricacies of extrusion and molding capabilities, and the importance of robust supplier certification is essential for procurement teams operating in competitive and often demanding environments.

This guide is designed as a comprehensive resource to help B2B buyers confidently navigate every phase of the rubber edge protector sourcing process. Inside, you’ll find actionable insights on:

- Types and applications of rubber edge protectors—including standard and custom profiles for diverse needs

- Material selection and performance characteristics, matched to environmental and operational requirements

- Manufacturing and quality control considerations to ensure reliability and compliance

- Supplier qualification and management strategies to mitigate risks and drive value

- Cost drivers and negotiation tactics for better procurement outcomes

- Regional market trends—covering the unique demands and best practices in Africa, South America, the Middle East, and Europe

- Practical answers to common sourcing questions faced by global buyers

By leveraging global expertise and rigorously distilled best practices, this guide empowers international procurement professionals to make well-informed, cost-effective, and future-ready decisions—ensuring your operations are protected, compliant, and positioned for long-term success.

Understanding rubber edge protector Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Solid Rubber Edge Protector | Dense rubber, no internal reinforcement | Machinery, automotive panels, furniture | Cost-effective and flexible, but less durable in high-impact or extreme temperature scenarios |

| Rubber Edge Protector with Metal Core | Embedded steel or aluminum core for stronger grip | Heavy vehicles, marine, enclosures, transport equipment | Superior retention and rigidity, but heavier and higher cost; material and substrate compatibility |

| Sponge/Foam Rubber Edge Protector | Compressible, made from closed- or open-cell rubber | HVAC, electronics, door seals | Excellent sealing/compression for irregular edges; less suited for abrasive or chemical exposure |

| Custom Profile Rubber Protector | Tailored cross-sections, colors, compounds | OEM equipment, custom devices, branded products | Precise fit and branding, but requires longer lead times and higher MOQs |

| Recycled Material Edge Protector | Produced from reclaimed or engineered rubber material | Sustainable packaging, cost-sensitive projects | Environmentally friendly and lower cost, but quality and strength may be variable |

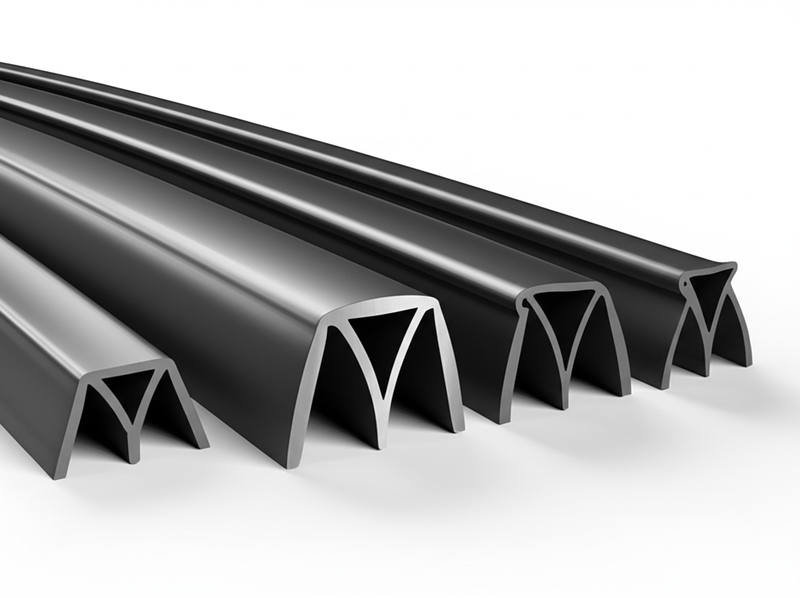

Solid Rubber Edge Protector

Solid rubber edge protectors are fabricated from materials such as EPDM, neoprene, or natural rubber, forming a uniform, dense section. Their simplicity and moderate resistance to weather and chemicals make them highly suitable for general-purpose safeguarding of machinery, automotive panels, glass edges, and furniture. For B2B buyers, the primary advantages include low upfront cost, widespread availability, and ease of installation even in large-scale projects. However, their use should be evaluated carefully in applications exposed to continuous impact, abrasion, or wide temperature fluctuations, as their lifespan and integrity may be compromised under such conditions.

Rubber Edge Protector with Metal Core

This variation incorporates a sturdy metal insert—usually galvanized steel or aluminum—within the rubber profile, delivering superior clamping force and retention. They are well-suited for demanding sectors like heavy transport, marine, and industrial enclosures, where vibration or repeated movement is common. B2B purchasers benefit from a reliable, long-lasting edge protection solution; however, these protectors come at a higher price point and shipping weight, and it’s essential to confirm compatibility with the intended substrate (e.g., non-corrosive cores for marine/saltwater use). Partnering with suppliers experienced in meeting international quality standards is advised for such mission-critical applications.

Sponge/Foam Rubber Edge Protector

Sponge and foam rubber edge protectors are manufactured from closed-cell or open-cell rubbers, providing compressibility and enhanced sealing properties. These are ideal for doors, HVAC units, electronics enclosures, and any application requiring air, water, or dust tightness along irregular or uneven surfaces. Their installation is straightforward, thanks to the flexible fit, and they contribute excellent insulating qualities. When specifying these products, buyers must carefully assess resistance to chemicals, UV exposure, and abrasion, as softer compounds can degrade faster in harsh environments.

Custom Profile Rubber Protector

Custom-profiled edge protectors are engineered to meet unique dimensional, color, or material requirements. They can incorporate branding elements or serve specialized functions for OEMs and infrastructure providers. While the initial engineering and setup costs are higher—and often accompanied by substantial minimum order quantities and longer lead times—these protectors allow B2B buyers to achieve optimal, application-specific performance and brand differentiation. Early collaboration with a manufacturer experienced in both extrusion and compound formulation is crucial to ensure quality, consistency, and fit-for-purpose solutions.

