Introduction: Navigating the Global Market for seals & gaskets

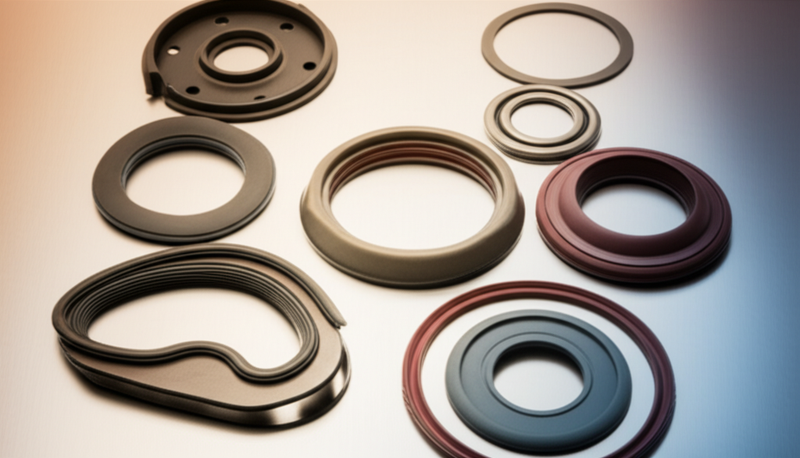

Seals and gaskets are the silent workhorses underpinning dependable industrial operations across the globe. Whether ensuring leak-free pipelines on the African continent, supporting high-precision manufacturing in Europe, or safeguarding equipment integrity in the demanding climates of South America and the Middle East, these components have an outsized impact on performance, safety, and profitability. The right choice can drive efficiency and compliance, while a poor selection risks unplanned downtime, regulatory breaches, or environmental hazards—outcomes no procurement leader can afford.

Today’s international B2B buyers, from oil & gas in Egypt to food production in Kenya or chemical processing in Germany, face an increasingly complex global market. Variations in climate, regulatory frameworks, application environments, and supplier credibility make sourcing decisions higher-stakes than ever. With material science evolving and manufacturing standards tightening, aligning your sourcing strategy with best-fit solutions is not only challenging but crucial for lasting competitiveness.

This guide delivers an actionable, expert roadmap to mastering the global seals and gaskets landscape:

- Comprehensive overviews of core seal and gasket types—from O-rings and spiral wound gaskets to advanced elastomers and metallics—matched with optimal industrial applications

- Clear, comparative analyses of materials (rubber, PTFE, graphite, metal, ceramic) tailored to extreme conditions, chemical compatibilities, and diverse pressure demands

- Essential frameworks for evaluating supplier quality and manufacturing standards worldwide, including ISO certifications, traceability practices, and compliance checkpoints

- Strategic insights on pricing, negotiation, and total cost of ownership, customized to the unique purchasing dynamics of markets in Africa, South America, the Middle East, and Europe

- Practical market intelligence on emerging trends, risk mitigation, and regional best practices, plus targeted answers to the most critical B2B sourcing questions

Armed with these insights, procurement and engineering teams will be equipped to make informed, confident decisions; minimize supply risks; control costs; and secure the high-performance sealing solutions that underpin sustainable growth and operational excellence—regardless of geography or sector.

Understanding seals & gaskets Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard O-Ring | Circular cross-section, elastomeric, globally standardized sizes | Pumps, valves, hydraulics, general machinery | Inexpensive, widely available; limited to uniform grooves |

| Flat (Sheet) Gasket | Flat, cut-to-shape, various non-metallic materials | Flanges, covers, HVAC, water treatment | Highly customizable, rapid lead times; needs precise cutting |

| Spiral Wound Gasket | Alternating metal and filler windings, compressible, thickened center | High-pressure pipes, heat exchangers | Excellent for extremes; higher cost, skilled installation |

| Metallic Gasket | Solid/corrugated metal, engineered profiles, high strength | Oil & gas, power generation, critical pipelines | Superior durability, resists heat/pressure; less flexible |

| PTFE Gasket | Made from PTFE polymer, exceptional chemical resistance, inert surface | Food, pharma, chemical process, medical | Chemically inert, food-grade; low compressive strength |

Standard O-Ring

Standard O-rings are versatile elastomeric seals recognized for their circular cross-section and ability to fit into a wide spectrum of groove sizes. They excel in sealing pressurized fluids and gases in pumps, valves, and hydraulic cylinders—common in manufacturing and infrastructure across diverse regions. B2B buyers should prioritize O-rings certified to international standards and test for compatibility with the region’s prevalent chemicals and temperature extremes. Their broad material range allows buyers to tailor performance for applications exposed to weather, steam, or aggressive fluids.

Flat (Sheet) Gasket

Flat gaskets are manufactured by die-cutting or CNC machining from sheets of rubber, PTFE, graphite, or fiber. Their key advantage lies in how they can be easily customized to complex shapes or large flanged joints, which is critical for varied industrial equipment found in agriculture, mining, and utilities. For purchasing teams, working with suppliers offering flexible material and fabrication options is vital, especially when local standards or irregular flange geometries are encountered. Ensuring strict dimensional tolerances and material quality certifications mitigates leakage risks and improves equipment reliability.

Spiral Wound Gasket

Spiral wound gaskets leverage layered metal (often stainless steel) and soft filler (such as graphite or PTFE), making them a go-to choice for high-stress environments subject to severe pressure or temperature changes. They are indispensable in oil refineries, chemical plants, and power plants—sectors critical in Africa, South America, and the Middle East. Their long-term performance offsets higher procurement and installation costs. Buyers need to assess supplier expertise, global standard compliance (like ASME), and availability of installation support, given the technical precision required.

