Introduction: Navigating the Global Market for door rubber strip

Rubber door strips, though often overshadowed by more conspicuous components, are mission-critical for businesses across a range of industries—from construction and transport, to manufacturing, energy, and beyond. They provide essential sealing, insulation, and protection, directly impacting product performance, regulatory compliance, and customer satisfaction. For international B2B buyers, especially those operating in dynamic and climate-diverse regions such as Africa, South America, the Middle East, and Europe, sourcing the right door rubber strip is not just a technical decision; it’s a strategic move that shapes operational efficiency and long-term value.

Today’s global market for door rubber strips is vast and increasingly sophisticated, featuring a wide spectrum of materials like EPDM, silicone, neoprene, and innovative blends—each tailored to address specific environmental, safety, and durability requirements. With suppliers and manufacturers spanning Asia, Europe, and beyond, procurement teams face both immense opportunity and growing complexity. The stakes are high: choices around strip type, material, manufacturing standards, supply chain resilience, and regulatory adherence can directly affect lifecycle costs, maintenance needs, and end-user experience.

This comprehensive B2B guide has been meticulously developed to equip procurement professionals and sourcing managers with the operational intelligence required to thrive in this competitive landscape. Inside, you will discover:

- Detailed overviews of key door rubber strip types and materials, highlighting strengths, limitations, and suitable applications across industries.

- Insights into contemporary manufacturing processes, quality assurance protocols, and what to demand in supplier audits.

- Global sourcing and supplier benchmarking strategies to help buyers select partners that align with their market goals, whether in Thailand, South Africa, or beyond.

- Up-to-date cost structures and market trends, enabling effective budgeting and long-term value assessment.

- Clear answers to frequently asked questions, addressing regulatory, logistical, and technical concerns experienced by international buyers.

Armed with this knowledge, procurement teams will be empowered to minimize sourcing risks, optimize performance and cost, and forge reliable supply partnerships—ensuring that each door, facility, or product benefits from robust, fit-for-purpose rubber sealing solutions.

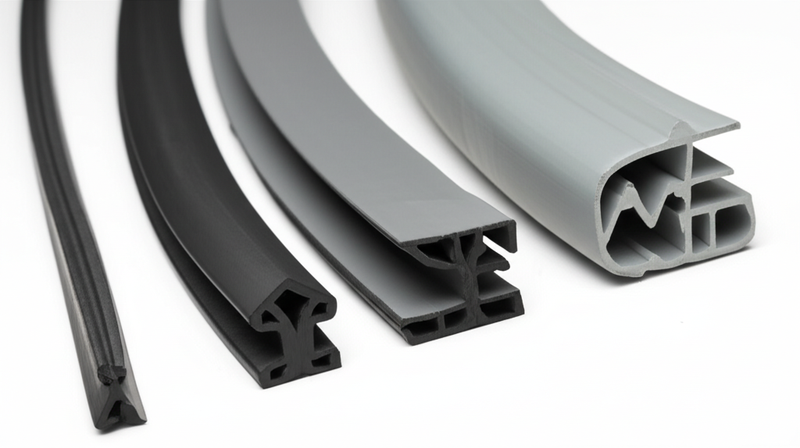

Understanding door rubber strip Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Self-Adhesive Neoprene Strip | Flexible, easy peel-and-stick install, moderate durability | Construction doors, industrial enclosures | Cost-effective and simple install; adhesive may limit durability in harsh climates |

| EPDM Rubber Sealing Strip | Superior UV, ozone, and water resistance, high elasticity | Automotive, external doors, infrastructure | Excellent longevity for outdoor use; higher unit cost, must confirm adhesive suits application |

| Silicone Rubber Door Strip | Broad temperature tolerance, food/medical safe, high flexibility | Cold room doors, medical, electronics | Meets hygiene/compliance needs; premium cost and not ideal for high-abrasion areas |

| D-Profile & Custom Extrusions | Shaped for enhanced compression/seal; tailored to fit profiles | Automotive doors, heavy machinery, OEM | Optimal for precise sealing; custom tooling raises costs, lead times |

| Expanded (Foam) Rubber Strip | Spongy, compressible, superior insulation, lightweight | HVAC, packaging, noise/vibration dampening | Excellent conformity on uneven surfaces; may be less durable vs. solid strips |

Self-Adhesive Neoprene Strip

Self-adhesive neoprene strips are commonly selected for projects prioritizing fast, simple installation. Their peel-and-stick nature reduces installation time and labor, offering immediate cost savings for construction, retrofit, or light industrial projects. Neoprene delivers moderate weather and chemical resistance, making it a pragmatic choice for interior doors or enclosures not exposed to severe environments. Procurement teams should validate adhesive quality—especially if the end-use involves high humidity, temperature variation, or uneven substrates. Batch consistency and shelf life are also relevant for large-volume buyers.

EPDM Rubber Sealing Strip

EPDM rubber strips are engineered for rigorous outdoor conditions, featuring strong resistance to UV, ozone, water, and temperature extremes. This makes them indispensable for applications like automotive door seals, external infrastructure, and any project in hot, humid, or sun-exposed regions—key for buyers in Africa or the Middle East. While the upfront price is higher, EPDM’s lifecycle cost is often lower due to its extended service life and reduced maintenance. Buyers should confirm compatibility with local climate requirements and equally scrutinize adhesive performance in UV and heat.