Recycled Material Edge Protector

Edge protectors made from recycled or engineered rubber compounds are gaining traction, particularly among buyers prioritizing sustainability and cost efficiency. They offer a practical solution for packaging, logistics, and other sectors with green procurement policies or budget constraints. Environmental certifications and the ability to pass compliance audits are additional benefits. Nevertheless, buyers should exercise due diligence regarding quality assurance, as recycled blends may exhibit a broader range of mechanical performance compared to virgin materials. Close liaising with suppliers on technical specifications and quality controls is recommended.

Related Video: Lecture 1 Two compartment models

Key Industrial Applications of rubber edge protector

| Industry/Sector | Specific Application of rubber edge protector | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive & Transportation | Door trims, panel edge protection, cargo hold seals | Improves passenger safety, aesthetic finish, reduces wear | UV/weather resistance, color/finish matching, OEM compliance |

| Industrial Equipment | Machinery guard edge protection, enclosure sealing | Prevents injuries, reduces machine downtime, prolongs equipment life | Chemical/oil resistance, durability, custom fit |

| Construction & Infrastructure | Window/door frame edge sealing, glass protection | Enhances weather sealing, protects against chipping, easy installation | Fire/weather rating, installation method, size adaptability |

| Marine & Rail | Hatch, compartment, and hull edge guards | Corrosion resistance, protects high-traffic edges | Saltwater/ozone resistance, embedded metal core, vibration tolerance |

| Electrical & HVAC | Cabinet/enclosure edge sealing, duct protection | Ensures environmental sealing, prevents wire abrasion | Flame-retardance, flexibility, compliance with regional standards |

Automotive & Transportation

Rubber edge protectors are extensively used along vehicle doors, trunk lids, and exposed metal panels to enhance passenger safety by covering sharp edges and mitigating potential injury. Beyond safety, these protectors offer aesthetic benefits and help reduce the risk of corrosion and paint chipping over time. For B2B buyers in regions like Brazil or South Africa, factors such as UV resistance and the ability to withstand varying climates are critical. Ensuring compatibility with OEM standards, as well as matching colors and finishes for vehicle interiors, is vital for automotive applications.

Industrial Equipment

Machinery in sectors such as manufacturing, mining, and agriculture often features exposed metal panels and guards that can injure workers or sustain wear. Rubber edge protectors act as a safety buffer, reducing workplace accidents and protecting the machinery itself from damage. Buyers should specify materials with robust resistance to oils, chemicals, and physical abrasion, which is especially important for industrial environments across the Middle East and Africa where extreme temperatures may be common. Custom profiles may be necessary to accommodate unique equipment geometries.

Construction & Infrastructure

In building projects, rubber edge protectors serve as sealing elements for doors and windows, as well as protection for glass panels and architectural metalwork during transportation and installation. These protectors enhance building envelope performance by ensuring weather and dust resistance, while minimizing damage to finished surfaces. For buyers in Europe or fast-growing urban areas in South America, certifications for fire resistance and adaptability to varying installation methods can be decisive procurement factors. Custom sizing options support diverse regional building codes and project requirements.

Marine & Rail

Harsh marine environments and the demands of rail transportation require edge protectors that can withstand constant vibration, saltwater, and mechanical impact. Used on hatches, compartment edges, and hull accesses, rubber edge protectors with embedded metal cores are preferred for their excellent grip and long-term performance. Sourcing considerations include selecting materials with proven ozone and saltwater resistance, and ensuring profiles fit high-usage zones prone to impact. For buyers in Africa and coastal regions, supplier experience with global marine standards is key.

Electrical & HVAC

In electrical cabinets, switchgear enclosures, and HVAC ductwork, rubber edge protectors provide both insulation and physical protection for sensitive wiring and components. They are critical for maintaining safe electrical environments and preventing damage to cables during installation and maintenance. Flame-retardant materials and compliance with local standards (such as those in Europe or the Middle East) are important requirements. Flexibility for tight bends and ease of installation further streamline project timelines for B2B buyers managing large-scale infrastructure or building projects.

Related Video: Uses Of Polymers | Organic Chemistry | Chemistry | FuseSchool

Strategic Material Selection Guide for rubber edge protector

Common Material Options for Rubber Edge Protectors: B2B Insights

Selecting the optimal material for rubber edge protectors is a pivotal sourcing decision that impacts longevity, operational reliability, and cost-effectiveness. For international buyers, particularly in Africa, South America, the Middle East, and Europe, understanding specific material properties, standards compliance, and real-world application suitability is essential in meeting end-user expectations while minimizing total ownership cost.

EPDM Rubber

Key Properties:

EPDM (Ethylene Propylene Diene Monomer) rubber is highly regarded for its outstanding weather, ozone, and UV resistance. It exhibits a wide working temperature range (typically -40°C to +120°C, sometimes higher for specialized grades) and excellent flexibility. EPDM demonstrates good resistance to water, dilute acids, and many chemicals, but is not suitable for contact with oils or hydrocarbons.

Pros & Cons:

Pros include long-term outdoor durability, reliable performance in harsh sunlight or rain, and a competitive cost profile. EPDM is easy to extrude into complex profiles, supporting design flexibility. However, it does not fare well in applications exposed to oils, fuels, or some industrial solvents, which must be considered in certain manufacturing or automotive contexts.

Impact on Application:

Ideal for exterior trims, marine edge protection, and HVAC equipment. Widely specified for edge protectors in infrastructure projects where weather resistance is critical.