Metallic Gasket

Metallic gaskets—ranging from solid rings to corrugated and ring-type joint (RTJ) designs—are engineered for uncompromising sealing in the harshest conditions, such as deep wellheads, high-pressure vessels, and critical energy infrastructure. Their robust structure ensures resistance to high temperatures and mechanical stresses but typically demands flawless mating flange surfaces and precise sizing. B2B buyers should verify supplier traceability, corrosion-resistant alloys, and region-specific compliance (e.g., NACE for oil & gas) to reduce catastrophic leak and downtime risks in mission-critical systems.

PTFE Gasket

PTFE gaskets, favored for their non-reactivity and broad chemical compatibility, are essential in food, beverage, medical, and chemical industries where contamination risks and compliance with hygiene and safety regulations are stringent. Their inert nature ensures reliability in aggressive chemical processes common in global pharmaceutical and process industries. Buyers must ensure the PTFE’s purity, thickness specification, and whether virgin, filled, or expanded grades are best for the intended contact media. Partnering with suppliers offering international certifications and traceability is crucial for regulated markets and export-driven sectors.

Related Video: Mechanical seals gaskets and packing

Key Industrial Applications of seals & gaskets

| Industry/Sector | Specific Application of seals & gaskets | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Oil & Gas | Pipeline flanges, valve sealing, compressor units | Leak prevention under high pressure/temperature, safety compliance | Chemical/material compatibility, API/ISO certification, traceability |

| Water & Wastewater | Pump sealing, pipe joint gaskets, filter housings | Contamination avoidance, equipment protection, reliable uptime | Resistance to water, chemicals, local regulatory standards |

| Food & Beverage | Process equipment, hygiene sealing, bottling lines | Sanitary operation, contamination control, regulatory approval | Food-grade materials (FDA/EC 1935/2004), traceability, quick lead times |

| Power Generation | Turbine casing seals, boiler flange gaskets | High-temperature/pressure sealing, operational continuity | Heat resistance, material integrity, supplier technical support |

| Mining & Heavy Equipment | Engine housings, hydraulic systems, anti-vibration mounts | Extended equipment life, reduced downtime, operational safety | Abrasion/chemical resistance, custom sizing, local support |

Oil & Gas

In oil and gas operations, seals and gaskets are essential for preventing leaks in pipeline flanges, valves, and compressor assemblies operating under extreme pressures and temperatures. These components help ensure environmental protection, safety compliance, and minimal product loss—concerns magnified in projects spanning international jurisdictions. B2B buyers must prioritize material compatibility with aggressive hydrocarbons and sour gas, as well as strict adherence to API or ISO standards. Proven traceability and supplier certifications are vital, especially in regions such as West Africa and the Middle East, where regulatory scrutiny and operational risk are high.

Water & Wastewater

Seals and gaskets play a pivotal role in pumps, pipe joints, and treatment plant filter housings by maintaining proper sealing in the face of variable water quality and chemistry. Reliable gaskets prevent water leakage, protect equipment from premature wear, and support uninterrupted service to local populations or industries. Buyers in regions like North Africa or Latin America should focus on materials that resist aging, waterborne contaminants, and chlorine content, while ensuring compliance with relevant national standards. Procurement should also consider availability of locally compliant products and the ability to withstand both potable and wastewater environments.

Food & Beverage

Hygiene and regulatory compliance are top priorities in this sector. Seals and gaskets made from food-grade silicones, EPDM, and PTFE are crucial for reliable sealing in processing equipment, bottling lines, and storage vessels, where contamination could result in recalls or production halts. For buyers in Europe, South America, and beyond, sourcing requires verification of materials’ certification with global food safety standards such as FDA or EC 1935/2004. Rapid lead times and full batch traceability are also essential to prevent costly downtime and meet dynamic production schedules.

Power Generation

Whether in conventional or renewable plants, high-performance seals and gaskets in turbines, boilers, and heat exchangers are indispensable for maintaining pressure, managing thermal cycles, and preventing hazardous leaks. These environments demand materials that retain integrity under extreme temperatures and pressures typical of power infrastructure projects found in the Middle East and Eastern Europe. Buyers benefit from partnering with suppliers offering robust technical support, service records, and materials tested against international power sector standards, as equipment failure can have region-wide ramifications.

Mining & Heavy Equipment

Mining and heavy equipment operations generate intense vibration, dust, and wear; seals and gaskets are used extensively in engine housings, hydraulic circuits, and anti-vibration mounts. Their function extends equipment lifespans, reduces unplanned maintenance, and ensures safe operation in challenging locations, such as the copper mines of Chile or mineral operations in Southern Africa. Buyers should demand custom sizing for non-standard machinery, resistance to abrasive slurries and hydrocarbons, and responsive after-sales support, especially given logistics and terrain challenges common to remote mining sites.

Related Video: How to Select Rexnord Bearing Seals for your Applications – Rexnord Bearings

Strategic Material Selection Guide for seals & gaskets

Common Materials for Seals & Gaskets: Properties, Performance, and Strategic Considerations

Selecting the optimal material for seals and gaskets is fundamental for international B2B buyers seeking to ensure performance, cost-efficiency, and long-term reliability across diverse industrial settings. Below are four widely used materials, each with distinct advantages, disadvantages, and key considerations for buyers operating in Africa, South America, the Middle East, and Europe.

1. Nitrile Rubber (NBR)

Key Properties:

Nitrile rubber is celebrated for its excellent resistance to petroleum-based oils and fuels, moderate temperature tolerance (approximately -40°C to +120°C), and good mechanical strength. It also offers flexibility and resilience under repeated compression.

Pros & Cons:

NBR is cost-effective and readily available globally, making it a standard choice for automotive, agricultural, and general industrial seals. However, it shows limited resistance to ozone, sunlight, and certain chemicals such as ketones, esters, and chlorinated hydrocarbons. Longevity may be compromised under prolonged exposure to aggressive media or extreme temperatures.

