Introduction: Navigating the Global Market for pp on plastic

Polypropylene (PP) is at the heart of modern industrial manufacturing, enabling everything from high-strength packaging and durable consumer goods to automotive components and advanced textiles. For international B2B buyers—particularly those across Africa, South America, the Middle East, and Europe—the strategic sourcing of PP on plastic is now central to ensuring operational efficiency, product quality, and sustained business growth. Amid rapidly evolving supplier landscapes and increasing global demand, gaining a firm grasp of the complexities and opportunities within the PP market is paramount.

Why does PP on plastic matter so much? Its unique blend of chemical resistance, high melting point, tensile strength, and lightweight durability makes PP the material of choice across critical industries. However, leveraging these advantages hinges on more than just material selection; it requires informed navigation of global supplier networks, rigorous quality checks, and the ability to anticipate shifting pricing and regulatory dynamics. In regions such as South Africa and Colombia, where logistics, regional regulation, and sustainability pressures add further layers of complexity, the ability to source with confidence can become a clear competitive edge.

This comprehensive guide goes beyond surface-level tips, arming international buyers with practical insights at every decision point:

- Types & Materials: Understand the different PP grades, forms, and customizations relevant to your sector.

- Manufacturing & Quality Control: Learn how leading suppliers ensure consistency, compliance, and top performance.

- Supplier Evaluation: Master techniques for vetting global partners—reviewing certifications, production capacity, and supply chain resilience.

- Cost & Market Dynamics: Grasp the real drivers of global PP pricing, trade flows, and how to optimize your procurement strategy.

- FAQs & Actionable Advice: Tackle common sourcing challenges with proven solutions for your region.

By the end of this guide, you’ll have the clarity and tools to make informed, confident PP sourcing decisions—empowering your business to thrive in today’s global marketplace.

Understanding pp on plastic Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Homopolymer PP | Pure polypropylene, high clarity, rigid | Injection molding, packaging films | High strength and clarity, but reduced impact resistance at low temps |

| Random Copolymer PP | Ethylene incorporation, improved clarity | Food packaging, medical items | Excellent transparency and flexibility, slightly lower heat resistance |

| Block Copolymer PP | Ethylene blocks, enhanced impact resistance | Automotive, industrial containers | Superior toughness, good processability, often less transparent |

| Recycled PP | Made from post-consumer/post-industrial sources | Secondary packaging, textiles | Cost-effective and eco-friendly, but variable quality and performance |

| Filled/Modified PP | Mineral/glass fiber/talc additives | Appliance housings, automotive parts | Customized properties (e.g., stiffness), but higher cost and sourcing needs |

Homopolymer PP

Homopolymer polypropylene is composed solely of propylene monomers, resulting in a material known for its rigidity, strength, and high clarity. It’s especially suitable for applications requiring visual transparency, such as packaging films and clear containers. For international B2B buyers, especially in retail or FMCG sectors, its consistency and broad process compatibility are appealing. However, it is less suitable for applications subject to low temperatures or requiring high impact resistance, factors that should be considered when specifying for transport or outdoor uses.

Random Copolymer PP

Random copolymer PP integrates ethylene into the polymer chain, leading to improved flexibility and exceptional clarity. Its superior optical properties make it the material of choice for food-grade packaging, medical devices, and transparent lids. Buyers in regulated sectors such as healthcare or food processing will value its compliance with global safety standards and visual appeal. However, its lower heat resistance compared to homopolymers means it may not meet requirements for hot-fill or high-heat processes.

Block Copolymer PP

Manufactured by introducing ethylene blocks into the structure, block copolymer PP stands out for its high impact resistance and processability, even at sub-zero temperatures. Key B2B users include automotive part makers, industrial storage suppliers, and logistics companies seeking durable yet moldable components. For buyers in Africa and colder European regions, its resilience against cracking is invaluable. On the downside, block copolymers usually have lower transparency and might carry a premium price.

Recycled PP

Recycled PP is derived from post-consumer or post-industrial waste, answering the global call for sustainable materials. It’s widely adopted in secondary packaging, agricultural films, and woven sacks, offering notable cost savings and environmental benefits. Buyers targeting the eco-conscious market or local regulations on green sourcing will find recycled PP advantageous. However, variability in quality, color, and mechanical performance requires rigorous supplier vetting and clear technical specifications.

Filled/Modified PP

Filled or modified PP incorporates additives such as mineral fillers, glass fibers, or talc to achieve specific performance attributes—higher stiffness, increased thermal resistance, or improved dimensional stability. This makes it ideal for technical B2B applications in automotive, white goods, and electrical sectors. While these modifications enable precise tailoring to demanding requirements, they may complicate sourcing, increase costs, and require close technical collaboration with suppliers. Buyers should prioritize suppliers offering proven technical support and certifications.

