Introduction: Navigating the Global Market for o’ring groove

Global procurement teams and engineering leaders across Africa, South America, the Middle East, and Europe increasingly recognize that the right o’ring groove design is fundamental to reliable performance in everything from mining machinery and energy pipelines to food processing and automotive systems. A small mismatch in groove geometry or a misstep in standard compliance can lead to costly downtime, safety hazards, and even product recalls—risks that only intensify for B2B buyers managing multi-country operations or navigating complex supply chains. In a world where operational efficiency, cross-border standards, and supplier reliability are top priorities, mastering o’ring groove selection has become a strategic necessity, not merely a technical detail.

This authoritative guide distills the critical knowledge global buyers need to make confident, cost-effective sourcing decisions for o’ring grooves. It offers an in-depth breakdown of international groove standards—such as AS568 (inch) and ISO 3601 (metric)—and explores both standard and custom groove types suited for diverse industrial requirements. Buyers will find clear comparisons of material options and their certifications, ensuring compatibility with everything from aggressive chemical processes to food-grade applications. Up-to-date manufacturing and quality control practices are covered to help buyers vet potential suppliers, minimize defects, and maintain compliance with regional regulations.

Beyond technical know-how, this guide arms buyers with proven strategies for navigating global supplier networks, optimizing pricing, and understanding key market trends affecting both mature and emerging economies. Practical FAQs and sourcing checklists round out the resource, equipping you to avoid pitfalls and capitalize on new opportunities. Whether upgrading aging assets in Nigeria or driving innovation in French manufacturing, this guide empowers decision-makers to secure the right groove solutions for seamless, high-performance operations across international markets.

Understanding o’ring groove Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| AS568 (Inch) Grooves | Inch-based standard by SAE; broad international recognition | Hydraulic systems, industrial machinery, exports | Universally supported but regional stocks of rare sizes can be limited |

| ISO 3601 (Metric) Grooves | Metric dimensions per ISO; suited for non-US and global compliance | OEM manufacturing, EMEA machinery, process plants | Eases cross-border sourcing; not always compatible with US standards |

| Custom/Non-Standard Grooves | Tailored for unique equipment or legacy systems; dimensions vary by project | Retrofit, bespoke OEMs, emerging markets | Enables precision fit; longer lead times and higher MOQ possible |

| Face Seal (Axial) Grooves | O-ring compressed axially between flat surfaces; requires tight control of groove width | Flanges, valve covers, high-pressure seals | Excellent face sealing; needs precise machining to prevent overcompression |

| Radial Seal Grooves | O-rings compressed radially; for dynamic and static rod/piston sealing | Pneumatics, pumps, cylinders, automotive | Versatile sealing; sensitive to finish/material and prone to extrusion |

AS568 (Inch) Grooves

AS568 grooves are defined by the SAE Aerospace Standard and use inch measurements, making them widely adopted in North America and for widely exported machinery. Their standardized format streamlines global sourcing, especially for industries relying on established US supply chains. B2B buyers benefit from broad market compatibility and typically easier access to O-rings of matching sizes from multiple suppliers. However, certain less common groove sizes may not be consistently stocked in all regions, potentially causing procurement delays or additional import costs, especially in Africa or South America.

ISO 3601 (Metric) Grooves

Metric grooves specified by ISO 3601 are increasingly favored for international projects, with particular strength across the EMEA and Asia-Pacific regions. They simplify cross-border B2B transactions by adopting metric units and harmonized sizing, reducing risks linked to size mismatches on multinational projects. Buyers managing fleets of European or Asian-manufactured equipment should prioritize ISO 3601 grooves for compliance and sourcing efficiency. Alignment with metric-sized O-rings is essential to avoid logistical errors—failure to do so can delay installations or drive up rework costs.

Custom/Non-Standard Grooves

Custom groove designs are engineered for equipment with unique performance needs, legacy components, or adaptations for local operating conditions not addressed by primary standards. These grooves can be essential for buyers supporting older infrastructure, specialized industrial lines, or regional machinery variants found in emerging markets. While custom grooves provide the best possible sealing in atypical situations, buyers need to assess lead time, recurring costs for bespoke parts, and long-term availability—critical when planning ongoing maintenance or when negotiating international supplier agreements.

Face Seal (Axial) Grooves

Face seal or axial grooves employ O-rings compressed directly between two flat mating surfaces, common in flange connections and valve covers subject to high pressures. They offer robust static sealing when axial compression is tightly controlled, making them vital for applications where leakage is unacceptable. B2B purchasers must ensure precise tolerances in both groove width and surface finish. Overcompression risk means tight specification compliance is mandatory, particularly when sourcing or subcontracting machining in regions with variable manufacturing capability.

Radial Seal Grooves

Radial seal grooves accommodate O-rings compressed perpendicular to the axis of housing components, fundamental in both dynamic (moving) and static (stationary) piston/rod assemblies. Used extensively in pumps, hydraulics, and automotive cylinders, they deliver reliable sealing performance under a mix of pressure, movement, and fluid compatibility demands. For buyers, material choice and groove finish merit special focus, as mismatches can cause premature wear or extrusion failure. These grooves offer cross-industry versatility, but buyers must align groove tolerances and O-ring material with end-use pressures and regional service environments.