International B2B Considerations:

EPDM grades commonly align with ASTM D2000 and DIN 7863 standards. European buyers often specify UV-resistance due to stringent regulatory expectations, while buyers in regions with high sunlight or rainfall (e.g., Middle East, Brazil) benefit from its proven performance. Check for supplier certifications and proof of compliance with required local and international standards.

Neoprene Rubber

Key Properties:

Neoprene (Polychloroprene) offers a balanced combination of weather resistance, moderate oil and chemical resistance, and a typical working temperature of -30°C to +100°C. It displays good abrasion and flame resistance, supporting diverse industrial applications.

Pros & Cons:

Neoprene excels in providing some oil resistance lacking in EPDM, suitable for light contact with greases and mild industrial solvents. Its abrasion and flame resistance further diversify its application set. On the downside, it tends to be more expensive than EPDM and its weathering resistance, while good, is not quite at EPDM’s level.

Impact on Application:

Well-suited for automotive, machinery, and electrical enclosures, particularly where moderate oil, grease, or chemical exposure occurs.

International B2B Considerations:

Neoprene compounds often comply with ASTM D2000, and in Europe, EN ISO standards may apply. For Africa and South America, neoprene is valued in transportation sectors where combined weather and moderate oil resistance is needed. Be conscious of differing local regulations regarding flame retardancy and performance.

Nitrile Rubber (NBR)

Key Properties:

NBR (Nitrile Butadiene Rubber) is specialized for environments with high exposure to oils, fuels, and hydrocarbons. It supports a moderate operating range, usually -25°C to +100°C, and features impressive tensile strength and abrasion resistance.

Pros & Cons:

The greatest advantage is superb oil and solvent resistance, making it the first choice for automotive, petrochemical, and certain machinery environments. However, NBR has limited protection against ozone, sunlight, and weathering, so it is generally not specified for outdoor edge protection unless compounded with additives. It is typically more expensive than EPDM.

Impact on Application:

Ideal for edge protectors in fuel handling equipment, automotive engine compartments, or oil-soaked factory floors.

International B2B Considerations:

NBR grades adhere to ASTM D2000 and often to ISO 48 standards. Buyers in oil-rich regions (Middle East, parts of Africa) or industrial markets in South America will benefit from its specialty resistance, but should request information on weather-resistant modifications if products will be exposed outdoors.

Silicone Rubber

Key Properties:

Silicone rubber stands out for thermal stability, maintaining flexibility across -60°C to +200°C (special grades may exceed this). It is naturally inert, resisting ozone, UV, and many chemicals, but tends to be softer than other rubbers.

Pros & Cons:

Silicone’s primary strengths are its thermal operating window and long-term material stability; it does not degrade or crack in sunlight or high heat. These qualities drive a high cost versus EPDM or NBR, and physical toughness is typically lower—making it vulnerable to tearing under mechanical abuse.

Impact on Application:

Best for edge protectors in food processing, medical equipment, or environments with sustained high temperatures or regulatory cleanliness requirements.

International B2B Considerations:

Silicones are frequently specified to meet FDA, EC 1935/2004, or similar food-contact standards. In Europe and developed GCC nations, the demand for superior thermal resistance or food safety often justifies the cost premium.

Material Selection Summary Table

| Material | Typical Use Case for rubber edge protector | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| EPDM Rubber | Outdoor/UV-exposed trims, infrastructure, HVAC | Superior weathering & UV resistance | Not oil/fuel resistant | Low |

| Neoprene Rubber | Machinery, automotive, light chemical exposure | Good oil/flame/abrasion resistance | Higher cost than EPDM, moderate weather resistance | Medium |

| Nitrile Rubber (NBR) | Oil-exposed environments, automotive, industrial | Excellent oil/fuel resistance | Poor ozone/weather resistance | Medium to High |

| Silicone Rubber | Food/medical equipment, high-temp or clean areas | Wide temp range, inert & stable | Expensive, mechanically less robust | High |

In-depth Look: Manufacturing Processes and Quality Assurance for rubber edge protector

Rubber edge protectors are vital components across industries, offering safety, durability, and functional finishing. To ensure consistent quality and performance, their production follows a stringent, multi-stage process, backed by robust quality assurance systems. Understanding both the principal manufacturing methods and the critical quality control (QC) measures is fundamental for international B2B buyers, especially in regions like Africa, South America, the Middle East, and Europe where applications and compliance requirements vary widely.

Overview of the Manufacturing Process

1. Material Selection and Preparation

The journey begins with careful material selection, based on buyers’ specifications such as chemical resistance, UV stability, and flexibility. Common rubber types include EPDM (for weather resistance), neoprene (for oil/chemical exposure), and thermoplastics like TPE, among others. Suppliers typically blend raw polymers with fillers, curing agents, and additives to achieve the desired physical properties.

-

Key actions for buyers: Clearly communicate operational environments and regulatory needs to ensure the compound’s formulation aligns with the application.

-

Steps in preparation include:*

-

Raw material inspection: Verifying batch-to-batch consistency (color, viscosity, density).

- Weighing and mixing: Blending the rubber compound with additives using precision mixers.

- Pre-forming: Pre-heating or rolling the mixture into sheets or pellets for feeding into main forming machines.

2. Forming: Extrusion and Molding

The heart of the process involves shaping the rubber into precise edge profiles. The choice between extrusion and molding is dictated by profile complexity and order volume.

-

Extrusion: Most rubber edge protectors are created using this method. The prepared rubber is forced through a die that forms the profile’s cross-section. Advanced machinery allows for tight tolerances and repeatability, which is crucial for large orders and OEM work.