Silicone Rubber Door Strip

Silicone rubber strips stand out for their wide temperature tolerance and inert, non-toxic formulation. Industries that must meet stringent regulatory, health, or food safety standards—including medical, food processing, cold storage, and electronics—often rely on silicone. For buyers in Europe and the Middle East, where statutory requirements can be strict, this ensures both compliance and reliability. Silicone commands a premium price and, while resilient to extreme temperatures, is less suited for applications with heavy mechanical abrasion or where high tear strength is needed.

D-Profile & Custom Extrusions

D-profile and other custom extrusion strips are tailored to fit specific door frames or machinery clearances, ensuring optimal sealing and minimal leakage. Their design enhances compression and noise damping—crucial for automotive manufacturers, OEMs, and industrial machinery suppliers demanding precision. Buyers appreciate the bespoke fit, but must factor in extra costs for mold tooling, sampling, and lead times, especially when ordering unique profiles. For complex assemblies in high-value markets, the investment is justified by enhanced product quality and reduced warranty claims.

Expanded (Foam) Rubber Strip

Expanded or foam rubber strips deliver outstanding compressibility and thermal/acoustic insulation—advantages when sealing uneven door gaps or dampening vibration. Lightweight and easy to work with, these strips are often found in HVAC systems, export packaging, and appliances. Their cellular structure delivers effective air and moisture barriers, but may be less suitable for areas exposed to abrasion or sharp objects. B2B buyers should weigh insulation performance against mechanical durability, especially for applications involving frequent door operation or high-traffic areas.

Related Video: How to Replace Exterior Door Weather Stripping | Seal Out Bugs, Water & Air

Key Industrial Applications of door rubber strip

| Industry/Sector | Specific Application of door rubber strip | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Construction & Real Estate | Weather sealing in commercial and residential doors | Enhanced insulation, energy efficiency, acoustic dampening | Material durability, climate compatibility, adherence to fire and building codes |

| Automotive & Transport | Automotive door sealing and trunk weatherstripping | Water/dust ingress prevention, noise reduction, improved occupant comfort | UV and ozone resistance, fit to vehicle models, OEM/aftermarket certification |

| Manufacturing & Industrial Equipment | Machinery enclosure sealing, cleanroom doors | Protection from dust, contamination control, equipment longevity | Chemical resistance, compressibility, ease of installation and replacement |

| HVAC & Energy | Sealing access and maintenance doors, duct gateways | Thermal insulation, leakage prevention, energy cost control | Temperature range tolerance, flame resistance, long-term sealing performance |

| Mass Transit & Infrastructure | Platform screen door/weatherstrip for terminals & stations | Passenger safety, environmental separation, reliability in high-traffic areas | Fire safety compliance, durability under heavy use, supplier quality systems |

Construction & Real Estate

In commercial and residential construction, door rubber strips are vital for achieving airtight and watertight seals on entryways, fire doors, and service access points. These strips combat drafts, moisture intrusion, and noise pollution, contributing to improved energy efficiency and occupant comfort. For buyers in regions with variable climates, such as South Africa or central Europe, ensuring material durability and compliance with regional building codes is crucial. Selecting suppliers offering certified, weather-resistant products can translate to lower maintenance costs and long-term tenant satisfaction.

Automotive & Transport

Within the automotive sector, door rubber strips are integral to vehicle door frames, trunks, and hoods—providing barriers against water, dust, and external noise. Highly resistant formulations like EPDM ensure longevity under intense sunlight and diverse weather, which is especially relevant for markets in Africa and the Middle East. Reliable supply partnerships and adherence to OEM or regional quality standards are paramount, as inconsistent seals can lead to warranty issues, increased aftersales costs, and diminished passenger comfort.

Manufacturing & Industrial Equipment

For manufacturing facilities and sensitive industrial environments (such as food processing or electronics assembly), door rubber strips are used to seal machinery enclosures, panel doors, and cleanroom accesses. These applications demand strips featuring excellent chemical resistance, easy conformability, and minimal compression set over time. International buyers serving these sectors should prioritize suppliers with stringent quality control and a proven track record of delivering consistent product dimensions and mechanical properties, as equipment downtime due to faulty seals can be costly.

HVAC & Energy

In the HVAC and energy industries, door rubber strips are crucial for sealing duct access panels, maintenance doors, and service hatches in heating, ventilation, and energy storage installations. These strips help prevent energy leakage and thermal bridging, resulting in improved system efficiency and cost savings—a high priority for buyers in regions with extreme seasonal temperatures. Key procurement criteria include verified temperature resistance, flame retardancy, and compatibility with installation substrates.

Mass Transit & Infrastructure

Door rubber strips serve a critical role in mass transit infrastructure, specifically as weatherstripping on platform screen doors, passenger terminals, and public facility access points. These environments demand high cycle durability, superior fire performance, and effective protection against environmental ingress. For international buyers managing busy rail hubs or airports, choosing suppliers with robust product lifecycle testing and relevant transit safety certifications mitigates risk and ensures regulatory compliance.

Related Video: Turbo Garage Tips #4: Restore Your Rubber Seals!

