Introduction: Navigating the Global Market for gaskets and sealants

When it comes to industrial performance and operational reliability, gaskets and sealants are the unsung heroes that keep global industries running smoothly. From preventing catastrophic leaks in oil refineries to ensuring the hygienic integrity of food processing facilities, these essential components safeguard assets, protect reputations, and underpin regulatory compliance across borders. For B2B buyers in markets as diverse as Nigeria, Brazil, Saudi Arabia, and Germany, the complexity of specifying, sourcing, and importing the right gaskets and sealants can shape the success—or failure—of entire projects.

Navigating the global marketplace for these products has never been more critical. With rapid advancements in manufacturing, increasing demands for sustainability, and shifting international standards, procurement leaders face a landscape crowded with material options, manufacturing techniques, supplier claims, and evolving price dynamics. Diverse regional climates—from the humid tropics of Indonesia to the arid Middle East—further complicate selection, driving home the need for highly tailored sealing solutions that can withstand specific operational stresses.

This comprehensive guide demystifies the world of gaskets and sealants, empowering you to make strategic, data-backed sourcing decisions. Inside, you’ll find:

- Clear categorization of gasket and sealant types, and their most suitable industrial applications

- Expert analysis of material choices (including rubber, PTFE, graphite, and metals) and their performance in varying chemical, temperature, and pressure environments

- Insight into modern manufacturing methods and quality certifications relevant to international and local markets

- Step-by-step frameworks for vetting global suppliers, with focus on compliance, reliability, and total landed costs

- Actionable advice for navigating regional market realities, logistical challenges, and evolving global price trends

- Answers to common B2B sourcing challenges derived from real-world international projects

By delivering practical insights and a deep market perspective, this guide equips B2B buyers—whether new to global procurement or seasoned professionals—to reduce risk, unlock better value, and secure reliable sealing solutions for any industrial environment.

Understanding gaskets and sealants Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard O-Ring | Toroidal shape, elastomeric, fits in circular grooves | Hydraulic/pneumatic sealing, pumps | Economical, widely available; limited to round groove applications |

| Flat Sheet Gasket | Flat, cut from sheet material, customizable shapes/sizes | Flanged joints, equipment enclosures | Highly versatile, cost-effective; requires precise cutting |

| Spiral Wound Gasket | Alternating metal and filler layers wound in spiral | High-pressure pipelines, heat exchangers | Withstands extremes; expensive, needs skilled installation |

| Metallic Gasket | Manufactured from solid or profiled metals | Oil & gas, chemical processing | Excellent at high temp/pressure; rigid, costlier |

| Industrial Sealant | Liquid/paste; cures in place to fill irregular surfaces | Thread sealing, pipe joints, assemblies | Adapts to complex gaps; may need cure time, harder to inspect |

Standard O-Ring

Standard O-rings are circular seals made from elastomer materials like NBR, EPDM, or FKM. Their simple design makes them an industry staple for sealing static and dynamic joints, especially in hydraulic and pneumatic systems. For B2B buyers, especially across international markets, sourcing in both metric and imperial standards is crucial to ensuring compatibility with global machinery. Key considerations include chemical and temperature resistance, certification requirements, and the ability of suppliers to provide consistent quality and rapid delivery for high-volume needs.

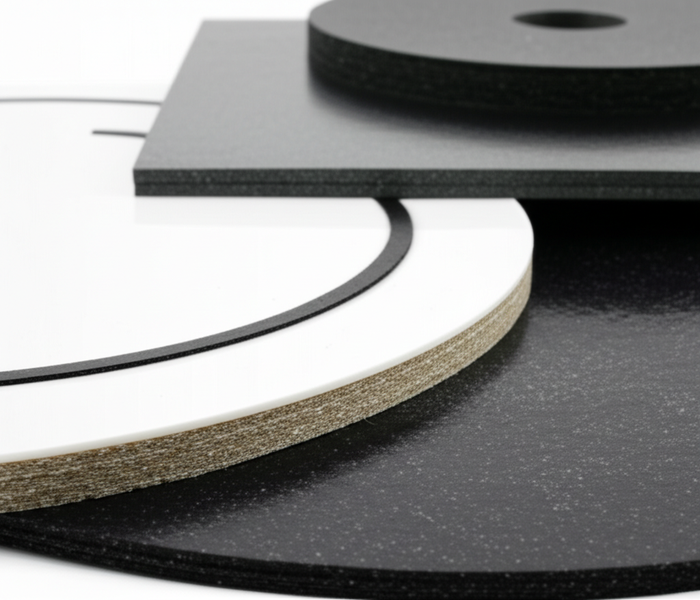

Flat Sheet Gasket

Flat sheet gaskets are tailored from materials like rubber, graphite, PTFE, and fiber composites to match specific equipment contours. Their adaptability suits them to enclosure flanges, compressors, pipeline connections, and general-purpose sealing where surface irregularities exist. When procuring, B2B buyers must assess not only material compatibility with the process media but also the precision of the supplier’s cutting methods. Reliable partners should offer a range of certified materials, scalability for small and large orders, and rapid prototyping and modification services.

Spiral Wound Gasket

Spiral wound gaskets combine resilience and strength through alternating layers of metal (often stainless steel or Inconel) and soft fillers like graphite or PTFE. These gaskets excel in applications where extreme pressure and temperature variations are present, such as petrochemical plants and refineries. Buyers should ensure suppliers adhere to global standards (e.g., ASME, EN), offer robust export packaging, and provide technical guidance for installation. While costlier than standard gaskets, their durability and safety performance often justify the investment for mission-critical sealing points.