Impact on Application:

Ideal for dynamic and static applications where exposure to hydrocarbons is common—such as fuel lines, hydraulic systems, and oil processing equipment. Unsuitable in situations with regular UV exposure or severe weather fluctuations.

International B2B Considerations:

NBR formulations must comply with ASTM D2000 or DIN EN 682 standards for global acceptance, especially in regulated European or Middle Eastern environments. Buyers should verify compound purity and compatibility for local oil compositions, noting that high ambient temperatures in Africa or the Middle East can accelerate aging if not specified correctly.

2. EPDM (Ethylene Propylene Diene Monomer) Rubber

Key Properties:

EPDM offers outstanding resistance to water, steam, and a range of chemicals, including mild acids and alkalis. It is especially valued for weatherability, standing up well to ozone, sunlight, and heat (operating range around -50°C to +150°C).

Pros & Cons:

The primary appeal of EPDM is its durability in outdoor and water-based environments. It is not compatible with petroleum oils or solvents, which limits its use in oil & gas or certain manufacturing sectors. It’s cost-effective and easy to fabricate, but buyers should be aware of potential performance variability depending on compounding quality.

Impact on Application:

Commonly used in water systems, HVAC, food processing, and building/construction, particularly for gaskets and seals exposed to the elements. EPDM’s compatibility with drinking water standards makes it suitable for water treatment projects across Africa and Europe.

International B2B Considerations:

EPDM should meet relevant international standards (e.g., WRAS for potable water in Europe, ASTM D1418, or DIN standards). In regions like Kenya or Egypt, selection should account for local water qualities (chlorination, hardness) and regulatory acceptance, ideally supported by certification and traceability.

3. PTFE (Polytetrafluoroethylene)

Key Properties:

PTFE stands out for its exceptional chemical resistance, high thermal stability (-200°C to +260°C), low coefficient of friction, and non-adhesive surface. It does not degrade or lose integrity even when exposed to aggressive acids, bases, or solvents.

Pros & Cons:

PTFE gaskets deliver unmatched longevity and are nearly universal in chemical compatibility, making them ideal for food, pharmaceutical, and chemical processing. However, they are more expensive than elastomers and less elastic, requiring careful design for sealing under fluctuating pressures.

Impact on Application:

Frequently specified in environments with aggressive chemicals—such as refineries, pharmaceuticals, and food processing facilities—where contamination must be minimized. Not suited for applications requiring great flexibility or compressibility.

International B2B Considerations:

PTFE materials should conform to FDA (for food) or EN 1935/2004 (Europe) as well as ASTM F104 (general industrial) requirements. For global buyers, ensure the supplier provides documentation covering origin, testing, and compliance, especially in regions with strict import or sanitary regulations.

4. Graphite (Flexible Graphite)

Key Properties:

Flexible graphite provides excellent thermal conductivity, resilience under high temperatures (up to 500°C and beyond for some grades), and strong chemical resistance across both acids and bases (excluding strong oxidizers). It is also naturally fire-safe and compressible.

Pros & Cons:

The key strength of graphite is its reliability under thermal cycling and high-pressure environments. While more costly than general elastomers, it offers significant longevity and reduced maintenance needs. Installation requires care due to material fragility, and not all grades are suitable for every chemical.

Impact on Application:

Suitable for oil & gas, petrochemical, and power generation industries, particularly at high temperatures and pressures. Ideal for static gaskets in flanged joints, heat exchangers, and high-integrity sealing applications.

International B2B Considerations:

Request materials certified to ASTM F2168 or EN1514-1, especially for critical process industries in Europe or the Middle East. Traceability and test certificates are essential, especially for buyers in regulated sectors or those exporting to Europe or Asia. Considerations around supply chain reliability are also important in Africa and South America, where local sourcing may be limited.

Material Selection Summary Table

| Material | Typical Use Case for seals & gaskets | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Nitrile Rubber (NBR) | Automotive, oil/fuel/hydraulic seals, pumps | Excellent oil/fuel resistance, cost-effective | Limited weather, ozone, and chemical resistance; not for outdoor/UV use | Low |

| EPDM Rubber | Water, HVAC, food, outdoor gaskets | Superior weather/steam/UV resistance | Not compatible with oils/solvents; performance varies with compounding | Low-Medium |

| PTFE (Polytetrafluoroethylene) | Chemical, food, pharmaceutical, aggressive media | Broad chemical resistance, temperature stability | Low elasticity, higher cost, requires proper installation | Medium-High |

| Flexible Graphite | High-temp pipelines, refineries, power sector | Tolerates extreme heat/pressure, chemically inert | Fragile during handling/installation; more expensive than standard elastomers | High |

In-depth Look: Manufacturing Processes and Quality Assurance for seals & gaskets

Overview of Manufacturing Workflows for Seals & Gaskets

The production of seals and gaskets involves a precisely controlled set of processes, each impacting final quality, performance, and adherence to buyer specifications. From initial material selection to finishing, every stage requires strict oversight to ensure that seals deliver leakage prevention, mechanical resilience, and regulatory compliance across diverse industries and operational environments.

Key Stages of Manufacturing

1. Material Selection and Preparation

- Rubber, Elastomers, and Metals: Selection hinges on end-use application, chemical compatibility, and region-specific requirements (e.g., EPDM for water-rich Middle Eastern environments, PTFE for aggressive chemical processing in South America).

- Preparation: Bulk materials are tested for purity and consistency. Granulates, metal coils, or sheets are conditioned (e.g., pre-heated, calendered) to assure predictable forming and cure properties.

2. Forming and Shaping

- Compression & Injection Molding (Elastomeric Seals and O-Rings): Material is heated and shaped under high pressure in steel molds. This supports high-volume, repeatable production, especially for standard O-rings.