Related Video: What are the Different Types of Plastics | 7 Types of Plastic and Categories

Key Industrial Applications of pp on plastic

| Industry/Sector | Specific Application of pp on plastic | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Packaging | Flexible packaging films, woven bags | Lightweight, moisture resistance, recyclable options | Material grade, strength, certifications, sustainability practices |

| Automotive | Interior and exterior automotive components | High durability, weight reduction, chemical resistance | Dimensional consistency, UV stability, OEM standards |

| Agriculture | Seed and fertilizer bags, greenhouse films | Protection from humidity, chemical stability | Tensile strength, resistance to agrochemicals, customization |

| Consumer Goods | Household containers and storage products | Safe food contact, impact resistance, longevity | Food-grade compliance, clarity, shipment reliability |

| Healthcare | Medical device housings, sterile packaging | Hygiene, chemical inertness, safety | Traceability, sterilization compatibility, strict QA |

Application Details

Packaging: Flexible Films and Woven Bags

Polypropylene (PP) is widely used in packaging—ranging from flexible films for food items to robust woven bags for industrial goods. In regions where cost-effective and durable solutions are needed for agricultural exports or retail, PP delivers moisture resistance and is recyclable, helping businesses align with global sustainability expectations. When sourcing, buyers must assess material grade, tensile strength, supplier certifications (such as ISO or food-grade), and commitment to eco-friendly production. For African and South American producers especially, sourcing PP packaging that meets local and export standards is crucial for market acceptance and compliance.

Automotive: Interior and Exterior Components

The automotive industry utilizes PP on plastic for interior panels, bumpers, grilles, and under-the-hood components. The material’s lightweight nature directly reduces vehicle weight, improving fuel efficiency and helping meet emission regulations in Europe and the Middle East. Its chemical resistance and durability ensure long-term reliability in harsh climates. Sourcing requirements include dimensional consistency, superior UV resistance (critical for sun-exposed regions), and adherence to stringent OEM or international automotive standards for performance and safety. Supply chain reliability for just-in-time production is also essential for manufacturers in all regions.

Agriculture: Seed and Fertilizer Bags, Greenhouse Films

PP on plastic is prominent in agriculture as it resists chemicals and moisture, making it ideal for storage solutions and protective greenhouse films. In climates such as South Africa or Colombia, where humidity and pests are persistent threats, the robustness and customizable thickness of PP ensure seeds and fertilizers are adequately protected. Buyers must look for materials with high tensile strength, agrochemical resistance, and the ability to customize size and print for branding or regulatory information. Reliable logistics and consistent product quality are critical, especially for export-oriented agribusinesses.

Consumer Goods: Household Containers and Storage Products

Household and commercial storage solutions leverage PP for its clarity, safety, and impact resistance. Products such as kitchen containers, bins, and organizers benefit from PP’s non-toxicity and suitability for direct food contact. For B2B buyers in Europe and the Middle East focused on consumer safety and transparency, material traceability and food-grade compliance are top priorities. Ensuring shipment reliability and consistent quality helps avoid costly recalls and strengthens trust with downstream retailers.

Healthcare: Medical Device Housings and Sterile Packaging

PP is trusted in healthcare for housings of medical devices, labware, and sterile packaging due to its inertness and ease of sterilization. For importers across Africa and South America, where regulatory standards are rising, sourcing PP that meets international quality assurance and traceability requirements is key to preventing supply chain risks. Sterilization compatibility and rigorous supplier quality audits (ISO 13485 or equivalent) ensure patient safety and brand credibility in diverse healthcare markets.

Related Video: Plastic Processing Overview

Strategic Material Selection Guide for pp on plastic

Comparative Analysis of Common Materials Used with PP in Plastics

In the plastics industry, polypropylene (PP) is frequently combined with or compared against several other materials to optimize performance, cost, and regulatory compliance across diverse applications. For international B2B buyers—especially those in Africa, South America, the Middle East, and Europe—careful material selection is essential to meeting both market requirements and operational conditions. Below are analyses of four materials commonly encountered alongside PP in plastic solutions: pure PP, HDPE, PET, and glass-filled PP.

Polypropylene (PP) – Homopolymer & Copolymer Grades

Key Properties: PP is known for its high chemical resistance, moderate temperature tolerance (up to ~130°C), low density, and good tensile strength. Homopolymer PP offers clarity and strength, while copolymer variants add impact resistance—important for packaging or automotive components.

Pros: Lightweight, chemically inert, durable, relatively low cost, and suitable for food contact applications. Easy to process using common plastic manufacturing techniques.

Cons: Lower impact strength at low temperatures (especially for homopolymers), limited UV resistance unless stabilized, and moderate barrier properties.

Application Impact: Excellent for packaging, piping, textiles, household goods, and automotive parts. In packaging for food, pharmaceuticals, and chemicals, its inertness and clarity are major advantages.

International Considerations: Widely standardized (ASTM, ISO, DIN), making global sourcing relatively straightforward. European and Middle Eastern buyers often specify food safety and REACH compliance, while African and South American buyers may prioritize cost and durability for harsh environments.

High-Density Polyethylene (HDPE)

Key Properties: HDPE features higher impact strength and lower permeability than PP, along with a slightly lower melting point (~120°C). It is highly resistant to chemicals and moisture, making it a leading choice in bottles, containers, and pipework.

Pros: Superior toughness, excellent resistance to a broad range of chemicals, and very good weatherability. Cost-effective and widely available.

Cons: Opaque in thick sections, may stress-crack under certain loads, and not suitable for high-temperature applications compared to PP.