-

Molding: Used mainly for custom shapes or small batch runs. Compression, transfer, or injection molding techniques may be applied, each suitable for different performance demands.

-

Buyers from emerging markets should assess:*

- If the supplier’s equipment supports specific geometries, multi-material co-extrusion (e.g., rubber with metal core), and consistent output for your project scale.

3. Assembly and Insertion of Reinforcement

Complex or heavy-duty edge protectors may require internal reinforcements (e.g., metal cores for added grip/strength). This step often occurs inline during extrusion, where metals are inserted into the rubber profile as it forms.

- Assembly checks: Ensuring alignment, secure bonding, and absence of gaps between rubber and reinforcement.

4. Curing (Vulcanization)

After forming, most rubbers require vulcanization—exposure to heat, sometimes under pressure or with chemical agents. This cross-links the rubber molecules, giving the final product its elasticity, strength, and environmental resistance.

- Process variants: Continuous vulcanization for extruded profiles; batch curing for molded items.

5. Cutting, Finishing, and Packaging

Once cured, rubber profiles are cut to length, and finishing operations such as trimming, surface texturing, or application of adhesives (for peel-and-stick types) are performed. Automated or manual inspection spots visible flaws, then the product is cleaned, labeled, and packed per buyer requirements.

Quality Control: Best Practices and Global Standards

Essential Standards and Certifications

Buyers should insist that suppliers adhere to recognized management and product quality benchmarks. These standards not only assure consistent production but also streamline cross-border trade.

- ISO 9001: Core quality management system standard for manufacturing; ensures traceability, corrective action systems, and continual process improvement.

- REACH/ROHS (Europe): Controls on hazardous substances—especially critical for EU buyers.

- CE Marking: Mandatory for many products and applications in the EEA; requires proof of conformity with health, safety, and environmental protection standards.

- ASTM/EN/BS Standards: Technical specifications for material and mechanical properties.

- Local compliance: (e.g., SABS for South Africa, INMETRO for Brazil) may be required—clarify requirements during quotation.

QC Checkpoints Through Production

A robust QC regime includes systematic checks at several points along the manufacturing chain:

| QC Checkpoint | Focus Area | Typical Actions |

|---|---|---|

| IQC | Incoming materials | Raw material certification, physical testing |

| IPQC | In-process (during manufacturing) | Line inspection, dimensional checks |

| FQC | Final product | Appearance, functionality, sample testing |

| OQC | Outgoing, prior to shipment | Packaging, labeling, document verification |

- Incoming Quality Control (IQC): Before manufacturing, raw materials are checked for conformity (e.g., tensile strength, hardness, contamination).

- In-Process Quality Control (IPQC): During production, operators and QC staff monitor dimensions, rubber adhesion to metal inserts, profile uniformity, and absence of surface defects.

- Final Quality Control (FQC): Post-production, products undergo checks for visual defects, length consistency, and mechanical property testing (compression set, tear resistance, etc.)

- Outgoing Quality Control (OQC): Packaging and documentation are double-checked to ensure shipments match buyer specifications; random sampling for additional peace of mind.

Common Testing Methods

To verify functional performance, manufacturers typically employ:

- Hardness (Shore A/D) testing: Confirms material flexibility and resistance.

- Tensile and elongation tests: Evaluate how much stretching the edge protector can withstand.

- Compression set: Checks how well it recovers after deformation—especially important for sealing applications.

- Aging/weathering tests: Expose samples to UV, ozone, temperature cycling.

- Adhesion/bond tests: For rubber profiles with reinforcing cores or applied adhesives.

-

Dimensional and visual inspection: Using calipers, gauges, and magnifiers.

-

For buyers using edge protectors in critical applications (transportation, food, or medical equipment), additional chemical and flame-resistance tests may be indicated.*

Ensuring Supplier Quality as a B2B Buyer

Verification Strategies

Savvy buyers go beyond accepting certificates at face value by:

-

Requesting comprehensive QC reports

Ask for batch-wise test reports, traceability documentation, and records of all critical tests. Reports should reference both in-house and third-party test results. -

Arranging pre-shipment inspections

Utilize third-party inspection agencies to conduct onsite or remote audits before payment/shipment. Key focus areas include process hygiene, product identification, and compliance labels. -

Reviewing supplier audit documentation

Audit reports (internal/external) confirm that the supplier’s quality systems are active and regularly reviewed—request access and discuss any findings. -

Conducting regular quality reviews

For ongoing supply, initiate scheduled quality reviews—either through digital meetings or physical audits—addressing non-conformances, corrective actions, and improvements.

Regional and International Buyer Considerations

-

Africa & South America (e.g., South Africa, Brazil):

Local regulatory bodies may require conformity marks or additional environmental documentation. Currency volatility and logistics add further incentive to avoid quality-related returns—insist on documented, proven quality history and consider warehousing options or third-party testing upon arrival. -

Middle East:

Projects in infrastructure and oil/gas often mandate traceable certificates (API, ISO); ensure suppliers can export compliant goods and provide clear origin and batch documents. -

Europe:

Strict REACH, ROHS, and CE requirements mean buyers should verify chemical contents and traceability down the supply chain. Language of compliance documentation may also be relevant.

Actionable Tips for B2B Buyers

- Detail application-specific requirements upfront (e.g., resistance to salt spray for marine use, compliance with local standards).

- Vet shortlists for certified, regularly-audited manufacturers.

- Implement a dual-verification process: request both in-house and independent test results.

- Plan for potential repeat or custom orders by confirming supplier consistency over time.

- Document and communicate feedback on delivered batches to foster quality improvements.

By developing a robust understanding of the manufacturing and QC landscape, international buyers can minimize risk, reduce costs, and ensure reliable performance for every rubber edge protector—regardless of geography or application.