- Die Cutting, CNC Cutting, Water Jet or Laser Cutting (Flat Gaskets): Advanced digital control ensures precision tolerances—crucial for custom and non-standard shapes common in African and European utility projects.

- Spiral Winding / Metal Machining (Spiral Wound & Metallic Gaskets): Automated winding machines interweave metal and filler for high-integrity gaskets. Solid metal gaskets may be CNC-machined or formed from metal sheets, then subjected to finishing treatments for improved durability.

3. Assembly and Curing

- Assembly: Multi-component designs involve precise assembly, such as layering composites (e.g., metal+graphite), where contamination control is vital.

- Curing & Vulcanization: Elastomeric seals undergo controlled heating cycles to achieve required resilience, resistance, and dimensional stability. Manufacturers use programmable ovens with real-time monitoring to eliminate undercure/overcure defects.

4. Finishing and Quality Checks

- Trimming & Surface Finishing: Parts are trimmed, deburred, washed, or coated (e.g., anti-stick, anti-corrosive) based on the end-user’s operational demands.

- Marking & Packaging: Unique part numbers, material codes, batch tracing, and region-specific documentation accompany each shipment—crucial for traceability in regulated industries or public tenders in Africa and Europe.

Quality Assurance: Global Best Practices & Compliance

Ensuring the reliability and compliance of seals and gaskets is non-negotiable for B2B buyers. Below are the essential controls and standards that top suppliers integrate into their processes.

Global and Industry Standards

- ISO 9001: The foundational international standard for quality management systems. Suppliers with ISO 9001 certification demonstrate consistent process control, traceability, and a commitment to continuous improvement.

- ISO 14001, ISO 45001: These may be relevant for environmental and occupational safety, valuable in sustainability-focused markets (e.g., the EU).

- API (American Petroleum Institute): Critical for oil, gas, and petrochemical sectors, especially when sourcing from or for the Middle East and Africa.

- CE Marking: Required for products used within Europe, signifying conformity with EU safety, health, and environmental requirements.

- WRAS, FDA, or NSF: Required for seals/gaskets in potable water or food applications (commonly demanded in European, Middle Eastern, and select African tenders).

In-Process Quality Checkpoints

- Incoming Quality Control (IQC): All raw materials and components are inspected for compliance with chemical, mechanical, and dimensional specifications. Material certifications, such as test reports from rubber or metal suppliers, must be verified and retained for audits.

- In-Process Quality Control (IPQC): During forming and assembly, technicians perform real-time checks using gauges, visual inspection, and automated sensors. This minimizes scrap, ensures dimensional accuracy, and enables early detection of defects.

- Final Quality Control (FQC): Before shipment, finished goods are subject to comprehensive testing (detailed below), traceability checks, and random sampling according to international statistical standards (e.g., ANSI/ASQC Z1.4).

Common Testing Methods and Equipment

- Visual and Dimensional Inspection: Micrometers, calipers, coordinate measuring machines (CMM), and digital imaging validate dimensional tolerances and surface finish.

- Hardness and Compression Set Testing: Durometers assess material hardness; crush/indentation tests verify resilience and deformation resistance.

- Leakage and Pressure Testing: Specialized rigs simulate operational environments to confirm sealing performance under pressure, vacuum, or fluid exposure.

- Chemical and Thermal Resistance: Accelerated aging, chemical soak, and high/low temperature cycling validate lifespan for demanding settings—critical for South America’s chemical industry and the Middle East’s high-temperature operations.

- Traceability and Batch Testing: Every production lot is tagged, with quality and material records maintained for rapid recall or compliance verification.

Verifying Supplier Quality: What B2B Buyers Must Know

Practical Verification Methods

- On-Site Audits: Schedule periodic factory evaluations—review cleanroom standards, machining infrastructure, calibration records, and documented QC protocols. Larger buyers may mandate these before annual agreements; smaller buyers can leverage local chamber-of-commerce consultants or third-party inspection agencies.

- Review of Certifications: Scrutinize copies of ISO, CE, API, and material-specific certificates. Confirm their validity and issuing bodies. Request process flowcharts and past QC audit results for assurance.

- Third-Party Inspections: Engage international inspection firms (e.g., SGS, Bureau Veritas, TÜV) for pre-shipment conformity checks and random sampling—common in cross-continental trades, especially when importing to Africa or South America, where risk mitigation is vital.

- QC Reports and Test Data: Require suppliers to submit batch-specific inspection reports, tensile strength graphs, and traceability logs. Evaluate consistency over time to detect trends in defect rates or process drift.

Special QC Considerations for International Buyers

- Country-Specific Regulations: Ensure supplier compliance with target market directives (e.g., EC1935/2004 for food-contact gaskets in Europe, SONCAP for Nigerian imports). Request documented evidence for audit trails.

- Material Origin and Purity Claims: In regions prone to variable feedstock quality (such as some suppliers in Asia), demand full disclosure and, where necessary, request third-party lab tests for critical compounds (like PTFE or Viton® purity)—vital for medical, food, or water system contracts.

- Remote Verification: With greater remote sourcing, especially post-pandemic, leverage live video inspections, digital documentation audits, and robust sample approval processes before mass production.

- Logistics and Packaging: Specify packaging standards that safeguard gaskets against humidity, contamination, or deformation during long-haul transit—important for Africa and South America, where supply routes are longer and more complex.

Actionable Insights: Maximizing Quality and Minimizing Risk

- Supplier Prequalification: Develop a checklist incorporating international standards, material traceability, and proven QC practices tailored to your industry and region.

- Long-Term Partnerships: Favor manufacturers with demonstrable investments in automation, digital QC tracking, and regular certification renewals—this reduces the risk of quality decay or compliance lapses.

