Introduction: Navigating the Global Market for shock absorber rubbers

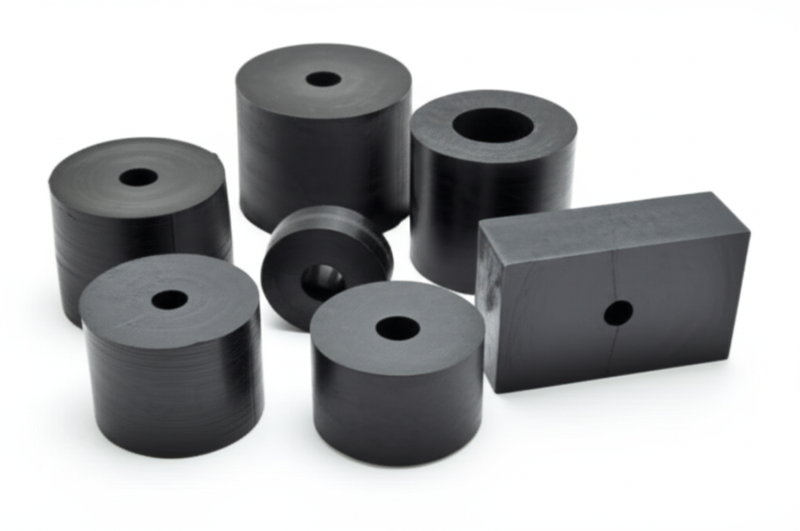

Rubber shock absorber components stand at the heart of high-performing machinery and infrastructure, making them an essential procurement item for sectors ranging from automotive and rail to mining, energy, and large-scale construction. Their primary role—dampening vibration, minimizing noise, and shielding equipment from damaging shocks—directly feeds into the reliability, safety, and cost-effectiveness of your operational assets. For B2B buyers in rapidly advancing regions like Africa, South America, the Middle East, and dynamic European markets, the ability to secure robust, compliant, and competitively priced shock absorber rubbers is no longer a commodity—it’s a powerful lever for market success and differentiation.

Yet, in a global landscape defined by fluctuating raw material costs, evolving production technologies, and a dizzying array of supplier choices, sourcing shock absorber rubbers is increasingly complex. Decisions now extend far beyond initial price points. Today’s buyers must weigh material science—distinguishing between natural, neoprene, EPDM, and silicone formulations—for specific environmental and performance profiles. They must scrutinize manufacturing standards, advanced quality control protocols, and thoroughly vet supplier credibility across diverse geographies. Understanding total cost of ownership, tapping into emerging market trends, and anticipating region-specific logistical hurdles are equally crucial in sidestepping procurement risks and seizing new growth opportunities.

This guide delves deeply into the full spectrum of shock absorber rubbers, offering actionable insights into product types, material advantages, state-of-the-art manufacturing and QC processes, best practices for supplier assessment, cost drivers, and evolving market landscapes. Comprehensive FAQs and procurement checklists are included to help your teams make smart, strategic buying decisions. Whether you’re sourcing for mass transport projects in Turkey, energy infrastructure in Nigeria, or OEM manufacturing in Brazil, these insights are designed to equip your organization with the expertise and confidence needed to optimize sourcing and stay ahead in the global marketplace.

Understanding shock absorber rubbers Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Natural Rubber Mounts | High elasticity, cost-effective | Automotive, rail, light machinery | Affordable, flexible; limited oil/heat resistance |

| Neoprene Rubber Isolators | Oil and chemical resistance, synthetic compound | Industrial engines, HVAC, process lines | Broad compatibility, durable; higher initial cost |

| EPDM Rubber Pads | Weather, ozone, and UV resistance | Construction, outdoor equipment | Outdoor durability; limited petroleum resistance |

| Silicone Rubber Shock Absorbers | Wide operating temperature range, inertness | Medical, food processing, electronics | Compliant, long-lasting; premium-priced |

| Metal Bonded Rubber Bushings | Rubber bonded to metal, enhanced load handling | Heavy equipment, mining, marine | High strength, longevity; complex procurement |

Natural Rubber Mounts

Natural rubber mounts are valued for their significant elasticity and cost advantage, making them a popular choice for automotive, railway, and general equipment sectors, especially in price-sensitive markets like Africa and South America. Their capability to absorb shocks and dampen vibrations helps reduce equipment wear and prolong operational life. However, B2B buyers should account for their relatively short lifespan in environments exposed to oils, solvents, or elevated temperatures. Ensure suppliers provide reliable product quality and adequate documentation of material origin and compliance with sector-specific standards.

Neoprene Rubber Isolators

Neoprene is a synthetic rubber renowned for resilience against oils, greases, and industrial chemicals—attributes particularly important for businesses operating in demanding industrial settings and HVAC systems. While neoprene isolators involve a higher upfront investment, their extended service life and lower maintenance needs can drive substantial total cost of ownership savings. For international buyers, especially from regions like the Middle East or Europe where operational downtime is costly, prioritizing neoprene can minimize risk and improve plant uptime. Always verify manufacturer certifications and test reports to ensure chemical performance matches application requirements.

EPDM Rubber Pads

EPDM (Ethylene Propylene Diene Monomer) rubber pads are distinguished by superior resistance to weathering, ozone, and ultraviolet exposure. These properties make them highly suitable for construction projects, infrastructure, and any applications with significant outdoor installation in Europe or the fluctuating climates of the Middle East. Although their resistance to oils and petroleum-based fluids is moderate, their proven durability under harsh outdoor conditions makes them a strategic fit for B2B buyers focused on minimizing unplanned maintenance. Request clear datasheets on EPDM formulation to guarantee alignment with your specific climate and project needs.