Application Impact: Favored in containers, tanks, and outdoor applications where impact, chemical resistance, and UV exposure are concerns. In water or chemical storage, HDPE’s advantage over standard PP may justify its marginally higher cost.

International Considerations: Highly compatible with international standards (ASTM D3350, ISO 4427). Regions with greater UV exposure (e.g., Middle East, Africa) benefit from UV-stabilized HDPE grades. For potable water, compliance with international (ISO) safety standards is critical.

Polyethylene Terephthalate (PET)

Key Properties: PET has excellent barrier properties for gases and moisture, good transparency, and higher temperature tolerance (up to ~150°C). It is lightweight and easily recycled.

Pros: Superior clarity, great barrier characteristics, and good strength-to-weight ratio. Extensively used for containers requiring visual appeal and product protection.

Cons: More brittle than PP, susceptible to stress whitening and can be more expensive. Needs higher processing precision.

Application Impact: Dominant in beverage bottles, food packaging, and medical product containers where shelf-life and appearance matter.

International Considerations: PET is universally accepted, with compliance to FDA, EU (Regulation 10/2011), and other local food safety standards often required. South America and Europe particularly value PET for its recyclability, aligning with regional sustainability goals. Import duties and recycling infrastructure may influence PET’s practicality in regions like Africa.

Glass-Filled Polypropylene (GFPP)

Key Properties: GFPP combines PP resin with glass fibers (typically 10–40% by weight) to greatly enhance rigidity, dimensional stability, and temperature tolerance (up to ~150°C, depending on grade).

Pros: Much higher strength and stiffness than standard PP, minimal warping, and increased temperature/performance profile. Maintains much of PP’s chemical resistance.

Cons: Higher processing complexity, increased material cost, and typically reduced impact resistance. Not as suitable for applications needing ductility.

Application Impact: Used in demanding engineering applications, such as automotive components, appliance housings, and structural parts operating under stress.

International Considerations: Complies with major global standards (such as ASTM D4101 for reinforced PP). Buyers in Europe and the Middle East may prioritize GFPP for precision parts exposed to higher thermal or mechanical stresses. Consider supply chain capability—specialized production and QC are required for consistent quality.

Material Comparison Summary Table

| Material | Typical Use Case for pp on plastic | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polypropylene (PP) | General packaging, piping, consumer goods | Lightweight, chemically inert, cost-effective | Lower impact at low temp, limited UV resistance | Low |

| High-Density Polyethylene (HDPE) | Containers, pipes, outdoor products | High impact and chemical resistance | Opaque, stress-crack potential, lower heat tolerance | Low–Medium |

| Polyethylene Terephthalate (PET) | Bottles, food/medical packaging, films | Excellent barrier and clarity | Brittle, more costly, sensitive to processing | Medium |

| Glass-Filled Polypropylene (GFPP) | Automotive, appliances, high-stress parts | Enhanced strength and stiffness | Higher cost, complex processing, less ductile | Medium–High |

In-depth Look: Manufacturing Processes and Quality Assurance for pp on plastic

Polypropylene (PP) is a cornerstone material for modern plastic manufacturing, widely used in packaging, textiles, automotive, and construction products due to its favorable balance of strength, chemical resistance, and cost-efficiency. For B2B buyers sourcing “pp on plastic” internationally, rigorously understanding the manufacturing and quality assurance (QA) processes is essential to ensure product quality, regulatory compliance, and supply chain reliability. Here’s a detailed overview of typical manufacturing workflows, QA checkpoints, relevant standards, and pragmatic guidance to empower your procurement strategy.

Key Stages in the PP on Plastic Manufacturing Process

For most PP-on-plastic applications—ranging from extruded films and bags to molded containers and parts—the manufacturing process follows a structured path. Each stage offers specific opportunities for quality control and customization to meet diverse B2B requirements.

1. Material Preparation

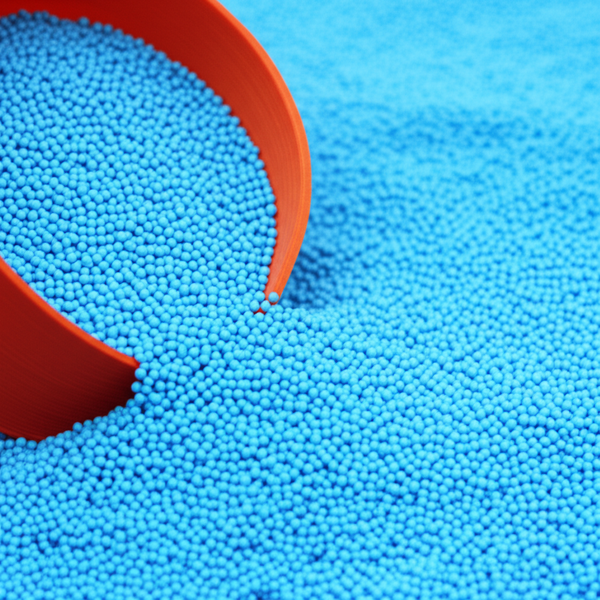

- Resin Sourcing: Polypropylene resin (formulated as pellets or granules) is sourced, often with targeted molecular weights or additives for properties like UV resistance or anti-static performance.