Related Video: Diffusion Models | Paper Explanation | Math Explained

Key Industrial Applications of o’ring groove

| Industry/Sector | Specific Application of o’ring groove | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Oil & Gas | Wellhead assemblies and pipeline flanges | Secure sealing under high pressure/temperature | Chemical compatibility, regional certifications (API/ISO), delivery lead times |

| Water & Wastewater | Pump and valve sealing systems | Prevents leaks and contamination, low maintenance | Durability in varying water quality, local availability of replacement parts |

| Food & Beverage | Hygienic seals in processing equipment | Ensures sanitary operations, meets food safety regs | FDA/EU compliance, tolerance to cleaning agents, precise groove specs |

| Automotive & Transport | Hydraulic and pneumatic cylinder sealing | Reliable motion control, reduces downtime | Conformance to international standards (ISO/SAE), compatibility with lubricants |

| Mining & Heavy Industry | Cylinder, actuator, and crusher assemblies | Extends lifespan of critical equipment | Abrasion and chemical resistance, availability of metric/inch groove sizes |

Oil & Gas: Wellhead Assemblies and Pipeline Flanges

O’ring grooves are fundamental in the oil and gas sector, particularly for sealing wellhead assemblies and pipeline flanges. They provide the robust, leak-proof connections required to withstand extreme pressures and aggressive media typical of upstream and midstream operations. For international B2B buyers, especially in regions with challenging logistics or regulatory oversight like the Middle East and West Africa, it’s vital to specify materials and groove designs that conform to both API and ISO certifications. Buyers should also confirm supplier ability to meet rapid delivery needs to minimize costly operational downtime.

Water & Wastewater: Pump and Valve Sealing Systems

In the water and wastewater industry, o’ring grooves are essential in pumps, valves, and filtration systems to maintain tight seals and prevent cross-contamination. Proper groove design ensures reliability despite fluctuating pressures and the presence of corrosive chemicals or particulates. For buyers across Africa and South America, robust sourcing strategies should prioritize materials that handle local water conditions and environments. Ensuring a steady supply of compatible O-rings and replacement grooves is also critical, minimizing service interruptions and supporting long-term infrastructure maintenance.

Food & Beverage: Hygienic Seals in Processing Equipment

O’ring grooves find critical application in food and beverage processing, where hygienic sealing is paramount. Grooves must be designed for easy cleaning and resistant to aggressive sanitizing agents. European buyers, as well as those exporting to or from the EU, must demand FDA and EU food contact compliance, with grooves machined to exact tolerances to avoid bacterial harbors. Material traceability and documentation are essential for audit readiness, while prompt supplier support ensures equipment uptime.

Automotive & Transport: Hydraulic and Pneumatic Cylinder Sealing

In automotive manufacturing and transport equipment, o’ring grooves are found in hydraulic and pneumatic cylinders, enabling accurate, reliable motion control and minimizing fluid leaks. Groove dimensions and finishes directly impact seal longevity and system efficiency, with standards such as ISO 3601 and SAE AS568 guiding compatibility. Buyers from Mexico, France, and beyond should scrutinize engineering support for local specifications and lubricant compatibility to optimize both performance and cost effectiveness.

Mining & Heavy Industry: Cylinder, Actuator, and Crusher Assemblies

The mining and heavy industrial sectors rely on o’ring grooves to safeguard actuators, crusher hydraulics, and other high-load assemblies. These applications demand grooves designed for heavy abrasion, shock loads, and chemical exposure. Sourcing considerations include availability of grooves to metric and inch standards for mixed equipment fleets, as well as high-performance materials capable of extended service intervals. International buyers in South America and Africa should also evaluate suppliers’ capacity for supporting legacy machinery and delivering parts promptly to remote locations.

Strategic Material Selection Guide for o’ring groove

Assessing Common O-Ring Groove Materials for International B2B Sourcing

Selecting the optimal material for O-ring grooves is critical to maximizing both sealing performance and total lifecycle value. B2B buyers navigating diverse regional conditions must balance a matrix of variables—chemical exposure, temperature range, pressure cycles, regulatory compliance, and total landed cost. Here, we analyze four widely used O-ring groove materials, evaluating their core properties, trade-offs, and application impacts, with explicit guidance for international procurement across Africa, South America, the Middle East, and Europe.

1. Carbon Steel (e.g., ASTM A36, AISI 1018)

Key Properties:

Carbon steel offers good mechanical strength and machinability, making it commonly used for O-ring grooves in general-purpose equipment. Typical temperature tolerance is from -29°C to 425°C, though its resistance to corrosion is limited unless surface-treated (e.g., plating or painting).

Pros:

– Economical and widely available worldwide.

– Straightforward to machine and form, minimizing manufacturing complexity.

– High structural strength supports robust groove geometry under load.

Cons:

– Poor innate corrosion resistance; not ideal for aggressive media or marine environments.

– May require protective coatings, increasing long-term maintenance needs.

Impact on Application:

Best suited for non-corrosive service environments and general industrial machinery. In humid or high-salinity regions (such as Nigeria or coastal South America), buyers must ensure adequate surface protection or opt for alternative materials.

Regional Considerations:

Meets broad standards (ASTM, DIN) but may not be accepted for potable water or food-grade applications in the EU or Middle East. Procurement in Africa and South America is robust, but corrosion concerns elevate whole-life costs.

2. Stainless Steel (e.g., 316, 304; per ASTM A240, DIN 1.4401)

Key Properties:

Stainless steels (notably 316) offer excellent corrosion resistance, superior cleanliness, and moderate to high strength. Operating range extends from cryogenic temperatures up to 800°C, with good resistance to most process chemicals and exposure environments.

Pros:

– Outstanding durability, particularly in corrosive or sanitary settings.

– Low maintenance and long service life.

– Global acceptance in regulated sectors (pharma, food, oil & gas).

Cons:

– Higher material and fabrication cost versus carbon steels.

– Potential galling or seizing during assembly, especially in high-load, dry conditions.

– Heavier than advanced alloys or engineered plastics.

Impact on Application:

Ideal for demanding applications: chemical processing, potable water, medical equipment, and outdoor environments. Global compliance (ASTM, EN/DIN, JIS) supports ease of cross-border sourcing.

Regional Considerations:

Widely specified in Europe (notably France) and the Middle East; often required for projects meeting EU or GCC standards. In Africa and South America, import tariffs can affect delivered cost—local stock verification is advised.