Silicone Rubber Shock Absorbers

Silicone rubber shock absorbers excel in environments requiring exceptional resistance to temperature extremes and absolute material inertness—critical in medical, food processing, and sensitive electronics manufacturing. Their ability to retain physical properties across a broad temperature spectrum (from -60°C to over 200°C) ensures consistent protection of sensitive machinery. Though silicone comes at a premium, for buyers in regulated or high-tech sectors it offers peace of mind regarding compliance and longevity. Confirm that supplied products meet all relevant safety and hygiene certifications, including FDA or EU food-grade approvals where applicable.

Metal Bonded Rubber Bushings

Metal bonded rubber bushings combine the load-bearing capacity of metal with the vibration isolation of rubber, offering unmatched durability for heavy-duty and high-load applications such as mining, marine, and large industrial equipment. Their robust construction is ideal for regions with challenging infrastructure demands, such as parts of Africa or industrial sectors in Turkey and Indonesia. These components require careful specification, as sourcing can be more complex and lead times longer due to custom manufacturing processes. Diligently assess supplier engineering capabilities and quality control practices to safeguard against premature failure in critical installations.

Related Video: Shock Absorber Types in Suspension System | Explain in details (Twin Tube, Mono tube, ASD, PSD, etc)

Key Industrial Applications of shock absorber rubbers

| Industry/Sector | Specific Application of shock absorber rubbers | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive & Transportation | Engine mounts, suspension bushings, cabin vibration isolation | Enhanced ride comfort, equipment longevity, reduced maintenance | Material durability, temperature & oil resistance, OEM certification |

| Construction & Infrastructure | Foundation pads, machinery mounts, bridge expansion joints | Vibration reduction, structural protection, noise control | Weather/ozone resistance, compliance to local standards, custom sizing |

| Energy & Mining | Equipment dampers, pump/motor mounts, pipeline isolation | Minimized operational downtime, improved safety, lowered TCO | Chemical resistance, load ratings, supplier reliability |

| Industrial Machinery | Press beds, conveyor supports, HVAC isolators | Precision operation, worker safety, decreased machine wear | Wide compound selection, consistent quality, fast lead times |

| Rail & Mass Transit | Track pad systems, bogie mounting, passenger car buffers | Reduced track fatigue, passenger comfort, long service life | Fatigue and weather resistance, EN or ISO compliance, lifecycle costs |

Automotive & Transportation

Shock absorber rubbers are foundational components in automotive and transportation systems, functioning in engine mounts, suspension bushings, and cabin vibration isolation. These rubbers limit noise and absorb both road and drivetrain shocks, preserving sensitive assemblies and improving passenger comfort. For buyers in fast-growing markets like Africa, South America, and Eastern Europe, sourcing rubbers with proven durability and multi-environment resistance is essential. Prioritize suppliers who offer compounds tailored for high temperature and oil exposure, and ensure all products meet regional OEM and safety certifications to secure long-term operational reliability.

Construction & Infrastructure

In construction, shock absorber rubbers are widely used for building foundation pads, heavy machinery mounts, and bridge expansion joints. These applications demand materials that shield structures from continuous vibration, dynamic loads, and noise transmission—critical for urban infrastructure and seismic-prone regions. Buyers in areas with temperature extremes or high humidity, common in the Middle East and South America, must emphasize weather and ozone-resistant formulations. Custom sizing and compliance with local or international civil engineering standards will assure suitability for diverse project requirements.

Energy & Mining

Mining sites and energy facilities utilize shock absorber rubbers in equipment dampers, pump/motor mounts, and for isolating pipeline infrastructure. Such settings involve harsh chemicals, abrasive dust, and intense operational loads. Selecting rubbers with superior chemical resistance and high load-bearing capacity is non-negotiable for minimizing unplanned downtime and safeguarding personnel. B2B buyers from these sectors should also assess supplier reliability and after-sales support, as remote or challenging environments in Africa and South America necessitate robust logistics and technical assistance.

Industrial Machinery

Shock absorber rubbers are integral in reducing vibrational impact on press beds, conveyor systems, and HVAC installations. The primary benefits include increased machine accuracy, extended service intervals, and improved operator safety through reduced exposure to constant vibration. For buyers in both developed and emerging markets, consistent product quality and compound variety are key. Engage suppliers who can maintain fast lead times and geographic flexibility for spares and support, as unplanned downtime can significantly impact production schedules.

Rail & Mass Transit

In the rail and mass transit sector, shock absorber rubbers are fitted in track pad systems, bogie suspensions, and passenger car buffers to dampen movement, reduce track fatigue, and enhance travel comfort. This is especially valuable in regions experiencing rapid transit infrastructure growth, such as Turkey and parts of Eastern Europe. Materials must withstand high cyclic loading, broad temperature ranges, and comply with EN or ISO fleet standards. A proven lifecycle cost advantage—factoring both initial price and durability—should drive sourcing decisions for public and private transport operators.

Related Video: ACETips | How does an ACE Industrial Shock Absorber work?

Strategic Material Selection Guide for shock absorber rubbers

Key Considerations in Selecting Materials for Shock Absorber Rubbers

Selecting the right rubber material for shock absorbers is a mission-critical decision influencing durability, lifecycle cost, and operational efficiency. International B2B buyers must balance environmental conditions, product performance, legislative compliance, and cost competitiveness—often across diverse markets like Africa, South America, the Middle East, and Europe. Below, we examine four widely-used materials: Natural Rubber (NR), Neoprene (CR), EPDM, and Silicone Rubber, focusing on their B2B relevance and procurement implications.

