Introduction: Navigating the Global Market for square o rings

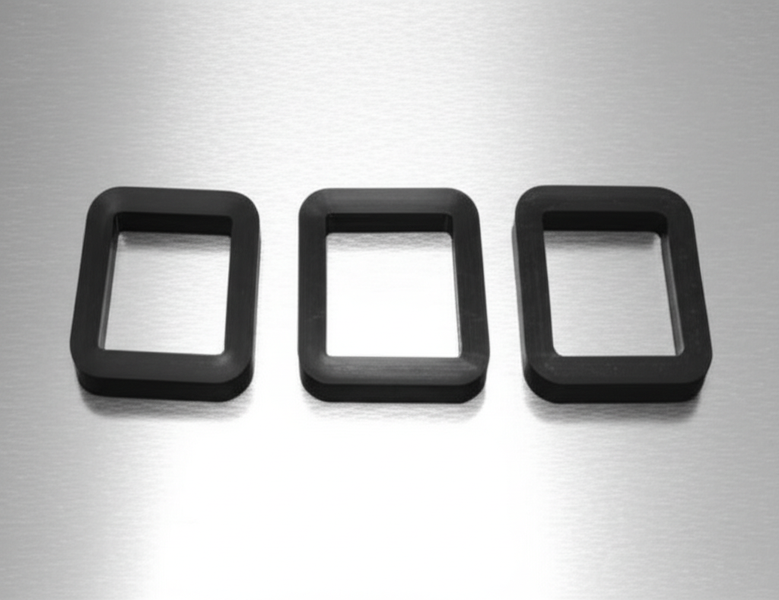

Square O-rings are a small yet critical component underpinning countless industrial systems worldwide. Whether you operate in the oilfields of Nigeria, the automotive factories of Spain, the agricultural hubs of Argentina, or the energy sector in the Middle East, the integrity of your machinery often rests on the quality and reliability of your sealing solutions. Unlike their round counterparts, square O-rings offer a unique profile that delivers enhanced sealing capabilities in demanding environments—helping to prevent leaks, reduce maintenance downtime, and ensure optimal operational efficiency.

Yet, navigating the global market for square O-rings is not without its challenges. An ocean of suppliers, varying quality standards, multiple material options, and complex logistical considerations can complicate sourcing—especially for buyers based in Africa, South America, the Middle East, and Europe, where import regulations and local operating conditions add another layer of complexity. The stakes are high: a misstep in sourcing could mean costly downtime, supply chain disruptions, or compliance risks.

To empower international B2B buyers to make confident, well-informed purchasing decisions, this guide delivers a comprehensive exploration of the square O-rings sector, addressing:

- Key types and applications suited to diverse industry needs

- Material options and their performance implications under different operating conditions

- Manufacturing processes and quality control essentials to ensure durability and compliance

- Global supplier landscape, with guidance on evaluating and partnering with international vendors

- Cost drivers and negotiation strategies to secure better value

- Regional market insights relevant to Africa, South America, the Middle East, and Europe

- Frequently asked questions directly addressing common buyer pain points

With this targeted, actionable roadmap, you can streamline your global sourcing strategy, mitigate supply risks, and unlock competitive advantages in your market—no matter where your operations or customers are based.

Understanding square o rings Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard Square O Ring | Flat-edged profile with uniform cross-section | Hydraulic/pneumatic sealing, general industry | Reliable, economical, but less suitable for dynamic use |

| PTFE-Coated Square O Ring | Square core with PTFE coating for enhanced chemical resistance | Aggressive chemical processes, food processing | Superior resistance, low friction; higher price point |

| FDA-Grade Square O Ring | Made from food/pharma-safe elastomers, compliant materials | Food & beverage, pharmaceutical machinery | Regulatory compliance; limited material/color options |

| High Temperature Square | Formulated for thermal stability, usually from FKM or silicone | Engines, HVAC, oil & gas, power gen | Withstands heat; potential cost and lead time considerations |

| Fabric-Reinforced Square | Embedded fabric layer for strength and extrusion resistance | Heavy machinery, hydraulic systems | Durable, resists extrusion; less flexible, may be harder to source |

In-depth Overview of Square O Ring Types

Standard Square O Ring

This is the most widely used variation, recognized for its flat, square-edged profile. Ideal for static applications, it delivers improved sealing surface contact compared to round O rings. B2B buyers benefit from broad availability and cost efficiency. However, in dynamic or high-movement settings, buyers should consider potential wear and opt for reinforced types if needed. Suitable for hydraulic systems, enclosures, and pipeline sealing across diverse industries in Africa, Europe, and beyond.

PTFE-Coated Square O Ring

Combining a conventional square elastomeric core with a thin PTFE coating, this variant excels in environments exposed to aggressive chemicals or solvents. The PTFE layer offers excellent chemical compatibility and reduces friction, making it valuable for buyers in the chemical processing, pharmaceutical, and food sectors. Higher upfront costs are offset by longevity and reduced maintenance. When sourcing internationally, verify coating adhesion and compliance with relevant safety standards.