- Continuous Monitoring: Request ongoing access to supplier QC metrics, shipment defect logs, and certification renewal dates. Set up periodic performance reviews to catch and resolve issues proactively.

- Invest in Staff Training: Ensure your procurement and technical teams are familiar with both global and regional compliance requirements, enabling them to spot red flags before contracts are signed.

By understanding and actively managing every stage of the manufacturing and quality assurance process, B2B buyers—from Kenya to Brazil—can secure seals and gaskets that deliver not only on cost but also on consistency, compliance, and operational peace of mind.

Related Video: Glenroy’s Flexible Packaging Manufacturing Process

Comprehensive Cost and Pricing Analysis for seals & gaskets Sourcing

Key Elements of Seals & Gaskets Cost Structure

Procurement professionals must understand that the final price of seals and gaskets is shaped by a combination of core cost components, each with distinct drivers and caveats:

-

Material Costs: Material selection is the primary cost driver. Common elastomers (NBR, EPDM, SBR) are cost-effective, whereas specialty polymers (Viton®, FKM, food-grade silicones, or PTFE) and metallic alloys command higher prices due to their performance in harsh environments. For applications involving aggressive chemicals, extreme temperatures, or regulatory compliance (e.g., in pharmaceutical or food sectors), expect premiums.

-

Labor and Manufacturing Overhead: Precision manufacturing—including CNC die-cutting, molding, and finishing—requires skilled labor and sophisticated equipment. Overhead costs may rise if suppliers utilize advanced QC systems, traceability protocols, or cleanroom facilities for food or medical-grade gaskets.

-

Tooling and Setup: Standard seals and gaskets benefit from low tooling costs due to established moulds and die sets. However, custom designs or prototypes demand upfront investments, especially if unique geometries or tight tolerances are specified.

-

Quality Control (QC): Rigorous QC (e.g., for ISO 9001:2015, FDA, or EN certifications) enhances product reliability but adds to inspection and testing costs—essential for high-stakes sectors like oil & gas or exports into the EU.

-

Logistics & Supply Chain: Shipping methods, destination distance, product fragility, and packaging all contribute to landed cost. The logistics footprint can be more pronounced for buyers in Africa, South America, and remote regions, especially for heavy metallic gaskets.

-

Supplier Margin: Supplier size, reputation, and regional market conditions affect mark-up. High-volume global players may offer better economies of scale, whereas niche or highly certified suppliers might charge more for specialized expertise.

Primary Price Influencers

The actual B2B pricing you encounter will be determined by several interdependent factors:

-

Order Volume & Minimum Order Quantities (MOQs): Larger orders typically secure better per-unit rates due to manufacturing economies of scale. However, MOQs may be higher for non-standard items or suppliers serving global OEMs.

-

Specifications & Customization: Customized geometries, tight tolerance requirements, branded materials, and specialty coatings increase costs. Standard catalog items are far more budget-friendly and quicker to source.

-

Material Grade & Certification: Food, pharma, or export-grade materials must meet demanding international standards, affecting both base cost and supplier universe. Always factor in the cost of certification (e.g., FDA, EU, WRAS) and the credible documentation of compliance.

-

Supplier Location & Capabilities: Sourcing from global markets like China or India can offer cost savings, but buyers must weigh this against potential risks—longer lead times, quality assurance variability, and higher shipping costs.

-

Incoterms & Tariffs: All-in pricing must clarify Incoterms (FOB, CIF, DDP, etc.)—this has a major impact on your true landed cost. Additionally, local import duties and taxes (especially in Africa or Latin America) can be significant.

Practical Buyer Tips: Reducing Risk and Securing Value

-

Negotiate on Total Cost of Ownership (TCO): Go beyond the headline price. Factor in expected service lifespan, failure risks, installation costs, and the potential impact on plant uptime. A cheaper gasket that fails prematurely can prove far costlier overall.

-

Consolidate Volumes Where Possible: Pool orders across sites or regions to reach favorable MOQ thresholds, minimizing per-unit cost and negotiation friction.

-

Leverage Supplier Audits & Certifications: Prioritize suppliers with credible third-party certifications. For international buyers, this minimizes compliance risk, especially in regulated European and Middle Eastern sectors.

-

Clarify All-Inclusive Pricing: Always request detailed quotes that separate material costs, tooling, freight, documentation, and duties. This helps uncover hidden expenses and strengthens your position in price negotiations.

-

Stay Informed on Local Regulatory Nuances: Countries across Africa, the Middle East, and South America may have unique standards or documentation for industrial imports. Partner with suppliers who understand these requirements to avoid customs delays and costly non-compliance issues.

Regional Pricing Considerations

-

Africa & South America: Logistics costs are typically higher, and import duties can be significant. Local supplier options are often limited, so build in extra lead time and establish relationships with experienced global exporters familiar with your regulatory needs.

-

Middle East: Demand for high-performance seals (oil & gas, petrochemical) means specification accuracy and supplier reliability are critical. Engage certified suppliers who can back claims with documentation for international audits.

-

Europe: Stringent certification, traceability, and sustainability standards (e.g., REACH, RoHS) can increase costs, but buyers benefit from robust local supplier networks and high QC standards.

Disclaimer: All pricing references in this analysis are indicative only; the actual cost will vary with specification, volume, supplier, region, and market conditions. Always secure detailed, written quotations and sample TCO analyses before any procurement commitment.

Spotlight on Potential seals & gaskets Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘seals & gaskets’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

21 Manufacturers in Rubber Gasket and Seal Industry (www.inven.ai)

EagleBurgmann, headquartered in Germany, stands out as a leading global manufacturer of sealing solutions, with a strong emphasis on mechanical seals, high-performance gaskets, and advanced packing systems. With roots dating back to 1884 and a workforce exceeding 5,000, the company brings deep manufacturing expertise and a longstanding reputation for reliability across diverse industries, including oil & gas, chemical processing, water treatment, and power generation. EagleBurgmann is recognized for its robust investment in R&D—delivering both standardized and custom-engineered products that address complex sealing challenges, including corrosive, high-pressure, and high-temperature environments.