Natural Rubber (NR)

Key Properties:

Natural rubber is distinguished by high elasticity and superior vibration damping. It operates effectively in moderate temperatures (-40°C to +70°C), but its resistance to oils, solvents, and ozone is limited.

Pros & Cons:

– Pros: Excellent mechanical shock absorption; highly cost-effective; widely available.

– Cons: Poor resistance to oils, fuels, and harsh weather; prone to degradation in extreme heat or UV exposure.

Impact on Application:

Best suited for vehicles, rail, and machinery in controlled environments. Limited weather and chemical resistance restrict its use in heavy industry or outdoor/exposed settings.

International B2B Considerations:

Often chosen in price-sensitive regions such as Africa and South America. Material quality can vary; insist on suppliers meeting ASTM D2000 or DIN ISO 1629 standards. Consistency and long-term supply must be verified.

Neoprene Rubber (CR)

Key Properties:

Neoprene excels in chemical, oil, and ozone resistance, with operating temperatures from -35°C to +120°C. It is mechanically tough and offers moderate elasticity.

Pros & Cons:

– Pros: Excellent resistance to lubricants, oils, and weathering; robust for diverse industrial uses.

– Cons: Higher cost vs. natural rubber; slightly less elastic; can be challenging to process in complex geometries.

Impact on Application:

Favoured for shock absorbers in industrial engines, HVAC systems, and settings with frequent contact with oils or chemicals—common in Middle Eastern manufacturing and European heavy industry.

International B2B Considerations:

Complies with global standards such as ASTM D2000 and ISO/TS 7620. Material traceability and documentation (e.g., reach/ROHS compliance) are often required in Europe; buyers in emerging markets should factor in total lifecycle cost over simple unit price.

EPDM (Ethylene Propylene Diene Monomer) Rubber

Key Properties:

Featuring top-tier resistance to weather, ozone, steam, and water, EPDM supports operating temperatures from -50°C up to +140°C. However, it is susceptible to swelling or degradation in the presence of oils or fuels.

Pros & Cons:

– Pros: Outstanding weather and UV resistance; long service life in outdoor/harsh climates.

– Cons: Does not resist petroleum-based fluids; moderate mechanical strength for shock-intensive applications.

Impact on Application:

Ideal for construction, infrastructure, and outdoor machinery—especially where exposure to sunlight or fluctuating temperatures is unavoidable (notably in Europe and the Middle East).

International B2B Considerations:

Verify conformance to DIN 7863/ASTM D1418, and check for local preferences, especially where regional weather extremes are common. Sourcing consistency and supplier experience with export logistics are important for cross-border deals.

Silicone Rubber

Key Properties:

Silicone offers exceptional temperature resistance (-60°C to +230°C), chemical inertness, and stability under compressive strain. It is non-reactive and approved for food/medical use.

Pros & Cons:

– Pros: Extreme operational temperature range; chemically inert; ideal for high-purity or specialized environments.

– Cons: Higher cost; lower tear and abrasion resistance than other rubbers; sourcing/lifecycle serviceability can be limiting in emerging markets.

Impact on Application:

Indispensable for medical, food processing, and electronics applications—where regulatory demands (FDA, EU, etc.) or performance in extreme conditions is key.

International B2B Considerations:

Preferred in European and Middle Eastern markets requiring top regulatory compliance. Confirm certifications (e.g., FDA, EN ISO 10993) and logistic capabilities for sensitive shipments. Cost-benefit analysis is crucial, especially where up-front price is high but maintenance costs are low.

Summary Comparison Table

| Material | Typical Use Case for shock absorber rubbers | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Natural Rubber (NR) | Automotive mounts, light machinery, rail | Cost-effective, excellent vibration damping | Poor oil/weather/ozone resistance | Low |

| Neoprene (CR) | Industrial engines, HVAC, heavy equipment | Strong oil/chemical & weather resistance | Higher cost, less elastic | Medium |

| EPDM Rubber | Outdoor machinery, infrastructure, construction | Superior weather/UV resistance | Not suitable for oil/petroleum exposure | Medium |

| Silicone Rubber | Medical, food processing, electronics | Extreme temperature range, inert, clean | High cost, lower abrasion/tear resistance | High |

In-depth Look: Manufacturing Processes and Quality Assurance for shock absorber rubbers

Key Stages in Manufacturing Shock Absorber Rubbers

1. Material Preparation and Compound Formulation

The quality and properties of shock absorber rubbers begin with the careful selection and mixing of base materials. Manufacturers typically use natural rubber, various synthetic elastomers (like neoprene or EPDM), or blends, depending on application-specific needs (e.g., weather resistance, oil resilience). The process starts with rigorous inspection and testing of incoming raw materials—ensuring the required physical and chemical properties align with intended performance. Compounding involves precise mixing of rubber with fillers, plasticizers, antioxidants, and vulcanizing agents using specialized mixers (such as Banbury or two-roll mills). Consistency in this stage is critical: even minor deviations can significantly affect final elasticity, durability, and vibration damping.

2. Shaping and Forming

Once the compound is prepared, it is shaped into the required profiles or components through forming processes—primarily compression molding, transfer molding, or injection molding.

- Compression Molding: Most common for high-density or simple geometries, where pre-measured rubber is placed in a heated mold, pressure is applied, and vulcanization occurs.