- Blending and Coloring: Resins may be blended with fillers, colorants, stabilizers, or recycled content, depending on final application needs and regulatory markets.

- Drying: To prevent moisture-related defects, pellets are often dried prior to processing, especially when recycled content is used.

2. Forming and Extrusion/Molding

- Extrusion (for films/sheets): Heated PP resin is forced through a die to form films, sheets, or tapes. Advances in multilayer co-extrusion improve barrier properties or surface finish.

- Injection/Blow Molding (for parts/containers): Melted PP is injected or blown into precise molds to produce three-dimensional products, allowing for high repeatability and tight tolerances.

- Compression/Hot Press Forming (for composites or assembled parts): Used for embedding PP with other substrates or forming more complex parts.

3. Assembly and Secondary Processing

- Lamination or Coating: PP films can be laminated onto other substrates (such as woven fabric or paper) to enhance strength or create multi-functional products.

- Welding or Sealing: Ultrasonic, heat, or solvent-based methods are commonly applied for joining PP parts, especially in bag or film manufacturing.

4. Finishing and Post-Processing

- Cutting, Trimming, or Slitting: Final dimensions are achieved, and any excess material is removed to ensure product uniformity.

- Punching or Printing: For branding or regulatory labeling, printing or die-cutting is completed according to buyer requirements.

- Packaging: Finished products are packed under controlled conditions to mitigate contamination and ensure safe transportation.

Quality Assurance: Standards, Checkpoints, and Testing Methods

Essential International Standards

Working with globally distributed B2B supply chains, adherence to recognized standards is non-negotiable for reliability and cross-border acceptability:

- ISO 9001: Key benchmark for quality management systems, certifying consistency in production and record-keeping.

- ISO 14001: Environmental management—critical if your buyers or customers prioritize sustainability.

- Industry-Specific Standards: Depending on final use, relevant certifications may include CE Marking (Europe), FDA Compliance (for food-contact plastics), or specialized marks such as API (for automotive/industrial parts).

- Material-Specific Testing: For PP bag exports, standards like ASTM D882 (tensile properties), EN 1889 (for food packaging), or local equivalents may apply.

Typical Quality Control (QC) Checkpoints

A robust manufacturing partner will implement QC at multiple stages, commonly categorized as:

- Incoming Quality Control (IQC): All raw materials (PP resin, additives, recycled content) undergo testing for purity, melt flow rate (MFR), and contamination. Certificates of Analysis (CoAs) are commonly reviewed here.

- In-Process Quality Control (IPQC): Constant monitoring during forming/manufacturing, including dimensional verification, color inspection, and process parameter tracking (temperature, pressure, etc.).

- Final Quality Control (FQC): Comprehensive inspection before packing/shipment—tests include tensile strength, impact resistance, seal integrity, thickness uniformity, and visual quality assurance (colors, print clarity, absence of defects).

Common QC Tests and Methods

For dependable “pp on plastic” outcomes, expect suppliers to deploy:

- Mechanical Testing: Tensile, elongation at break, puncture resistance, and drop tests (essential for packaging and industrial parts).

- Visual and Dimensional Inspection: Automated and manual checks for bubbles, warpage, opacity, or surface defects.

- Migration and Safety Testing: For food-contact applications, migration tests per EU or FDA guidelines; for industrial components, chemical resistance or aging tests.

- Batch Traceability: Barcoding and digital records link each batch to raw material lots and process parameters, critical for quick response in the event of recalls.

Supplier Transparency: How B2B Buyers Can Ensure Effective Quality Control

Supplier Audits and Certifications

- Onsite Audits: For major orders or strategic partnerships, conduct (or commission) audits of manufacturing sites. Assess equipment condition, cleanliness, workforce training, and calibration of lab instruments.

- Third-party Inspection: Utilize recognized bodies (SGS, TÜV Rheinland, Intertek) to perform random sampling or pre-shipment inspection, verifying consistency with order specifications and international standards.

Documentation and Ongoing Evaluation

- Review QC Reports: Insist on detailed quality control and test reports for each shipment. Look for key metrics: melt flow rate, physical test results, batch traceability.

- Certificates of Conformity: For regulated markets (e.g., EU, South Africa, Saudi Arabia), require CE marking, CoC, or region-specific documentation along with customs clearance papers.

- Performance Samples: Before finalizing bulk contracts, review production samples under real-world or simulated end-use conditions.

Ensuring Regional Compliance and Navigating International Nuances

- Africa: Buyers in markets such as South Africa or Nigeria should verify that products meet SABS or SONCAP certification as applicable. Local agents or agencies may help validate paperwork to expedite customs clearance.

- South America: Colombian and Brazilian buyers often require INVIMA (food safety) or INMETRO (industrial) approval marks. Be aware of Mercosur-specific chemical and packaging requirements.

- Middle East: For Saudi Arabia, Qatar, and UAE, SASO (Saudi Standards) or ESMA (Emirates Authority) certification may be compulsory, especially for food-grade or packaging plastics.

- Europe: CE marking is essential for most regulated products, with REACH compliance documentation required for chemical safety. Buyers should confirm suppliers are registered with the ECHA database if substances are imported into the EU.