Metallic Gasket

Metallic gaskets, such as ring-type joints (RTJ) and corrugated metal designs, are engineered entirely from metals like steel, copper, or advanced alloys. These are indispensable in high-risk environments—oil & gas, chemical processing—where conventional elastomers can fail due to heat, pressure, or aggressive chemicals. When sourcing, buyers need to closely evaluate supplier capabilities in metallurgy, traceability, and the provision of international compliance documentation (e.g., API, NORSOK). The initial price may be higher, but reliability and safety gains are often substantial.

Industrial Sealant

Industrial sealants are viscous compounds applied in liquid or paste form that chemically cure to seal gaps between joints, threads, or flanges. Commonly used for pipework, threaded fittings, assemblies, and filling irregular surfaces where traditional gaskets may not suffice, they offer flexibility and convenience for on-site repairs and complex geometries. Buyers should consider product compatibility with substrates, resistance to chemicals and pressures, cure time requirements, and local regulations regarding VOCs or hazardous content. Partnering with reputable suppliers is essential for ensuring consistent formulation and support across regions.

Key B2B Takeaways:

Selecting the right gasket or sealant involves evaluating not just technical performance but also supplier quality, export readiness, and region-specific needs such as certifications or climate adaptability. International buyers should maintain close collaboration with manufacturers to optimize lead times, technical specifications, and post-purchase support, ensuring durable, compliant, and cost-effective sealing solutions suited to their operational environments.

Related Video: Lecture 1 Two compartment models

Key Industrial Applications of gaskets and sealants

| Industry/Sector | Specific Application of gaskets and sealants | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Oil & Gas | Flange joint sealing in pipelines and pressure vessels | Leak prevention, safety, compliance | Chemical compatibility, API/ISO certification, supplier traceability |

| Power Generation | Turbine, boiler, and heat exchanger sealing | Efficiency, uptime, thermal resilience | High temperature/pressure tolerance, life-cycle cost, regional standards |

| Food & Beverage | Hygienic sealing for processing equipment and piping | Sanitary compliance, contamination-free operation | FDA/EU food-grade certifications, non-reactive materials, traceability |

| Water Treatment | Sealing pumps, valves, and filtration systems | Leak-free operation, equipment longevity | Resistance to diverse chemicals, local environmental regulations, flexible supply |

| Mining & Heavy Equipment | Dust, fluid, and anti-vibration sealing in machinery | Equipment protection, reduced maintenance | Abrasion and chemical resistance, custom dimensions, backup stock levels |

Oil & Gas

Gaskets and sealants are fundamental in the oil and gas industry, ensuring secure, leak-free flange joints in pipelines, separators, compressors, and pressure vessels. They protect against hazardous leaks, environmental contamination, and costly downtime. For international buyers, selecting materials compatible with hydrocarbons, aggressive chemicals, and local climate conditions is crucial. Compliance with API or ISO standards and the ability to trace materials and manufacturing processes back to the source are non-negotiable requirements, especially in regions with strict safety regulations like the Middle East or offshore operations in Africa and South America.

Power Generation

Power plants rely on gaskets and sealants to maintain airtight and watertight seals in turbines, boilers, and heat exchangers under extreme temperatures and pressures. Failure in sealing can result in energy loss, hazardous leaks, or catastrophic equipment damage. Buyers must source high-performance materials—such as graphite, metal, or advanced composites—with proven resistance to temperature cycling and corrosive fluids. Adhering to regional standards, ensuring longevity, and assessing suppliers for documented life-cycle testing are vital, particularly for plants in Europe and rapidly expanding markets like Brazil or Indonesia.

Food & Beverage

In the food and beverage sector, gaskets and sealants are used to maintain hygienic seals on processing tanks, piping systems, and filling machines. These components prevent microbial ingress and cross-contamination, ensuring product safety and regulatory compliance. Buyers must prioritize FDA, EU 1935/2004, or equivalent certifications, and verify that all sealing materials are inert, non-toxic, and resistant to cleaning agents. Given diverse regional export requirements, traceability and documentation of food-grade compliance are especially important for suppliers serving markets in Europe and beyond.

Water Treatment

Gaskets and sealants play a critical role in water and wastewater treatment plants, sealing pumps, valves, and filter housings across a range of operating conditions. They ensure reliable operation despite exposure to chlorinated water, caustic chemicals, and variable pressures. International buyers should look for materials tested for chemical resistance and long-term durability, and confirm that suppliers can accommodate varying local regulations regarding potable water safety. The ability to provide responsive, region-adapted supply chains is a significant advantage, especially in Africa and emerging economies.

Mining & Heavy Equipment

Mining and heavy machinery environments expose sealing components to abrasive slurries, dust, high pressures, and vibration. Gaskets and sealants are used in engine housings, hydraulic systems, and protective casings to prevent fluid leaks, entry of contaminants, and minimize vibration-induced damage. Buyers in remote or challenging regions such as South America or Africa require robust, application-specific solutions—often with custom dimensions and rapid turnaround. Supplier ability to deliver rugged, wear-resistant materials and maintain substantial stock levels to reduce equipment downtime is essential for operational reliability.