FDA-Grade Square O Ring

Manufactured using food-safe elastomers such as FDA/EC-approved silicone or EPDM, these O rings are indispensable in food, beverage, and pharmaceutical production facilities. Buyers in regions with stringent regulatory requirements (e.g., EU, Middle East) prioritize these for machine sealing where contamination must be minimized. Main considerations include verifying material certifications and ensuring compatibility with cleaning agents used in specific markets. Sourcing partners with documented quality systems are advised.

High Temperature Square O Ring

Designed for robust performance at elevated temperatures, this type is typically made from FKM (Viton®), silicone, or other specialty materials. Ideal for the energy, oil and gas, and heavy manufacturing sectors, these O rings maintain gasket integrity under extreme heat. For B2B buyers in oil-abundant regions or areas with high operational temperatures, balancing cost with thermal requirements and sourcing from suppliers with demonstrated temperature testing is crucial.

Fabric-Reinforced Square O Ring

This advanced type integrates a fabric mesh within the elastomer, significantly increasing resistance to extrusion and mechanical wear. Particularly effective for high-pressure hydraulic systems or heavy equipment, common in mining or construction sectors in Africa and South America. Buyers should assess requirements for flexibility versus durability, as these O rings offer superior longevitiy but may be less adaptable to complex geometries. Lead times and minimum order quantities can be longer—factor these into procurement schedules.

Related Video: Lecture 1 Two compartment models

Key Industrial Applications of square o rings

| Industry/Sector | Specific Application of square o rings | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Oil & Gas | Valve stem and flange sealing | Enhanced pressure retention, leak prevention | Resistance to hydrocarbons, temperature specs, compliance standards |

| Food & Beverage | Pump and equipment seals in processing lines | FDA/EC food-safe, improved hygiene | Certification (FDA/EC), non-reactivity, traceability |

| Water Treatment | Sealing in filtration and flow control systems | Reliable, long-term leak resistance | Chemical compatibility, durability, availability of sizes |

| Automotive | Fluid connector and hydraulic system sealing | Increased operational lifespan, safety | Material resilience, consistent sizing, cost-effectiveness |

| Chemical Processing | Reactor, pump and pipe system gaskets | Superior seal under aggressive chemicals | Chemical resistance, fast turnaround, customization |

Oil & Gas

Square o rings are widely implemented in oil & gas infrastructure, such as for sealing valve stems and flanges. Their flat-sided geometry offers improved sealing contact compared to traditional o rings, minimizing leakage even under high-pressure or high-temperature conditions. For buyers in regions like Nigeria or the Middle East, prioritizing resistance to specific hydrocarbons and ensuring compliance with industry standards (such as API or ISO) is essential. Selecting materials like FKM or NBR, and verifying supplier certifications, helps minimize downtime and protect overall system integrity.

Food & Beverage

In the food and beverage sector, square o rings are crucial for sealing pumps and other processing equipment. Their distinct shape ensures tighter seals, reducing contamination risks and supporting hygienic processing environments. For international buyers—especially in Europe and South America—sourcing rings with FDA or EC food-grade certifications and full traceability documentation is vital for compliance and consumer safety. Non-reactive materials and support for stringent regulatory needs should be top sourcing priorities to avoid costly recalls or shutdowns.

Water Treatment

Square o rings excel in filtration systems and flow control equipment within water treatment plants. Their robust seal delivers reliable, leak-free operation for extended periods, safeguarding water quality and plant efficiency. Buyers in Africa and developing regions face challenges such as fluctuating water chemistry and resource constraints, making it essential to select chemical-resistant, durable compounds and ensure a ready supply of standard and custom sizes.

Automotive

In automotive manufacturing and aftermarket supply, square o rings are favored for their capability to maintain seals in hydraulic systems and fluid connectors. Their design reduces assembly errors and helps extend service intervals, contributing to lower maintenance costs and greater safety. For European and Latin American buyers, ensuring material resilience to temperature swings and compatibility with varied automotive fluids is crucial. Bulk purchasing options, predictable lead times, and international quality certifications add significant sourcing value.

Chemical Processing

Chemical manufacturing facilities depend on square o rings for gasket applications in reactors, pumps, and pipe systems, where they encounter aggressive chemicals and continuous operation. Their squared edges maximize surface contact area, delivering better sealing in dynamic environments. Sourcing considerations should revolve around proven chemical resistance, the ability to customize sizes and materials, and a supplier’s track record for quick delivery—especially important for plants operating in remote or infrastructure-limited areas.

Related Video: O-Rings? O-Yeah! How to Select, Design, and Install O-Ring Seals

Strategic Material Selection Guide for square o rings

Key Materials for Square O Rings: B2B Evaluation

Selecting the right material for square o rings is critical for ensuring reliable sealing performance, reducing maintenance costs, and complying with local standards. Below is a practical evaluation of the most commonly used materials, focusing on their suitability for industrial and commercial buyers from Africa, South America, the Middle East, and Europe. Considerations include technical performance, economic factors, and region-specific requirements.