- Injection Molding: Preferred for complex shapes or mass production; the rubber compound is injected into closed molds, providing greater precision and uniformity.

- Transfer Molding: Blends characteristics of both, enabling high repeatability for mid-complexity parts.

Each method is chosen based on product design, required tolerances, and volume, with tooling maintenance and mold precision being crucial to achieving consistent dimensions and surface quality.

3. Curing (Vulcanization)

The critical transformation from raw to engineered rubber happens via vulcanization—most often in heated molds under pressure. This cross-links the rubber molecular structure, imparting elasticity, strength, and resilience. Precise control of temperature and curing duration ensures the desired balance of flexibility and mechanical properties. Improper curing can cause premature failure or inconsistent vibration isolation.

4. Post-Curing and Finishing Operations

Certain applications—especially those exposed to high stresses or requiring enhanced heat resistance—might undergo post-curing (secondary heating in ovens). Finishing processes include trimming excess flash, surface treatments (such as coating for UV/weather resistance), and in some cases, bonding to metal inserts or bushings to create composite assemblies. Surface finish not only impacts aesthetics but can also influence long-term performance by limiting crack initiation or chemical ingress.

5. Assembly with Metal Components

For bushings, mounts, or isolators, rubber components are often bonded to metal casings. This metal-rubber vulcanization involves cleaning and preparing the metal, applying bonding agents, and molding the rubber in place. Key factors include surface preparation, adhesive compatibility, and process timing—especially relevant for buyers sourcing complex assemblies requiring high durability.

Quality Control Practices for Shock Absorber Rubbers

1. Adherence to International and Sectoral Standards

Global buyers must insist on compliance with recognized quality systems and certifications, such as:

- ISO 9001: Baseline for Quality Management Systems (QMS); ensures traceability, process discipline, and continual improvement.

- ISO/TS 16949 (now IATF 16949): Focused on the automotive sector, detailing expectations for rubber component suppliers.

- Industry-Specific Marks: For some applications, certifications like CE (Europe), API (oil & gas), or REACH/RoHS (chemical/environmental compliance) may be required.

2. Critical Quality Checkpoints

Effective manufacturing leverages structured quality gateways:

- IQC (Incoming Quality Control): Verification of raw materials and purchased components. Includes material certificates, compound testing (hardness, tensile strength), and inspection of metal inserts for contamination or defects.

- IPQC (In-Process Quality Control): Inspection during production stages. Checks for proper mixing, mold temperature, curing times, and real-time dimensional measurements.

- FQC (Final Quality Control): Comprehensive review post-production, including visual inspection, dimensional checks, and functional or performance testing.

3. Common and Advanced Testing Methods

Due diligence for B2B buyers should focus on these testing protocols:

- Physical Property Tests: Tensile strength, elongation at break, Shore hardness—ensuring the rubber meets design criteria.

- Aging & Environmental Simulation: Accelerated heat, ozone, or oil immersion tests to forecast long-term durability under end-use conditions.

- Compression Set & Resilience: Evaluates how well the rubber retains shape and energy absorption after prolonged loading.

- Bond Strength (for metal-inserted parts): Measures adhesion between rubber and metal—critical for mounts and bushings.

- Visual and Automated Defect Detection: Use of cameras, sensors, and automated gauges safeguards against surface flaws or dimensional deviations.

Verifying Supplier Quality: What International Buyers Should Do

Supplier Audits and On-Site Assessment

Before placing significant or repeat orders, B2B buyers—especially from emerging markets—should conduct or commission audits of supplier facilities. Key points include checking certification validity, reviewing production and QC records, observing manufacturing processes, and evaluating in-house laboratories.

Third-Party Inspections

Engaging neutral inspection agencies (SGS, BV, TÜV, etc.) for pre-shipment verification ensures product integrity. This is particularly valuable for buyers unfamiliar with local suppliers, as it reduces the risk of accepting substandard batches.

Quality Documentation and Traceability

Insist on full documentation: material certificates, batch test reports, and process records. Leading suppliers provide traceability from raw material through finished part, enabling root-cause analysis in the event of failure.

Sample Approvals and Pre-Production Trials

Obtain representative samples and subject them to in-house or independent laboratory testing before mass orders. For critical or customized components, require PPAP (Production Part Approval Process) or equivalent validation as per industry best practice.

Regional Nuances: What Buyers in Africa, South America, the Middle East, and Europe Need to Consider

- Regulatory Compliance: European buyers must ensure strict adherence to CE marking, REACH, and environmental directives, while Middle Eastern buyers may focus on API and ISO certifications for energy and infrastructure projects.

- Climate and Use-Case Alignment: In Africa and South America, where extreme temperatures and humidity are common, prioritize compounds validated via accelerated aging/weathering tests. Request supplier data on heat, ozone, and UV performance to assure product lifespan in harsh settings.

- Supply Chain Transparency: Working with overseas suppliers (e.g., from Turkey, Indonesia, China) amplifies the need for robust documentation and inspection protocols. Consider language and time zone differences when clarifying specifications and QC expectations.

- Batch Consistency: For buyers in regions with fluctuating import infrastructure, large-lot, consistent-quality deliveries are essential—demand evidence of process stability and previous batch quality performance.

Summary of Actionable Recommendations for B2B Buyers

- Define technical requirements and compliance needs early—share use-case details with suppliers for optimal compound selection.

- Require full disclosure of manufacturing processes, material sourcing, and QC regimes in RFI/RFQ documentation.

- Mandate access to quality records, and plan for periodic site visits or third-party inspections.

- Use international certifications as baseline qualifiers but validate with your own performance testing, particularly for critical or high-volume supply chains.