Related Video: Gaskets Definition and their functions

Strategic Material Selection Guide for gaskets and sealants

Rubber-Based Elastomers (Nitrile, EPDM, Neoprene)

Rubber-based materials, especially Nitrile (NBR), EPDM, and Neoprene, are among the most widely used options for gaskets and sealants in industrial applications. They offer good flexibility, moderate chemical resistance, and effective sealing under low to moderate temperature and pressure. Nitrile is particularly prized for oil and fuel resistance, while EPDM excels with water and steam, and Neoprene balances oil and ozone resistance. From a manufacturing standpoint, these elastomers are cost-effective and compatible with various cutting or molding processes, which supports fast production for both standard and customized parts.

Pros:

– Excellent flexibility and sealing for flanges and irregular surfaces

– Broad availability in global supply chains

– Relatively low cost with wide material certifications (ASTM, ISO, DIN)

Cons:

– Limited upper temperature capability (typically up to 120–150°C, depending on type)

– Poor chemical resistance versus aggressive solvents or strong acids

– Can degrade in outdoor, UV, or ozone-rich environments (except EPDM)

International B2B Considerations: Sourcing rubber gaskets is straightforward globally, but buyers in hot climates (e.g., Middle East, Africa) must confirm the compound can tolerate local ambient temperatures or UV exposure. Pay attention to regional water standards or oil compatibility when specifying for water treatment or petrochemical projects in Europe or South America.

Graphite and Carbon Materials

Flexible graphite and carbon-based gaskets and sealants are engineered for high stability in extreme environments—both in terms of temperature (up to ~450°C for graphite) and chemical exposure. These materials are self-lubricating and highly conformable, providing superior sealing even when flange surfaces are imperfect. They are often used in energy, processing, and refinery sectors where steam, acids, or hydrocarbons are present.

Pros:

– Outstanding chemical and thermal resistance

– Maintains sealing under cycling temperature/pressure

– Suitable for aggressive media (acids, solvents, steam)

Cons:

– Higher production cost compared to rubber or fiber

– Brittle and may require metal inserts for strength in wide flanges

– Not ideal for highly oxidizing environments at elevated temperatures

International B2B Considerations: For buyers in South America and the Middle East (oil & gas, chemical processing sectors), focus on supplier ability to meet relevant quality standards (API, ASTM F36, EN13555). Packaging and shipping can be critical, as graphite materials are sensitive to bending and impact—ensure logistics partners are vetted for export protection.

Polytetrafluoroethylene (PTFE and Filled PTFE)

PTFE, commonly recognized by the brand name Teflon®, is valued for its near-universal chemical inertness and the ability to function at both very low and moderately high temperatures (approximately -200°C to +260°C). Expanded or filled PTFE composites further broaden application suitability—handle higher pressure or mechanical loads, or offer anti-creep characteristics.

Pros:

– Wide chemical compatibility (almost all industrial fluids except molten alkali metals and fluorine gas)

– Non-stick, does not support microbial growth (suitable for food, pharma, water)

– Consistent performance across a wide temperature spectrum

Cons:

– High material cost

– Can be prone to cold flow (creep) under long-term pressure unless filled/expanded grades are used

– Lower mechanical strength compared to metals or reinforced graphite

International B2B Considerations: PTFE is favored in process industries, water treatment, and where hygiene or regulatory compliance (FDA, EU 1935/2004) is needed. In hot or humid regions (Africa, Southeast Asia), PTFE’s resistance to chemical attack and microbial growth is a key asset. Always confirm material grade and certification (ASTM F104, ISO 12086-1), as performance varies significantly.

Metallic Gaskets (Stainless Steel, Inconel, Copper)

Metallic gaskets—formed from stainless steel, Inconel, copper, or alloys—are essential for severe conditions: high pressure, high temperature, or extreme chemical exposure (steam, hydrocarbons, aggressive chemicals). They are routinely used in petrochemical refineries, power generation, and heavy industrial sectors. Precision machining or spiral winding techniques ensure both durability and effective sealing under compressive load.

Pros:

– Withstands extreme temperatures/pressures

– High durability and reusability in some designs

– Excellent for applications requiring fire safety or critical containment

Cons:

– High acquisition and installation costs

– Demands precise flange finishes and bolt loads

– Not suitable for low-pressure/severe misalignment situations

International B2B Considerations: When sourcing metallic gaskets across Africa, South America, and the Middle East, insist on full traceability and compliance (ASME B16.20, EN1514-2, API 6A). Bulk shipments should be checked for proper marking/packaging to avoid substitution of inferior grades, a common risk in cross-border trade.

Material Comparison Table

| Material | Typical Use Case for gaskets and sealants | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Nitrile/EPDM/Neoprene Rubber | General industrial sealing, piping, water treatment, low/moderate oil service | Cost-effective, easy to source and fabricate | Limited temperature and chemical resistance | Low |

| Flexible Graphite/Carbon | Refineries, chemical plants, high-temp steam, acids | Superb temperature and chemical tolerance | Brittle, higher cost, may need reinforcement | Medium |

| PTFE/Filled PTFE | Food processing, pharma, aggressive chemicals, water, sanitary | Universal chemical inertness, hygiene rating | Expensive, cold flow/can creep under pressure | High |

| Stainless Steel/Inconel/Copper (Metallic) | Oil & gas, power gen, high-pressure steam, petrochemicals | Withstands extremes, very durable | Costly, installation-sensitive, not for soft/uneven flanges | High |

In-depth Look: Manufacturing Processes and Quality Assurance for gaskets and sealants

Key Stages in Gasket and Sealant Manufacturing

Delivering reliable gaskets and sealants at scale requires a disciplined, multi-stage manufacturing process. Each stage—beginning with meticulous material selection and running through precise forming, assembly, and finishing—has a direct impact on end-product performance and compliance. Understanding these steps gives B2B buyers critical leverage when specifying requirements and negotiating with global suppliers.