Nitrile Rubber (NBR)

Key properties: NBR is highly regarded for its resistance to oils, fuels, and many hydraulic fluids. It performs well in a moderate temperature range of approximately -40°C to +120°C and offers reasonable mechanical strength and abrasion resistance.

Pros:

– Cost-effective and widely available

– Excellent oil and fuel resistance

– Easy to manufacture in a range of sizes

Cons:

– Poor resistance to ozone, sunlight, and weathering

– Limited performance at high temperatures or with certain chemicals (e.g., strong acids)

Application impact: Best suited for applications involving petroleum-based lubricants, such as hydraulic systems, pumps, and automotive assemblies.

International considerations: NBR is widely accepted and produced to ASTM D2000 and DIN standards. For markets such as Spain or Nigeria, ensure suppliers can provide documentation of conformity. It’s a pragmatic choice where broad compatibility and affordability are priorities, but confirm climate suitability for hot, outdoor, or ozone-exposed installations (especially relevant for Africa and the Middle East).

Fluoroelastomer (FKM, e.g., Viton®)

Key properties: FKM provides outstanding chemical resistance, especially against aggressive fuels, acids, and solvents. It operates across a broad temperature range (-20°C to +200°C), making it ideal for harsh or hot environments.

Pros:

– Superior thermal and chemical resistance

– Excellent longevity in challenging media

– Minimal swelling and compression set

Cons:

– High relative cost

– More complex manufacturing process and sometimes longer lead times

– Limited low-temperature flexibility

Application impact: Suited for chemical plants, automotive fuel systems, and regions with extreme ambient temperatures (like the Middle East). It’s also preferred where regulatory compliance for emission-critical applications is required.

International considerations: Commonly manufactured to global standards (ASTM D1418, ISO 1629). B2B buyers in Europe may specifically require compliance with REACH and RoHS. The higher cost is justified in critical industries; in regions like Africa and South America, vet the supply chain to ensure genuine FKM material, as counterfeit or blended elastomers sometimes enter these markets.

Ethylene Propylene Diene Monomer (EPDM)

Key properties: EPDM stands out for its excellent resistance to water, steam, and weathering, as well as polar substances like ketones, alcohols, and certain acids. Its operational temperature range is typically -40°C to +140°C.

Pros:

– Outstanding outdoor and ozone resistance

– Excellent flexibility and sealing under compression

– Cost-effective for water and steam applications

Cons:

– Not compatible with mineral oils, fuels, and hydrocarbons

– Slightly lower tear and wear resistance compared to NBR and FKM

Application impact: Ideal for potable water systems, HVAC, and outdoor equipment—especially important in humid or tropical regions like parts of Africa and South America.

International considerations: Widely accepted under standards such as EN 681 (potable water), ASTM D2000, and WRAS (UK). European markets may enforce drinking water certifications for EPDM. For Middle Eastern and African buyers, its weathering resistance is a key benefit for installations exposed to sunlight and heat.

Silicone Rubber

Key properties: Silicone is notable for its excellent high- and low-temperature stability (-60°C to +230°C) and flexible performance across a wide range of environments. It is highly inert and suitable for food and medical applications.

Pros:

– Exceptional temperature range

– Safe for food and medical use (available with relevant certifications)

– Excellent flexibility and resilience

Cons:

– Poor resistance to oils, fuels, and many acids

– Lower mechanical strength and abrasion resistance

– Higher cost than NBR or EPDM

Application impact: Particularly valuable in food processing, pharmaceuticals, and where exposure to extreme temperature fluctuations is expected. For instance, industrial food equipment in Spain or medical facilities across Europe benefit from its compliance profile.

International considerations: Conforms to FDA, EN 1935/2004, and other food-grade standards. Buyers should verify necessary certifications, especially when serving regulated markets in the EU. Due to its higher cost and niche uses, ensure it truly matches the application’s demands.

Material Comparison Table

| Material | Typical Use Case for square o rings | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Nitrile Rubber (NBR) | Hydraulic and pneumatic seals, fuel systems | Cost-effective, oil/fuel resistance | Poor weathering/ozone resistance | Low |

| Fluoroelastomer (FKM) | High-temp, aggressive chemical or fuel applications | Excellent chemical/heat resistance | High cost, limited low-temp flexibility | High |

| EPDM | Water, steam, and outdoor applications | Weather & water resistance | Not suitable for oils/fuels | Low to Medium |

| Silicone Rubber | Food, pharma, extreme temperature apps | Wide temp range, food-grade options | Weak oil/fuel/acid resistance | Medium to High |

In-depth Look: Manufacturing Processes and Quality Assurance for square o rings

Square O-rings, despite their simple geometry, require sophisticated manufacturing and rigorous quality control to consistently meet the performance demands of industrial applications. For international B2B buyers sourcing from global suppliers, a clear understanding of each production stage and relevant quality standards is crucial for risk mitigation, compliance, and product reliability.