Related Video: China’s Top 5 Manufacturing and Mass Production Videos | by @miracleprocess

Comprehensive Cost and Pricing Analysis for rubber edge protector Sourcing

Breaking Down the Cost Structure

Sourcing rubber edge protectors internationally involves several interrelated cost components that must be understood to achieve the best value:

- Raw Materials: The primary cost driver is the rubber compound itself—most commonly EPDM, silicone, neoprene, or a blend. Specialty formulations (e.g., UV-, oil-, or flame-resistant) command a premium.

- Labor: Labor input fluctuates based on supplier location, process automation, and required finishing (cutting, notching, packing). Countries with lower labor costs may offer initial savings, but these can be offset by longer lead times or quality considerations.

- Manufacturing Overhead: This includes facility maintenance, machine amortization, utilities, and waste management. Highly automated plants typically spread overhead efficiently, lowering per-unit costs for larger orders.

- Tooling and Die Costs: For custom profiles or unique cross-sections, one-time tooling expenses can be substantial. Tool amortization becomes cost-effective at higher volumes.

- Quality Control (QC) and Testing: Costs rise with stringent QC protocols or demands for certifications (ISO, REACH, fire/dust/oil compliance). Buyers in regulated industries or markets should account for these when budgeting.

- Logistics and Packaging: International buyers need to factor in shipping (air, sea, or land), customs clearance, duties, and specialized packaging, especially for bulky or sensitive profiles.

- Supplier Margin: Each supplier builds in a profit margin, affected by their business model, scale, and competitive position in the local or international marketplace.

Key Pricing Influencers

Several factors can shift quotations, often significantly:

- Order Volume and Minimum Order Quantities (MOQs): Higher order volumes reduce per-unit costs, especially once tooling and setup costs are amortized. Suppliers often set MOQs to justify production changeovers—buyers can sometimes negotiate these, especially during off-peak cycles.

- Product Specifications and Customization: Complex cross-sections, tight tolerances, special colors, or co-extruded materials increase both direct processing cost and reject rates, resulting in higher pricing.

- Material Grade and Sourcing: Premium or certified-compound rubbers command higher base prices. Sustainability credentials (e.g., recycled rubber) may impact both cost and supplier selection.

- Quality and Certifications: Demands for compliance with specific market standards (e.g., EN45545 for rail in Europe) affect both raw material sourcing and process controls—translating into higher prices but lower risk for mission-critical applications.

- Supplier’s Capacity and Geographic Location: Proximity to raw materials, specialization, and export experience all impact pricing. For instance, Southeast Asian or North African suppliers may offer cost benefits for bulk, commodity-grade protectors, while EU suppliers can expedite delivery for smaller, certification-heavy orders.

- Incoterms (Shipping Terms): Whether pricing is quoted as EXW, FOB, CIF, or DDP greatly influences your landed cost; each term shifts responsibility for shipping, insurance, and customs fees between supplier and buyer.

Cost Management Strategies for International B2B Buyers

- Negotiate Based on Total Cost of Ownership (TCO): Avoid focusing solely on unit price. Factor in transportation, tariffs, QC rework, storage, and lifecycle durability. A higher upfront cost may be offset by savings in replacement, downtime, or scrap.

- Leverage Volume and Long-Term Agreements: Request stepped pricing for higher volumes or multiyear contracts. Many suppliers will offer price reductions in exchange for assured pipeline orders.

- Assess Customization ROI: For non-standard profiles, weigh the business value of customization against upfront tooling and increased minimum orders. Collaborate closely with engineering to avoid unnecessary complexity that drives up costs.

- Scrutinize Material Specifications: Consider if a more readily available or recycled material can meet your performance requirements at a lower cost, especially if local regulations allow flexibility.

- Optimize Shipping and Consolidation: In markets like Africa or South America, shipping costs can eclipse product value. Explore bulk shipments, local warehousing, or consolidated container loads to minimize freight spend.

- Supplier Audits and Prequalification: Vet suppliers’ QC credentials and export experience to avoid costly delays or compliance failures. In regions with variable enforcement (certain Middle Eastern or African markets), direct verification prevents after-sale issues.

- Monitor Currency Fluctuations: For buyers handling cross-border payments (especially in volatile currency environments), negotiate fixed price windows or hedge against swings in USD, EUR, or local currencies.

Regional Nuances and Best Practices

- Africa: Port infrastructure and inland logistics can add weeks to delivery. Engage in DDP (Delivered Duty Paid) terms where possible to minimize surprise landed costs, or work with agents familiar with local customs regimes.

- South America: Import duties and taxes in Brazil, Argentina, and others are substantial. Seek suppliers experienced with Mercosur or bilateral trade agreements to offset tariffs.

- Middle East: Project-based bulk orders are common in construction and energy. Early engagement in specification reviews saves cost overruns later, as revisions are expensive after order commitment.

- Europe: Stringent REACH and CE standards make certified suppliers essential. Buyers gain leverage with local manufacturers for smaller, precision-heavy projects despite higher labor costs.

Disclaimer: All price-related guidance is indicative and may fluctuate based on raw material indexes, global supply chain volatility, and changing market conditions. Always

Spotlight on Potential rubber edge protector Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘rubber edge protector’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Rubber edge protector, Rubber corner protector (www.directindustry.com)

Rubber edge protector, Rubber corner protector—featured on DirectIndustry—serves as a reputable aggregator and supplier source for professional-grade rubber edge and corner protection products, collaborating with globally recognized manufacturers such as Ganter and RS. Their platform offers a diverse portfolio including angled, rounded, and flat designs suitable for a wide range of industrial sectors—from machinery and transportation to energy and infrastructure. This breadth allows B2B buyers to efficiently compare products and obtain competitive quotations across multiple suppliers, streamlining the procurement process for varied project demands.