For international B2B buyers, especially in Africa, South America, the Middle East, and Europe, EagleBurgmann’s portfolio is attractive due to its adherence to globally recognized quality benchmarks such as ISO certifications, its proven track record on international projects, and its comprehensive after-sales and technical support network. The company’s ongoing innovation, sustainability focus, and ability to meet stringent industry regulations make it a preferred supplier for mission-critical applications where failure is not an option.

Parjetseals (www.parjetseals.com)

Parjetseals stands out as a reputable international manufacturer and supplier in the seals and gaskets sector, recognized for delivering reliable, high-performance solutions across diverse industries. The company is noted for its extensive product range, including both standard and custom-engineered seals designed to meet demanding industrial requirements in sectors like automotive, oil & gas, and advanced manufacturing. Parjetseals’ strengths appear to center on material innovation and technical expertise, enabling them to address challenges such as chemical resistance, extreme temperatures, and rigorous compliance needs—critical factors for global B2B buyers.

While detailed public information regarding certifications and manufacturing capabilities is limited, Parjetseals is featured among the top global seal manufacturers, implying robust industry credentials and a significant export presence. International buyers from Africa, South America, the Middle East, and Europe benefit from Parjetseals’ proven experience in serving cross-border markets and adapting solutions to meet varied regulatory and operational standards. For procurement teams prioritizing quality, technical support, and reliable logistics in seals and gaskets sourcing, Parjetseals presents a competitive and capable partner.

10 Mechanical Seal Manufacturers & Brands in World (www.machinemfg.com)

Established in China in 1988, Dandong Group Co., Ltd. is recognized as a high-tech private enterprise specializing in the production of mechanical seals, gaskets, magnetic drive pumps, welded metal bellows, and more. The company’s diverse product portfolio supports a broad range of demanding industrial applications—from chemical processing and oil & gas to power generation—making it an attractive partner for international B2B buyers seeking comprehensive sealing solutions. Dandong Group is noted for its advanced manufacturing capabilities, combining precision engineering with a focus on product reliability and service life. With a proven track record in export and compliance with major international markets, the company provides both standard and custom-engineered sealing products designed to operate under harsh operating conditions.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| 21 Manufacturers in Rubber Gasket and Seal Industry | Global sealing specialist, broad industries, high certifications | www.inven.ai |

| Parjetseals | International seals & gaskets expertise, diverse industries | www.parjetseals.com |

| 10 Mechanical Seal Manufacturers & Brands in World | Diverse, industrial-grade seals with global reach | www.machinemfg.com |

Essential Technical Properties and Trade Terminology for seals & gaskets

Key Technical Properties for Informed Sourcing

Selecting the right seals and gaskets requires careful consideration of specific technical properties. These specifications directly impact performance, compliance, and lifecycle cost—especially crucial for B2B buyers across varied regional climates, regulatory frameworks, and industrial applications.

1. Material Grade & Compatibility

The material composition is fundamental to seal and gasket performance. Common grades include elastomers (EPDM, NBR, FKM/Viton®, silicone) and non-elastomeric materials (PTFE, graphite, metallic alloys). Each grade offers distinct resistance to chemicals, temperatures, and environmental factors. For example, EPDM is suitable for water and steam, while PTFE excels against aggressive chemicals. Always ensure the selected grade matches your medium (fluid, gas), temperature range, and local compliance standards (e.g., US FDA, EU food contact).

2. Temperature and Pressure Rating

Seals and gaskets are engineered to perform within defined temperature and pressure limits. Overstepping these thresholds can result in seal failure, costly downtime, or safety hazards. Pay particular attention to the maximum continuous operating temperature and pressure, and account for surges or fluctuations common in your facility. For projects in the Middle East or sub-Saharan Africa, where temperature extremes are frequent, verify real-world application data and relevant certifications.

3. Tolerance and Dimensional Accuracy

Tolerance refers to the allowable deviation in dimensions (thickness, diameter, width). Tight tolerances are essential for effective sealing, especially in high-pressure or precision applications like refineries or pharmaceuticals. When sourcing internationally, confirm that your suppliers can meet specified tolerances according to recognized standards (e.g., ISO, DIN) and can provide quality documentation.

4. Chemical Resistance & Durability

Exposure to aggressive chemicals or solvents is routine in many industries. The right seal or gasket material will be engineered for resistance to specific acids, alkalis, fuels, or other process fluids. Assess both short-term compatibility and long-term degradation, as unsuited materials can swell, crack, or lose integrity—risking leaks or equipment damage.

5. Compliance and Certification

International buyers must address not just technical fit, but also regulatory compliance. Request documentation such as FDA, EU 1935/2004, WRAS, or ISO 9001 certifications, depending on your sector (food, water, pharmaceuticals, etc.). These certifications also act as risk management tools by ensuring the supplier’s process and products align with international safety and quality standards.

Common B2B Trade Terminology Explained

Understanding prevailing trade jargon streamlines communication with suppliers and helps B2B buyers negotiate favorable terms, avoid misunderstandings, and confidently oversee cross-border transactions.