Key Stages in the Manufacturing Process

1. Material Preparation

The process begins with the selection and compounding of elastomeric materials—common options include nitrile (NBR), fluorocarbon (FKM), silicone, and EPDM. Material formulation balances chemical resistance, hardness, temperature tolerance, and compliance with regulations such as REACH (Europe) or similar directives in target markets. High-quality manufacturers invest in computerized batching and mixing systems to ensure homogeneity, minimizing defects due to material inconsistencies.

2. Forming and Molding

Square O-rings differ from traditional round counterparts in cross-section, requiring precision tooling and optimization of molding parameters. Compression and injection molding are standard techniques. The key variables controlled here are mold temperature, pressure, fill times, and curing profiles. For large B2B volumes, automated or multi-cavity molds enhance throughput and consistency. Manufacturers must also ensure sharp edge definition and uniform cross-sectional dimensions to guarantee sealing performance.

3. Assembly and Secondary Operations

If the O-ring design includes bonded joints or specific surface treatments (such as anti-stick or lubrication coatings), these are typically applied post-molding. For specialty applications, O-rings might undergo additional vulcanization or be assembled into subcomponents, with strict process documentation for traceability—vital for buyers in regulated sectors (e.g., oil & gas, food processing).

4. Finishing and Deflashing

Excess material (“flash”) from the molding process is removed via mechanical trimming, cryogenic deflashing, or tumbling, ensuring clean, dimensionally exact components. Visual and automated inspections check for surface integrity, edge squareness, and absence of voids or inclusions.

International Quality Standards and Industry Certifications

Global buyers must ensure supplier compliance with relevant standards:

– ISO 9001: This is the baseline for quality management systems, denoting process control and continual improvement.

– Industry-Specific Certifications:

– API Q1/Q2: For petroleum and natural gas industries, especially relevant for buyers in the Middle East, West Africa, and South America.

– CE Marking: Required for products entering the European Economic Area, indicating compliance with EU safety, health, and environmental requirements.

– FDA/USP Class VI: Necessary if O-rings will contact food or pharmaceuticals.

– Regional Regulation Alignment: For buyers in Spain, ensure REACH and RoHS compliance; in Nigeria and other African nations, verify local standards or governmental certifications.

In-Process Quality Control: Checkpoints and Testing

Multiple QC checkpoints throughout production minimize the risk of defects:

-

Incoming Quality Control (IQC):

- Verification of raw elastomer batches for physical properties, contaminants, and documentation compliance.

- Buyers can request supplier records of material certifications (CoC, CoA).

-

In-Process Quality Control (IPQC):

- Continuous monitoring during molding, including dimensional checks and process parameter recording.

- Automated systems may perform real-time visual inspections for geometry and surface flaws.

-

Final Quality Control (FQC):

- Comprehensive inspection before shipment, covering dimensional accuracy (using precision gauges), physical properties (hardness, tensile strength), and functional leak or compression tests.

Common Testing Methods:

– Dimensional Measurement: Digital calipers, optical comparators, and custom gauges ensure cross-section uniformity—critical for sealing reliability.

– Material Properties: Shore A hardness testing, tensile and elongation analysis, and aging/resistance testing.

– Specialty Tests: For high-performance or niche applications, tests for chemical compatibility, temperature cycling, or pressure retention may be required.

Verifying Supplier Quality as an International B2B Buyer

Proactive engagement and documentation review are essential:

-

Quality Documentation:

- Request full traceability records—batch numbers, process logs, test results.

- Ensure suppliers provide up-to-date certificates (ISO, API, CE, etc.) and third-party audit reports.

-

Factory Audits & Inspections:

- On-site or remote audits by buyers or accredited third-party agents (such as SGS, TÜV, or Intertek) help verify actual manufacturing capabilities, process control, and real-world adherence to quality procedures.

- Sample-based inspections (AQL methodology) prior to shipment reduce the risk of non-compliant lots.

-

Routine Performance Feedback:

- Establish channels for ongoing supplier communication and performance evaluation, including complaint resolution, corrective actions, and batch-to-batch consistency.

- Long-term supply agreements can include periodic re-certification or spot-check audits.

Nuances for International Buyers: Regional and Compliance Considerations

-

Africa:

- Quality standards can vary widely; insist on international certifications as a non-negotiable. Consider local customs procedures and requirements for standards documentation at import.

-

South America:

- Increasing alignment with ISO and regional trade bloc standards (e.g., Mercosur); ensure documentation matches both local and end-user country needs.

-

Middle East:

- Strict requirements in oil, gas, and petrochemical sectors; API and ISO documentation must be thorough. Engage technical staff for specification reviews.

-

Europe (e.g., Spain):

- Stringent regulatory environment—REACH and CE compliance are critical for market access. Confirm that documentation is in both local language and English.

-

General Tip:

- Hold sample approvals before committing to full-scale orders, and negotiate clear rework or return clauses for non-conforming batches. Leverage digital platforms for real-time supplier scorecards and QC transparency.