Practical Tips for International B2B Buyers

- Prioritize certified partners: Work with manufacturers who display ISO accreditation and provide up-to-date documentation transparently.

- Ask about process controls: Evaluate if your supplier uses modern automated monitoring, real-time process data capture, and advanced QC technology.

- Consider sustainability: If your clientele or regulatory regime prioritizes green credentials, ensure that suppliers can demonstrate recycled content usage, energy-efficient processes, or environmental certificates (such as ISO 14001).

- Weigh customization and scalability: Choose partners with flexibility for custom formulations or packaging but with sufficient capacity and infrastructural reliability to avoid bottlenecks.

- Insist on traceability: Make sure every step from resin source to finished goods is documented for supply chain transparency—essential for both recall contingency and regulatory audits.

By building these manufacturing and QA insights into your procurement processes, you can mitigate risks, improve product consistency, and foster trusted supplier relationships across Africa, South America, the Middle East, and Europe. This rigor helps ensure your “pp on plastic” products meet market expectations, regulatory demands, and sustainable business goals on a global scale.

Related Video: Plastic bottle manufacturing process – explained by UpSkul

Comprehensive Cost and Pricing Analysis for pp on plastic Sourcing

Understanding the Cost Structure for PP on Plastic Sourcing

When sourcing polypropylene (PP) materials or finished plastic products at a B2B level, breaking down the cost structure is essential to securing the best value and competitive pricing. Major cost components include:

- Raw Materials: The base cost of PP resin or granules typically constitutes the largest share. Prices fluctuate based on global oil prices, regional supply-demand balances, and grade (virgin vs. recycled PP).

- Labor Costs: Manufacturing labor can significantly impact cost, especially in regions with higher wage structures. Automation can reduce labor costs, but initial investments in advanced machinery may offset savings temporarily.

- Manufacturing Overhead: This encompasses factory operational expenses, utilities, waste management, maintenance, and compliance with local regulations.

- Tooling and Mold Costs: For custom products or large-scale production, initial tooling and mold investments can be substantial. Amortizing tooling costs across production runs improves unit economics.

- Quality Control (QC): Rigorous QC practices add costs but minimize product failures and help maintain brand reputation. These include material testing, process inspections, and adherence to compliance certifications.

- Logistics and Shipping: Freight (sea, land, air), packaging, insurance, and customs clearance all contribute to landed cost. Geopolitical factors and port conditions can further influence freight charges.

- Supplier Margin: The supplier must cover their overhead, financing, and risks, so a profit margin—often negotiable based on order size and relationship—is embedded in the price.

Main Pricing Influencers in the International Market

Several factors specifically shape the final price for international buyers of PP plastics:

- Order Volume / Minimum Order Quantity (MOQ): Large orders usually secure price breaks, while small lots may incur higher unit prices.

- Product Specifications & Customization: Non-standard colors, additives (e.g., UV stabilizers), film thickness, or specialty packaging increase costs due to more expensive formulations or adjustments in production runs.

- Material Selection: Virgin PP, food-grade PP, or eco-friendly (recycled/recyclable) grades each have unique pricing dynamics.

- Quality Standards & Certifications: Compliance with ISO, REACH, FDA, or local standards often requires enhanced process controls and documentation, adding cost but reducing risk.

- Supplier Origin & Reputation: Established suppliers with recognized quality command premium pricing, but may offer better reliability and after-sales service.

- Incoterms (International Commercial Terms): FOB, CIF, DDP, and others determine the distribution of shipping, insurance, and customs costs between buyer and seller, directly affecting net landed price.

Strategic Buyer Tips for Optimizing Cost and Value

B2B buyers—especially in Africa, South America, the Middle East, and Europe—can benefit from the following actionable strategies:

- Negotiate for Bundled Volume Across SKUs: Even if individual product volumes are modest, consolidating multiple SKUs with one supplier can unlock better pricing.

- Leverage Local Market Expertise: Collaborate with sourcing agents or local consultants knowledgeable about supplier performance, regulatory environments, and transport logistics.

- Vet for Reliable Supply Chains: Suppliers with proven logistics and contingency planning reduce the risk of costly delays—vital for markets with port or customs challenges (e.g., South Africa, Colombia).

- Prioritize Total Cost of Ownership: Don’t fixate solely on unit price. Consider QC requirements, shipping times, import duties, and post-sale support, as these can impact total cost and operational efficiency.

- Utilize Third-Party Inspections: Investing in third-party audits before shipment mitigates risks of substandard batches, reduces rework, and protects your brand.

- Understand Incoterm Implications: Select Incoterms suited to your in-country logistics capacity; for less experienced importers, DDP may offer predictability but at a premium.

- Request Transparent Quotations: Insist on itemized quotes highlighting raw materials, labor, QC, freight, and margin—this transparency supports more effective negotiation.

Regional Pricing Considerations

Markets like Africa and South America may experience higher inbound freight costs and potential customs complexities, impacting landed costs. Middle Eastern buyers often have access to competitively priced raw materials due to proximity to petrochemical hubs but must watch for specification alignment and certification. European buyers, while typically more price-sensitive due to competitive pressures, may prioritize advanced certifications and sustainability, which affect costs.