1. Material Preparation: The Foundation of Performance

The process starts with selecting raw materials to match the intended application’s chemical, mechanical, and temperature demands. For gaskets, materials range from elastomers (NBR, EPDM, FKM) and soft fibers, to metals (stainless steel, Inconel) and advanced composites (PTFE, graphite, ceramic fiber). For sealants, silicone, polyurethane, acrylics, and modified butyl rubbers are common.

Quality-focused manufacturers enforce robust material procurement protocols:

– Supplier vetting: Raw material origin, batch traceability, and supplier certifications like ISO 9001 are verified.

– Material certification: Compliance with global (ASTM, EN, JIS) and application-specific standards (e.g., FDA, NSF, API) is checked.

– Incoming inspection: Material integrity—thickness, hardness, purity, and uniformity—is measured by lab or inline tests.

This stage is particularly crucial for buyers in regions with extreme climates (e.g., the Middle East, sub-Saharan Africa) or those operating across multiple regulatory regimes.

2. Forming and Shaping: Techniques That Define the Product

Material is transformed into gaskets and sealants by methods tailored to order volume and design complexity:

- Die Cutting & CNC Cutting: Used for flat gaskets from sheets (fiber, rubber, PTFE, graphite). CNC cutting achieves precision tolerances for custom or complex profiles.

- Compression/Injection Molding: Suitable for large quantities of rubber, silicone, or custom-profile gaskets. Mold tools must be regularly maintained and verified.

- Spiral Winding: Combines metallic and filler ribbons into spiral wound gaskets for high-pressure or temperature applications—common in oil & gas, chemical, and refining industries.

- Stamping and Machining: Employed for solid metal gaskets; often performed under strict controls for thickness and flatness.

- Sealant Compounding & Packaging: For liquid or paste sealants, automated batching and mixing units guarantee uniformity before packaging into cartridges or drums, often in controlled environments to avoid contamination.

Throughout forming, process parameters—pressure, temperature, dwell time—are tracked and recorded, supporting both consistency and traceability.

3. Assembly and Final Processing

Assembly steps vary by product type:

– For gaskets: Multi-material types may require bonding (lamination), metal insertion, or application of anti-stick coatings.

– For sealants: Homogenization continues as material is transferred into final packaging, ensuring mixture integrity.

Intermediate inspections (in-process QC) confirm dimensional accuracy, material adherence, and absence of structural defects.

Finishing involves trimming, deburring, marking (e.g., laser/inkjet for lot tracking), and—where necessary—surface treatments for corrosion resistance or improved sealing.

Essential Quality Control Practices & Standards

For B2B buyers globally, quality assurance is non-negotiable. Trusted suppliers institutionalize multilayered quality control checkpoints that combine international best practices with local compliance needs.

Quality Management Systems and Product Standards

- ISO 9001: The backbone for consistent process and documentation; certification indicates robust end-to-end quality management.

- Industry-Specific Approvals:

- API (American Petroleum Institute): Required for gaskets in oil & gas.

- EN 1514/EN 13555: European standards guiding gasket dimensions and performance.

- CE Marking: Essential for gaskets used within Europe in regulated applications.

- FDA / NSF / WRAS: Critical for food, beverage, and potable water seals.

International buyers, especially from Africa and South America, should prioritize suppliers already holding both foundational (ISO 9001) and application-specific certifications matching export destination requirements.

QC Checkpoints: From Material to Shipment

Effective QC hinges on staged inspections—each an opportunity for defect elimination and compliance confirmation:

– Incoming Quality Control (IQC): Verifies raw material and critical component conformance upon arrival.

– In-Process Quality Control (IPQC): Monitors forming, molding, and assembly. Measurements include thickness, density, surface finish, and bonding integrity.

– Final Quality Control (FQC): Comprehensive checks on finished products covering:

– Dimensions: Tolerances checked by coordinate measuring machines (CMM) or calibrated gauges.

– Physical Integrity: Visual inspection for cracks, voids, or delamination.

– Performance Testing: Pressure, temperature, and chemical resistance—often simulated in test rigs or using accelerated aging methods.

– Leakage and Compression Set: Critical for pressure-rated gaskets and dynamic sealants.

– Batch Testing: Representative products may undergo destructive testing to validate claims.

For sealants, additional chemical composition analysis (DCS, GC-MS) may be conducted to confirm formulation compliance.

Common Testing Methods

- ASTM F36 (Compressibility/Recovery for Gaskets)

- ASTM D2240 (Hardness, Shore Durometer)

- ASTM F37 (Sealability)

- Hydrostatic/Helium Leak Testing

- Thermal Cycling and Chemical Resistance Soak Tests

Buyers in the Middle East and South America should pay particular attention to hydrocarbon resistance and high-temperature tests, while those in Europe must demand RoHS/REACH compliance and robust documentation for CE conformity.