A systematic approach to supplier evaluation, focusing on validated manufacturing processes and robust quality control, ensures square O-rings meet both technical and regulatory demands. B2B buyers, particularly those entering new markets or managing complex supply chains, should make QC transparency and international certification a core part of their sourcing criteria.

Related Video: China’s Top 5 Manufacturing and Mass Production Videos | by @miracleprocess

Comprehensive Cost and Pricing Analysis for square o rings Sourcing

Key Cost Drivers in Square O Ring Sourcing

In the international B2B landscape, understanding the complete cost structure of square o rings is essential for buyers seeking both value and reliability. The final unit price is shaped by the sum of numerous underlying components:

- Raw Materials: The type and grade of elastomer (such as NBR, FKM, EPDM, or silicone) accounts for a significant share. Specialized materials for chemical or thermal resistance will increase costs.

- Labor: Direct labor costs are influenced by the production location. Suppliers in Asia may offer cost advantages, but final budgets must account for variations in skill levels and local wage rates.

- Manufacturing Overhead: This includes equipment depreciation, factory utilities, and indirect labor. High automation typically reduces per-unit overhead over large orders.

- Tooling and Molds: Initial investments in custom molds or processing equipment are often amortized over high-volume orders. For low-MOQ or one-off prototypes, per-piece costs rise substantially.

- Quality Control: Robust inspection regimes, material traceability, and compliance documentation (e.g., ISO, RoHS) add necessary but sometimes overlooked costs.

- Logistics: Freight mode (air, sea, courier), shipping terms, customs duties, insurance, and inland transport to destinations in Africa, South America, or Europe have a major impact, especially in remote or limited-infrastructure regions.

- Supplier Margin: The markup applied by the supplier or distributor covers their overhead, risks, and profit expectations, and is often negotiable depending on relationship and order size.

Main Price Influencers in the International Market

B2B prices for square o rings rarely follow a one-size-fits-all model. Buyers need to consider:

- Volume & Minimum Order Quantity (MOQ): Unit pricing generally improves with volume, but there may be steep minimums for cost-effective production—particularly with custom dimensions.

- Specifications & Customization: Deviations from standard size, color, or material, or the addition of branding or packaging requirements, add to complexity and cost.

- Material Grade & Certification: Demanding FDA, medical, or automotive-grade materials, or requiring specific certs (like REACH or ISO/TS) typically increase both price and lead time.

- Supplier Reputation & Capacity: Leading manufacturers and those with extensive export experience or regional offices may price higher, reflecting their enhanced quality control, after-sales support, and risk mitigation.

- Incoterms & Payment Terms: Whether you negotiate EXW, FOB, CIF, or DDP trade terms directly impacts landed cost. Flexible payment terms can also be a lever for improved pricing or cashflow optimization.

Actionable Tips for International B2B Buyers

To maximize value and reduce risk, especially for buyers in Africa, South America, the Middle East, and Europe:

- Emphasize Total Cost of Ownership (TCO): Evaluate more than just FOB or supplier costs—factor in customs, shipping, duty rates, and last-mile delivery. In emerging markets, unpredictable logistics or tariffs can erode initial price advantages.

- Negotiate Through Volume Leverage: Aggregate regional or annual demand to unlock better tier pricing and justify reduced tooling charges. Some suppliers may offer rebates or future discounts for long-term partnerships.

- Balance Customization with Standardization: Where possible, use industry-standard sizes to avoid unnecessary tooling costs and supply delays. Reserve customization for essential performance features only.

- Scrutinize Quality Certifications: Especially in regulated industries or demanding climates, prioritize suppliers with proven compliance documentation. Insist on batch-testing, and request samples when feasible.

- Clarify Incoterms Early: Determine who manages freight and insurance to avoid hidden charges at destination. For remote locations, consider DDP (Delivered Duty Paid) or partner with local agents for smoother clearance.

- Plan for Regional Price Variations: Local duties, currency fluctuations, and transport infrastructure disparities (e.g., African inland logistics) can alter final landed cost. Request itemized quotations that separate each cost element for accurate comparison.

Disclaimer: All price and cost analyses are indicative and subject to market fluctuations, supplier quotations, and variable international logistics. Request up-to-date, written offers from vetted suppliers before making commitments.

By understanding these nuances, international buyers can negotiate confidently, minimize risk, and secure square o rings that align with both technical and budgetary requirements.

Spotlight on Potential square o rings Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘square o rings’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

10 O rings manufacturers in the World 2025 (www.sourcifychina.com)

With a focus on streamlining the O-ring sourcing process, this manufacturer stands out for providing a well-curated selection of both standard and custom square O-rings to support B2B buyers globally. Their portfolio features advanced material options—including FFKM, Viton®, and Buna-N—making them suitable for demanding applications across OEM production, hydraulics, and industrial maintenance. Holding ISO 9001:2015 certification, they emphasize quality assurance and consistent product traceability. Buyers benefit from an expansive in-stock inventory, personalized order consultation, and responsive quoting to facilitate urgent procurement needs. The company has experience serving international clients, with logistics and order parameters designed for business efficiency. However, minimum order values and shipping costs may apply for lower-volume purchases.