While specific proprietary manufacturing processes or certifications such as ISO standards are not highlighted, their selection policy prioritizes established quality brands and proven suppliers, signaling a reliable baseline for performance and compliance. International buyers from Africa, South America, the Middle East, and Europe benefit from DirectIndustry’s multilingual platform, global logistics support, and transparent supplier vetting—key advantages for navigating cross-border transactions and ensuring fit-for-purpose edge protection solutions. Publicly detailed information remains limited, but their standing as a B2B marketplace leader underscores a strong track record in industrial rubber protection applications.

Edge Protection Rubber Profiles (therubbercompany.com)

Based in the United Kingdom, Edge Protection Rubber Profiles (part of The Rubber Company) supplies a comprehensive range of rubber edge protectors designed for industrial, automotive, and construction applications. Their offerings include standard and custom-extruded profiles, suitable for safeguarding panels, machinery, and equipment edges against impact, wear, and environmental exposure. The company is known for its technical expertise in material formulation—particularly EPDM, neoprene, and PVC—allowing them to tailor solutions for high UV, chemical, and temperature resistance. Their manufacturing capabilities encompass both small-batch and large-scale production, supporting international projects with varied volume requirements. With a strong export track record and responsive customer support, they are a trusted partner for B2B buyers across Europe, Africa, the Middle East, and South America seeking reliable, compliant edge protection solutions.

Rubber Edge Protectors (www.industrystock.com)

With over 30 years of industry expertise, Rubber Edge Protectors (Industrieservice Speyer GmbH) is a recognized specialist in rubber edge protection and profile solutions, serving industrial buyers across Europe and beyond. The company demonstrates strong capabilities in developing tailored edge protection products, including seals, molded parts, and custom profiles, often collaborating directly with clients to address demanding industrial requirements. Their commitment to quality is underpinned by DIN EN ISO 9001 certification, ensuring consistent product reliability and robust quality management processes. Rubber Edge Protectors is distinguished by its rapid response times, customer-focused service, and attractive price-performance ratio, making them a valuable partner for international procurement teams—especially those seeking both off-the-shelf and custom-engineered solutions. Sustainability and readiness to deliver are central to their philosophy, contributing to strong appeal in global B2B supply chains.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| Rubber edge protector, Rubber corner protector | Diverse, vetted edge/corner rubber protection suppliers | www.directindustry.com |

| Edge Protection Rubber Profiles | UK-based, custom and standard edge protectors | therubbercompany.com |

| Rubber Edge Protectors | Quality-certified, custom industrial rubber edge solutions | www.industrystock.com |

Essential Technical Properties and Trade Terminology for rubber edge protector

Critical Technical Properties for B2B Buyers

Selecting a rubber edge protector requires careful evaluation of several key technical properties. Understanding these specifications empowers procurement teams to ensure performance, quality, and value throughout the product’s lifecycle.

-

Material Grade and Compound

The type and quality of rubber—such as EPDM, Neoprene, Nitrile, or Silicone—directly affect resistance to weathering, temperature, chemicals, and mechanical stress. For example, EPDM is prized for outdoor durability and UV resistance, while Nitrile provides superior oil resistance for industrial applications. The compound’s formulation determines not only longevity but also its suitability for local environmental and regulatory conditions across Africa, South America, the Middle East, and Europe. -

Hardness (Shore A/D)

Hardness is measured using Shore durometer scales, typically Shore A for soft rubbers. Hardness values (e.g., 60±5 Shore A) indicate flexibility and compressibility—a softer profile offers better sealing, while a harder one ensures greater impact protection. Clarifying the hardness requirement is essential for balancing ease of installation with in-service durability. -

Tolerance and Dimensional Consistency

Tolerance refers to the acceptable variation in cross-section, length, or other dimensions due to manufacturing. Tight tolerances (e.g., ±0.5mm) are critical for applications requiring precision fits, such as automotive or equipment assembly. For large or less demanding installs, broader tolerances may reduce costs. Confirming these with suppliers minimizes rework and ensures compatibility with your application. -

UV and Weather Resistance

This property is crucial for edge protectors used outdoors or in harsh environments. UV resistance prevents cracking and degradation under sunlight, while weather resistance protects against rain, humidity, and temperature extremes. Buyers in equatorial, Mediterranean, or desert climates should verify these ratings to avoid premature product failure. -

Flame Retardancy and Compliance

Certain industries—like transportation or public infrastructure—demand rubber edge protectors meeting flame-retardant standards (such as UL94 or FMVSS 302). Buyers should always request verifiable compliance certificates to satisfy local safety or export regulations. -

Grip Strength and Core Type

For edge protectors with embedded metal wires or cores (e.g., steel or aluminum), grip strength ensures stable, long-term fastening onto the substrate. This is vital in high-vibration or heavy-duty applications. Details like the type of metal, coating for corrosion resistance, and insertion method impact both lifespan and application suitability.