- Build contingency into supply agreements for cultural, technical, and regulatory differences across regions.

A disciplined focus on manufacturing quality and process transparency will enable international buyers to safeguard operational reliability, minimize risk, and capitalize on competitive opportunities in the global shock absorber rubber market.

Related Video: Manufacturing Process Of Motorcycle Front Shock Absorber

Comprehensive Cost and Pricing Analysis for shock absorber rubbers Sourcing

Dissecting the Shock Absorber Rubber Cost Structure

When sourcing shock absorber rubbers at scale, B2B buyers must consider a multi-layered cost structure—not just the unit price but every element leading to the final delivered component. The primary cost components include:

-

Raw Materials: The choice between natural and synthetic rubbers (e.g., neoprene, EPDM, silicone) significantly impacts cost. Natural rubber is generally more affordable but may lack specific resistances required by some applications, while specialty compounds increase per-unit material expenditure.

-

Labor: Labor costs hinge on both region and production complexity. Integrated automated processes in established economies (Europe, select Asian suppliers) might reduce labor input per part, but wage rates are higher.

-

Manufacturing Overhead: This includes tooling (molds, presses), facility costs, and machine depreciation. First-time orders for custom designs may incur non-recurring engineering (NRE) and tooling charges; large, repeat orders typically dilute these costs.

-

Quality Control (QC): International buyers often require certified QC processes (e.g., ISO 9001, IATF 16949), which add to costs but provide assurance for consistency and compliance. Stricter QC, common for export orders to Europe and the Middle East, builds in premium.

-

Logistics and Packaging: Freight, insurance, and packaging vary dramatically by destination. Long-distance shipping to Africa or South America may require robust, moisture-resistant packaging and multi-modal freight solutions, all of which can add 10–20% to the landed cost.

-

Supplier Margin: Exporter markups are influenced by order size, payment terms, perceived creditworthiness, and the current supplier pipeline.

Key Variables Impacting Final Price

Several real-world factors influence the total price offered by suppliers:

-

Order Volume/MOQ: Larger orders command stronger discounts. Many suppliers set minimum order quantities (MOQs) to optimize production runs and spread fixed overheads over more units.

-

Customization & Specifications: Bespoke sizes, shapes, or material formulations will increase unit costs due to additional tooling, NRE, or smaller production batches. Standard catalogue parts are usually the most cost-effective.

-

Material Grade and Certification: International and export markets may require compliance certifications (e.g., REACH, RoHS), adding to input material and QC expenses, especially for sensitive applications in automotive and construction.

-

Supplier Location and Capacity: Suppliers in markets like Turkey and Indonesia can often offer competitive prices due to lower input costs, but may have lead-time, standardization, or QC differences compared to established European vendors.

-

Incoterms: Whether a price is quoted ex-works (EXW), free on board (FOB), cost insurance and freight (CIF), or delivered duty paid (DDP) changes the financial responsibility for freight, insurance, and customs. Always clarify which Incoterm applies to your quoted price.

Strategic Insights for International B2B Buyers

B2B buyers from Africa, South America, the Middle East, and Europe should leverage these strategies to maintain cost-control and maximize value:

-

Negotiate Based on Volume and Commitment: Consider consolidating demand with fewer suppliers for better pricing and leveraging framework agreements for recurring needs.

-

Seek Transparent Cost Breakdowns: A detailed cost breakdown from suppliers helps pinpoint savings or areas to negotiate—particularly on labor, logistics, and QC costs.

-

Evaluate Total Cost of Ownership (TCO): Factor in lifecycle aspects such as product longevity, maintenance intervals, and replacement rates. A higher-priced but more durable rubber compound may significantly lower long-term costs.

-

Leverage Regional Advantages: Suppliers closer to Africa or Europe can offer savings on shipping and shorter lead times. Consider regional free-trade zones for reduced tariffs.

-

Clarify Quality and Compliance Requirements: Avoid costly delays or rejections by specifying required certifications and compliance standards upfront, especially for critical sectors like automotive or infrastructure.

-

Plan for Currency and Freight Fluctuations: In volatile markets, negotiate flexible payment terms or currency hedging where possible, and factor in freight rate swings when budgeting.

Indicative Pricing Disclaimer

All pricing references within this guide are for indicative purposes only. Market conditions—including raw material costs, currency movements, and global supply chain factors—can cause significant variations. Always request up-to-date quotations from suppliers tailored to your order specifications and region.

By methodically analyzing costs and recognizing the nuances of global rubber sourcing, international buyers can secure more competitive deals and create resilient, cost-effective supply chains for shock absorber rubbers.

Spotlight on Potential shock absorber rubbers Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘shock absorber rubbers’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

33 Shock Absorber Manufacturers in 2025 (us.metoree.com)

33 Shock Absorber Manufacturers in 2025, as aggregated by Metoree, represents a diverse group of global producers and suppliers specializing in shock absorber rubbers. This listing acts as a gateway for B2B buyers to access manufacturers experienced in serving a variety of industries—including automotive, industrial machinery, and infrastructure. Companies included typically offer a broad range of shock absorber solutions, including natural and synthetic rubber components for dampening and vibration isolation. While specific details vary across each listed manufacturer, buyers can expect to find suppliers with advanced rubber molding capabilities, adherence to international quality standards (such as ISO certifications), and experience fulfilling complex, high-volume export orders.

For international buyers from Africa, South America, the Middle East, and Europe, engaging with this consolidated resource streamlines supplier selection, comparison, and outreach. The platform’s focus on reputable companies enhances procurement transparency and is particularly beneficial for buyers seeking partners with proven export experience and multilingual support.