60 O-Ring Manufacturers in 2025 (us.metoree.com)

Metoree presents a curated network of 60 o-ring manufacturers, with a strong emphasis on square o rings for diverse industrial applications. As a sourcing hub, Metoree aggregates top manufacturers—primarily based in the United States—offering capabilities ranging from standard to custom-engineered sealing solutions. This collective is recognized for robust product variety, catering both to bulk and specialized B2B requirements. While individual company details and certifications (such as ISO compliance or specific export experiences) are not exhaustively listed, multiple leading manufacturers displayed here hold global reputations and advanced manufacturing processes. For B2B buyers across Europe, Africa, South America, and the Middle East, Metoree’s platform streamlines supplier discovery and comparison, making it relevant for businesses seeking vetted, export-ready partners in the square o ring space.

O-Ring Manufacturers (o-rings.org)

O-Ring Manufacturers (https://o-rings.org/) is a recognized supplier specializing in precision-engineered o-ring solutions, including square o rings, for diverse industrial and commercial applications. The company serves sectors such as automotive, aerospace, medical devices, chemical processing, food and beverage, and more—where sealing integrity is mission-critical. Noted for breadth of application, O-Ring Manufacturers supports hydraulic, pneumatic, and vacuum systems across international markets.

Key strengths for B2B buyers include the capacity to supply specialized square o rings suitable for challenging environments prone to leakage or contamination. While specific quality certifications are not prominently disclosed, their emphasis on reliability and performance suggests adherence to rigorous industry standards. Buyers from Africa, South America, the Middle East, and Europe can expect access to a wide range of materials and sizes, supporting both OEM and replacement requirements.

Unique selling points include depth of application experience and solutions tailored to both standard and custom specifications.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| 10 O rings manufacturers in the World 2025 | Extensive range, custom solutions, ISO-certified | www.sourcifychina.com |

| 60 O-Ring Manufacturers in 2025 | Top-tier US-based supplier network aggregator | us.metoree.com |

| O-Ring Manufacturers | Versatile industrial square o rings supplier | o-rings.org |

Essential Technical Properties and Trade Terminology for square o rings

Key Technical Specifications for Square O Rings

When procuring square o rings for industrial or commercial applications, understanding the essential technical specifications ensures compatibility, performance, and compliance. Here are core properties to evaluate during the sourcing process:

-

Material Grade

The polymer or elastomer used greatly affects chemical resistance, temperature tolerance, and mechanical strength. Common options include Nitrile (NBR), Viton (FKM), EPDM, and Silicone, each suited to different environments—such as oil, chemical, or high-temperature applications. Always request material certification and consult with your supplier on the best grade for your operating conditions. -

Cross-Section Dimensions & Tolerance

Unlike traditional round o rings, the square profile requires close attention to the cross-sectional height and width, typically specified in millimeters or inches. Standard industry tolerances (e.g., ±0.1 mm) dictate sealing reliability and interchangeability—nonstandard tolerances may impact fit and function, especially in automated assembly or high-pressure environments. -

Hardness (Shore A Scale)

The hardness rating defines how resistant the o ring is to deformation. Measured on the Shore A scale (usually between 40 and 90), softer rings offer better sealing for low-pressure or irregular surfaces, while harder rings resist extrusion in demanding or dynamic settings. Specify your required hardness to ensure optimal sealing performance. -

Temperature Resistance

Each material grade comes with a recommended working temperature range (e.g., -40°C to +200°C). Exceeding these can lead to premature failure or chemical incompatibility. Always align with both the operating and potential peak temperatures of your equipment, particularly in regions with extreme climates. -

Tensile Strength & Elongation

These values (usually given in MPa or %) describe the ring’s ability to withstand stretching without damage. They’re essential for applications involving frequent installation, dynamic movements, or mechanical stress. A high tensile strength ensures longevity and dependable sealing, reducing costly downtime.

Common B2B Trade Terms and Industry Jargon

To ensure clear communication and streamlined transactions in the international trade of square o rings, familiarize yourself with these widely used terms:

-

OEM (Original Equipment Manufacturer)

Denotes whether the product is produced specifically for another company’s brand and meets unique specifications. Many buyers in Africa and Europe prioritize OEM partnerships for better aftersales compatibility and brand alignment. -

MOQ (Minimum Order Quantity)

The smallest batch a supplier is willing to produce or ship. MOQ impacts pricing, storage requirements, and budgeting—especially important for Middle Eastern and Latin American buyers managing diverse inventories. -

RFQ (Request for Quotation)

A formal process to solicit pricing and terms from suppliers. Providing detailed specs (dimensions, material, tolerance) in your RFQ avoids misunderstandings and ensures accurate quotes. -

Incoterms (International Commercial Terms)

Standardized trade rules (e.g., FOB, CIF, DDP) set by the International Chamber of Commerce. They define responsibilities related to shipping, risk, and customs—critical for importers in Spain and Nigeria seeking to minimize logistics risks and hidden costs. -

Lead Time

Refers to the period between placing an order and receiving goods. Lead time management is vital when coordinating supply chains that span multiple countries; anticipate possible delays due to customs or manufacturing schedules. -

Certification & Compliance

Many buyers require evidence that products meet specific quality standards (ISO, REACH, RoHS). This reassures stakeholders and simplifies cross-border transactions, especially for regulated industries.