Disclaimer: Price ranges for PP plastics can vary widely by grade, application, and market. International dynamics—such as resin price volatility, forex rates, and logistics disruptions—cause regular fluctuations. All pricing information should be considered indicative; request updated, formal quotations for budgeting and procurement.

Spotlight on Potential pp on plastic Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘pp on plastic’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Google (www.google.com)

Google appears in industry listings and global directories as a manufacturer or supplier linked to ‘pp on plastic’ solutions, though verifiable details are limited. Available sources suggest the company offers a range of polypropylene-based products used in packaging, industrial, or consumer applications. While specifics on production capabilities, quality management, or international certifications (such as ISO) are not clearly disclosed, Google is noted within broad-trade search channels, indicating at least some level of international market engagement. For buyers in Africa, South America, the Middle East, and Europe, direct verification of Google’s supply chain transparency, customization capabilities, and compliance with stringent quality standards is recommended. Due to the lack of detailed public documentation, careful due diligence is essential before forming procurement partnerships.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| Limited details; noted as global supplier | www.google.com |

Essential Technical Properties and Trade Terminology for pp on plastic

Key Technical Properties of Polypropylene (PP) on Plastic

When sourcing polypropylene (PP) products—whether as raw particles, films, or finished goods—understanding the critical technical specifications is essential. For international B2B buyers, these properties directly impact product quality, compliance, and final application suitability. Below are the most important technical properties to evaluate:

-

Material Grade

Polypropylene is categorized into various grades, such as homopolymer (HP) and copolymer (CP), each optimized for specific uses. Homopolymer PP offers higher rigidity and a slightly higher melting point, making it ideal for injection molding and packaging. Copolymer grades provide improved impact resistance, suited for products requiring flexibility or durability under stress. Specifying the correct PP grade aligns material performance with your industry’s needs and helps avoid downstream quality issues. -

Melt Flow Index (MFI)

The melt flow index measures how easily molten PP flows during processing, typically expressed in grams/10 min at a certain temperature and load. A higher MFI indicates better flow, suitable for thin films or fibers, while lower values are better for structural, high-strength applications. Clear communication of required MFI with suppliers ensures process compatibility and consistent product quality. -

Tensile Strength

This property describes the maximum pulling force the material can withstand before breaking. High tensile strength is crucial for applications like industrial packaging, woven bags, and automotive components, where structural integrity is non-negotiable. Always request technical datasheets confirming this parameter to prevent performance failures in end-use environments. -

Tolerance

Tolerance refers to the acceptable deviation in dimensions or weight from specified standards. For PP components, strict tolerances are key where products are used as parts in automated lines or fit with other precision-engineered elements. Consistent tolerances reduce waste, rework, and compatibility problems. -

Chemical Resistance

PP exhibits strong resistance to many acids, bases, and solvents. This makes it suitable for packaging chemicals, food products, and medical supplies. Understanding the specific resistance profile of your material grade—not just generic PP—is necessary to match with regulatory and safety requirements in different export regions. -

Thermal Properties (Melting Point)

Polypropylene typically melts at around 130°C. This stability under heat is a selling point for containers, automotive parts, and industrial applications requiring sterilization or high-temperature exposure. Confirm the melting point specification to ensure suitability for intended processing and usage conditions.

Common Industry and Trade Terms in Global PP Sourcing

Navigating international trade for PP on plastic involves specialized terminology. Understanding these terms streamlines supplier negotiations and minimizes misunderstandings:

-

OEM (Original Equipment Manufacturer)

Refers to suppliers who manufacture products based on the buyer’s specifications, frequently under the buyer’s brand. Clarifying OEM involvement ensures you receive customized products that match your unique requirements, enabling differentiation in local markets. -

MOQ (Minimum Order Quantity)

The lowest quantity a supplier is willing to accept per order. Negotiating appropriate MOQs is vital, particularly for African, Middle Eastern, or South American buyers scaling market entry, and helps manage cash flow and warehousing costs. -

RFQ (Request for Quotation)

An RFQ is a formal inquiry sent to suppliers asking for detailed price quotations based on specific PP grades, sizes, packaging, and delivery terms. Using standardized RFQs accelerates procurement cycles and helps in transparent supplier comparisons. -

Incoterms (International Commercial Terms)

Globally recognized terms defining responsibilities for shipping, insurance, customs clearance, and risk transfer. Examples include FOB (Free On Board), CIF (Cost, Insurance, and Freight), and DDP (Delivered Duty Paid). Specifying preferred Incoterms in contracts protects your interests and clarifies cross-border logistics responsibilities. -

Quality Certification

Supplier adherence to global standards like ISO 9001 (quality management) or ISO 14001 (environmental management). Always ask for up-to-date certification documentation; this is especially crucial in regulated sectors or when exporting to regions with strict compliance demands such as the EU. -

Lead Time

Total duration from order placement to delivery. Variable lead times can disrupt B2B supply chains, especially for buyers importing into Africa, the Middle East, or South America where customs processes may also add delays. Accurate discussions about lead time help align inventory planning and mitigate disruptions.