Strategic Material Selection Guide for door rubber strip

When selecting door rubber strips, understanding the properties and applications of various materials is crucial for international B2B buyers. Here, we analyze four common materials used in door rubber strips—Neoprene, EPDM, Silicone, and PVC—highlighting their key properties, advantages, disadvantages, and considerations specific to the global market, particularly for buyers in Africa, South America, the Middle East, and Europe.

Neoprene Rubber Strips

Key Properties: Neoprene is a synthetic rubber known for its flexibility and moderate resistance to temperature extremes, ranging from -20°C to 100°C. It offers good resistance to water and various chemicals, making it suitable for diverse environments.

Pros & Cons: Neoprene is cost-effective and easy to install due to its self-adhesive options. However, its outdoor durability is moderate, and prolonged exposure to UV light can lead to degradation. This material is best suited for indoor applications or areas with limited exposure to harsh weather.

Impact on Application: Neoprene strips are compatible with many common media but may not perform well in extreme conditions. Buyers should consider the specific environmental factors to which the strip will be exposed.

Considerations for Buyers: Buyers from regions with high UV exposure, such as parts of Africa and the Middle East, should assess the long-term viability of Neoprene in their applications. Compliance with local standards, such as ASTM or DIN, is essential to ensure quality.

EPDM Rubber Strips

Key Properties: EPDM (ethylene propylene diene monomer) rubber excels in extreme weather conditions, with a temperature range of -40°C to 120°C. It is highly resistant to UV rays, ozone, and water, making it ideal for outdoor applications.

Pros & Cons: The durability of EPDM makes it a preferred choice for automotive and construction applications. However, it tends to be more expensive than Neoprene, and the adhesive used must be verified for compatibility with the intended surfaces.

Impact on Application: EPDM is particularly suitable for areas exposed to the elements, such as door seals in vehicles and buildings. Its superior resistance to environmental factors enhances the longevity of installations.

Considerations for Buyers: Buyers in regions with harsh climates, such as South America and the Middle East, will benefit from EPDM’s durability. Ensuring compliance with local manufacturing standards is crucial for maintaining product integrity.

Silicone Rubber Strips

Key Properties: Silicone rubber is known for its exceptional temperature stability, functioning effectively between -60°C and 200°C. It is also non-toxic and can be formulated for food-grade applications.

Pros & Cons: Silicone strips provide high durability and compliance with stringent regulations, making them suitable for medical and food processing applications. However, they come with a higher initial cost compared to other materials.

Impact on Application: Silicone is ideal for sensitive environments where chemical exposure is a concern. Its flexibility and resilience make it a reliable choice for seals in electronics and appliances.

Considerations for Buyers: Buyers in Europe and the Middle East, where regulatory compliance is stringent, should prioritize silicone for applications requiring food safety or medical standards. Understanding local regulations is vital for successful procurement.

PVC Rubber Strips

Key Properties: PVC (polyvinyl chloride) rubber is a versatile material with good resistance to chemicals and moisture. Its operating temperature typically ranges from -10°C to 60°C, making it suitable for moderate environments.

Pros & Cons: PVC is generally low-cost and easy to manufacture, making it a popular choice for many applications. However, it lacks the temperature and UV resistance of other materials like EPDM and Silicone.

Impact on Application: PVC strips are often used in indoor applications where exposure to harsh conditions is minimal. They are effective for sound insulation and light sealing.

Considerations for Buyers: For buyers in regions with fluctuating temperatures, such as parts of Europe, PVC may not be the best choice for outdoor applications. Compliance with local environmental regulations regarding PVC usage is also important.

Summary Table

| Material | Typical Use Case for door rubber strip | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Neoprene | Indoor seals, general-purpose applications | Cost-effective, easy installation | Moderate outdoor durability | Low |

| EPDM | Automotive seals, outdoor applications | Superior weather resistance | Higher cost, adhesive compatibility needs verification | Medium |

| Silicone | Medical, food processing, electronics | Exceptional durability, compliance | Higher initial cost | High |

| PVC | Indoor sound insulation, light sealing | Low-cost, easy to manufacture | Limited temperature and UV resistance | Low |

This analysis provides international B2B buyers with the insights needed to make informed decisions regarding the selection of door rubber strips, ensuring optimal performance and compliance with regional standards.

In-depth Look: Manufacturing Processes and Quality Assurance for door rubber strip

Manufacturing Processes for Door Rubber Strips

The production of door rubber strips involves a series of well-defined stages, ensuring that the final product meets the required specifications and quality standards. Understanding these processes is crucial for B2B buyers looking to procure reliable sealing solutions.

1. Material Preparation

The first step in manufacturing door rubber strips is material preparation. Manufacturers typically use various types of rubber, such as neoprene, EPDM, or silicone, depending on the intended application.

-

Material Selection: Suppliers should provide detailed specifications of the rubber types, including their physical and chemical properties. Buyers should ensure that the selected material meets the performance requirements for their specific environment (e.g., temperature, exposure to chemicals).

-

Compounding: The raw rubber is mixed with additives to enhance its properties, such as UV resistance, durability, and flexibility. This process involves precise measurements and mixing techniques to ensure uniformity.

2. Forming

Once the materials are prepared, the next stage is forming the rubber strips into their desired shapes.