Fundamental Industry and Trade Terms Explained

Navigating the international sourcing process requires familiarity with key trade jargon. Here are essential terms every B2B buyer should know when procuring rubber edge protectors:

-

OEM (Original Equipment Manufacturer)

Refers to a manufacturer that produces parts designed for client integration into final products. Specifying “OEM requirements” ensures edge protectors will fit and function according to your equipment or application’s design. -

MOQ (Minimum Order Quantity)

The smallest order a supplier will accept. Understanding MOQ is crucial for budget planning—smaller orders may incur higher per-unit pricing, whereas larger orders benefit from economies of scale. -

RFQ (Request for Quotation)

A document or process initiated by buyers to solicit detailed price, lead time, and specification offers from potential suppliers. An accurate RFQ—including drawings, material specs, and standards—yields faster and more precise quotations, streamlining sourcing. -

Incoterms (International Commercial Terms)

Standardized international trade terms (e.g., FOB, CIF, DDP) that define responsibilities for shipping, insurance, customs, and risk transfer between buyer and seller. Choosing the right Incoterm directly influences landed cost and logistical risk—especially vital for distant or cross-continental trade. -

Lead Time

The period from order confirmation to receipt of goods. It incorporates production, packaging, shipping, and customs clearance. B2B buyers should always confirm lead times up front, particularly in unpredictable supply chain environments. -

Certification and Compliance Documentation

Third-party certificates (e.g., ISO 9001 for quality systems, RoHS for environmental compliance, or UL for safety) validate product claims and regulatory adherence. Always request and review certificates to minimize legal or operational risk during customs clearance or product deployment.

By prioritizing these technical properties and mastering relevant trade terminology, global B2B buyers can confidently assess supplier proposals, ensure regulatory and operational fit, and safeguard total project value in any market.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the rubber edge protector Sector

Global Market Landscape and Sourcing Trends

The rubber edge protector market has matured into a truly globalized sector, driven by its indispensable role in industries ranging from automotive to construction, electronics, marine, and heavy machinery. For international B2B buyers – especially those in rapidly urbanizing regions across Africa, South America, the Middle East, and central/eastern Europe – several trends are shaping both sourcing strategies and competitive dynamics.

Key market drivers include:

– Industrial growth and infrastructure investment: Demand for rubber edge protectors is intrinsically linked to economic expansion, new manufacturing facilities, transport infrastructure upgrades, and the swelling automotive market (notably in Brazil, Turkey, Poland, and South Africa).

– Heightened safety and regulatory standards: Global harmonization of safety codes (e.g., ISO, EU REACH compliance) is raising the bar for product quality, material traceability, and supplier validation.

– Customization and rapid prototyping: The proliferation of niche industrial applications is increasing demand for custom profile trims, small-batch production, and rapid prototyping. Suppliers with advanced extrusion, molding, and digital CAD/CAM capabilities are increasingly preferred.

– Supply chain agility: Recent disruptions have spotlighted the importance of diversified supplier bases and logistics agility. Buyers are rebalancing between traditional Asian sources and emerging players in EMEA or the Americas, aiming to optimize lead times, freight costs, and mitigate risk.

Emerging sourcing trends to watch:

– Digital procurement platforms: More buyers are leveraging B2B portals and digital RFQ systems to access competitive quotes, track certifications, and simplify cross-border transactions.

– Direct-from-manufacturer sourcing: Disintermediation is on the rise as buyers seek technical support, transparency, and better pricing by engaging directly with manufacturers or certified OEM partners.

– Regionalization: There is growing interest in regional supply partners – especially in Europe and the Middle East – to offset longer Asian shipping times and currency volatility.

Actionable tip for buyers: Always verify that prospective suppliers demonstrate robust quality control, can provide international shipping logistics, and offer technical support aligned with your specific operational and regulatory requirements.

Sustainability and Ethical Sourcing Imperatives

Sustainability is rapidly moving from “nice to have” to a critical procurement criterion in the rubber edge protector sector. Major international buyers now expect suppliers to minimize environmental impact across the product lifecycle, influencing material selection, manufacturing, and logistics practices.

Environmental impact considerations:

– Material choices: Forward-thinking suppliers are offering formulations utilizing recycled rubber compounds, fine rubber powders, or thermoplastic elastomers (TPEs) derived from sustainable sources. Sponge/foam trims made with closed-loop materials can further reduce the carbon footprint.

– Production efficiency: Energy-efficient extrusion and waste-minimizing manufacturing processes are valued, especially in markets where environmental regulation is tightening.

– End-of-life solutions: Design for recyclability and product take-back programs are relevant, particularly for large-volume buyers in the EU or eco-conscious segments in the Middle East.

Ethical and traceable supply chains:

Buyers are under increasing organizational and reputational pressure to ensure ethical labor, sourcing transparency, and the absence of restricted substances in their supply chains. Certification to global frameworks – such as ISO 14001 (environmental management), FSC/PEFC (for packaging), or REACH/ROHS compliance – is becoming a baseline requirement.

‘Green’ certifications and documentation:

– Insist on suppliers providing clear documentation of recycled content, renewable materials usage, and third-party certifications.

– For projects with government or multinational stakeholders, prioritize suppliers that can evidence low-VOC emissions, compliance with extended producer responsibility (EPR) schemes, or Life Cycle Assessment (LCA) reports.

Practical advice: Engage with suppliers early to clarify your sustainability criteria, request sample documentation, and conduct periodic audits or third-party verifications, especially when sourcing from new geographies.

Evolution and Historical Perspective

The development of rubber edge protectors mirrors broader trends in industrial safety and advanced manufacturing. Originally introduced as simple solid rubber trims for basic impact protection, their evolution tracks the introduction of sophisticated rubber polymers (such as EPDM and silicone) and the integration of reinforcement cores to meet the needs of demanding sectors like automotive and marine.

Over the past two decades, advances in extrusion technology, CAD-driven custom profiles, and the pressure for lighter, recyclable components have fostered rapid diversification of the product portfolio. Today, rubber edge protectors play a strategic role in not only safeguarding assets and people but also enabling regulatory compliance and supporting the transition to more sustainable supply chains. International buyers benefit from a far wider range of options — but also face the challenge of making informed selections amidst increasing complexity and expectation for transparency.