By focusing on these technical specifications and familiarizing yourself with key trade terms, B2B buyers in emerging and mature markets alike can confidently evaluate potential suppliers, ensure product compliance, and mitigate sourcing risks in the global PP plastics market.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the pp on plastic Sector

Market Overview & Key Trends

The global polypropylene (PP) on plastic sector is experiencing robust growth, fueled by escalating demand for lightweight, durable, and cost-effective materials across industries such as packaging, agriculture, textiles, and automotive manufacturing. For international B2B buyers, particularly in Africa, South America, the Middle East, and Europe, this expansion presents both opportunities and complexities.

Key Drivers and Regional Dynamics:

Rapid urbanization, shifting consumer preferences toward flexible and sustainable products, and the booming e-commerce market are major catalysts. African and South American markets, such as South Africa and Colombia, are seeing increased local manufacturing and a drive to substitute imports with domestic production. Meanwhile, Europe and the Middle East remain significant consumers, with a focus on high-quality, value-added applications.

Emerging Sourcing & Technology Trends:

– Digital Sourcing Platforms: Buyers are leveraging digital procurement solutions and B2B marketplaces to streamline supplier discovery, manage RFQs, and compare quality certifications efficiently.

– Customization and Specialization: Demand is rising for customized PP compounds (e.g., UV-resistant grades, food-grade particles) tailored to regional regulatory requirements and end-use specifications.

– Integrated Supply Chains: Reliable, agile supply chains—featuring real-time tracking, advanced logistics, and contingencies for market disruption—are distinguishing top-tier suppliers.

– Supplier Vetting: There’s a strong emphasis on supplier audits, documentation of ISO and environmental certifications, and transparency in raw material sourcing.

Market Challenges:

Buyers must navigate fluctuating raw material prices (linked to oil and gas markets), evolving trade regulations, and heightened scrutiny on supply chain ethics. Tariffs, varying import/export controls, and logistical hurdles, especially in emerging markets, require resilient sourcing strategies and diversified supplier bases.

Actionable Insights for B2B Buyers:

– Develop multi-sourcing strategies to reduce risk and ensure continuity.

– Prioritize partners with proven quality control, certification, and strong logistics capabilities.

– Utilize technology for supplier benchmarking in real time, especially when evaluating new entrants from emerging economies.

Sustainability & Ethical Sourcing in B2B

As sustainability shapes procurement decisions globally, B2B buyers must integrate both environmental and ethical considerations into their sourcing frameworks for PP on plastic products.

Environmental Impact & Innovations:

Polypropylene is inherently recyclable, but the sector is under mounting pressure to reduce carbon footprints and address plastic waste. The most forward-thinking manufacturers are investing in closed-loop recycling systems, producing high-quality PP from post-consumer and post-industrial sources, and minimizing process emissions. Adoption of lightweight, yet durable PP bags and packaging solutions is helping companies lower logistic costs and reduce total material consumption.

Ethical Supply Chains:

Transparency and traceability within the supply chain are now expected. Ethical sourcing includes ensuring fair labor practices, adherence to international safety standards, and full disclosure of material provenance. B2B buyers are increasingly required to provide proof of responsible sourcing to downstream customers, especially in markets with stringent regulatory frameworks (such as the EU’s Green Deal and extended producer responsibility requirements).

Certifications and ‘Green’ Materials to Seek:

– ISO 14001: Environmental Management Certification

– Global Recycled Standard (GRS): For products containing recycled content

– REACH and RoHS Compliance: Ensures materials are safe for use, particularly in the EU

– Eco-labels: Verification of reduced environmental impact

Action Points:

– Engage only with suppliers who can document eco-friendly practices.

– Incorporate supplier audits and sustainability KPIs into sourcing policies.

– Consider the full lifecycle impact—from raw material sourcing, production, to end-of-life recycling.

Brief Evolution of PP on Plastic for B2B Applications

Polypropylene’s ascent in the plastics sector began in the 1950s, when it was initially prized for its chemical and thermal resistance. Over subsequent decades, innovations in polymerization techniques and compounding have enabled the production of specialized grades suited to diverse applications—from heavy-duty industrial packaging to precision automotive components. In the 21st century, global supply chains and advances in recycling technology have solidified PP’s place as the backbone material for flexible and rigid B2B products. Sustainability, customization, and supply chain resilience now define its continuing evolution—directly influencing procurement approaches for international buyers targeting reliable and future-proof PP on plastic solutions.

Related Video: Incoterms® 2020 Explained for Import Export Global Trade

Frequently Asked Questions (FAQs) for B2B Buyers of pp on plastic

-

How can I effectively vet international suppliers of PP on plastic for quality and reliability?

Start by requesting detailed documentation such as ISO 9001 or industry-specific certifications, which indicate adherence to strict quality management practices. Verify the supplier’s production capacity, past performance, and experience in exporting to your region. Request product samples and third-party lab test results to ensure they meet your required standards. Additionally, ask for client references, especially from companies operating in similar markets (e.g., South Africa, Colombia, or the Middle East), and assess their responsiveness and transparency during early communications. Site visits—either virtual or physical—can provide further assurance of manufacturing capabilities and quality controls. -

Are customization options (e.g., grade, color, additive) readily available for PP on plastic orders?