Understanding these technical and commercial fundamentals is essential for international buyers sourcing square o rings, ensuring product performance and seamless trade relationships across regions.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the square o rings Sector

Global Market Overview and Emerging Sourcing Trends

The square o rings market continues to demonstrate resilience and adaptability amid shifting global dynamics. Demand remains strong across critical industries such as oil and gas, water treatment, agriculture, automotive, and various manufacturing segments. Key growth drivers include expansive infrastructure projects in Africa and the Middle East, increased industrial automation in Europe, and modernization efforts within Latin America’s processing sectors.

Regional demand diversification is notable. Buyers in Nigeria, for example, are fueling demand for robust sealing solutions to support oil extraction and refining, while Spain and other European nations prioritize advanced materials and precision engineering for their automated manufacturing lines. Across South America, growing agricultural and industrial machinery sectors require high-performance sealing components resistant to fluctuating temperatures and aggressive media.

Sourcing practices are evolving rapidly:

– Digital B2B platforms and specialized procurement portals now streamline supplier discovery, technical specification matching, and RFQ cycles.

– Supplier consolidation is a trend, with buyers seeking to build fewer, deeper partnerships to ensure product reliability and better price negotiation.

– Just-in-time (JIT) inventory models are expanding in popularity, particularly in Europe and parts of the Middle East, as buyers look to minimize warehousing costs while enhancing supply chain agility.

Technology is shaping sourcing choices. Increasing adoption of ERP integration, e-procurement systems, and supplier scorecards helps buyers from Spain to South Africa make data-driven decisions, monitor supplier compliance, and reduce lead times. Traceability is also a heightened concern, with buyers expecting clear documentation covering raw material provenance, manufacturing standards (such as ISO 9001), and comprehensive testing data.

Emerging trends include:

– Shift to specialty elastomers and robust polymer blends (e.g., FFKM, HNBR), driven by demand for resistance to harsh chemicals and extreme conditions.

– Interest in tailored solutions and custom dimensions to match localized equipment standards or retrofitting needs in African and Middle Eastern markets.

– Expansion of supplier shortlisting based on ESG factors — environmental, social, and governance compliance now factors into strategic vendor selection alongside cost and technical criteria.

Sustainability and Ethical Sourcing Considerations

Sustainability is ascending the procurement agenda in the square o rings sector, influenced by both regulatory changes and end-user expectations. International buyers now weigh the environmental impact of materials and manufacturing when selecting suppliers. Conventional elastomers such as NBR, EPDM, and Viton remain standards, but there is a discernible shift toward recyclable compounds, bio-based alternatives, and low-VOC manufacturing processes.

Key sustainability priorities for B2B buyers include:

– Supplier transparency: Documentation on source materials, energy use, and waste reduction practices.

– Eco-certifications: Preference for manufacturers holding ISO 14001 (environmental management), RoHS (restriction of hazardous substances), and REACH compliance.

– Green logistics: Emphasis on reduced packaging, optimized shipping routes (to minimize carbon footprint), and regional warehousing to limit long-haul freight.

Ethical sourcing is equally crucial. Buyers are increasingly scrutinizing supply chains for labor practices, health and safety standards, and community engagement—especially when sourcing from regions with known risks. Leveraging third-party audits and requiring suppliers to adhere to international codes of conduct (e.g., SA8000 or Sedex) is becoming best practice.

Actionable next steps for B2B buyers:

– Request and verify documentation related to sustainability and ethics as part of RFQ processes.

– Pilot partnerships with suppliers offering bio-based square o rings or closed-loop supply chains.

– Consider supplier track record in ESG reporting as a tie-breaker in sourcing decisions.

Brief Evolution and Market Significance

Square o rings have evolved from simple replacement components to engineered seals fulfilling critical performance and regulatory roles. Historically, round o rings dominated most industrial applications. However, as machinery tolerances tightened and operational environments became more demanding, square o rings rose in prominence due to their superior surface contact, minimal compression set, and enhanced sealing integrity for static and reciprocating systems.

This evolution is especially relevant in regions like Africa and the Middle East, where equipment maintenance cycles must be optimized due to environmental and supply chain constraints. The global market now offers a wide array of material options, certifications, and customizable profiles—empowering B2B buyers to specify products that directly address their technical and sustainability requirements.