-

Extrusion: This is the most common technique for producing rubber strips. The compounded rubber is forced through a die to create a continuous strip of the required profile.

-

Molding: For custom shapes or more complex designs, molding techniques such as compression or injection molding may be employed. This method allows for greater flexibility in design but often comes with higher costs and longer lead times.

-

Cutting: After extrusion or molding, the rubber strips are cut to specific lengths according to customer specifications. Precision cutting ensures that all pieces meet the exact dimensions needed for installation.

3. Assembly

In some cases, additional components may need to be assembled with the rubber strips.

-

Adhesive Application: If the rubber strip is self-adhesive, manufacturers apply a pressure-sensitive adhesive layer during this stage. The adhesive must be compatible with the rubber material to ensure strong bonding.

-

Integration with Other Materials: Door rubber strips may also be integrated with metal or plastic components for added functionality. This process requires careful handling to maintain the integrity of the rubber.

4. Finishing

The final stage involves finishing the rubber strips to enhance their appearance and performance.

-

Surface Treatment: This may include processes such as vulcanization, which improves elasticity and durability. The strips may also undergo surface treatments to enhance adhesion or resistance to environmental factors.

-

Quality Checks: Before packaging, the finished strips are subjected to various quality control tests to ensure they meet the specified standards.

Quality Assurance in Manufacturing

Quality assurance (QA) is a critical aspect of the manufacturing process for door rubber strips. International B2B buyers should be aware of the relevant standards and testing methods to ensure they receive high-quality products.

International Standards

-

ISO 9001: This is the most recognized quality management standard globally. Manufacturers adhering to ISO 9001 demonstrate their commitment to quality and continuous improvement. Buyers should request certification documents from suppliers to verify compliance.

-

Industry-Specific Standards: Depending on the application, other standards may apply, such as CE marking for products sold in Europe, or API standards for those used in the oil and gas industry. Understanding these standards helps buyers assess the suitability of the products for their markets.

QC Checkpoints

Quality control involves several checkpoints throughout the manufacturing process:

-

Incoming Quality Control (IQC): This initial inspection checks the raw materials for compliance with specifications before production begins. Buyers should inquire about the supplier’s IQC procedures to ensure material quality.

-

In-Process Quality Control (IPQC): Continuous monitoring during production helps identify defects early. This includes checks on the mixing process, extrusion parameters, and dimensions of the strips.

-

Final Quality Control (FQC): After production, finished products undergo rigorous testing. This can include dimensional checks, tensile strength tests, and aging tests to evaluate performance under various conditions.

Common Testing Methods

-

Physical Testing: Buyers should be familiar with tests that measure hardness, tensile strength, elongation at break, and compression set. These metrics provide insight into the material’s durability and performance.

-

Environmental Testing: Testing for resistance to UV light, ozone, and extreme temperatures is essential, particularly for applications exposed to outdoor conditions.

-

Adhesion Testing: For adhesive-backed strips, peel tests ensure that the adhesive maintains its bond under various conditions.

Verifying Supplier Quality Control

For international buyers, verifying the quality control processes of potential suppliers is vital. Here are actionable steps to ensure supplier credibility:

-

Conduct Audits: Engage in regular audits of suppliers to assess their manufacturing processes and quality control systems. This can include on-site visits or remote evaluations.

-

Request Documentation: Suppliers should provide quality assurance documentation, including test reports, certifications, and compliance records. This transparency is crucial for assessing product reliability.

-

Utilize Third-Party Inspections: Consider employing third-party inspection services to verify quality at various stages of production. This can provide an unbiased evaluation of the supplier’s capabilities.

-

Assess Certifications: Look for suppliers with relevant certifications that demonstrate adherence to international quality standards. This adds a layer of assurance regarding product quality.

Conclusion

Understanding the manufacturing processes and quality assurance standards for door rubber strips is essential for B2B buyers, particularly in diverse international markets. By focusing on material preparation, forming, assembly, and finishing stages, as well as implementing robust quality control measures, buyers can ensure they procure high-quality products that meet their specific needs. Engaging with suppliers transparently and verifying their quality practices will further enhance procurement strategies, leading to successful outcomes in various applications across Africa, South America, the Middle East, and Europe.

Comprehensive Cost and Pricing Analysis for door rubber strip Sourcing

Key Cost Components in Door Rubber Strip Procurement

A deep understanding of the cost structure is essential for effective sourcing and negotiation. The total landed cost for door rubber strips typically consists of the following components:

- Raw Materials: Material selection (EPDM, silicone, neoprene, PVC, etc.) is the largest cost driver. Premium formulations or specialty grades for harsh climates or compliance (e.g., fire-retardancy, food-grade) carry higher prices. Global rubber price fluctuations and supply chain constraints can further impact costs.

- Labor Costs: Production processes such as extrusion, vulcanization, and finishing require varying levels of skilled labor. Labor cost differentials between manufacturing regions (e.g., Southeast Asia vs. Europe) significantly influence unit pricing.

- Manufacturing Overhead: Includes factory utilities, machine maintenance, and amortization of equipment. Efficient facilities tend to provide more stable and competitive pricing.

- Tooling and Molds: Custom profiles or branding (such as specific cross-section shapes or co-extruded parts) require upfront tooling investments. For high-volume buyers, these can often be amortized or partially subsidized by the supplier.