Many reputable suppliers offer customization to accommodate industry-specific requirements, including alterations in polymer grade, color, melt flow index, and the incorporation of additives like UV stabilizers or antistatic agents. When requesting a quote, specify all technical parameters and intended applications to ensure optimal fit. Be prepared for slightly longer lead times and potentially higher minimum order quantities (MOQs) for custom formulations. Open discussion about customization early in the procurement process allows for smoother sampling, approval, and production scheduling. -

What are typical minimum order quantities (MOQs) and lead times when sourcing PP on plastic internationally?

MOQs can vary widely depending on supplier and product type—standard orders may start from 1–5 metric tons, while custom items often require larger volumes. Lead times generally range from 2 to 6 weeks, with additional time needed for complex customizations or during peak global shipping periods. For African, South American, Middle Eastern, or European buyers, consider both production and transit times, and encourage suppliers to provide realistic schedules in writing. Negotiating flexible terms may be possible with established relationships, but always plan for unexpected delays in your supply chain. -

What payment methods and terms are common in international PP on plastic trade?

Standard payment options include telegraphic transfer (T/T), letters of credit (L/C), and, less commonly, open account terms for longstanding partners. Down payments of 30% before production and 70% on shipment are typical. For new suppliers, favor secure options like confirmed L/Cs to mitigate risk. Review local currency restrictions and foreign exchange limits, particularly in regions such as Africa and South America. Discuss all payment milestones, penalties for late delivery, and refunds for quality disputes upfront, preferably having these terms detailed in a clear contract. -

Which certifications and quality assurance measures should international buyers demand?

Insist on globally recognized certifications such as ISO 9001 (quality management), ISO 14001 (environmental management), or product-specific safety and compliance marks. For packaging applications, relevant food safety or medical-grade certifications may also be required. Ask about the supplier’s quality control process, including raw material traceability, in-line inspections, and third-party testing reports. Regular audits or batch-specific certificates of analysis help maintain ongoing assurance. These steps not only ensure product performance but also streamline compliance with local regulations in your destination market. -

What are the key logistics considerations for importing PP on plastic, especially regarding cost and reliability?

Shipping bulk PP on plastic typically involves containerized sea freight; FOB (Free On Board) and CIF (Cost, Insurance, and Freight) terms are common. Inquire about the supplier’s experience with your country’s port documentation and customs clearance—delays can be costly, especially in regions with complex import regulations like West Africa or the Middle East. Consider working with international freight forwarders and customs brokers familiar with your commodity. Evaluate total landed cost, including duties, tariffs, inland transport, and warehousing, to avoid unexpected expenses. -

How should buyers handle diputes regarding quality or delivery with international PP on plastic suppliers?

Clear, upfront contractual agreements are essential—specify product standards, delivery terms, inspection protocols, and dispute resolution mechanisms. In the event of quality or delivery disputes, refer first to the mutually agreed documentation and photographs taken at dispatch and upon receipt. Arrange for independent third-party inspection if needed. Most reputable suppliers will seek an amicable resolution, such as replacement, credit, or partial refund. In persistent or serious cases, mediation through trade bodies or legal recourse under the contract’s designated jurisdiction may be necessary. -

What are current trends regarding sustainability and recycled content in PP on plastic, and how do they affect international sourcing?

Demand for sustainable PP solutions is growing worldwide, with many buyers now seeking products featuring recycled content or designed for recyclability. Suppliers may offer post-consumer recycled (PCR) or post-industrial recycled (PIR) grades to help meet environmental targets or regional regulations, particularly prevalent in Europe and increasingly in Africa and Latin America. Confirm the percentage of recycled material, its quality certifications, and any performance impacts. Sourcing from environmentally responsible manufacturers can also improve your own brand’s sustainability credentials and appeal to increasingly eco-conscious customers.

Strategic Sourcing Conclusion and Outlook for pp on plastic

International buyers face an increasingly dynamic landscape when sourcing polypropylene (PP) for plastic applications. The global demand for PP—driven by sectors such as packaging, automotive, and textiles—underscores the importance of partnering with suppliers who prioritize quality, transparency, and operational excellence. Key factors, such as strict adherence to international standards, robust quality control, reliable supply chain logistics, and the ability to offer sustainable or customized solutions, have become crucial differentiators in a competitive market.

For B2B organizations in Africa, South America, the Middle East, and Europe, strategic sourcing is not just about cost—it is about safeguarding operational continuity, ensuring compliance with evolving regulations, and protecting brand reputation. Conduct rigorous due diligence: verify certifications, assess production capacity, and demand evidence of environmental responsibility. Building strong supplier relationships and leveraging sourcing agents can help mitigate risks associated with cross-border procurement, including logistics and quality variances.

Looking ahead, the emphasis on sustainability and supply resilience will only intensify. Forward-thinking buyers should prioritize partners capable of innovation and who actively invest in eco-friendly processes. Proactively adapting your sourcing strategies will ensure you remain competitive and resilient, regardless of regional or global shifts. Now is the time to review your supply chain, raise quality expectations, and collaborate with reputable PP suppliers who can drive your business forward in the years to come.