By staying informed of market dynamics, prioritizing ethical and environmental considerations, and leveraging new digital sourcing tools, international buyers can achieve optimal value and continuity in their square o ring supply chains.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of square o rings

-

How can I thoroughly vet international suppliers of square o rings?

Thorough supplier vetting involves more than just reviewing online profiles. Start by requesting proof of business licenses, export records, and certifications such as ISO 9001 or relevant industry standards. Ask for references from other international clients, particularly those in your region. Consider arranging third-party factory audits or virtual tours, and always verify export history to Africa, South America, the Middle East, or Europe. This process reduces risk and ensures reliability for ongoing supply relationships. -

Can suppliers provide customized square o rings and what details should I specify?

Most reputable manufacturers offer customization options for square o rings, including material selection, dimensions, hardness, color, and packaging. Clearly communicate your application requirements, expected operating environment, and any regulatory standards specific to your region (such as REACH for Europe or FDA requirements). Sharing technical drawings or samples helps ensure precise fulfillment. Discuss minimum order quantities, associated costs, and lead times for custom orders upfront to align expectations. -

What are typical minimum order quantities (MOQ) and lead times for bulk orders?

MOQs can vary widely by manufacturer and product complexity. Typical MOQs for square o rings range from 1,000 to 10,000 units, though some Asian suppliers may accommodate lower quantities for standard items. Lead times generally range from 2 to 8 weeks, depending on customization, order size, and supplier capacity. For urgent needs, negotiate expedited production or seek suppliers with inventory stock. Always confirm MOQs and lead times in writing to avoid misunderstandings. -

Which quality assurance measures and certifications should international buyers look for?

Robust quality assurance is critical. Look for suppliers with ISO 9001 certification, which indicates systematic quality management. Request documentation for material traceability and compliance with regional standards (e.g., RoHS for electronics, REACH in the EU). Ask for sample inspection reports or permit pre-shipment quality checks by trusted third-party inspection agencies. Ensure that final products meet your material and performance requirements before shipment. -

What logistics and shipping options are available for overseas orders, and what should I consider?

International shipping methods include air freight (faster, more expensive) and sea freight (cost-effective for bulk, longer transit). For regions with complex import regulations—such as Africa or South America—select suppliers experienced with local customs and capable of providing the necessary shipping documents (commercial invoice, packing list, certificate of origin). Plan for potential delays or port congestion, and consider using freight forwarders for smooth delivery. -

How should payment terms be structured when buying from international suppliers?

Standard international payment terms include T/T (wire transfer), L/C (letter of credit), and sometimes PayPal or escrow services for new partners. L/Cs offer greater buyer security, especially for first-time transactions. Negotiate split payments—such as an upfront deposit and balance upon shipment or after inspection. Clarify all terms contractually, and factor in local banking restrictions or currency exchange considerations, which can impact buyers in Africa, South America, or the Middle East. -

How are disputes or quality issues typically handled in cross-border transactions?

Best practice is to agree on detailed specifications, quality standards, and recourse clauses within your purchase contract. Establish a mutually agreed process for addressing nonconformity—such as replacement shipments, refunds, or price adjustments. Retain all communications and inspect goods promptly upon arrival. Many buyers use third-party inspection companies and international trade arbitration bodies to resolve unresolved disputes efficiently. -

Are there regulatory requirements or import restrictions I should be aware of in my country?

Import regulations for square o rings differ by country and sector. For instance, some South American and African nations may have specific import duties, product standards, or documentation requirements. The European Union enforces REACH and RoHS compliance for goods entering its market, while Middle Eastern countries may request conformity certifications. Work closely with your customs broker or freight agent to ensure all regulatory obligations are met, and request relevant compliance assurances from your supplier before finalizing the deal.

Strategic Sourcing Conclusion and Outlook for square o rings

International buyers seeking square o rings are navigating a rapidly evolving sourcing landscape shaped by fluctuating raw material costs, shifting regulatory standards, and demands for supply chain resilience. Key factors for success include thorough supplier vetting, strong quality assurance protocols, and adaptability to regional logistics realities. Especially for organizations in Africa, South America, the Middle East, and Europe, forging relationships with reliable manufacturers and leveraging transparent procurement processes are critical for long-term value and risk mitigation.

Strategic sourcing goes beyond price—it entails evaluating technical specifications, compliance with relevant certifications, and the ability to innovate with customized formulations or packaging. Savvy buyers prioritize suppliers who can demonstrate traceability, flexible order management, and proactive communication regarding lead times or quality challenges. Regular contract reviews and performance benchmarks ensure that partnerships remain competitive and responsive to market changes.

Looking ahead, the procurement landscape for square o rings is expected to emphasize sustainability, digitalization, and regional supply chain diversification. Now is the time for forward-thinking buyers to re-evaluate their sourcing strategies, invest in supplier collaboration, and harness digital procurement tools to gain real-time insights. By taking proactive steps today, international buyers can secure reliable supply, drive down total cost of ownership, and position their organizations for continued growth in dynamic global markets.