3. Aluminum Alloys (e.g., 6061-T6, per ASTM B221)

Key Properties:

Aluminum alloys provide an optimal strength-to-weight ratio, are easy to machine, and offer good corrosion resistance in many fresh water and atmospheric conditions. Typical temperature handling is from -196°C to ~150°C; not ideal for very high pressure or highly acidic/alkaline media.

Pros:

– Lightweight—beneficial for transport-critical or mobile equipment.

– Excellent machinability translates to lower groove manufacturing costs.

– Forms a natural corrosion-resistant oxide layer.

Cons:

– Lower strength and hardness; vulnerable to mechanical damage in abrasive or high-load applications.

– Limited chemical compatibility (sensitive to strong acids and chlorides).

– More prone to galling versus carbon/stainless steel.

Impact on Application:

Suitable for pneumatic, low- to moderate-pressure hydraulic, and mobile assemblies. Not suitable for aggressive chemical processing environments or high-pressure systems.

Regional Considerations:

Well-accepted for mobile and lightweight solutions in Europe and Latin America. Cost-effective in areas where shipping weight is a concern (e.g., remote projects in Africa/Middle East). Confirm ASTM or EN certification matches project needs.

4. Engineering Plastics (e.g., PEEK, PTFE; per ASTM D4894/D4895, ISO 12086)

Key Properties:

High-performance plastics like PTFE (Teflon) and PEEK exhibit outstanding chemical resistance, low friction, and broad service temperatures (-200°C to 250°C for PTFE; up to 260°C+ for PEEK). Non-metallic composition eliminates galvanic corrosion risks.

Pros:

– Inert to most chemicals and extreme pH (ideal for aggressive process media).

– Reduces friction and wear in dynamic seal applications.

– Lightweight and non-contaminating (suitable for pharma/food, semiconductor).

Cons:

– High material and machining cost, especially for PEEK.

– Lower mechanical strength vs. metals—risk of deformation under heavy load.

– Limited availability in some emerging regions, elevating lead times.

Impact on Application:

The material of choice for high-performance sealing: aggressive chemicals, ultra-clean service, or where metal extractables must be minimized.

Regional Considerations:

Demand is strong in European and Middle Eastern high-spec sectors (petrochemical, pharma). High cost and supply constraints may pose challenges in developing economies; always verify local sourcing and import controls.

Comparative Table: O-Ring Groove Material Selection

| Material | Typical Use Case for o’ring groove | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Carbon Steel (e.g., ASTM A36) | General industrial service, non-corrosive environments | Economical, widely available | Susceptible to corrosion without protective coating | Low |

| Stainless Steel (e.g., 316, 304) | Chemical, water treatment, food & pharma, offshore | Exceptional corrosion resistance, global compliance | Higher cost, risk of galling, heavier than alternatives | High |

| Aluminum Alloy (e.g., 6061) | Mobile & pneumatic equipment, general light-duty | Lightweight, easy to machine, moderate corrosion resistance | Limited strength, poor for aggressive media | Medium |

| Engineering Plastics (e.g., PTFE, PEEK) | Chemical processing, clean rooms, high-purity & aggressive media | Extreme chemical resistance, low friction, non-metallic | Expensive, lower load capacity, supply may be limited | High |

In-depth Look: Manufacturing Processes and Quality Assurance for o’ring groove

Overview of O’Ring Groove Manufacturing: Stages and Techniques

O’ring grooves, while appearing deceptively simple, demand a precise, quality-driven manufacturing approach to ensure optimal sealing performance, reliability, and cross-border compliance. Global B2B buyers — particularly those sourcing for diverse industrial environments in Africa, South America, the Middle East, and Europe — should understand not just the specifications on paper, but also how those grooves are produced, inspected, and verified.

1. Material Preparation

The process begins with the selection and preparation of raw materials, typically metals (aluminum, steel, stainless steel) or engineered polymers, depending on the housing application. Material choice is driven by mechanical demands, chemical resistance, and regional standards. For instance, clients in petrochemical or mining hubs (e.g., Nigeria, Brazil, Saudi Arabia) may require certified corrosion-resistant alloys, while European OEMs might prioritize REACH/ROHS-compliant materials.

Batch traceability is essential at this stage: reputable suppliers log heat numbers, source certifications (e.g., EN 10204 3.1), and chemical composition, enabling backward traceability in case of future failure analysis or regulatory checks.

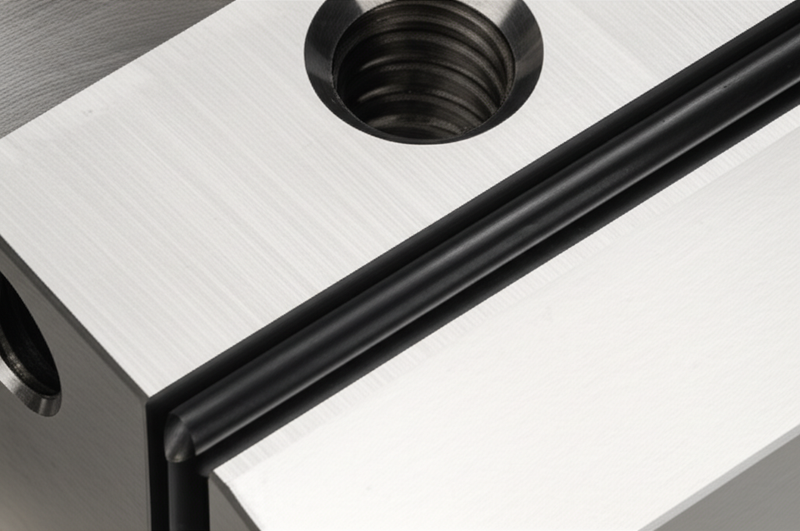

2. Forming and Machining of Grooves

CNC Machining is the norm for most precision grooves, offering repeatability and tight tolerances. For large runs, automated CNC lathes or milling machines are programmed per the chosen groove standard (AS568, ISO 3601, custom), ensuring profile accuracy typically within ±0.02 mm or better.