-

OEM (Original Equipment Manufacturer):

Refers to seals/gaskets produced to the exact specifications of the equipment’s original design. If equipment uptime or warranty is critical, specify OEM parts or certified equivalents to guarantee fit and performance. -

MOQ (Minimum Order Quantity):

The smallest unit or batch a supplier is prepared to sell. This is essential for budgeting—particularly for buyers in Africa or South America, where storage or cash flow may be constraints. Always clarify MOQ early to align procurement with your operational needs. -

RFQ (Request for Quotation):

A formal document requesting pricing and terms for specified products. Submitting a detailed RFQ—including material, dimensions, quantity, and certifications required—accelerates supplier response time and ensures you receive comparable, actionable offers. -

Incoterms (International Commercial Terms):

A set of standardized trade terms from the International Chamber of Commerce defining logistics responsibilities, risks, and costs between buyer and seller (e.g., FOB, CIF, DDP). Choosing the right Incoterm minimizes hidden expenses and surprises in international shipments. -

Lead Time:

The duration from order confirmation to delivery. This is vital when coordinating global supply chains, managing plant shutdowns, or meeting project deadlines. For markets where logistics infrastructure or customs processes are variable, build in buffer stock or early ordering to avoid disruptions. -

Traceability:

The ability to track a seal or gasket’s origin and manufacturing journey. For high-consequence industries—such as petrochemicals or pharmaceuticals—traceability supports quality auditing and compliance, and expedites root-cause analysis if failures occur.

By grasping these core technical and trade concepts, international B2B buyers can elevate sourcing strategies, drive negotiation leverage, and reduce risk—regardless of geography or industry.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the seals & gaskets Sector

Market Overview & Key Trends

The seals and gaskets sector remains foundational to a broad range of industries—spanning oil and gas, water treatment, automotive, food processing, and heavy manufacturing. Recent years have seen heightened global demand driven by industrialization in emerging markets (notably across Africa and South America), infrastructure upgrades in the Middle East, and tightening regulatory requirements in Europe. Growth is further accelerated by the need for advanced sealing technologies that ensure safety, minimize leaks, and comply with evolving environmental standards.

Key B2B sourcing trends include:

– Digital Procurement Platforms: Adoption of e-marketplaces and procurement software is streamlining cross-border sourcing, improving price visibility, and enabling real-time supplier assessment for buyers in Egypt, Kenya, Brazil, and beyond.

– Supplier Diversification: Regional disruptions (such as raw material shortages, currency fluctuations, and port closures) have pushed buyers to expand supplier networks beyond traditional hubs in Asia, seeking local and regional partners with proven compliance and reliable lead times.

– Material Innovation: Demand for high-performance polymers (e.g., PTFE, FKM) and composite gaskets is rising, especially in markets where harsh environments and extreme temperatures are common. Buyers are increasingly specifying industry certifications such as ISO 9001 and requesting custom compound formulations to meet sector-specific needs.

– Compliance and Traceability: Markets in Europe and the Gulf states are imposing stricter traceability standards, favoring suppliers with robust documentation, batch tracking, and product testing records. International buyers must monitor evolving export controls and product marking requirements (such as CE or FDA for food-grade applications).

International buyers—from African energy producers to European food manufacturers—should leverage strategic partnerships with suppliers who demonstrate agility, can accommodate small-batch as well as high-volume orders, and invest in technical support. Close monitoring of freight, tariffs, and regulatory trends is essential for managing landed costs and supply chain risk in an increasingly complex global landscape.

Sustainability & Ethical Sourcing in B2B

Sustainability is now central to the competitive edge in industrial sourcing. For seals and gaskets—products used in applications where leakage mitigation directly affects environmental compliance—pressure is mounting to choose solutions that minimize ecological footprint across their lifecycle.

Key sustainability considerations include:

– Eco-friendly Materials: Preference is growing for gaskets and seals produced from recyclable or bio-based elastomers, as well as low-VOC rubber compounds. Products made from expanded PTFE, recycled rubber, or certified food-safe materials are increasingly requested in regulated markets.

– Green Certifications: Leading buyers demand evidence of third-party certifications such as RoHS, REACH, or ISO 14001. These demonstrate that suppliers operate within strict environmental management frameworks. In food, water, or pharma applications, additional certifications (FDA, NSF/ANSI) are often mandatory.

– Ethical Supply Chains: Ensuring that raw materials—such as minerals in metallic gaskets or rubber in O-rings—are sourced responsibly is pivotal, particularly for markets sensitive to human rights or anti-deforestation standards. Transparent, traceable sourcing documentation is becoming a procurement requirement, not an afterthought.

– Waste Minimization: Modern gasket production increasingly employs water-jet, CNC, and precision die-cutting to optimize yield from sheet material and minimize scrap. Some suppliers now offer take-back or recycling programs for used components.

For B2B buyers in regions where regulatory enforcement is rising (notably the EU and GCC), integrating these sustainability factors into sourcing policies is vital for safeguarding both operational continuity and brand value. Early engagement with suppliers on green initiatives can yield supply chain savings and support corporate ESG goals.

Brief Evolution and Historical Context

The evolution of seals and gaskets mirrors the progress of industrialization itself. Early sealing solutions relied on leathers and basic textiles, with the introduction of molded rubber in the late 19th century marking a step change in performance and reliability. The mid-20th century brought a proliferation of synthetic polymers—such as PTFE (Teflon) and silicone—expanding the operational window for gaskets into new extremes of temperature and chemical resistance.

Today, the sector is defined by rapid advances in material science, high-precision manufacturing, and digital supply chain integration. This evolution has allowed buyers from diverse regions—whether Kenyan automotive assemblers, Middle Eastern petrochemical operators, or European pharmaceutical producers—to specify and source specialized seals and gaskets tailored for climate, regulatory context, and industry. As markets and requirements continue to shift, agility and technical acumen in B2B sourcing will remain key competitive differentiators.

Related Video: How Trump’s tariffs are changing the rules of global trade | The Take

Frequently Asked Questions (FAQs) for B2B Buyers of seals & gaskets

-

How can I effectively vet international suppliers of seals and gaskets?