- Quality Control: Ongoing QC, product testing (dimensional and material properties), and compliance certifications (ISO, CE, RoHS, etc.) add to the cost. Buyers in regulated markets must factor in these premiums to avoid penalties or import rejections.

- Packaging and Logistics: Export-worthy packaging, integrated labeling, and anti-damage measures incur added costs. Freight (air/sea), customs duties, and insurance must be included, especially for buyers in Africa and South America facing longer supply chains.

- Supplier Margin: Margins vary by supplier reputation, demand, and market positioning. Established brands usually command higher prices, reflecting consistent quality and support.

Pricing Dynamics and Influencing Factors

Pricing for door rubber strips is shaped by a range of variables beyond the basic cost calculation:

- Order Volume & MOQ: Higher volumes yield better economies of scale and lower per-unit costs. Suppliers often set Minimum Order Quantities (MOQs), which can impact price negotiations—especially for buyers from markets with limited warehousing capacity.

- Specification and Customization: Non-standard sizes, cross-sections, colors, durometer (hardness), or adhesive types raise unit costs due to specialized tooling and materials. Standardized options offer quicker lead times and lower costs.

- Material Grade and Source: Sourcing from original manufacturers or those using certified raw materials secures better consistency and performance, but costs more than “grey market” alternatives.

- Quality Assurance & Certifications: Buyers in Europe or the Middle East may require REACH, CE marking, or similar certifications, which tie into added documentation and process control expenses.

- Supplier Location and Reputation: Proximity to major ports, established export experience, and multilingual support often come with price premiums, but reduce risk and hidden costs.

- Incoterms: International Commercial Terms (such as FOB, CIF, DDP) fundamentally change price quotes. Buyers must clarify what each quoted price includes to avoid budget surprises.

Actionable Tips for International B2B Buyers

- Benchmark and Breakdown: Seek detailed quotations with cost breakdowns. Compare multiple suppliers (including direct manufacturers and trading companies) to reveal hidden markups and negotiate effectively.

- Optimize Order Volumes: Combine orders or coordinate buys across departments or subsidiaries to leverage better volume-based discounts and absorb fixed tooling costs more efficiently.

- Balance Quality & Cost: Avoid the false economy of ultra-low-cost strips—substandard materials or poor QC will raise Total Cost of Ownership (TCO) through premature failure, reputational risk, or regulatory hurdles.

- Negotiate Incoterms and Payment Terms: Clarify your preferences early and consider working with suppliers who can consolidate shipments or offer staggered delivery, helpful for buyers in Africa or South America with longer supply chains.

- Anticipate Lead Times & Logistics: Factor regional logistics complexity, customs clearance, and potential port delays into your sourcing schedule—particularly for Middle Eastern and African markets.

- Scrutinize Certifications: Require suppliers to furnish all necessary compliance and test certificates. For higher-value or sensitive contracts, consider third-party lab validation.

Pricing Benchmarks & Market Insights

As of early 2024, indicative FOB prices for door rubber strips range from $1 to $6 per linear meter, depending on material grade, profile complexity, and certification requirements. Bulk and standardized orders attract discounts as low as $0.75/meter, while specialized, low-volume, or highly certified orders may exceed $8/meter. Actual prices fluctuate based on rubber market trends, freight rates, and regional demand.

Disclaimer: All pricing provided is for general reference only and subject to variation based on region, order size, custom requirements, raw material costs, and global logistics conditions. Always request formal, up-to-date quotations from vetted suppliers before finalizing procurement decisions.

By understanding the full scope of cost drivers and pricing influencers, and by applying strategic evaluation and negotiation practices, international B2B buyers can confidently secure competitive, high-performance door rubber strip solutions tailored to their markets’ specific needs.

Spotlight on Potential door rubber strip Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘door rubber strip’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

10 door rubber strip Manufacturers in the world (www.topmfg.info)

Based in China, this manufacturer is recognized among the world’s top suppliers of door rubber strips, with a portfolio that extends to PVC strip curtains and site safety rubber products. The company is well-positioned to support diverse B2B market needs, offering a wide range of door sealing solutions for commercial, industrial, and safety-critical applications. Its strength lies in competitive pricing, international export readiness, and the ability to handle both standardized and volume-custom orders. There are indications of established supply routes to buyers in Africa, South America, the Middle East, and Europe, catering to environments where durability and compliance are paramount. While detailed certification or QC information is limited, the firm’s strong online presence and broad product catalog make it a reliable first-tier sourcing option for global buyers seeking flexibility and scale.

Seal Strip Manufacturers (seashorerubber.com)

Qingdao Seashore Rubber Industrial Co. Ltd, operating from Qingdao, China, is a globally recognized manufacturer specializing in high-quality rubber seal strips, including a diverse range dedicated to door applications. The company’s offerings encompass EPDM, neoprene, and silicone-based door rubber strips, targeting automotive, residential, and industrial sectors. B2B buyers benefit from Seashore Rubber’s ability to accommodate both standard and custom specifications, underpinned by extensive rubber processing expertise and tailored manufacturing capabilities.