- For high-volume needs (e.g., automotive, energy production), multi-axis machining centers or dedicated groove-cutting tools are employed to maximize throughput.

- Surface Finish is crucial. Grooves are finished to specified Ra values (typically 0.8–1.6 microns) to avoid micro-leak paths or O-ring abrasion.

In some specialized cases—especially for unique applications in, say, French aerospace or African mining—EDM (Electrical Discharge Machining) may be used for non-standard profiles, or laser machining for intricate dimensions on advanced composites.

3. Cleaning and Degreasing

Post-machining, parts undergo thorough degreasing and cleaning to eliminate metal chips, lubricants, and particulates. This often involves ultrasonic cleaning, solvent baths, or steam cleaning, depending on end-use criticality and any customer-imposed cleanliness standards (e.g., oxygen service assemblies for European medical or food industries).

4. Assembly (Where Applicable)

For some assemblies—such as hydraulic valve blocks or customized machinery—grooves are machined on sub-components before integration. Assembly accuracy is monitored to ensure the groove’s integrity is not compromised by subsequent processes like welding, coating, or thermal treatments.

5. Final Finishing

If design calls for it, parts may receive protective coatings (anodizing, plating, painting) or secondary processes (deburring, passivation), tailored to the destination market’s environment and standards. For instance, harsh conditions in Middle Eastern oil & gas operations may necessitate additional anti-corrosive treatments.

Quality Assurance Protocols: Standards, Checkpoints, and Testing

Consistent, defendable quality is non-negotiable in global O’ring groove sourcing. International buyers should demand robust quality assurance at every link in the supply chain, with documentation that transcends borders and languages.

Key Quality Standards to Demand

- ISO 9001 for general Quality Management — a baseline expected for any serious industrial supplier.

- ISO 3601 or AS568 for groove and O-ring dimensional compatibility.

- API (American Petroleum Institute) spec Q1/Q2 for suppliers to oil and gas (especially for Middle East and Africa).

- CE marking for products entering Europe, covering safety and performance compliance.

- Country/region-specific standards (e.g., DIN for Germany, NBR for Brazil) when required by national regulators.

The QC Workflow: Essential Inspection Checkpoints

B2B buyers should look for manufacturing partners that implement—a minimum—the following three-phase QC system and are transparent about their procedures:

-

Incoming Quality Control (IQC)

- Raw material certifications checked against order and regulatory requirements.

- Dimensional and hardness spot checks for material batches.

- Validation of supplier COAs (Certificate of Analysis/Conformity).

-

In-Process Quality Control (IPQC)

- Real-time groove measurements using calibrated optical comparators or CMMs (coordinate-measuring machines) during machining.

- Surface roughness tested with profilometers, especially for dynamic sealing applications.

- Documentation of tool wear, machine calibration, and periodic First Article Inspection Reports (FAIR).

-

Final Quality Control (FQC)

- 100% dimension inspection or statistically valid sampling, recorded in inspection reports.

- Pressure testing for assembled components (as per ISO or API standards).

- Surface contamination and visual flaw inspection.

- Marking, traceability tagging, and packaging inspections to prevent damage or contamination in transit.

Common Testing Methods

- Dimensional Inspection (caliper, micrometer, CMM data logging)

- Surface Finish Analysis (profilometer readings—verify groove Ra is per standard)

- Material Testing (spectrographic analysis, hardness tests)

- Pressure and Leak Testing (for assemblies)

- Documentation Review (ensuring all certificates, batch records, and inspection reports are present and correct)

Best Practices for International B2B Buyers: Verifying Supplier Quality

Sourcing o’ring grooves internationally requires extra vigilance, especially when bridging continents, languages, and regulatory regimes.

1. Audit and Assess: Don’t Rely Solely on Declarations

- Visit or virtually audit your supplier’s facilities. Look for evidence of standardized work procedures, up-to-date calibration certificates, and an organized QC department.

- Third-party inspections are advisable for initial orders or high-value shipments, especially in regions where quality standards can be inconsistent.

2. Demand Documentation

- Insist on detailed inspection reports (with measurement data, surface finish, and material traceability) with each lot.

- For critical applications, require FAIRs (First Article Inspection Reports), PPAP (Production Part Approval Process), or even batch samples before full-scale production.

3. Specify Certification Needs Upfront

- Clearly state in RFQs and purchase orders which certifications (e.g., ISO 9001, CE, API Q1/Q2) are mandatory.

- For European-bound products, require CE marking evidence and Declaration of Conformity in the local language (e.g., Spanish for Mexico, French for France).

- If supplying into oil & gas or food sectors, request sector-specific material and testing certificates.

4. Clarify QC and Test Methods

- Ensure the supplier’s test methods match your expectations and regulatory norms. For example, pressure testing methods accepted in Europe may differ from those in Africa.

- For mission-critical applications, consider specifying precise test protocols or jointly developing incoming inspection criteria with the supplier.

Regional Considerations: Navigating Certification and Quality in Multinational Supply Chains

International buyers must recognize that quality control documentation and certification norms vary widely by region:

- Europe places heavy emphasis on verifiable CE marking and EN certification. B2B buyers in France, Germany, or Spain should ensure the documentation complies with EU directives. Having bilingual paperwork (English/local language) eases customs and regulatory reviews.

- Middle East and Africa often operate under mixed standards (API, ISO, EU, local). In sectors like oil & gas, insist on API-related certificates and local content compliance where applicable (e.g., NCEC in Saudi Arabia, SONCAP in Nigeria).

- South America (e.g., Brazil, Mexico) may have further import checks. For Mexico, clarity and accuracy in COA and Spanish-language documents streamline customs. NBR standards could also apply.