Related Video: Incoterms® 2020 Explained for Import Export Global Trade

Frequently Asked Questions (FAQs) for B2B Buyers of rubber edge protector

-

How should we evaluate and vet international suppliers of rubber edge protectors?

Begin by reviewing each supplier’s manufacturing capabilities, certifications (such as ISO 9001 or IATF 16949 for automotive applications), and history serving export markets. Request detailed product technical datasheets and references from global clients, ideally from regions with similar regulatory standards to your own. Evaluate their responsiveness, ability to fulfill customized requirements, and willingness to provide samples or prototypes. Verify legal documentation, financial stability, and compliance with your country’s import regulations. Site visits or engaging third-party inspection agents can provide further assurance for long-term partnerships. -

Can rubber edge protectors be customized for specific applications or branding needs?

Yes, most reputable manufacturers offer both geometric and material customization. You can typically specify the cross-sectional profile, durometer (hardness), color, and even integrate metal cores or co-extruded sealing lips. For specialized applications—such as anti-static properties, UV resistance, or certain fire-retardancy levels—request bespoke rubber formulations. Some suppliers also provide custom embossing or logo marking for OEM or branded solutions. Clearly communicate your technical requirements and request drawings or 3D files to ensure precise production. -

What are the typical minimum order quantities (MOQs) and lead times for B2B orders?

MOQs depend on the product’s complexity and the supplier’s manufacturing process. Standard profiles may be available from as low as 500–1,000 meters, while custom extrusions can require higher volumes, sometimes starting at 3,000–5,000 meters per order. Lead times generally range from 2–6 weeks for standard items, with custom or specialty products taking 6–12 weeks, especially when tooling is required. Early engagement and clear forecasting can help optimize lead times, especially if you have ongoing or phased requirements. -

Which international payment terms are commonly accepted, and how can risk be minimized?

Common payment methods for international orders include T/T (bank transfer), L/C (letter of credit), and, occasionally, escrow services or PayPal for smaller trial orders. L/Cs provide the highest level of buyer protection, especially for large, first-time transactions. It is advisable to negotiate staggered payment schedules—such as deposits with final payment upon pre-shipment inspection—whenever possible. Always confirm banking details via secure channels to prevent fraud, and consider credit insurance for high-value contracts. -

How do we ensure consistent product quality and compliance with international standards?

Require suppliers to provide certificates of analysis, test reports, and compliance documentation aligned with relevant standards—such as REACH, RoHS, CE, or EN 681-1 for sealing applications. Institute clear quality acceptance criteria in your purchase contract, such as tolerances, hardness ranges, and visual defect definitions. Where feasible, arrange independent laboratory testing or engage local inspection services before shipment. Ongoing supplier audits and periodic requalification can further safeguard product consistency. -

What logistics considerations are important for importing rubber edge protectors internationally?

Assess the total landed cost, factoring in shipping mode (ocean or air), transit times, freight insurance, and compliance with your market’s import duties or taxes. Clarify Incoterms (e.g., FOB, CIF, DAP)—these dictate responsibility for transport, insurance, and customs clearance. Request robust packaging to prevent deformation or contamination in transit, and verify that all export documentation, such as commercial invoices and packing lists, meets your country’s requirements for seamless customs clearance. -

How are product quality disputes or non-conformities typically handled with overseas suppliers?

Establish clear procedures within your purchase contract, including timeframes for reporting defects, required evidence (photos, inspection reports), and agreed-upon remediation steps—such as replacement shipments or credits. Reputable suppliers will often assign a dedicated account manager or aftersales team to resolve such cases. Opt for suppliers with established policies on product recalls and have access to dispute resolution channels, such as arbitration bodies or international trade associations, if mutual agreement is not reached. -

What steps can be taken to optimize long-term supplier relationships and secure better pricing?

Develop a partnership mindset by sharing forecasts or long-term demand projections with your supplier. Larger, consolidated orders often lead to more competitive pricing, as does committing to annual volume agreements. Request information on volume pricing tiers, payment discounts, or value-added services like inventory holding or local distribution support. Sustained communication on product updates, quality performance, and logistics can foster improvements and ensure stable supply, even during market volatility.

Additional Tips:

– Always compare multiple suppliers and request samples before committing to bulk orders.

– Stay updated on regional regulations or trade agreements that may affect import duties or logistics.

– Partner actively with local agents or consultants if you are new to the specific market or supplier region.

Strategic Sourcing Conclusion and Outlook for rubber edge protector

As global markets continue to evolve, the role of strategic sourcing for rubber edge protectors only grows in importance. International buyers—especially those from Africa, South America, the Middle East, and Europe—must recognize that the right sourcing strategy impacts not only upfront costs, but also long-term operational resilience, compliance, and product reputation. Selecting the optimal rubber edge protector involves balancing technical requirements, material performance, lead times, and supplier reliability, while keeping an eye on shifting regulatory standards and regional market preferences.

Key takeaways for procurement teams include the necessity of clear technical specifications, rigorous supplier vetting, and proactive risk management—inclusive of material availability, minimum order constraints, and logistics planning. Collaborating with suppliers who prioritize quality control, offer flexible manufacturing capabilities, and maintain robust support channels can make the difference between a smooth supply chain and costly project delays.

Looking forward, B2B buyers are encouraged to view rubber edge protector sourcing as a dynamic partnership rather than a transactional process. Continually investing in supplier relationships, staying informed on new material innovations, and aligning your procurement strategy with both local and international trends will help secure both cost advantages and product excellence. Now is the time to reevaluate your sourcing approach—pursue trusted partners, harness new technologies, and ensure your edge protection investments are future-proofed for sustainable business success.