The company is noted for its competitive pricing structures and responsiveness to international sourcing needs, making it a reliable choice for buyers in Africa, South America, the Middle East, and Europe. Their export experience, broad product catalog, and apparent focus on quality control (though publicly available certification details are limited) support seamless cross-border procurement. Seashore Rubber stands out for flexibility in order quantities and solutions for demanding climate or regulatory conditions.

10 Rubber strip Manufacturers in World (www.mfgpro.tech)

Rubber strip manufacturers featured by mfgpro.tech offer a global directory of leading suppliers with expertise in door rubber strips and related sealing solutions. Their portfolio includes both broad-line producers and specialized manufacturers with in-house capabilities for materials such as EPDM, neoprene, silicone, and Viton—hallmarks of quality and versatility across diverse B2B applications like construction, automotive, and industrial equipment. Many companies in this network provide custom extrusion services, ensuring tailored profiles and specifications to meet regional compliance requirements and project needs, which is crucial for buyers in Africa, South America, the Middle East, and Europe. While public certification details vary, most highlighted manufacturers emphasize reliable sourcing, scalable production, and global logistics experience—enabling efficient, large-volume procurement and technical support for international B2B clients.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| 10 door rubber strip Manufacturers in the world | Wide range, export-ready, competitive pricing | www.topmfg.info |

| Seal Strip Manufacturers | Diverse door strip range; export-oriented; custom support | seashorerubber.com |

| 10 Rubber strip Manufacturers in World | Global directory, custom profiles, diverse rubber materials | www.mfgpro.tech |

Essential Technical Properties and Trade Terminology for door rubber strip

Key Technical Properties of Door Rubber Strips

When sourcing door rubber strips for industrial, commercial, or infrastructure applications, attention to specific technical properties is essential. These parameters determine product fit, durability, regulatory compliance, and ultimately, customer satisfaction. Below are the most critical properties that international B2B buyers should evaluate:

1. Material Grade

Material selection drives the overall functionality of rubber strips. Common grades include EPDM (superior weather/UV resistance), Neoprene (balanced oil and chemical resistance), Silicone (high/low temperature stability), and Nitrile (excellent oil resistance). Each grade is tailored for distinct industry environments—such as automotive, construction, or medical. Assessing compatibility with your target application prevents premature failure and supports compliance with local or regional standards, especially in harsh climates like the Middle East or Africa.

2. Hardness (Shore A)

Measured on the Shore A scale, hardness indicates the rubber’s resistance to indentation and compression. Lower Shore A values (softer rubbers) are ideal for tight seals and vibration dampening, while higher values suit structural or heavy-duty applications. Precise hardness matching ensures optimal performance, particularly for automotive door seals or industrial enclosures subject to frequent use or pressure variation.

3. Compression Set

This property measures how well the rubber returns to its original thickness after prolonged compressive stress. A low compression set is desirable, as it ensures the door strip maintains an effective long-term seal, crucial for energy efficiency, water ingress prevention, and acoustic insulation. This is especially important in diverse environments across Europe and South America, where temperature and humidity can vary significantly.

4. Dimensional Tolerance

Tolerance defines the permissible variation in profile dimensions during manufacturing. Tight tolerances (for example, ±0.2mm) guarantee consistent fit and prevent installation issues or quality complaints. For high-volume OEM projects or export orders with strict specifications, ensuring reliable dimensional accuracy is critical to minimizing supply chain disruptions.

5. UV and Ozone Resistance

Not all rubber grades are equal in resisting UV radiation and ozone, which cause brittleness, cracking, and performance loss. EPDM is usually preferred when high UV/ozone resistance is needed, such as for external doors in Africa or the Middle East. Long-term durability in challenging environments contributes directly to total cost of ownership.

6. Adhesion Strength (for Self-Adhesive Strips)

For products featuring a pressure-sensitive adhesive backing, high adhesion strength across different substrate materials (metal, plastic, wood) is crucial. Poor adhesive quality leads to detachment, costly rework, and reputational risk, particularly when shipping to international markets where after-sales support is limited.

Core Trade and Industry Terminology

Clarity around commercial and technical terminology improves buyer-supplier coordination and risk management. Key terms include:

-

OEM (Original Equipment Manufacturer): Refers to suppliers producing rubber strips either to their own specification or strictly to the buyer’s design. For large-scale or brand-driven projects, OEM capabilities ensure tailor-made performance and secure competitive differentiation.

-

MOQ (Minimum Order Quantity): The smallest batch a supplier is willing to produce or sell. Understanding MOQ helps buyers align purchase planning with their cash flow, inventory policies, and market demand—critical for buyers in emerging regions managing diverse customer bases.

-

RFQ (Request for Quotation): A formal document sent to potential suppliers to obtain detailed pricing, lead times, and technical submissions. Crafting a clear RFQ, complete with test standards and property requirements, accelerates procurement cycles and avoids miscommunication.

-

Incoterms: International Commercial Terms define responsibility for shipping, insurance, and customs at each transaction stage (e.g., EXW, FOB, CIF). Correct Incoterm selection protects buyers from unexpected costs and logistical delays—especially significant for shipments across continents.

-

REACH/RoHS Compliance: Acronyms referencing European directives governing use of hazardous substances. Even for projects outside Europe, specifying these standards during procurement can future-proof supply chains and widen resale/installation markets.