- Traceability is critical in all regions, especially when goods are destined for critical industries (aerospace, pharma, oil & gas).

- Counterfeit prevention is a growing issue, especially in some emerging markets. Partnering with established, internationally certified suppliers and using third-party verification mitigates this risk.

Action Points for B2B Buyers

- Develop a supplier pre-qualification checklist covering manufacturing and QC capability, with region-specific requirements.

- Schedule periodic onsite or virtual audits, and maintain a working relationship with QA contacts at the supplier.

- Document every batch: retain digital copies of all test certificates, inspection reports, and regulatory documents.

- Continually monitor for changes in destination market regulations—update your compliance checklist at least annually.

Key Takeaway:

By thoroughly understanding the underlying manufacturing processes and demanding transparent, standards-aligned quality assurance, international B2B buyers safeguard their supply chains against costly failures, regulatory non-compliance, and reputational risk when sourcing o’ring groove components across borders.

Related Video: Amazing factories | Manufacturing method and top 4 processes | Mass production process

Comprehensive Cost and Pricing Analysis for o’ring groove Sourcing

Understanding Cost Structure and Price Drivers in O-Ring Groove Procurement

Smart sourcing of o-ring grooves for international B2B operations demands a clear grasp of both the underlying cost components and the external factors that influence market price. By breaking down these elements and applying region-specific insights, buyers in Africa, South America, the Middle East, and Europe can more effectively steer negotiations, build resilient supply chains, and reduce total lifecycle costs.

Key Cost Components in O-Ring Groove Sourcing

1. Raw Materials:

The costliest variable is often the choice of O-ring material (e.g., Nitrile, Viton, EPDM, silicone, FFKM). Commodity prices fluctuate, with specialty or high-performance compounds (chemically resistant, food-grade) increasing base cost. Material selection must balance technical requirements and price sensitivity, especially when sourcing for diverse climates or compliance regimes.

2. Manufacturing Labor & Overhead:

Labor rates vary widely by region. Automation can reduce per-unit labor costs, but initial investment is reflected in overhead. Overhead also includes utilities, equipment depreciation, and plant administration, with high-tech QC or multi-stage finishing (precision machining, surface treatments) adding to the baseline.

3. Tooling and Setup Costs:

Standard AS568 or ISO grooves benefit from existing tooling, while custom grooves typically incur one-time or amortized setup fees. For low- to mid-volume orders or unique profiles, factor in NRE (non-recurring engineering) charges and minimum production run constraints.

4. Quality Control (QC) and Certification:

Globally oriented buyers increasingly require batch traceability, material certifications (e.g., ISO, FDA, REACH), and full inspection reports. QC costs, including testing for dimensions, surface finish, or performance, factor into pricing—especially for regulated industries (pharma, food, petrochemicals).

5. Logistics and Shipping:

Transportation costs are highly region-dependent, influenced by distance, shipping mode (air, sea, ground), and Incoterms (e.g., EXW, FOB, DDP). Security, insurance, and customs documentation (such as EUR.1 certificates for Europe or local compliance in Africa/Middle East) can affect landed cost significantly.

6. Supplier Margin:

Final quotes incorporate the supplier’s required profit margin. Margin levels may reflect supply-demand dynamics, competitive pressure, payment terms, and risk exposure (such as currency fluctuations or region-specific credit risks).

Price Drivers and Influencers

- Order Volume and MOQ: Higher volumes unlock economies of scale and can justify tooling investments, but minimum order quantities may be elevated for custom grooving.

- Customization and Complexity: Deviations from standard groove designs, unique tolerances, or dual-material requirements generally increase unit price.

- Grade of Materials and Performance Specs: Elevated chemical or temperature resistance, or certification requirements (e.g., ATEX, FDA) command premium prices.

- Supplier Credentials and Regional Factors: Reputation, on-time delivery record, and inventory availability in target geographies (Mexico, France, Kenya, Saudi Arabia) can affect prices. Local warehousing reduces lead time but may include distribution markups.

- Terms of Sale (Incoterms): Differences between ex works (EXW), free on board (FOB), or delivered duty paid (DDP) significantly alter the buyer’s total cost footprint, especially when sourcing from overseas.

Actionable Tips for Cost-Efficient Sourcing

- Negotiate Volume Discounts: Consolidating orders across facilities or projects helps meet MOQs and unlocks favorable pricing.

- Validate Total Cost of Ownership (TCO): Cheap upfront unit prices can be offset by higher maintenance, replacement, or compliance costs. Analyze lifecycle value over mere purchase price.

- Specify Clearly and Standardize Where Possible: Favor AS568 or ISO 3601 standards for maximum sourcing flexibility and competitive bidding; reserve custom grooves for cases of necessity.

- Leverage Supplier Competition: Obtain quotations from both local and global vendors to benchmark and drive cost transparency. Monitor currency trends and hedging options when dealing with volatile markets.

- Scrutinize QC and Certification Costs: Where not mission-critical, avoid over-specification. For highly regulated sectors, ensure documentation is comprehensive, as post-purchase compliance gaps can be costly.

- Understand Regional Logistics: Factor in duties, local taxes, and port/transport infrastructure when sourcing from or into Africa, South America, and the Middle East. Explore local stocking solutions in Europe to minimize delays.

Disclaimer: Prices for o-ring groove components are indicative and subject to frequent change based on raw material markets, geopolitical influences, shipping volatility, and supplier conditions. Buyers should conduct independent supply chain and risk evaluations to arrive at up-to-date, tailored cost estimates.