10 Shock Absorber manufacturers in the World (gdstauto.com)

KYB Industries, Ltd, established in 1919 and headquartered in Japan, is one of the world’s leading manufacturers of automotive shock absorbers and related rubber components. The company operates 32 branches across 21 countries, supported by 15 major production bases located in key automotive markets, including Europe and the Americas. KYB’s wide product portfolio includes original equipment and aftermarket shock absorbers designed to meet diverse vehicular requirements, from passenger cars and SUVs to heavy trucks.

As a global supplier, KYB is recognized for advanced engineering, stringent quality assurance, and adherence to international standards, with its products frequently used by major automotive OEMs. Their shock absorber rubbers are engineered for durability and optimal vibration control, making them reliable even in demanding climatic and operational conditions—key considerations for B2B buyers across Africa, Europe, the Middle East, and South America. The company’s robust global distribution network and technical support facilitate prompt delivery and post-sale service for international buyers.

5 Shock Absorber Manufacturers You Can Trust (www.nbmaxauto.com)

MAX Auto Parts stands out as a major manufacturer and global exporter of shock absorber rubbers and related components, including auto coilovers and piston rods. With a reputation for delivering products that meet stringent international quality standards, MAX Auto Parts serves diverse markets in Africa, South America, the Middle East, and Europe, making them a reliable choice for international B2B buyers seeking consistent supply and product compatibility. The company emphasizes the use of premium materials and innovative manufacturing processes, supporting enhanced durability and optimal performance in demanding environments. Certifications such as ISO 9001 and TS16949 signify a robust commitment to quality assurance and safety. Their broad product portfolio and focus on technological advancement enable them to cater to a wide array of automotive requirements, offering strong after-sales support and flexible order customization to suit regional market needs.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| 33 Shock Absorber Manufacturers in 2025 | Global supplier aggregator for rubber shock absorbers | us.metoree.com |

| 10 Shock Absorber manufacturers in the World | Global OEM-grade shock absorbers and rubber components | gdstauto.com |

| 5 Shock Absorber Manufacturers You Can Trust | Global certifications, broad product range, export expertise | www.nbmaxauto.com |

Essential Technical Properties and Trade Terminology for shock absorber rubbers

Key Technical Properties of Shock Absorber Rubbers

Understanding and specifying the correct technical properties is vital when sourcing shock absorber rubbers, especially for buyers navigating international supply chains. Below are the most critical specs to consider in procurement and contract discussions:

-

Material Composition and Grade

The base material (e.g., natural rubber, neoprene, EPDM, silicone) and its precise formulation directly impact performance, cost, and compliance with local industry standards. For example, natural rubber offers high elasticity for general machinery, while EPDM excels outdoors due to its weather resistance. Request detailed specifications—including compound percentages and any additives—to ensure suitability for your operational environment and regulatory requirements. -

Hardness (Shore A Durometer)

Measured on the Shore A scale, hardness indicates rubber’s resistance to indentation and compression. A higher value (e.g., 70–80 Shore A) means stiffer material, suitable for heavy loads; lower values (40–60 Shore A) provide greater flexibility and isolation for sensitive equipment. Specify hardness tolerances upfront to align the product’s damping characteristics with your application’s real-world demands. -

Tensile Strength and Elongation at Break

Tensile strength defines the maximum pulling force rubber can withstand before breaking, measured in megapascals (MPa). Elongation at break notes how much the rubber can stretch before failure, presented as a percentage. These values are crucial for applications with continuous or dynamic stress, such as automotive suspension or rail systems. Ensure that supplier data matches or exceeds minimum requirements for your intended use. -

Compression Set and Resilience

Compression set measures how well the rubber returns to its original shape after being compressed—directly influencing long-term vibration absorption. Lower compression set values suggest longer service life and better performance under continuous loading. Resilience, often tested as rebound percentage, signals how quickly and effectively the rubber can absorb and dissipate energy, a key factor in dynamic environments. -

Chemical and Temperature Resistance

Resistance to oils, solvents, ozone, and temperature extremes affects material lifespan and safety. For regions with harsh climates (such as the Middle East or Africa), or for sectors like mining or oil & gas, choose compounds proven to withstand your unique exposure levels. Always request certifications or test results to validate manufacturer claims on chemical and thermal stability.

Core Industry and Trade Terminology

Securing optimal terms and avoiding misunderstandings with global suppliers depends on fluency in common B2B and rubber industry jargon. These are the terms every international buyer should know:

-

OEM (Original Equipment Manufacturer)

Indicates the producer for branded or certified components intended as direct replacements in new equipment or vehicles. Sourcing OEM-grade shock absorber rubbers assures compatibility and often meets stringent performance and safety benchmarks. -

MOQ (Minimum Order Quantity)

Refers to the smallest order size a supplier will accept, which influences pricing, logistics, and stock management. Clarify MOQs in negotiations to avoid unexpected costs or inventory risks—especially important when piloting new suppliers or entering new markets. -

Tolerance

Defines acceptable variation in product dimensions (e.g., ±0.2 mm for rubber bushings). Tight tolerances are essential for critical applications where fit and performance are non-negotiable, such as railways or high-speed vehicles. Always align tolerance requirements with technical drawings or application specs. -

RFQ (Request for Quotation)

A formal inquiry sent to suppliers requesting pricing and terms for a specified product. Providing accurate technical and commercial information in your RFQ streamlines the bidding process, reduces miscommunication, and helps secure competitive, apples-to-apples offers from multiple vendors. -

Incoterms (International Commercial Terms)

Standardized trade terms (like FOB, CIF, DAP) set responsibilities and cost-sharing for shipping, insurance, and customs between buyer and seller. Choosing the right Incoterm protects your interests and clarifies shipping risks—vital for cross-border shipments to or from Africa, South America, and other regions with complex logistics. -

Lead Time

The period between order confirmation and product delivery. Understanding and managing lead times is essential for project planning and avoiding costly downtime. Factors such as production schedules, raw material sourcing, and international freight availability all impact lead time for shock absorber rubbers.