Verifying Supplier Quality: B2B Best Practices

Sourcing internationally demands more than reviewing certificates. Sophisticated buyers deploy a layered approach to due diligence:

- On-site Audits: Arrange pre-contract or periodic supplier audits to verify QMS implementation, calibration of equipment, and operator training.

- Third-Party Inspections: Engage firms (e.g., SGS, Intertek, TÜV) for independent batch or shipment checks. This is invaluable for buyers in Africa or South America scaling partnerships with unfamiliar suppliers.

- Document Review: Scrutinize material certificates, test reports, process logs, and traceability data (batch and lot coding).

- Sample Validation: Require production sample runs and independent lab testing—especially for high-stakes industries such as oil & gas, pharma, and water treatment.

- Performance Guarantees: Negotiate clear warranty terms and expectations for post-sale support.

When importing into markets with variable regulatory scrutiny or limited in-country testing labs (common in Africa and parts of the Middle East), securing multilingual documentation and leveraging global inspection networks is essential for uninterrupted customs clearance.

Navigating Quality Nuances for Global Markets

International B2B buyers must harmonize global best practices with region-specific requirements:

- Regulatory Alignment: Confirm compatibility with end-user country regulations early; for instance, EN/CE for Europe, INMETRO for Brazil, SASO for Saudi Arabia.

- Climate and Application Fit: Ensure material choices and test regimens reflect local operational realities—high humidity, extreme temperatures, or aggressive media.

- Logistics and Packaging: Specify export-grade packaging, moisture barriers, and shipment labelling in local languages per destination norms.

- Supplier Collaboration: Foster transparent communication with suppliers regarding documentation, process changes, and non-conformance reporting.

By mastering these manufacturing and quality assurance fundamentals, buyers gain control—reducing the risk of supply disruptions, costly failures, or compliance gaps regardless of region.

Key Takeaway for B2B Buyers:

Stay proactively engaged with your supply base—demand rigorous, transparent QC backed by international certifications and third-party verification. A well-structured approach to manufacturing oversight and quality assurance not only elevates safety and reliability but also confers a competitive sourcing advantage across diverse markets.

Related Video: Glenroy’s Flexible Packaging Manufacturing Process

Comprehensive Cost and Pricing Analysis for gaskets and sealants Sourcing

Key Cost Components in Gasket and Sealant Procurement

When sourcing gaskets and sealants at scale, understanding the primary cost drivers is essential for effective budgeting and supplier negotiations. The total unit cost can be broken down into:

- Raw Materials: Material selection has a major impact. Commodity grades (e.g., natural rubber, basic fiber sheet) are less expensive than high-performance options like graphite, PTFE, Viton®, or specialty metals. For sealants, costs vary significantly between silicones, polyurethanes, and high-spec chemistries.

- Manufacturing Labor: Labor accounts for more of the cost for custom-molded gaskets, intricate die-cut shapes, or sealants requiring precision blending. Automated processes reduce labor costs on repeat orders and standard items.

- Manufacturing Overhead: Facility expenses, energy, tooling wear, and in-plant logistics factor into overhead. These often vary by country, so expect differences between, for example, an EU-certified operation and a Southeast Asian plant.

- Tooling and Customization: Standard sizes avoid major tooling costs. However, customized profiles, unique shapes, or small-batch runs may carry significant one-off tooling or die-cut fees—often amortized over your order volume.

- Quality Control and Certification: Testing, inspection, and compliance (such as ISO 9001, FDA, or ASME/EN standards) add to costs, especially for critical-use gaskets in regulated industries (pharma, food, oil & gas).

- Logistics and Shipping: Heavy or bulky gasket shipments and hazardous or temperature-sensitive sealants increase freight charges—particularly for cross-continental orders.

- Supplier Margin: Varies according to the supplier’s overhead, market position, and order size. Higher margins are typical for low-MOQ, urgent, or highly customized orders.

Major Price Influencers in Global B2B Sourcing

Numerous factors affect final purchase price—these should guide your sourcing strategy and negotiations:

- Order Volume & MOQ: Higher volumes enable economies of scale, reducing price per unit. Many suppliers offer price breaks at quantity thresholds. Be attentive to minimum order quantity (MOQ) policies, which can be stricter for specialized items.

- Product Specification & Customization: Bespoke shapes, tight tolerances, branded sealants, or unique certification requirements boost both direct and indirect costs. Standardized products remain most cost-efficient.

- Material Choice: The leap from basic NBR or SBR rubbers to PTFE, graphite, Viton®, or metallic/alloy gaskets is substantial—often multiplying material costs 2–5x or more.

- Quality & Documentation: Demanding certificates of compliance or origin, third-party testing, and detailed traceability can increase quotations. For export, documentation also affects customs processing and fees.

- Supplier Type & Location: Large manufacturers may undercut smaller shops on price but offer less customization. Exporters from Asia may have lower costs, but buyers must weigh compliance, shipping times, and after-sales support. Proximity to ports, air freight facilities, and your own operation impacts total landed cost.

- Incoterms and Delivery Terms: Whether pricing is FOB, CIF, DDP, or EXW directly affects your cost exposure. “Landed cost” may include local duties, taxes, and last-mile logistics not shown in the invoice price.