Spotlight on Potential o’ring groove Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘o’ring groove’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

60 O-Ring Manufacturers in 2025 (us.metoree.com)

Metoree’s “60 O-Ring Manufacturers in 2025” listing aggregates leading O-ring producers and suppliers, offering international buyers a consolidated view of top industry players. The platform emphasizes manufacturers equipped to meet diverse O-ring groove requirements, referencing standards such as JIS for precise groove depth and compression ratio selection. While individual company details are limited, the directory is tailored for B2B buyers seeking validated sources with global supply capabilities, including shipment to Africa, South America, the Middle East, and Europe. Buyers benefit from access to a wide range of O-ring materials and groove configurations for new projects or retrofits. The Metoree listing suggests a focus on suppliers with experience in complying with international standards, making it valuable for procurement teams requiring confidence in specification compatibility and sourcing flexibility.

Your Ultimate Guide to Sourcing O Ring Groove Depth (www.rubber-tools.com)

Your Ultimate Guide to Sourcing O Ring Groove Depth, featured on rubber-tools.com, is recognized as a resource and platform engaging with B2B buyers seeking reliable O-ring groove depth solutions. This entity appears focused on delivering technical insights and supply perspectives for industries with stringent sealing needs, supporting applications across critical sectors such as energy, automotive, and food processing. While public information on manufacturing capacities and certifications is limited, the guide emphasizes the significance of precise groove depth for operational reliability in diverse geographies—including Africa, South America, the Middle East, and Europe. Buyers can expect an informed approach to material compatibility, compliance standards, and sourcing complexity. However, rigorous due diligence is recommended before formal engagement, as direct manufacturer qualifications or in-house production details are not explicitly outlined.

10 O rings manufacturers in the World 2025 (www.sourcifychina.com)

10 O Rings Manufacturers in the World 2025 is a curated resource spotlighting leading global O-ring suppliers, with a particularly useful focus for B2B buyers seeking quality and variety in O-ring groove solutions. Featured suppliers, such as The O-Ring Store LLC, deliver an extensive portfolio—covering AS568 and metric O-rings, hydraulic seals, and custom-engineered options to accommodate diverse application needs. Companies highlighted are ISO 9001:2015 certified and offer advanced material selections (including FFKM, Viton®, and Buna-N), ensuring broad compatibility for international OEMs and MRO operations. Notably, these manufacturers invest in advanced measurement and quality control technologies, reducing supply chain risk for cross-border projects in markets like Africa, South America, the Middle East, and Europe. Personalized support and substantial inventory enable rapid fulfillment, though buyers should anticipate minimum order values and potential freight considerations for global shipments.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| 60 O-Ring Manufacturers in 2025 | Aggregator of global, standards-driven O-ring suppliers. | us.metoree.com |

| Your Ultimate Guide to Sourcing O Ring Groove Depth | Informed sourcing insights, global B2B focus. | www.rubber-tools.com |

| 10 O rings manufacturers in the World 2025 | Leading O-ring suppliers, global inventory, custom groove solutions. | www.sourcifychina.com |

Essential Technical Properties and Trade Terminology for o’ring groove

Key Technical Properties for O-Ring Grooves

Selecting and specifying O-ring grooves for international B2B supply requires a clear understanding of several technical properties that directly impact sealing performance, compliance, and long-term operational cost. The following critical specifications should be prioritized:

1. Groove Dimensions and Geometry

Groove width, depth, and shape must match both the O-ring size and the application’s operational requirements. These measurements (often in either inch [AS568] or metric [ISO 3601] standards) affect the squeeze and stretch of the O-ring and, therefore, its ability to create an effective seal. Minor mismatches can result in leakage, premature wear, or application failure—issues that are costly to correct in international operations.

2. Surface Finish and Roughness

The finish of the groove’s surface significantly impacts seal integrity, particularly in dynamic or high-pressure environments. Excessive roughness can cause O-ring abrasion or poor sealing, while a surface too smooth may hinder lubrication retention. For most industrial applications, a surface roughness (Ra) between 16–32 μin (0.4–0.8 μm) is standard. For export buyers, always verify if the supplier’s finishing aligns with application and regional standards.

3. Material Compatibility and Grade

Groove and O-ring material compatibility is critical, especially in industries exposed to chemicals, extreme temperatures, or food-grade regulations. Common groove materials include aluminum, stainless steel, and plastics, each with distinct advantages in terms of corrosion resistance or weight. Certification (FDA, REACH, RoHS) may be required for certain global markets—ensuring traceability and regulatory compliance.

4. Tolerance and Manufacturing Precision

Tolerance refers to the allowable deviation in groove dimensions, commonly specified in millimeters or thousandths of an inch. Tight tolerances are vital for high-pressure or safety-critical applications but may increase manufacturing complexity and cost. For buyers from emerging markets or cost-sensitive sectors, balancing performance needs and attainable tolerances is a key negotiation point.

5. O-Ring Squeeze and Compression

Squeeze describes the deformation of the O-ring when installed, typically expressed as a percentage. Too high a squeeze can accelerate O-ring wear or extrusion; too low compromises sealing effectiveness. Industry standards generally recommend 15-30% squeeze for most applications. Always request documentation or reference charts from suppliers, particularly when operating across multiple regions with different default standards.

6. Temperature and Pressure Ratings

Every groove design is subject to maximum temperature and pressure limitations based on both material and geometry. Overlooking these parameters may lead to unexpected failures, especially in power generation, oil and gas, or food processing sectors prevalent in Africa or South America. Confirm that all products are clearly rated, and request supplier validation where third-party certifications are required.

Common Industrial and Trade Terms Explained

International B2B transactions for O-ring grooves frequently involve industry-specific language and contractual terms. Understanding the following will streamline negotiations and reduce sourcing risk:

OEM (Original Equipment Manufacturer)

Refers to companies that produce components—such as O-ring grooves—integrated into another company’s end product. Sourcing directly from an OEM can improve quality assurance and, often, pricing transparency.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier will accept per order. Custom-sized grooves or non-standard materials frequently carry high MOQs, impacting warehousing and cash flow—especially relevant when consolidating shipments for African or Middle Eastern markets.