Actionable Tip for B2B Buyers:

Create a technical and commercial checklist before engaging with suppliers. Detailing and verifying each technical property and trade term can prevent miscommunication, safeguard quality, and strengthen your negotiation position—regardless of region or application sector.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the shock absorber rubbers Sector

Global Market Overview and Emerging Sourcing Trends

The shock absorber rubbers sector sits at the heart of industrial progress, enabling reliable performance in automotive, rail, heavy machinery, and infrastructure projects worldwide. Recently, the market has experienced heightened volatility due to fluctuations in the costs of raw materials—such as natural rubber, synthetic rubbers like neoprene and EPDM, and specialty compounds. Increasing demand from rapidly growing regions, including Africa, South America, and Southeast Asia, is also influencing supply chains and creating fresh sourcing opportunities.

For international B2B buyers, a key trend is the diversification of sourcing networks. Companies are moving beyond traditional suppliers in East Asia, actively exploring partnerships with manufacturers in Turkey, Eastern Europe, and regions closer to end markets. This shift aims to mitigate geopolitical risks, reduce lead times, and optimize costs. Moreover, advances in compound engineering—such as blends tailored for extreme temperatures or chemical resistance—are transforming product offerings and enabling buyers to specify highly customized solutions for regional operational requirements.

Digitalization is reshaping the procurement landscape as well. Marketplaces, supplier portals, and ERP integrations are streamlining supplier discovery, technical vetting, and compliance checks. Buyers can now compare global suppliers on criteria like quality certifications (ISO/TS, REACH, RoHS), manufacturing capability, and sustainability standards in real time. In markets where price sensitivity is paramount—such as parts of Africa and Latin America—emphasis is placed on balancing upfront costs with total lifecycle value, including durability, local after-sales support, and logistical efficiency.

Finally, regulatory convergence and harmonization of product standards are accelerating cross-border trade. B2B buyers should closely monitor evolving international regulations concerning rubber compounds, environmental safety, and product traceability, as these shape both procurement strategy and supplier selection.

Sustainability and Ethical Sourcing Considerations

Sustainability has become a defining criterion in the shock absorber rubbers supply chain. Environmental scrutiny of both natural and synthetic rubber sourcing highlights the need for transparent, responsible procurement. B2B buyers are increasingly prioritizing suppliers who can demonstrate ethical raw material harvesting (especially for natural rubber), reduced environmental footprint in compound manufacturing, and adherence to labor and fair-trade standards.

Green certifications are emerging as industry benchmarks. Recognitions such as the Forest Stewardship Council (FSC) for natural rubber, ISO 14001 for environmental management, and third-party audits covering REACH chemicals compliance are increasingly required by buyers—particularly those in Europe, the Middle East, and multinational corporations. Buyers should seek documentation on supplier commitments to minimizing waste, energy use, and emissions throughout manufacturing, alongside implementation of recycling or closed-loop production for rubber offcuts and end-of-life products.

A focus on sustainable innovation is evident in the growing use of alternative materials—such as bio-based rubbers, recycled compounds, and additives sourced from renewable resources. While these options may command a premium, they align with ESG mandates and can offer long-term value, including improved reputational standing and readiness for evolving regulatory requirements. In emerging markets, aligning sourcing with global sustainability norms not only opens access to broader customer bases but may also qualify buyers and suppliers for green financing or export incentives.

B2B buyers are encouraged to embed sustainability criteria into RFPs, supplier scorecards, and contracts—requiring clear disclosures and targets on environmental and ethical performance. This approach mitigates operational risks, strengthens brand equity, and ensures future-proof access to global supply networks.

Brief Sector Evolution and Relevance for Today’s B2B Buyer

The evolution of shock absorber rubbers mirrors the broader industrial and automotive revolutions of the last century. Early isolation products were crude natural rubber blocks, but rapid advances in polymer chemistry, materials engineering, and precision manufacturing have since given rise to a vast array of specialized compounds. The adoption of synthetic rubbers in the mid-20th century expanded resistance and durability, while modern engineering enabled rubber-metal hybrids and highly tailored damping solutions.

For B2B buyers today, this history translates into a mature but continually innovating supply landscape—one where the right sourcing strategy balances material science, supplier capabilities, regulatory compliance, and ethical stewardship. Understanding this evolution equips buyers to navigate both legacy supply chains and the emerging demands for customization, sustainability, and resilience in a globally interconnected economy.

Related Video: Tariffs will cause ‘massive shock’ to U.S. cost of living and will reshape global trade: Expert

Frequently Asked Questions (FAQs) for B2B Buyers of shock absorber rubbers

Supplier Evaluation and Qualification

1. How can I effectively vet and qualify international suppliers of shock absorber rubbers?

To thoroughly assess suppliers, start by reviewing their manufacturing capabilities, quality certifications (such as ISO 9001 or IATF 16949 for automotive standards), and client references, especially from regions relevant to your business. Conduct virtual audits or request video documentation of production processes. Insist on samples for testing and seek third-party inspection reports if possible. Evaluate their responsiveness, transparency, and willingness to cooperate with due diligence processes. Secure clear contractual terms around warranty, quality standards, and aftersales support to minimize risks associated with international sourcing.