Actionable Buyer Tips for Cost Optimization

Procurement professionals across Africa, South America, the Middle East, and Europe can realize significant cost advantages by integrating the following best practices:

- Request Structured Quotations: Always seek detailed breakdowns of unit price, tooling, quality control, logistics, and any surcharges. This enables clearer apples-to-apples supplier comparisons.

- Total Cost of Ownership (TCO): Don’t focus on unit cost alone. Factor in lifespan, maintenance, energy losses (especially with low-grade gaskets), freight, local handling fees, and downtime risks from subpar quality.

- Consolidate Orders: Where possible, aggregate multiple gasket/sealant needs into a single order to exploit volume pricing and minimize shipping costs per item.

- Negotiate Customization Fees: For unique applications, discuss tooling amortization options or multi-year frameworks to spread initial setup costs over longer purchase runs.

- Leverage Local Testing: In-country or regional pre-shipment inspection reduces quality risk and can avoid costly customs delays or rejections.

- Balance Global vs. Local Supply: Consider hybrid strategies—source high-volume standards internationally, but keep local suppliers for urgent custom needs or compliance-driven projects.

- Monitor Regional Price Trends: Material costs and supplier availability fluctuate by region. Engage with trusted local partners and global market intelligence sources to anticipate swings in raw material or logistics prices.

Disclaimer: All prices, costs, and savings referenced are indicative, subject to fluctuation based on market conditions, supplier location, and order specifics. Secure written, project-specific quotations and account for all applicable duties, taxes, and incidental charges in your cost assessment.

Spotlight on Potential gaskets and sealants Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘gaskets and sealants’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Google (www.google.com)

Google is broadly recognized as a global technology leader, but there is limited publicly available information indicating direct manufacturing or supply of gaskets and sealants. No verifiable evidence suggests Google specializes in industrial sealing solutions, certifications such as ISO 9001, or compliance with sector-specific quality standards. For international B2B buyers—particularly from Africa, South America, the Middle East, and Europe—there are no records of product lines, manufacturing capabilities, or regional distribution specific to gaskets and sealants. Buyers seeking established partners in this sector should consider vetted manufacturers with demonstrated expertise, traceability, and documentation in industrial sealing products. Google’s primary strengths and operations remain centered on digital services and technology infrastructure, not physical industrial components.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| No clear involvement in sealing products | www.google.com |

Essential Technical Properties and Trade Terminology for gaskets and sealants

Key Technical Properties for Gaskets and Sealants

Understanding the core technical properties of gaskets and sealants is critical for international B2B procurement—especially when negotiating across industrial sectors and global regions with varying standards. Below are the primary properties that directly impact performance, longevity, and compliance.

-

Material Grade and Composition

The base material (e.g., EPDM, PTFE, graphite, metal alloys) determines chemical resistance, temperature tolerance, and mechanical strength. For buyers, confirming the precise grade and relevant certificates—such as FDA, ASTM, or EN compliance—is essential. In oil, chemical, or food industries, sourcing the right material avoids legal risks and premature product failure. -

Operating Temperature Range

Each gasket or sealant is rated for specific minimum and maximum temperatures. Exceeding these limits can cause leaks, hardening, or rapid degradation. International buyers should factor in their local climate and process conditions. In regions like Africa or the Middle East, high ambient temperatures require materials with robust heat stability. -

Pressure Rating (Maximum Allowable Pressure, or MAP)

The ability to seal under specific internal or external pressures (measured in bar, psi, or MPa) is crucial for maintaining system integrity. Procurement managers should match the pressure rating to application needs—especially in sectors like petrochemicals or water treatment where pressure spikes are common. -

Chemical Compatibility

Not all gaskets or sealants withstand contact with aggressive chemicals, fuels, acids, or alkalis. Specify compatibility during sourcing to avoid costly downtime, especially in heavy industry or mining. Request chemical resistance charts from suppliers and, if possible, independent test results for your specific medium. -

Manufacturing Tolerances

Precision in thickness, width, and overall dimensions ensures a proper seal and mechanical fit. Tight tolerance requirements may increase costs, but prevent leaks and reduce later modification expenses. For buyers importing into Europe or from Asia, align ISO or DIN standards with your local equipment requirements. -

Certification and Traceability

International trade often requires proof of compliance with regional or industry certifications, such as ISO 9001, ASME, or PED. Traceability—being able to track raw materials and production batches—is increasingly requested in European and Middle Eastern markets to ensure quality and rapid root-cause analysis if issues arise.

Common Industry Terms and Trade Jargon

Navigating global procurement for gaskets and sealants requires fluency in industry-specific terminology. Here are essential terms every B2B buyer should know:

-

OEM (Original Equipment Manufacturer)

Denotes products made to the specifications of equipment brands. Buyers should clarify if gaskets or sealants must match OEM standards for warranty and fit; this is crucial for after-market replacements. -

MOQ (Minimum Order Quantity)

The lowest quantity a supplier is willing to produce or ship. Buyers, especially in Africa or South America, must align MOQs with their forecasted demand and storage capability to avoid overstock or import inefficiency. -

RFQ (Request for Quotation)

A formal process where buyers detail product specs to receive pricing, lead time, and payment terms from suppliers. Clear, complete RFQs reduce miscommunication and speed up the comparison of international offers. -

Incoterms (International Commercial Terms)

A standardized set of shipping and delivery clauses (e.g., FOB, CIF, DDP) that define risk, cost, and responsibility at each step of international transit. Understanding Incoterms prevents hidden costs and clears customs bottlenecks—a must for cross-continental trades. -

Lead Time

The total period from order confirmation to product delivery. Lead times may fluctuate with transport routes, customizations, or regional holidays. Managing and negotiating shorter lead times improves maintenance schedules and resilience to supply disruptions. -

Certificate of Conformity (CoC)

A document attesting that products meet specified standards or regulations (e.g., REACH for Europe). Increasingly demanded in the EU and Middle East, submitting a valid CoC at import can expedite customs clearance and avoid costly rejections.