RFQ (Request for Quotation)

A formal process where buyers outline technical specs and suppliers provide detailed quotes. RFQs should include groove dimensions, material requirements, tolerances, and certifications to avoid miscommunication, particularly when dealing with suppliers from multiple regions.

Incoterms (International Commercial Terms)

Globally recognized terms that define shipping responsibilities, insurance, and liability between buyers and sellers. Common Incoterms include FOB (Free on Board), CIF (Cost, Insurance, and Freight), and DAP (Delivered at Place). For European or South American buyers, clarifying Incoterms helps prevent disputes over transportation costs or delivery delays.

Lead Time

The period between order placement and delivery. Understanding lead times—especially for custom grooves—enables better inventory planning and can prevent production slowdowns commonly experienced in cross-continental supply chains.

Quality Certification

Standards like ISO 9001 (Quality Management) or ISO 3601 (O-ring Groove), and material certifications such as FDA or REACH, provide assurance of product quality and regulatory compliance. Always request copies when sourcing from new international partners or for regulated industry sectors.

By mastering these technical properties and trade terms, B2B buyers can confidently evaluate suppliers, negotiate favorable terms, and guarantee O-ring groove performance in diverse global markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the o’ring groove Sector

Global Market Overview and Key Sourcing Trends

The o’ring groove sector has become increasingly globalized, shaped by the demands of manufacturers, industrial end-users, and OEMs seeking enhanced equipment reliability, operational efficiency, and cost control. International B2B buyers from diverse regions such as Africa, South America, the Middle East, and Europe face a market marked by complex regulatory frameworks, rapid technological change, and evolving procurement models.

Key Market Drivers:

– Industrial Expansion: Growth in sectors such as oil & gas, mining, food processing, automotive, and water treatment continues to drive demand for high-performance sealing solutions, especially in emerging economies like Nigeria and Brazil.

– Standardization and Compliance: The need for compliance with international standards (AS568, ISO 3601) is paramount, especially for cross-border projects, plant expansions, or equipment upgrades. Buyers in regions like France or Saudi Arabia are increasingly specifying standardized groove dimensions and materials to simplify sourcing and minimize maintenance risks.

– Digitalization and Supply Chain Integration: B2B buyers are leveraging digital tools for real-time inventory tracking, spec verification, and automated reordering. Online configurators, global stock platforms, and virtual engineering support have become standard, reducing lead times and errors.

– Localization vs. Global Sourcing: There’s a growing emphasis on establishing reliable local supplier partnerships to mitigate logistics challenges and currency fluctuations, particularly in Africa and South America. Simultaneously, global sourcing strategies remain essential to access specialized materials or custom groove configurations not always available domestically.

Emerging Sourcing Trends:

– Custom and High-Performance Grooves: With equipment operating under higher pressures or aggressive media, there’s a shift toward custom groove profiles, advanced materials (e.g., FFKM, AFLAS®), and precision manufacturing—requiring deeper collaboration between buyers and engineering teams.

– Vendor Auditing and Multilingual Support: Multinational buyers increasingly prioritize suppliers with robust documentation, language support, and regional technical advisors capable of navigating both US inch-based and ISO metric specifications.

– Responsive Aftermarket Support: Fast access to replacement grooves and technical support increasingly influences supplier selection, especially for remote or high-value operations.

Action Points:

– Rigorously cross-reference groove standards and O-ring compatibility for international fleets.

– Evaluate suppliers for inventory reach, local support, and advanced digital capabilities.

– Consider the total cost of ownership—not just upfront price—when specifying groove designs, particularly for high-maintenance locations.

Sustainability and Ethical Sourcing Considerations

Environmental responsibility and ethically structured supply chains are becoming key themes for B2B buyers within the o’ring groove landscape, driven by regulatory requirements and corporate ESG mandates.

Environmental Impact:

– Material Choices: The sector historically relies on materials such as Nitrile, Viton®, and EPDM, some of which present recycling and environmental challenges at end-of-life. Transitioning to ‘green’ alternatives—biobased elastomers, low-VOC (volatile organic compound) compounds, and recyclable materials—is gaining traction, especially for European buyers and multinationals with global sustainability targets.

– Production Processes: Modern manufacturing is adopting cleaner technologies—energy-efficient curing, closed-loop water systems, and waste reduction protocols. Buyers should favor partners demonstrating environmental management certifications such as ISO 14001.

Ethical Supply Chains:

– Traceability and Transparency: With heightened scrutiny on labor conditions and material origins, particularly in regions with known supply risks, buyers are auditing upstream suppliers more closely. Documentation proving conflict-free minerals, responsible rubber sourcing, and compliance with REACH or RoHS should be requested.

– Certifications and ‘Green’ Labels: Look for grooves and associated O-rings validated by international eco-labels or ‘green’ seals (e.g., UL Environmental, Blue Angel), which demonstrate substantive reduction in hazardous substances or improved lifecycle impact.

– Regional Relevance: While sustainability programs are more advanced in the EU, buyers in Africa and Latin America are using sustainability as a differentiator to win contracts with multinational firms or export markets.

Action Points:

– Request sustainability documentation and life-cycle impact data during RFQ and supplier onboarding.

– Factor in long-term environmental and disposal costs, especially for high-consumption or short-life-cycle applications.

– Use sustainability credentials to enhance brand reputation and meet increasingly stringent procurement requirements from global customers.

A Brief Evolution of O’ring Groove Technology

O’ring grooves have evolved from purely functional components to critical engineered interfaces governing the sealing integrity of complex systems. The earliest standardized grooves emerged in the mid-20th century, paralleling the rise of mass manufacturing in aerospace and automotive sectors. In the decades since, globalization and the proliferation of international standards have driven convergence around AS568 and ISO 3601, fostering compatibility across borders.