-

Lead Time: The total duration required for manufacturing, quality inspection, and global delivery. Knowing the lead time is essential for project scheduling and inventory management, especially where supply chain disruptions are common.

By prioritizing these technical specifications and mastering the trade terminology, B2B buyers position themselves to secure the safest, most reliable, and cost-effective door rubber strips for their operational or resale needs worldwide.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the door rubber strip Sector

Global Market Overview & Key Sourcing Trends

The door rubber strip sector is experiencing a period of rapid transformation, shaped by dynamic global trade patterns, evolving end-user requirements, and technological advancements. As essential components for sealing, insulation, and vibration damping, door rubber strips are indispensable to industries such as construction, automotive manufacturing, logistics, and public infrastructure. The international B2B landscape across Africa, South America, the Middle East, and Europe reflects a rising demand for high-performance, customizable strip solutions that meet increasingly stringent quality and compliance standards.

Key market drivers include the expansion of urban infrastructure projects, growth in vehicle production, and the emphasis on energy-efficient building construction. B2B buyers are prioritizing strips with enhanced weather resistance, thermal insulation, and longevity—attributes particularly critical in regions with harsh climates or significant temperature fluctuations, such as South Africa and the Middle East. Consequently, materials like EPDM and advanced silicones have gained prominence for their durability and versatility.

Emerging sourcing trends encompass a marked shift toward digital procurement platforms, allowing buyers to compare international suppliers, obtain real-time quotations, and conduct quality audits remotely. The rise of on-demand manufacturing and custom extrusion has made it feasible to source door rubber strips tailored for specific applications, including unique profiles or integrated adhesives. Global buyers are also adopting a multi-sourcing strategy to mitigate supply chain disruptions and adapt to fluctuating shipping lead times—a trend amplified by recent logistical challenges and geopolitical uncertainties.

In response, established suppliers—especially in Asia and parts of Europe—are investing in smart manufacturing processes, including automated extrusion lines and precision inspection systems. These investments are improving efficiency and enabling consistent compliance with diverse international regulations. For B2B buyers, the ability to access detailed material test data, batch certifications, and digital documentation is becoming a key differentiator in supplier selection.

Sustainability and Ethical Sourcing Priorities

Sustainability considerations are now integral to B2B procurement decisions in the door rubber strip market. Environmental regulations are tightening across many export and import jurisdictions, particularly the EU, driving demand for eco-friendly materials and production practices. International buyers are increasingly expected to demonstrate that their supply chains minimize environmental impact while upholding ethical labor standards.

Key sustainability practices include sourcing rubber from certified sustainable forestry or plantations, reducing the use of hazardous chemicals, and implementing closed-loop manufacturing to recycle scrap material. Manufacturers offering door rubber strips made from recycled or bio-based elastomers can provide compelling value for buyers seeking to advance their organization’s environmental, social, and governance (ESG) objectives. Additionally, the adoption of water-based adhesives and processes with lower volatile organic compound (VOC) emissions supports compliance with both local and export-market environmental requirements.

Third-party certifications such as ISO 14001 (Environmental Management), REACH, and RoHS are increasingly non-negotiable for global tenders—especially within Europe and multinational projects based in Africa and the Middle East. Ethical sourcing requirements, such as compliance with ILO standards and fair labor audits, are also under scrutiny in response to consumer and shareholder activism. Buyers often favor suppliers who can provide transparent audit trails, documented origin of raw materials, and traceable supply chain data.

Action point for buyers: Integrate sustainability criteria into the early stages of supplier pre-qualification and request relevant documentation proactively. Building long-term partnerships with suppliers who invest in green manufacturing and ethical sourcing not only ensures compliance but can also provide a reputational advantage in your end-markets.

Evolution and Historical Perspective

Door rubber strips have evolved from simple natural rubber extrusions to a diverse portfolio of high-performance, application-specific sealing solutions. In the early years, usage was dominated by generic strips primarily designed for basic draught-proofing. The rise of the automotive and construction sectors in the mid-20th century drove innovation, leading to the adoption of synthetic elastomers like EPDM, neoprene, and silicone—each offering unique resistance characteristics catered to new industrial requirements.

Advancements in extrusion technology and adhesive systems have since enabled the development of complex profiles, self-adhesive variants, and strips with embedded value-added features (e.g., fire retardancy, antimicrobial coatings). As global trade has intensified, standardization and compliance have become central, prompting the sector’s leading manufacturers to invest in quality management, material traceability, and R&D. Today, the door rubber strip market is highly differentiated, with buyers empowered to source precision-engineered solutions aligned with regulatory, environmental, and performance criteria across continents.

Related Video: THINK GLOBAL CONFERENCE 2021 – The basics of international trade compliance

Frequently Asked Questions (FAQs) for B2B Buyers of door rubber strip

-

How should international B2B buyers effectively vet door rubber strip suppliers for quality and reliability?

Begin by assessing the supplier’s manufacturing credentials, such as ISO 9001 or IATF 16949 certifications, which suggest consistent product quality. Request product samples and technical data sheets to validate claims about material performance (e.g., resistance to UV, chemicals, or extreme temperatures). Investigate the supplier’s export experience, especially to markets like Africa, South America, or Europe, and seek recent customer references. Performing remote or on-site factory audits, even through third parties, adds further assurance. Clear responses to technical and compliance questions indicate supplier reliability. -

Can door rubber strips be customized for unique applications or regional requirements?