Familiarity with these properties and terms streamlines supplier vetting, ensures regulatory compliance, and boosts success rates in global gasket and sealant sourcing. This strategic understanding empowers buyers to negotiate with confidence and secure the optimal products for their regional markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the gaskets and sealants Sector

Global Market Overview & Key Trends

The gaskets and sealants sector is experiencing rapid transformation, driven by globalization, digitalization, and increasing regulatory complexity. For B2B buyers in regions such as Africa, South America, the Middle East, and Europe, the market is defined by evolving industrial requirements—particularly in sectors like oil & gas, mining, water treatment, and manufacturing. Growth is underpinned by infrastructure investments in emerging economies, modernization of legacy plants, and rising demand for efficient energy systems.

Globalization and Supply Chain Diversification: International buyers are increasingly opting for multisourcing strategies to buffer against supply chain shocks. This trend is especially pronounced in regions with volatile import conditions or logistics challenges, such as parts of Africa and South America, where resilience against disruptions is paramount. Sourcing from multiple qualified suppliers across different geographies—Asia for cost efficiencies, Europe for technical standards, or local partners for speed—offers flexibility and risk mitigation.

Digitalization and Smart Procurement: Adoption of digital procurement platforms is streamlining sourcing for gaskets and sealants. B2B buyers are leveraging e-commerce, online catalogs, and data-driven supplier evaluation tools to access global inventories and vet suppliers remotely. Artificial intelligence is enabling predictive demand planning and more accurate specification matching, reducing downtime and unnecessary inventory expenses.

Material Innovations and Customization: The market is seeing increased demand for application-specific materials—such as advanced elastomers, graphite, high-purity PTFE, and specialized metal alloys—tailored to challenging environments like petrochemical and mining operations. Customization has become a competitive differentiator; buyers frequently require precise fit, faster prototyping, and compliance with international standards (ISO, ASME, DIN), especially for cross-border projects.

Cost and Compliance Pressures: Fluctuating raw material prices (particularly metals and elastomers), evolving tariff regulations, and tightening environmental standards are shaping procurement priorities. Buyers are scrutinizing total cost of ownership, not just unit price, incorporating freight, lead times, durability, and local certification needs into sourcing decisions.

Sustainability and Ethical Sourcing

Sustainability is emerging as both a compliance mandate and a strategic differentiator in gasket and sealant procurement. Global buyers face increased scrutiny from regulators, stakeholders, and end customers to align operations with circular economy principles.

Environmental Impact Considerations: Key areas of concern include the recyclability of sealing materials, use of hazardous substances, energy intensity of production, and waste minimization. In response, leading manufacturers are transitioning towards more sustainable materials, such as bio-based rubbers, recycled composites, and low-VOC (volatile organic compound) sealants. The rise of “green” certification—such as ISO 14001 (Environmental Management) and certifications for REACH and RoHS compliance—provides buyers with verifiable, quantifiable environmental credentials.

Ethical Supply Chain Management: Ethical sourcing extends beyond materials to labor practices, supply chain transparency, and traceability. International buyers, especially those exporting to Europe or working with multinational clients, are increasingly required to document ethical sourcing practices throughout the supply chain, from raw material extraction to finished product shipping. This includes ensuring fair labor, compliance with local and international laws, and responsible sourcing of conflict minerals or restricted chemicals.

Green Procurement Strategies: Buyers can advance sustainability goals by selecting suppliers offering eco-friendly product lines, recyclable packaging, and transparent supply chain reporting. Long-term partnerships with certified manufacturers, investment in supplier audits, and inclusion of sustainability clauses in procurement contracts are becoming industry best practices.

Brief Evolution and Industry Context

The evolution of gaskets and sealants reflects broader trends in industrial technology and global trade. Early sealing solutions relied on natural materials—leather, cork, and untreated rubber—primarily cut and installed by hand. The industrial revolution spurred innovation, introducing synthetic rubbers, advanced fibers, and precision engineering to support higher pressures, temperatures, and chemical exposures.

From the late 20th century onwards, digital and automated manufacturing dramatically improved quality and consistency, enabling high-performance sealing solutions for specialized applications. Today, the sector is characterized by rapid prototyping, globalized supply chains, and an expanding portfolio of advanced materials—each designed to enhance process reliability and operational efficiency. For B2B buyers, this evolution has unlocked unprecedented access to diverse sealing technologies, provided they can adeptly navigate the complexities of sourcing, compliance, and sustainability.

Related Video: Global National: April 5, 2025 | “Hands off” protests worldwide in response to Trump’s trade war

Frequently Asked Questions (FAQs) for B2B Buyers of gaskets and sealants

-

How can I effectively vet gasket and sealant suppliers for international procurement?