Advancements in materials science—such as the introduction of high-temperature and chemical-resistant elastomers—have enabled grooves to function in harsher environments while reducing maintenance intervals. Today’s industry sees grooves engineered for specialized geometries (dovetail, face, radial) and precise tolerances, supported by CAD-integrated design and rigorous quality controls. For B2B buyers, understanding this progression underscores the importance of selecting suppliers who combine legacy expertise with cutting-edge manufacturing and sustainability practices.

Frequently Asked Questions (FAQs) for B2B Buyers of o’ring groove

-

How can I effectively vet international suppliers of O-ring grooves to ensure quality and reliability?

Begin by requesting documentation of ISO 9001 or equivalent quality certifications, and ask for recent third-party audit reports. Seek suppliers with a track record of servicing your region and demand references from companies with similar technical and volume requirements. Evaluate their groove manufacturing capabilities, adherence to AS568/ISO 3601 standards, and ability to provide detailed inspection reports. It’s also prudent to arrange a virtual or on-site audit and ensure they keep buffer inventory or offer robust support for urgent orders. -

What options are available if I need custom or non-standard O-ring groove dimensions for legacy equipment or unique applications?

Most reputable suppliers offer engineering support to help design custom grooves tailored to your equipment’s needs. This typically requires submitting detailed technical drawings or samples. Expect longer lead times—often several weeks—due to tool changes or non-stocked materials, and be prepared for higher minimum order quantities (MOQs). Confirm if the supplier provides prototypes and if ongoing supply for replacements is guaranteed, to avoid future disruptions.

-

What are typical lead times and minimum order quantities (MOQs) for standard and custom O-ring grooves in international trade?

For standard groove sizes, lead times can range from immediate shipment to 2 weeks, depending on stock and regional distribution. MOQs may be low (e.g., 100–500 units), especially for commonly stocked items. Custom grooves often require MOQs of 1,000 units or more, with lead times extending to 4–8 weeks due to bespoke tooling or material sourcing. Always clarify these terms upfront to align with your project timeline and inventory requirements. -

Which international payment methods are commonly accepted, and how can I ensure secure transactions?

Most suppliers accept wire transfers (TT), Letters of Credit (L/C), and, increasingly, secure online payment platforms. For large orders or new suppliers, opt for L/C to safeguard funds until all contractual terms are met. Understand payment milestones (e.g., deposits, balance upon delivery) and ensure they are clearly stipulated in your purchase agreement. It is advisable to work with suppliers who offer transparent invoicing and have established relationships with reputable banks. -

How do I verify that O-ring grooves conform to relevant international quality standards and certifications?

Request certificates of conformity (CoC), material data sheets, and inspection reports aligned with AS568, ISO 3601, or customer-defined specs. For critical industries (oil & gas, pharmaceuticals, food processing), require additional documentation such as FDA, REACH, or RoHS compliance where applicable. Engage in periodic third-party testing or random batch sampling, and establish a quality agreement that obligates the supplier to notify you of any process or material changes. -

What key logistical considerations should I factor in when importing O-ring grooves to Africa, Latin America, the Middle East, or Europe?

Work with suppliers well-versed in your region’s import regulations, tariff codes, and labeling requirements. Assess available incoterms (e.g., FOB, CIF, DAP) to determine responsibilities for shipping, insurance, and customs clearance. Plan for potential delays due to customs inspections or regional transport bottlenecks and inquire about local warehousing or agent support to minimize downtime. Consolidate shipments where feasible to reduce logistics costs and streamline import documentation. -

How can I handle disputes or issues with defective or non-conforming O-ring grooves from an overseas supplier?

Establish clear terms for returns, replacements, and dispute resolution in your initial contract, ideally referencing ICC Incoterms and arbitration venues. Maintain detailed inspection records upon receipt and notify the supplier of issues within the agreed claim window. Prioritize suppliers who offer rapid support, issue credit notes, or reimburse logistics costs for defective goods. For recurring issues, consider onsite audits or independent inspections to drive quality improvements. -

What best practices can enhance communication and long-term collaboration with international O-ring groove suppliers?

Adopt clear, written communication specifying technical and commercial requirements, and use standardized terminology (e.g., AS568, ISO 3601 numbers) to avoid misunderstandings. Leverage multilingual documentation or local representatives where language barriers exist. Regularly share demand forecasts and feedback on performance metrics. Building a relationship based on transparency and proactive problem-solving will improve response times, negotiate better pricing, and ensure supply chain resilience as your business grows.

Strategic Sourcing Conclusion and Outlook for o’ring groove

Strategic sourcing of O-ring grooves is a cornerstone for resilient, cost-effective, and high-performance supply chains in today’s global industrial landscape. International B2B buyers—whether sourcing for manufacturing hubs in France, infrastructure projects in Kenya, or oil & gas assets in Saudi Arabia—must balance technical precision, material compatibility, and compliance with international standards like AS568 and ISO 3601. Prioritizing partnerships with knowledgeable suppliers and leveraging detailed groove size charts are essential steps to mitigate risk and maximize operational uptime.

Key takeaways for B2B buyers include:

– Thoroughly validate groove specifications to ensure compatibility with both local and export-market standards.

– Engage with suppliers who offer flexible inventory and expert support, especially for custom or non-standard grooves required by legacy equipment and emerging markets.

– Monitor shifting regulations and regional dynamics to avoid costly compliance pitfalls and supply disruptions.

– Invest in quality assurance and rigorous supplier vetting to drive long-term reliability and performance.

– Embrace digital resources and multilingual expertise to streamline global transactions and technical collaboration.

Looking ahead, competitive advantage will favor buyers who adopt a proactive sourcing mindset: staying updated on material innovations, digital procurement tools, and evolving international standards. Now is the time to strengthen your sourcing strategies and supplier relationships—ensuring your organization remains agile and resilient as global supply chain complexity increases. Take strategic action today to secure more robust, compliant, and future-ready O-ring groove solutions for tomorrow’s demands.