To ensure reliability, start by verifying the supplier’s certifications (such as ISO 9001:2015, CE, or relevant local standards). Request third-party audit reports, check for a documented quality management system, and assess their history serving clients in your region. Additionally, ask for sample documentation—traceability, batch numbers, and performance test reports are key indicators of quality. Collect references from similar industries and arrange a virtual or physical factory tour if possible. Evaluating their export experience, especially to your geography, can highlight their familiarity with logistical and regulatory requirements, minimizing risk. -

What customization options are available and how can I specify them for my application?

Customization is vital for optimal performance, especially in markets with unique environmental or regulatory demands. Key variables you can request include material type (e.g., EPDM, PTFE, graphite), dimensional tolerances, hardness (durometer), and surface finish. For critical uses, clarify application conditions: temperature, pressure, chemical exposure, and certifications (food grade, anti-static, etc.). Most reputable suppliers offer engineering support to review drawings or co-develop specifications. Supplying precise technical drawings and service condition details upfront ensures your custom gaskets or seals are fit for purpose and reduces the risk of production errors. -

What is the typical minimum order quantity (MOQ) and what strategies can help manage this factor?

MOQs can range from a few hundred to several thousand units, varying by product complexity, customization, and supplier location. For custom or niche items, higher MOQs are common due to setup costs. If your demand is below supplier thresholds, consider negotiating pilot runs, bundling orders across multiple project sites, or collaborating with local distributors. Additionally, some manufacturers may offer lower MOQs at a premium or provide stock program options for recurring orders—valuable for buyers managing variable project timelines. -

What are standard lead times and how can I ensure prompt delivery to Africa, South America, the Middle East, or Europe?

Lead times depend on product type, customization, and existing inventory; standard catalog items may ship in 1–2 weeks, while custom or high-volume orders might require 4–8 weeks. For international shipments, add transit times (often 1–5 weeks depending on mode and region). To expedite delivery, communicate forecasts early, clarify incoterms, and select suppliers with regional stockholding or flexible logistics partners. Building a buffer stock or negotiating a vendor-managed inventory agreement can help mitigate unforeseen project delays, especially if your operations rely on just-in-time supply chains. -

How can I confirm seals and gaskets meet the required quality and compliance standards for my region or industry?

Insist on comprehensive documentation such as certificates of conformity, material safety data sheets (MSDS), and third-party laboratory test results aligned with your industry (e.g., PED, FDA, EN, ASTM). For regulated sectors—food, pharma, oil & gas—ensure materials are compliant with local and international standards. Request traceability records for each shipment and perform periodic incoming inspections. Partnering with suppliers with a strong track record in exporting to your country or sector helps avoid customs delays and regulatory non-conformities. -

What are the most secure payment terms for cross-border purchases of seals and gaskets?

Common international payment terms include advance payment, letters of credit (LC), and open account (with credit insurance). Letters of credit offer strong protection for both sides but may increase transaction costs. For new suppliers, consider using irrevocable LCs, escrow services, or split payments (partial advance, balance after quality approval or shipping). Gradually shift to more flexible terms as the business relationship matures. Always verify the supplier’s bank details independently to prevent fraud, and clarify currencies used to avoid forex surprises. -

What logistics factors should I consider, and how can I minimize risk of damage or loss in transit?

Demand robust packaging suitable for your product type and climatic conditions—seals and gaskets can deteriorate if exposed to excess moisture, heat, or ultraviolet light during shipping. Confirm the use of moisture-barrier bags, reinforced cartons, or wooden crates as appropriate. Select Incoterms (e.g., DAP, CIF) that match your logistical capabilities, and request shipment tracking plus cargo insurance. Work with freight forwarders or customs brokers who have experience with industrial components, as proper documentation and labeling streamline clearance and reduce the risk of costly delays or product seizures. -

How should disputes regarding product quality or shipment discrepancies be managed with international suppliers?

Establish clear contractual terms covering inspection periods, acceptance criteria, and remedies for non-conformance—ideally referenced in purchase orders and commercial agreements. Upon receipt, inspect shipments immediately for visible or functional deviations and document issues with photos, batch numbers, and incident reports. Notify the supplier in writing within the agreed timeframe and request corrective action—this may involve replacements, credits, or partial refunds. Maintain detailed communication records and, if needed, engage third-party inspection agencies or trade arbitration services. A reputable supplier will have clear after-sales policies to maintain long-term business trust.

Strategic Sourcing Conclusion and Outlook for seals & gaskets

Seals and gaskets are more than commodity components—they are critical assets in maintaining operational continuity, safety, and compliance across diverse industrial sectors worldwide. For buyers across Africa, South America, the Middle East, and Europe, successful sourcing hinges on a strategic approach: understanding the nuances of material performance, vetting supplier capabilities, and aligning procurement with regional and regulatory demands.

Key takeaways for international B2B buyers include:

– Material Selection: Choose materials tailored to your operational environment—be it extreme temperatures, aggressive chemicals, or unique climate factors—to reduce downtime and ensure long-term reliability.

– Supplier Evaluation: Prioritize suppliers with strong certifications, transparent traceability, and consistent quality control. Collaborate with partners who offer technical support and flexibility for custom solutions.

– Regional & Regulatory Alignment: Stay abreast of evolving standards and local requirements. Selecting seals and gaskets that comply with both global and specific regional certifications minimizes legal, safety, and supply chain risks.

– Total Cost of Ownership: Factor in not only unit price, but also performance longevity, maintenance needs, and logistics costs. The right sourcing decision drives operational efficiency and lowers the risk of sudden failures.

Looking forward, demand for advanced sealing solutions will accelerate—driven by new regulations, supply chain shifts, and increasingly complex applications. Buyers who proactively develop robust sourcing strategies, invest in supplier relationships, and continuously monitor market trends will be best positioned to secure long-term value and resilience in their industrial operations. Now is the time to transform sourcing into a competitive advantage.