Thorough supplier vetting is crucial in global B2B trade. Begin by verifying the supplier’s certifications (such as ISO 9001, API, or relevant regional standards) and assessing their track record through client testimonials and case studies. Request detailed documentation of quality control processes and material traceability. Conduct a video or third-party factory audit if an on-site visit isn’t feasible. For buyers in Africa, South America, the Middle East, or Europe, prioritize suppliers with a history of exporting to your region, as this indicates familiarity with local regulatory and logistics requirements. -

What customization options are available for gaskets and sealants, and how do I ensure the right fit for my industrial application?

Most reputable manufacturers offer tailored solutions, from custom sizes and shapes to specialized materials and surface finishes. Share precise technical drawings, operating conditions (temperature, pressure, chemical exposure), and regulatory requirements with suppliers. Collaborate closely on prototypes and request material samples or small production runs for verification. For buyers with unique climatic or industrial challenges, select partners experienced in delivering bespoke solutions for similar environments—this reduces risk and improves overall performance. -

What are typical minimum order quantities (MOQ), lead times, and payment terms for international orders?

MOQs vary by supplier, product type, and customization level. Standard off-the-shelf gaskets may have low MOQs (in the hundreds), while custom or specialty items generally require higher volumes. Lead times typically range from 2 to 8 weeks, depending on order complexity and production capacity. International payment terms often include T/T (bank transfer), LC (letter of credit), or open account arrangements for established buyers. Negotiate clear, written terms to avoid surprises, especially concerning deposits, balance payments, and penalties for delays. -

How do I assess and ensure the quality standards and certifications of gaskets and sealants for my market?

Evaluate suppliers on their ability to provide comprehensive quality certifications (e.g., ISO, CE, API, EN) and documented compliance with specific industrial or national standards. Request material data sheets, product test reports, and conformity declarations. For buyers in regulated industries or regions—such as food processing or oil and gas—specify your required standards upfront, and confirm whether the supplier’s products consistently meet them. Establish pre-shipment inspections or contract independent third-party testing to verify quality before dispatch. -

What logistical factors should I consider when importing gaskets and sealants internationally?

Plan for reliable global shipping, including robust export packaging that protects against moisture, corrosion, and mechanical damage during transit. Clarify Incoterms (e.g., FOB, CIF, DAP) in your contracts to define responsibilities for freight, insurance, and customs clearance. Work with suppliers experienced in international logistics to ensure proper export documentation, including commercial invoices, packing lists, and certificates of origin. For high-value or time-sensitive shipments, consider air freight or express services, balancing speed and cost. -

How are disputes or quality issues typically handled in cross-border B2B gasket and sealant transactions?

Dispute resolution should be addressed in the sales contract. Specify your preferred process, such as amicable negotiation, mediation, or arbitration in a neutral location. Establish clear procedures for reporting defects: provide photographs, test results, and a timeline of communication. Reputable suppliers often offer warranty terms and after-sales support, including replacement goods or refunds for substantiated claims. Buyers should document all correspondence and agreements, and utilize platforms like escrow services if concerned about payment security. -

What key trends or emerging requirements should international buyers watch for when sourcing gaskets and sealants?

Global buyers are facing increasing demand for eco-friendly materials, traceability, and compliance with stricter health and safety regulations. There’s a shift toward advanced polymers, high-performance composites, and digital documentation for traceability. In volatile markets, suppliers who can navigate supply chain disruptions and offer material alternatives stand out. Purchasers should look for partners who invest in R&D, can demonstrate supply flexibilities, and are proactive in aligning with evolving international and regional standards. -

How can I optimize total cost and supply chain efficiency when sourcing gaskets and sealants internationally?

Beyond unit price, consider total landed cost—including shipping, duties, storage, and local regulatory compliance. Consolidate orders to leverage volume discounts and reduce per-unit logistics costs. Build multi-sourcing strategies to minimize risk, balancing trusted local suppliers with established global partners. Collaborate on demand forecasting and inventory management with suppliers for improved delivery reliability. Prioritize suppliers with robust after-sales support, as this reduces long-term maintenance and operational costs, ultimately maximizing procurement value.

Strategic Sourcing Conclusion and Outlook for gaskets and sealants

Global B2B buyers in markets such as Africa, South America, the Middle East, and Europe face a complex but opportunity-rich landscape when sourcing gaskets and sealants. Key takeaways from this guide include the necessity of aligning product specifications—not just with operational requirements but also with local standards and supply chain realities. The right choice of materials, from graphite and PTFE to high-grade metals and elastomers, directly impacts reliability, compliance, and cost-effectiveness, especially in industries where safety and downtime carry substantial weight.

Strategic sourcing goes well beyond price negotiations. Forward-thinking buyers consistently evaluate supplier certifications, manufacturing capabilities, traceability, and after-sales support, seeking partners who offer flexibility in design, rapid prototyping, and responsive logistics. As global regulatory frameworks tighten and application environments diversify—from hot, dusty mining in Africa to food processing in Europe—the importance of documented quality, robust packaging, and technical assistance cannot be overstated.

Looking ahead, proactive engagement with suppliers—such as co-developing custom solutions, leveraging digital procurement tools, and monitoring innovation in sealing technologies—will unlock further value and resilience. International B2B buyers are encouraged to treat gasket and sealant procurement as a strategic lever for operational excellence, ultimately strengthening supply chain security and supporting long-term business growth in dynamic global markets.