Yes, most reputable manufacturers offer tailored solutions to match your specific design, dimensional, or performance needs. Common customizations include material selection (EPDM, silicone, neoprene, etc.), profile shape (D, P, E, or bespoke geometries), adhesive options, and color. Specify target standards for fire, chemical, or weather resistance depending on region—such as REACH compliance for Europe or high UV-resistance for Middle East markets. Provide clear technical drawings and detailed specifications early to minimize sampling cycles and avoid delays in mass production. -

What are typical minimum order quantities (MOQs), lead times, and acceptable payment terms for international orders?

MOQs vary greatly—often 500 to 3,000 meters depending on material and profile complexity. For repeat or high-value buyers, some suppliers are open to negotiation. Lead times usually range from 15 to 45 days, with sampling and customization extending timelines. For payment, common terms include 30% deposit with balance before shipment, L/C at sight, or net terms for trusted partners. Clarify all terms in advance and ensure payment timelines align with your cash flow and shipping requirements to avoid production or delivery bottlenecks. -

Which quality assurance measures and certifications should B2B buyers insist on when sourcing door rubber strips?

Insist on quality documentation such as Certificates of Analysis (COA), RoHS or REACH compliance (especially for the EU), and test reports for properties like tensile strength, aging, and compression set. Ask about manufacturer in-house QC protocols, such as dimensional checks during extrusion, tear resistance tests, and process traceability. For critical projects, consider third-party inspection before shipment. Stay alert for counterfeit certifications—verify through official channels when possible. These steps reduce quality risks in dynamic global supply chains. -

How can buyers ensure compliance with relevant international and local regulations?

Begin by mapping all regulations in the destination country—including EU REACH for Europe, fire safety standards for building codes, or automotive certifications if relevant. Share these compliance prerequisites with suppliers early, demanding documented evidence—not just verbal assurances. For emerging markets, verify any mandatory customs documentation or marking requirements, as non-compliance can result in customs holds or fines. Maintain clear records of all compliance correspondence to safeguard against future audits or liability disputes. -

What are the best practices for organizing international logistics and minimizing shipping risks?

Choose suppliers experienced with your region’s shipping networks and regulations. Define Incoterms (e.g., FOB, CIF) clearly in contracts to allocate responsibility for customs clearance, insurance, and freight. Verify the packaging—robust cartons or pallets suited to ocean or air transit—to prevent damage. Insist on tracking and timely shipment updates, and consider freight forwarders familiar with local import requirements. For project deadlines, build in buffer time for customs clearance and unforeseen delays, especially in Africa and South America where port congestion can occur. -

How should buyers handle disputes or claims regarding quality or delivery issues?

Address disputes quickly and formally, documenting the issue with photos, test reports, and clear timelines. Refer to contracted quality specifications and Incoterms to structure your claim. Effective suppliers will offer replacement, credit, or rework arrangements. Consider using international arbitration clauses in contracts to streamline resolution for higher-stakes or cross-border disputes. Maintaining regular communication and cultivating long-term relationships help ensure supplier cooperation and amicable settlements. -

What strategies can buyers use to secure competitive pricing and optimize total cost of ownership?

Benchmark prices by inviting quotes from multiple suppliers across regions, factoring in not just unit costs but also freight charges, customs duties, and potential maintenance/replacement intervals. Consider consolidating orders, standardizing specifications, or negotiating long-term contracts to unlock volume discounts. Evaluate lifecycle value—such as lower maintenance for higher-grade materials like EPDM versus initial savings with basic neoprene. Over time, close supplier collaboration on forecasting and cost drivers will yield price stability and improved bottom-line outcomes.

Strategic Sourcing Conclusion and Outlook for door rubber strip

Key Takeaways for International Buyers

Effective sourcing of door rubber strips hinges on a clear understanding of material properties, application environments, and regional compliance standards. Buyers in Africa, South America, the Middle East, and Europe must consistently balance quality, cost-efficiency, and supply reliability. Prioritizing supplier due diligence—including verification of manufacturing certifications, product testing protocols, and on-time delivery records—is essential to mitigate supply chain risks and ensure long-term value. Collaboration with manufacturers who offer both robust customization capabilities and transparent quality assurance can deliver a significant competitive edge.

Reinforcing the Value of Strategic Sourcing

A strategic sourcing approach goes beyond price negotiations and transactional procurement. It empowers your organization to optimize total cost of ownership, enhance product performance, and meet evolving regulatory or market-specific demands. By staying attuned to materials innovation—such as eco-friendly or high-durability compounds—buyers can future-proof their projects and respond to growing demands for sustainability and operational excellence.

Looking Ahead: Positioning for Future Success

The global market for door rubber strips will continue to advance, shaped by shifting industry standards, sustainability initiatives, and evolving customer needs. International procurement teams are encouraged to regularly review supplier networks, embrace digital sourcing tools, and foster partnerships grounded in transparency and shared innovation. Now is the time to leverage strategic sourcing to secure not only the right products but also resilient, scalable supply relationships that position your business for growth in both established and emerging markets.