Customization and Technical Specifications

2. Can shock absorber rubbers be customized to meet specific technical or regional requirements?

Yes, most established manufacturers offer customization options tailored to unique operational needs, environmental exposures, or industry standards. Buyers should provide detailed specifications, including load ratings, dimensions, and preferred material compounds (e.g., EPDM for outdoor use or neoprene for chemical resistance). It’s crucial to communicate any special requirements dictated by local climate (such as extreme heat in the Middle East or humidity in tropical regions) and applicable industry standards. Early technical dialogue will streamline prototyping and mitigate the risk of non-conformity.

Minimum Order Quantities, Lead Times, and Payment Terms

3. What are common minimum order quantities (MOQs), lead times, and international payment practices?

MOQs typically depend on the supplier’s production scale—ranging from a few hundred units for specialized components to several thousand for standard parts. Lead times vary by order complexity and customization, generally spanning 4–12 weeks. Payment terms often include a 30% advance with the balance payable on shipment or via irrevocable letter of credit (L/C). For new partnerships, consider third-party escrow or trade assurance platforms to secure transactions. Always clarify incoterms (e.g., FOB, CIF) early in negotiations to align on delivery and payment responsibilities.

Quality Assurance and Certifications

4. Which quality certifications and product testing should I require from suppliers?

Request documentation of ISO 9001:2015 or IATF 16949 (for automotive applications) certification, as these signal robust quality management systems. Ask for recent test reports on tensile strength, elasticity, chemical resistance, and durability, ideally from independent testing laboratories. For specialized industries—like food processing or medical—ensure compliance with relevant regional or international standards (such as FDA or EU RoHS). Regular factory audits and batch sampling can further safeguard product consistency and reduce liability.

Shipping, Logistics, and Import Considerations

5. What logistics and import factors should I anticipate when sourcing shock absorber rubbers internationally?

Shipping costs, transit insurance, customs duties, and local compliance documentation (such as certificates of origin) are key considerations. Engage logistics partners experienced with rubber goods to prevent delays or quality degradation due to improper storage. Factor in regulatory requirements, such as REACH compliance in the EU or SON standards in Nigeria. Consider warehousing or consolidation options to optimize freight costs, especially for buyers with distributed operations across Africa, South America, or multiple Middle Eastern countries.

Dispute Resolution and Claims Management

6. How should I handle disputes, defective shipments, or warranty claims with overseas suppliers?

Incorporate clear dispute resolution clauses into contracts, specifying response times, acceptable remedies, and the use of international arbitration where appropriate. Document all communications and quality inspections upon receipt. If product issues arise, notify the supplier promptly, providing evidence (photos, test results). Reputable suppliers will offer remediation—either replacement, credit, or reimbursement—within agreed terms. Utilizing an established trade platform or third-party escrow can add an additional layer of protection.

Market Trends and Cost Optimization

7. How can I stay updated on market trends and optimize costs in sourcing shock absorber rubbers?

Monitor commodity price trends for rubber and relevant raw materials to anticipate shifts that could impact pricing. Build relationships with multiple suppliers across different regions (e.g., Southeast Asia, Europe) to leverage competitive quotes and supply chain resilience. Attend trade fairs, subscribe to industry publications, and participate in professional networks to gain early insights into new compounds, sustainability innovations, and regulatory changes. Consider long-term contracts or volume commitments to negotiate better pricing and buffer against volatility.

Regional Considerations and Localization

8. Are there region-specific factors to consider when sourcing shock absorber rubbers for African, South American, Middle Eastern, or European markets?

Yes. Climate, local regulatory standards, transportation infrastructure, and typical machinery/equipment used in each region influence material selection and logistics. For example, UV and ozone resistance is vital for outdoor installations in the Middle East and Africa, while stringent EU environmental compliance is required for European imports. Engage suppliers to clarify compliance with local standards (such as GCC conformity or MERCOSUR technical regulations) and explore after-sales support or distribution partnerships within your target regions for smoother operations.

Strategic Sourcing Conclusion and Outlook for shock absorber rubbers

Rubber shock absorber components remain central to operational reliability and cost management across industries such as automotive, mining, infrastructure, and manufacturing. For international B2B buyers, especially those in Africa, South America, the Middle East, and Europe, strategic sourcing hinges on balancing price, performance, and long-term value. Key takeaways include the importance of aligning rubber compound selection—natural, neoprene, EPDM, or silicone—with local environmental demands and sector-specific requirements, while closely vetting suppliers for consistent quality and robust manufacturing standards.

A proactive sourcing approach requires ongoing monitoring of raw material trends, advances in production technologies, and evolving regulatory environments. Buyers who prioritize detailed supplier evaluation, including technical audits and clear quality benchmarks, are best positioned to mitigate risk and control costs throughout the procurement lifecycle. Leveraging regional market insights allows for better negotiation and the agility to respond to supply chain disruptions or opportunities.

Looking forward, resilient and adaptive procurement strategies will be essential as markets globalize and demand for high-performance shock absorber rubbers intensifies. International buyers are encouraged to invest in supplier relationships, foster knowledge exchange, and continually optimize their sourcing frameworks. By doing so, they can secure reliable supply chains, unlock greater operational efficiencies, and sustain a competitive edge in an increasingly dynamic marketplace.